4 minute read

Top 10 Forex Brokers in the world for India 2025

from Exness Broker

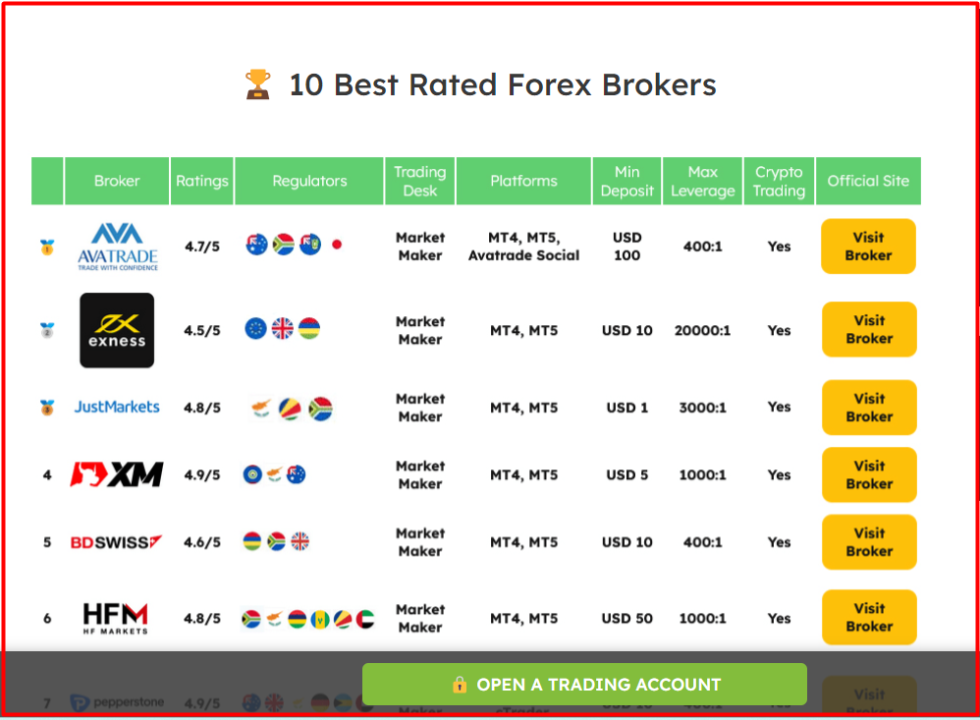

Indian traders seeking global forex exposure need brokers that combine safety, cost-efficiency, easy funding, and advanced tools. This 2025 ranking highlights the 10 best worldwide forex brokers suitable for Indian clients. Expect rigorous regulation, balance between spreads and fees, and trusted platforms. Let’s explore these leading brokers tailored for India.

1. EXNESS – Best Overall Broker

Who they are:A global powerhouse regulated by FCA, CySEC, and FSCA, offering MT4, MT5, and its own mobile app. Known for ultra-low spreads and high leverage.

👉 Start trading with EXNESS now

Why choose them:

Minimum deposit just $10

Tight spreads from 0.1 pips and unlimited leverage

Instant funding via UPI, net-banking, and crypto

Swap-free Islamic options, multilingual support

Watch for:

Slight inactivity fees

No full proprietary training suite

👉 Open your EXNESS account today

See more:

How to start Trading with EXNESS 2025

How to open a forex Trading account with EXNESS

2. IC Markets – Best for Algorithmic and Scalping

Who they are:An Australian ECN broker renowned for raw spreads and fast execution. Supports MT4, MT5, and cTrader.

Why choose them:

Spreads from 0.0 pips

Super-low latency, ideal for EAs and high-frequency strategies

Watch for:

$200 deposit requirement

Limited regional support infrastructure

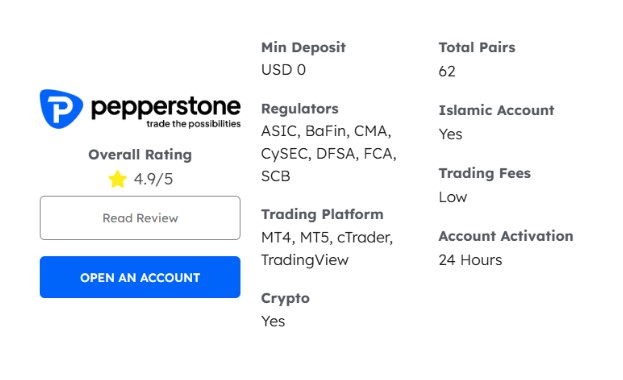

3. Pepperstone – Best for Institutional Execution

Who they are:Regulated by ASIC and FCA, offering MT4/MT5/cTrader and razor-thin spreads.

Why choose them:

Deep liquidity with sub-pip spreads

Free VPS for active traders

Fast mobile and web platforms

Watch for:

Higher initial deposit needed

No Islamic swap-free account

4. Forex.com – Best Research and Analytical Tools

Who they are:US-based under StoneX, regulated by CFTC, FCA, and ASIC; integrated with advanced analytics and trading tech.

Why choose them:

In-depth charting and risk management tools

Broad forex and CFD coverage

Watch for:

$100 minimum deposit

Slightly higher spreads on standard accounts

5. IG Group – Best for Market Variety

Who they are:UK-regulated global giant with 17,000+ trading instruments via proprietary and MT4 platforms.

Why choose them:

Access to a wide range of markets

In-built charting and sentiment indicators

Watch for:

$250 initial deposit

Spread-heavy on exotic pairs

6. Saxo Bank – Best for High-Net-Worth Investors

Who they are:Institutional-grade broker regulated by FCA, MAS, and Denmark’s FSA, targeting affluent clients.

Why choose them:

Premium trading platforms with tiered pricing

Portfolio diversification across assets

Watch for:

$10,000+ minimum deposit

Not suited for retail beginners

1️⃣ Exness: Open Account | Go to Website

2️⃣ JustMarkets: Open Account | Go to Website

3️⃣ XM: Open Account | Go to Website

5️⃣Avatrade: Open Account | Go to Website

7. OANDA – Best for Transparent Pricing

Who they are:Pioneering fintech-focused ECN broker with no minimum deposit and transparent, zero-commission pricing.

Why choose them:

Broad access to forex pairs

Mastery of historical data and API tools

Watch for:

Spreads start from 0.9 pips—higher than raw accounts

Less suited to ultra-fast trading strategies

8. XM – Best Starter Broker

Who they are:Highly regulated with low entry (from $5) and strong educational support, offering MT4/MT5 platforms.

Why choose them:

Beginner-focused learning

Spread from 0.6 pips and multiple bonus programs

Watch for:

Slower execution on standard accounts

Not ideal for tight-spread traders

9. FP Markets – Best True ECN Broker

Who they are:Australian ECN broker offering raw spreads, fast execution, and high leverage options via IRESS, MT4/MT5.

Why choose them:

Spreads from 0.0 pips

Supports multiple platforms

Watch for:

$100 deposit threshold

Regional support can vary

10. FXPro – Best Multi-Platform Offering

Who they are:Regulated by FCA and CySEC, offering MT4/MT5 and cTrader with reliable execution.

Why choose them:

Transparent pricing and diverse tools

No trading restrictions across strategies

Watch for:

$100 initial deposit

No ultra-high leverage (caps at ~1:500)

✅ Summary Table

For Low Costs & Indian Funding: EXNESS

Algo & Scalping Experts: IC Markets, Pepperstone

Advanced Tools & Instruments: Forex.com, IG Group

High-End Service: Saxo Bank

Transparency & No Min Deposit: OANDA

Beginner Learning Resources: XM

ECN Purity: FP Markets

Platform Variety: FXPro

💬 FAQs for Indian Forex Traders

1. Is forex trading legal for Indian residents?Yes—allowed via offshore brokers when following RBI (FEMA) rules.

2. Can I fund accounts from India directly?Major brokers support UPI, net-banking, cards, crypto, and e-wallets.

3. Which broker offers razor spreads under 0.1 pips?EXNESS, IC Markets, and FP Markets offer spreads from 0.0–0.1 pips.

4. Are Islamic (swap-free) accounts available?Yes—EXNESS, XM, FP Markets offer compliant accounts.

5. What’s the minimum deposit?From $5 (XM) to $10 (EXNESS), up to $200 for ECN brokers.

6. Which broker suits algo trading best?IC Markets, Pepperstone, Forex.com, and FXPro offer expert advisor support.

7. How long do withdrawals take?UPI/e-wallets: instantly; bank transfers: 1–3 business days.

8. Do brokers allow demo trading?Yes—all top 10 provide demo accounts with virtual funds.

9. Can I trade on mobile?Yes—EXNESS Go, IG, Pepperstone, and others offer mobile-optimized platforms.

10. How do I choose?Consider your needs—cost, speed, tools, funding. Test via demos before investing real money.