4 minute read

EXNESS Vs Pepperstone (2025) | Which One is Better? Review, Fees, Spread

from Exness Guide

Looking for the best broker between EXNESS vs Pepperstone in 2025? This detailed review compares spreads, fees, regulation, platforms, and more — discover which broker fits your trading style.

Introduction: Why Compare EXNESS vs Pepperstone?

Both EXNESS and Pepperstone are respected global brokers trusted by millions.They each offer competitive spreads, advanced trading platforms, and solid regulation.But which one is better for your trading in 2025?

👉 Want to explore EXNESS directly?Open your EXNESS account here

EXNESS Overview

🏢 Founded: 2008

🌍 Regulated by FCA (UK), CySEC (Cyprus), FSCA (South Africa), FSC (Mauritius)

✅ Over 250+ instruments: Forex, gold, indices, stocks, crypto CFDs, oil

📊 Platforms: MT4, MT5, WebTerminal, mobile apps

⚡ Known for ultra-tight spreads and instant withdrawals

🌙 Crypto trading available 24/7

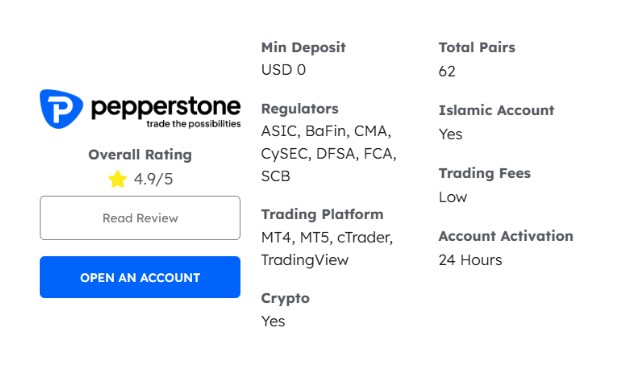

Pepperstone Overview

🏢 Founded: 2010

🌍 Regulated by FCA (UK), ASIC (Australia), DFSA (Dubai), CMA (Kenya), BaFin (Germany)

✅ Offers Forex, indices, commodities, crypto CFDs, and share CFDs

📊 Platforms: MT4, MT5, cTrader, TradingView

⭐ Known for fast execution and low-latency ECN trading

Spreads & Fees

EXNESS:

Raw & Zero accounts: spreads from 0.0 pips + commission (~$3.5 per lot)

Standard account: average spreads ~0.3–1.0 pips, no commission

Transparent and real-time spread updates

Pepperstone:

Razor account: spreads from 0.0 pips + ~$3.5–$4 per lot commission

Standard account: spreads start ~1.0 pips, no commission

Also transparent, with live pricing

👉 Want to check real-time EXNESS spreads? See EXNESS live spreads no

nstruments & Market Choice

EXNESS: 250+ instruments covering Forex, gold, oil, indices, stocks, and crypto CFDs

Pepperstone: 1200+ instruments, including Forex, indices, commodities, crypto, ETFs, and share CFDs

Pepperstone has more stock CFDs and ETFs, while EXNESS is known for its low spreads and 24/7 crypto CFD trading.

Platforms & Tools

EXNESS: MT4, MT5, WebTerminal, mobile apps — great for manual trading & EAs

Pepperstone: MT4, MT5, cTrader, and TradingView integration — ideal for charting fans & algorithmic traders

👉 Prefer MT4/MT5 & instant withdrawals?Start with EXNESS here

Leverage

EXNESS: Up to 1:2000 on Forex (depending on region)

Pepperstone: Up to 1:500 on Forex (due to FCA/ASIC rules)

Higher leverage with EXNESS can be useful for experienced traders managing small accounts.

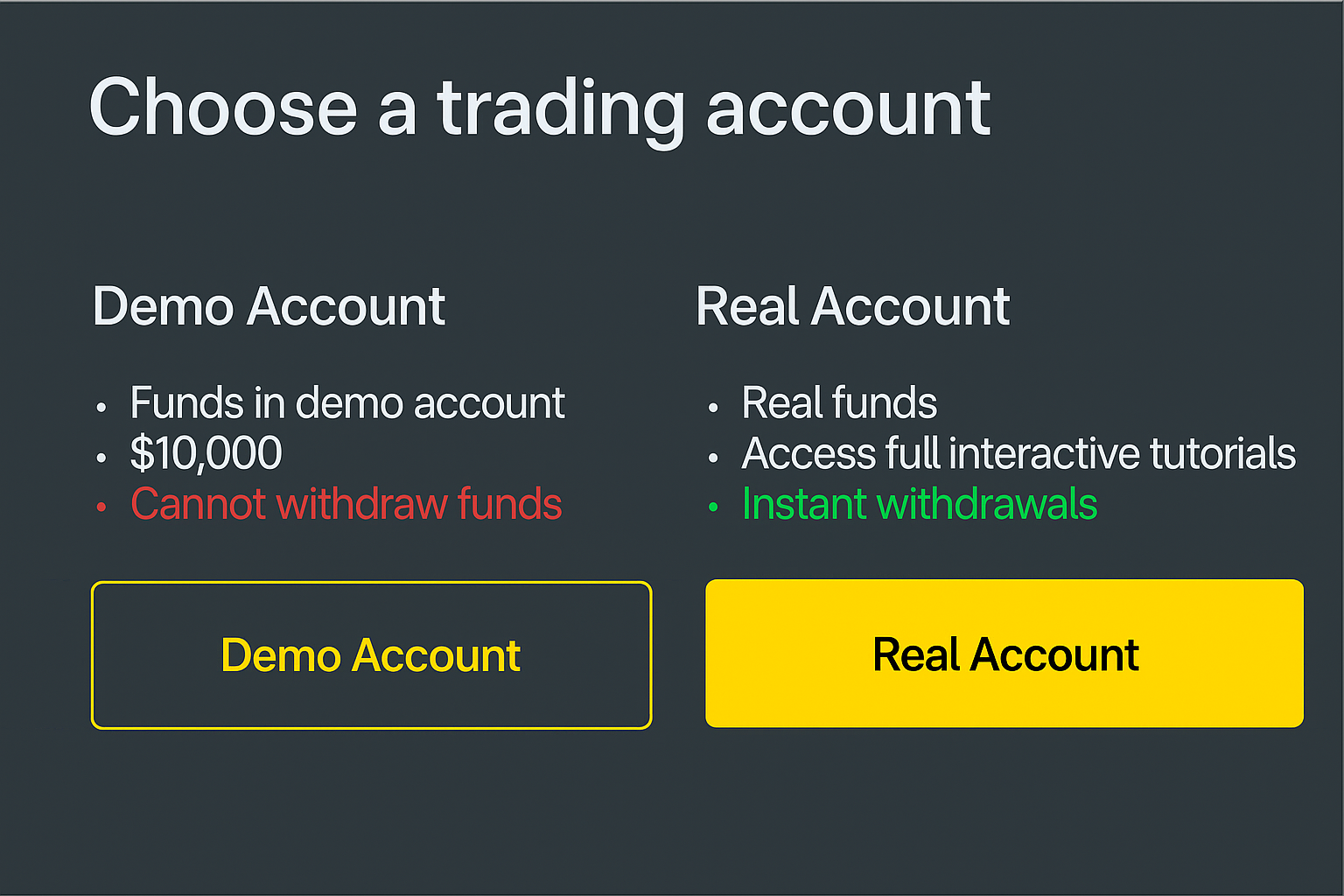

Deposit & Withdrawals

EXNESS: Famous for instant withdrawals, often processed within seconds

Pepperstone: Fast withdrawals, typically same or next business day

👉 Experience EXNESS instant withdrawals now:Open your EXNESS account here

Regulation & Trust

EXNESS: FCA, CySEC, FSCA, FSC — strong global licenses

Pepperstone: FCA, ASIC, DFSA, CMA, BaFin — equally strong, broader footprint in Europe and Australia

Both are very safe and transparent brokers.

Why Choose EXNESS?

✅ Ultra-low spreads, especially on major Forex pairs

⚡ Instant withdrawals — great for active traders

📈 Trade Forex, gold, stocks, crypto, indices

📊 MT4 & MT5 support, excellent for scalpers & EA traders

🌙 24/7 crypto CFD trading

🔒 Strong global regulation

👉 Try EXNESS now: Open your EXNESS account

Why Choose Pepperstone?

⭐ Wide range of CFDs, including stocks & ETFs

📊 Access to cTrader & TradingView integration

🛡 Strong global regulation (including ASIC & BaFin)

📈 Ideal for high-frequency & algorithmic traders

Conclusion: EXNESS vs Pepperstone — Which One is Better in 2025?

Choose EXNESS if you:

Want ultra-low spreads and faster withdrawals

Trade beyond Forex: crypto, stocks, gold

Prefer higher leverage (up to 1:2000)

Value 24/7 crypto trading

Choose Pepperstone if you:

Want to trade share CFDs and ETFs

Prefer cTrader or TradingView

Value a strong presence in Europe & Australia

👉 For most multi-asset traders who love tight spreads, instant withdrawals, and flexibility — EXNESS often comes out ahead. Start your EXNESS account now

See more:

EXNESS Vs Ic Markets (2025) | Which One is Better? Review, Fees, Spread

EXNESS Vs FBS (2025) | Which One is Better? Review, Fees, Spread

EXNESS Vs Fusion Markets (2025) | Which One is Better? Review, Fees, Spread

EXNESS Vs Oanda (2025) | Which One is Better? Review, Fees, Spread