5 minute read

Exness account types comparison update 2026: Standard, Raw Spread, Zero, Pro

Choosing the right trading account is one of the most important steps for any forex trader. Exness, one of the most trusted brokers worldwide, offers multiple account types designed for both beginners and professionals. But with so many options, traders often ask:

👉 Which Exness account is best for me?

In this article, we will compare all Exness account types in detail, including Standard, Cent, Raw Spread, Zero, and Pro, so you can decide which one matches your trading strategy.

Start trading here:

1. Exness Standard Account

The Standard Account is the most popular choice among beginners. It offers a simple and flexible setup with no commissions, making it easy for traders who want to start trading without worrying about extra fees.

Spreads start from 0.3 pips

No commission per trade

Minimum deposit depends on payment method (from $10)

Available for forex, metals, indices, crypto, and energies

Unlimited leverage available under certain conditions

👉 This account is best for beginners who want to experience real forex trading with a small deposit and low risk.

2. Exness Standard Cent Account

The Standard Cent Account is designed for new traders who want to practice trading with very small amounts of money. Instead of trading in standard lots, trades are measured in cent lots, meaning $10 becomes 1,000 cents in the account.

Spreads similar to Standard Account (from 0.3 pips)

No commission

Very low minimum deposit (from $1 depending on payment method)

Perfect for learning strategies without high risk

👉 This account is ideal for beginners and testers who want to practice in live market conditions before switching to larger accounts.

3. Exness Raw Spread Account

The Raw Spread Account is designed for professional traders who need very tight spreads. It starts from 0.0 pips, which means traders can enter and exit positions with minimal cost. However, there is a fixed commission per trade.

Spreads from 0.0 pips

Commission: $3.5 per side per lot ($7 per round lot)

Minimum deposit: $200

Fast execution with market orders

Suitable for forex, gold, and indices scalpers

👉 This account is best for scalpers, day traders, and algorithmic traders who trade frequently and need ultra-low spreads.

4. Exness Zero Account

The Zero Account offers guaranteed 0.0 spreads on major currency pairs 95% of the trading day. This makes it excellent for scalping and trading during news events when spreads usually widen.

Spreads 0.0 on majors (EUR/USD, GBP/USD, XAU/USD, etc.) most of the time

Commission starts from $0.2 per side per lot (varies by instrument)

Minimum deposit: $200

Designed for scalpers and news traders

👉 This account is perfect for traders who trade major pairs and need fixed tight spreads during volatile market conditions.

5. Exness Pro Account

The Pro Account is designed for experienced traders who prefer instant execution and zero commission. Unlike Raw Spread and Zero, this account has slightly higher spreads but does not charge commission fees.

Spreads from 0.1 pips

No commission

Minimum deposit: $200

Instant execution (no requotes)

Suitable for discretionary traders and swing traders

👉 The Pro Account is best for professional traders who want a balance between cost, reliability, and execution style.

Step-by-Step Guide to Open an Exness Account (Standard, Cent, Raw Spread, Zero, Pro)

1. Prepare Before Registering

Before opening your Exness account, make sure you have:

A valid email address and phone number.

ID card/Passport for identity verification (KYC).

Proof of address (utility bill, bank statement, etc.).

A funding method (bank transfer, e-wallet, crypto, or bank card).

👉 Official registration link: Sign up with Exness here

2. Register Your Exness Account

Step 1: Go to Exness homepage

Visit Exness Home.

Click Sign Up.

Step 2: Fill in basic information

Choose your country of residence.

Enter your email and create a strong password.

Select your preferred account type.

👉 You can choose between Standard, Standard Cent, Raw Spread, Zero, or Pro during registration.

3. Verify Your Account (KYC Process)

To unlock full deposit/withdrawal and trading features, you must verify your account:

Upload ID card/Passport: clear front and back photos.

Proof of address: utility bill or bank statement with your name.

⏳ Verification usually takes only a few minutes to a few hours.

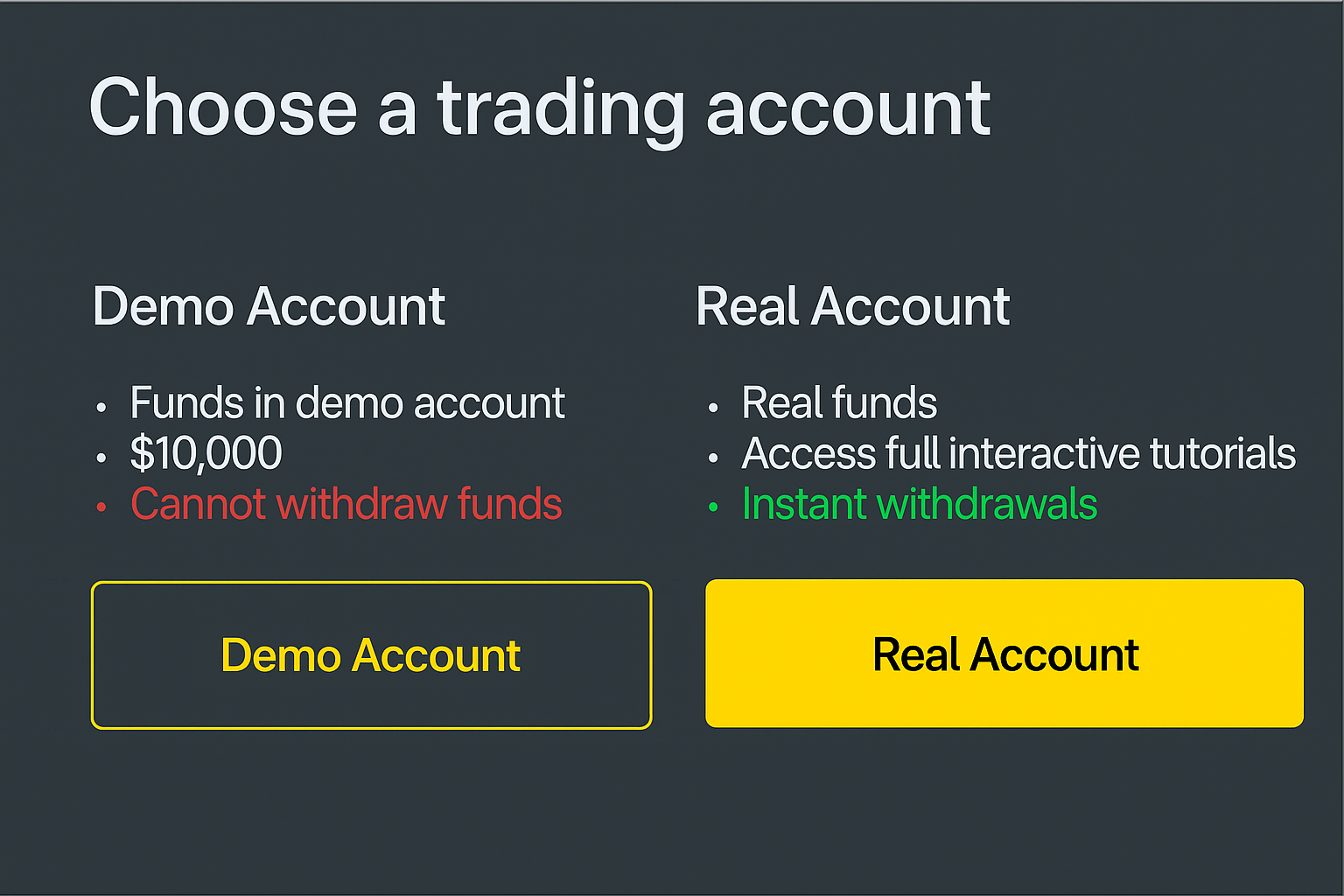

4. Choosing the Right Account Type

Each Exness account has its own benefits:

Standard Account → best for beginners, no commission.

Cent Account → ideal for new traders with very small capital.

Raw Spread Account → best for scalpers and professional traders who need ultra-low spreads.

Zero Account → great for news trading and scalping with guaranteed 0.0 spreads on major pairs.

Pro Account → designed for advanced traders and swing traders, no commission.

👉 You can open multiple account types later in your Exness Personal Area.

5. Deposit Funds

Minimum deposit starts from $1 for Cent Accounts, or $200 for Raw Spread / Zero / Pro Accounts.

Payment methods: local bank transfer, Visa/MasterCard, Skrill, Neteller, Crypto, e-wallets.

⚡ Deposits and withdrawals are free and very fast, with many methods processed instantly.

6. Start Trading on Exness

Download MT4/MT5 or use the Exness Web Terminal.

Log in using your trading account number and password.

Choose your instrument: Forex, Gold, Crypto, Indices, Energies.

👉 Get started today: Open your Exness account

Conclusion

Exness provides account types for every kind of trader, from beginners to professionals. If you’re new, Standard or Cent accounts are the best starting point. If you’re a scalper, Raw Spread or Zero will give you the lowest trading costs. For experienced professionals, the Pro Account offers excellent flexibility.

FAQ – Exness Account Types 2026

1. How many account types does Exness have?Exness offers five account types: Standard, Cent, Raw Spread, Zero, and Pro.

2. Which Exness account is best for beginners?The Standard Cent Account is best for new traders due to its low deposit requirement.

3. Which account has the lowest spreads?The Raw Spread Account offers spreads from 0.0 pips with commission.

4. Is there a commission-free account?Yes, the Standard and Pro Accounts do not charge commissions.

5. Which account is best for scalping?The Zero Account is best for scalping on major pairs, while Raw Spread is better for variety.

See more:

Exness Account Types Review: Standard, Raw Spread, Zero, Pro

EXNESS zero spread account review