10 minute read

Exness Standard vs Pro Account: Pros and Cons

When it comes to online trading, selecting the right account type can significantly impact your trading experience, costs, and profitability. Exness, a globally recognized forex and CFD broker founded in 2008, offers a variety of account types tailored to different trader profiles. Among its most popular options are Exness Standard Account vs Exness Pro Account. Each account is designed to cater to specific trading styles, experience levels, and financial goals. In this in-depth guide, we’ll compare the Exness Standard vs Pro Account, exploring their features, advantages, disadvantages, and suitability to help you make an informed decision.

✅ Join Exness now! Open An Account or Visit Brokers 👈

Whether you’re a beginner dipping your toes into forex trading or a seasoned trader seeking advanced tools and tighter spreads, understanding the nuances of these accounts is crucial. Let’s dive into the details, breaking down the pros and cons of each account type and offering insights to guide your trading journey.

Overview of Exness: A Trusted Forex Broker

Exness has established itself as a leading broker in the forex and CFD industry, serving over 800,000 active traders worldwide with a monthly trading volume exceeding $4 trillion. Regulated by top-tier authorities such as the Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), and Financial Sector Conduct Authority (FSCA), Exness ensures a secure and transparent trading environment. The broker is known for its competitive spreads, high leverage, fast execution speeds, and a user-friendly platform supporting MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary Exness Terminal and Exness Trade App.

Exness offers several account types, including Standard, Standard Cent, Raw Spread, Zero, and Pro accounts. The Standard and Pro accounts are among the most popular, catering to beginners and experienced traders, respectively. Let’s explore their key features, costs, and suitability to determine which account aligns with your trading strategy.

Exness Standard Account: Features and Benefits

The Exness Standard Account is designed for accessibility, making it an ideal choice for beginners and casual traders. It offers a straightforward, commission-free trading experience with no minimum deposit requirement, allowing traders to start with as little as $1 (depending on the payment method). Here’s a closer look at its features:

Key Features of the Standard Account

· No Minimum Deposit: Traders can start with a small amount, typically $1-$10, depending on the payment processor (e.g., UPI, bank cards, or e-wallets). This low entry barrier is perfect for those with limited capital.

· Commission-Free Trading: All trading costs are embedded in the spreads, eliminating per-trade commissions and simplifying expense tracking for new traders.

· High Leverage: Up to 1:2000 (subject to regional regulations and trading conditions), allowing traders to control larger positions with minimal capital.

· Wide Range of Instruments: Access to over 100 instruments, including forex pairs, metals, cryptocurrencies, indices, and stocks.

· Market Execution: Orders are executed at the best available market price, though slippage may occur during volatile conditions.

· Platform Support: Compatible with MT4, MT5, Exness Terminal, and the Exness Trade App.

· Stop-Out Protection: Exness ensures traders don’t lose more than their deposited funds, enhancing security.

Pros of the Exness Standard Account

· Low Entry Barrier: The absence of a minimum deposit requirement makes it accessible for traders with limited capital, ideal for beginners or those testing the platform.

· User-Friendly Platforms: The Standard Account supports intuitive platforms like MT4 and MT5, offering robust analytical tools and a seamless trading experience.

· Commission-Free Structure: No commissions mean predictable costs, which is beneficial for low-volume or infrequent traders.

· Diverse Trading Instruments: Traders can diversify their portfolios across forex, commodities, indices, and cryptocurrencies.

· Flexible Leverage: High leverage (up to 1:2000) provides opportunities for amplified profits, though caution is needed to manage risks.

· Beginner-Friendly: The straightforward structure and low financial risk make it ideal for novices learning the ropes of forex trading.

Cons of the Exness Standard Account

· Wider Spreads: Spreads start at 0.3 pips, which are higher compared to professional accounts like the Pro Account, increasing trading costs for high-volume traders.

· Market Execution Risks: Slippage during volatile market conditions can affect trade outcomes, which may be a drawback for scalpers or day traders.

· Limited Advanced Features: The Standard Account lacks the tighter spreads and advanced tools preferred by experienced traders.

· High Leverage Risks: While beneficial, the 1:2000 leverage can lead to significant losses if not managed properly, especially for inexperienced traders.

Who Should Choose the Standard Account?

The Standard Account is ideal for:

· Beginners seeking a low-cost, low-risk entry into forex trading.

· Casual traders who trade infrequently and prefer simplicity in their fee structure.

· Small-budget traders looking to test strategies with minimal capital.

Exness Pro Account: Features and Benefits

The Exness Pro Account is tailored for experienced traders, scalpers, and high-volume traders who prioritize competitive trading conditions and advanced features. It requires a higher minimum deposit of $200 (varies by region and currency) but offers tighter spreads and faster execution. Here’s a detailed breakdown of its features:

Key Features of the Pro Account

· Minimum Deposit: Starts at $200, reflecting its advanced features and professional-grade environment.

· Tighter Spreads: Spreads start at 0.1 pips on major forex pairs, significantly reducing trading costs for high-volume traders.

· Commission Structure: While most trades are commission-free, certain instruments may incur a small commission (e.g., $0.2 per side per lot), offering cost transparency.

· Instant Execution: The Pro Account supports instant execution on most instruments, reducing slippage and providing precise order fills, ideal for scalping and high-frequency trading.

· High Leverage: Up to 1:2000, matching the Standard Account’s leverage options.

· Advanced Tools: Access to sophisticated charting, technical indicators, and expert insights for in-depth market analysis.

· Wide Range of Instruments: Includes exotic forex pairs and a broad selection of CFDs, allowing traders to explore unique market opportunities.

· Platform Support: Compatible with MT4, MT5, Exness Terminal, and the Exness Trade App.

Pros of the Exness Pro Account

· Tighter Spreads: Spreads as low as 0.1 pips on major pairs make the Pro Account cost-effective for high-volume traders and scalpers.

· Faster Execution: Instant execution minimizes slippage, providing precise order fills critical for day trading and algorithmic strategies.

· Advanced Trading Tools: Access to professional-grade tools enhances market analysis and strategy development.

· Diverse Instruments: The inclusion of exotic forex pairs and CFDs allows traders to capitalize on unique market movements.

· Cost Transparency: The commission-based structure (where applicable) offers clearer visibility of trading costs, beneficial for frequent traders.

· Scalability: The Pro Account supports larger trading volumes and advanced strategies, accommodating experienced traders managing substantial portfolios.

Cons of the Exness Pro Account

· Higher Minimum Deposit: The $200 minimum deposit may be a barrier for beginners or traders with limited capital.

· Potential Commissions: Small commissions on certain instruments can add to trading costs, requiring careful cost management.

· Complex for Novices: The advanced features and tighter spreads may overwhelm beginners who lack trading experience.

· High Leverage Risks: Similar to the Standard Account, the 1:2000 leverage poses significant risks if not used with proper risk management.

Who Should Choose the Pro Account?

The Pro Account is best suited for:

· Experienced traders seeking tighter spreads and faster execution.

· Scalpers and high-frequency traders who require precise order fills and low trading costs.

· Professional traders managing large portfolios and employing advanced strategies.

✅ Join Exness now! Open An Account or Visit Brokers 👈

Exness Standard vs Pro Account: Key Differences

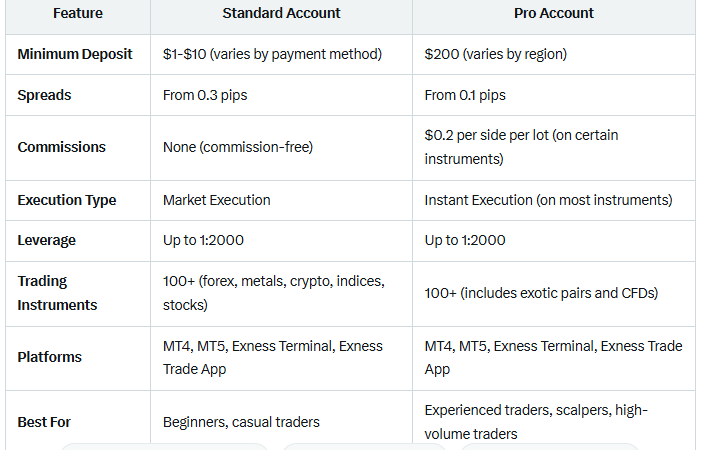

To help you decide between the Standard vs Pro accounts, here’s a side-by-side comparison of their key features:

Pros and Cons Comparison

Standard Account

Pros:

· Low entry barrier with no minimum deposit.

· Commission-free trading simplifies cost tracking.

· Beginner-friendly with user-friendly platforms.

· Wide range of trading instruments for diversification.

· High leverage for amplified profits (with caution).

Cons:

· Wider spreads increase costs for high-volume traders.

· Market execution may lead to slippage in volatile markets.

· Limited advanced features for professional trading.

· High leverage risks for inexperienced traders.

Pro Account

Pros:

· Tighter spreads reduce trading costs for frequent traders.

· Instant execution minimizes slippage, ideal for scalping.

· Advanced tools for in-depth market analysis.

· Access to exotic pairs and CFDs for diverse strategies.

· Transparent cost structure for better expense management.

Cons:

· Higher minimum deposit may deter beginners.

· Potential commissions on certain instruments.

· Advanced features may be complex for novices.

· High leverage risks require disciplined risk management.

Which Account Is Right for You?

Choosing between the Exness Standard vs Pro Account depends on your trading style, experience level, and financial goals. Here are some scenarios to guide your decision:

Choose the Standard Account If:

· You’re a beginner or have limited capital to start trading.

· You prefer a simple, commission-free trading structure.

· You trade infrequently or hold positions for longer periods (e.g., swing trading).

· You want to test strategies with minimal financial risk.

Choose the Pro Account If:

· You’re an experienced trader seeking low spreads and fast execution.

· You engage in scalping, day trading, or high-frequency trading.

· You manage a large portfolio and require advanced tools.

· You’re comfortable with a higher minimum deposit and potential commissions.

Additional Considerations

1. Risk Management

Both accounts offer high leverage (up to 1:2000), which can amplify profits but also magnify losses. Beginners should use lower leverage (e.g., 1:100) to minimize risks, while experienced traders must implement strict risk management strategies to protect their capital.

2. Educational Resources

Exness provides a wealth of educational materials, including webinars, video tutorials, and articles on trading strategies, risk management, and market analysis. These resources are available to both Standard and Pro account holders, helping traders enhance their skills.

3. Customer Support

Exness offers 24/7 customer support in multiple languages via live chat, email, and phone. This ensures traders can resolve issues or get assistance promptly, regardless of their account type.

4. Demo Account

If you’re unsure which account suits you, Exness offers a demo account that mirrors live trading conditions. This risk-free environment allows you to test both the Standard and Pro accounts before committing real capital.

Tips for Choosing the Right Exness Account

· Assess Your Trading Style: Scalpers and day traders benefit from the Pro Account’s tight spreads and instant execution, while swing traders may find the Standard Account’s simplicity sufficient.

· Evaluate Your Budget: If you have limited capital, start with the Standard Account. If you can afford the $200 minimum deposit, the Pro Account offers better cost efficiency for frequent trading.

· Test with a Demo Account: Use Exness’s demo account to experiment with both account types and determine which aligns with your strategy.

· Consult Experts: If you’re uncertain, consider reaching out to a financial advisor or trading mentor for personalized guidance.

Conclusion

The Exness Standard vs Pro Account debate ultimately boils down to your trading experience, strategy, and financial resources. The Standard Account is a beginner-friendly option with no minimum deposit, commission-free trading, and a straightforward structure, making it ideal for those new to forex or trading with limited capital. However, its wider spreads and market execution may not suit high-volume traders.

In contrast, the Pro Account caters to experienced traders with tighter spreads, instant execution, and advanced tools, offering cost efficiency and precision for scalping and high-frequency trading. Its higher minimum deposit and potential commissions may be a drawback for beginners but are justified for professionals seeking optimal trading conditions.

By understanding the pros and cons of each account and aligning them with your trading goals, you can make an informed decision that enhances your trading success. Exness’s robust regulatory framework, diverse instruments, and comprehensive support make both accounts reliable choices for traders worldwide.

✅ Join Exness now! Open An Account or Visit Brokers 👈

Read more:

Exness Raw Spread vs Zero Account Review: Pros and Cons