11 minute read

Exness Raw Spread vs Zero Account Review: Pros and Cons

In the dynamic world of forex and CFD trading, choosing the right trading account can make or break your success. Exness, a globally recognized broker established in 2008, offers a range of account types tailored to different trading styles. Among its professional offerings, the Raw Spread vs Zero Account stand out for traders seeking low-cost, high-efficiency trading environments. But which account is better suited for your needs? In this comprehensive review, we’ll dive deep into the Exness Raw Spread vs Zero Account, exploring their features, pros, cons, and ideal use cases to help you make an informed decision.

✅ Join Exness now! Open An Account or Visit Brokers 👈

Introduction to Exness: A Trusted Forex Broker

Exness is a multi-regulated broker known for its transparency, competitive trading conditions, and robust platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary Exness Terminal. Regulated by top-tier authorities such as the FCA (UK), CySEC (Cyprus), and FSCA (South Africa), Exness ensures a secure trading environment for its global clientele. With over 1 million traders and a daily trading volume exceeding $7 trillion in the forex market, Exness has earned a reputation as a reliable partner for both novice and experienced traders.

The Raw Spread vs Zero Account are part of Exness’s professional account offerings, designed for traders who prioritize low spreads, fast execution, and cost transparency. Whether you’re a scalper, day trader, or algorithmic trader, understanding the nuances of these accounts is crucial for your trading strategy. Let’s break down the key features, benefits, and drawbacks of each account to help you decide which one aligns with your goals.

What is the Exness Raw Spread Account?

The Exness Raw Spread Account is designed for traders who demand the tightest possible spreads and direct access to interbank market pricing. This account type connects traders to raw market spreads, often starting from 0.0 pips, with a fixed commission charged per lot traded. It’s particularly appealing to high-frequency traders, such as scalpers and day traders, who execute multiple trades daily and rely on minimal trading costs to maximize profitability.

Key Features of the Raw Spread Account

· Spreads: Ultra-low, starting from 0.0 pips, but variable based on market conditions.

· Commission: Fixed at up to $3.5 per side per lot (varies by instrument).

· Execution: Market execution with no requotes for fast and reliable trade processing.

· Leverage: Up to 1:unlimited (subject to regional regulations and account conditions).

· Minimum Deposit: Starts at $500 (may vary by region).

· Instruments: Includes forex, metals, cryptocurrencies, energies, stocks, and indices.

· Platforms: Supports MT4, MT5, Exness Terminal, and Exness Trade app.

Pros of the Raw Spread Account

· Ultra-Low Spreads: The ability to trade with spreads as low as 0.0 pips ensures minimal trading costs, especially during high-liquidity market conditions.

· Transparency: Direct access to interbank prices eliminates broker markups, offering a clear view of true market conditions.

· Ideal for High-Frequency Trading: Scalpers and day traders benefit from low spreads and fast execution, enabling precise entry and exit points.

· Diverse Asset Classes: Traders can diversify their portfolios with access to forex, cryptocurrencies, stocks, and more.

· Unlimited Leverage: High leverage options amplify potential profits (though they also increase risk).

· Advanced Platforms: MT4 and MT5 provide robust tools for technical analysis and algorithmic trading.

Cons of the Raw Spread Account

· Commission Costs: The fixed commission ($3.5 per side per lot) can add up for high-volume traders, potentially offsetting the benefits of low spreads.

· Variable Spreads: Spreads can widen during volatile market conditions, such as economic news releases, increasing trading costs.

· Not Beginner-Friendly: The $500 minimum deposit and commission-based structure may be intimidating for novice traders.

· Risk of High Leverage: Unlimited leverage can lead to significant losses if not managed carefully.

Who Should Choose the Raw Spread Account?

The Raw Spread Account is best suited for:

· Scalpers and Day Traders: Those executing multiple trades daily benefit from low spreads and fast execution.

· Algorithmic Traders: The account’s transparency and market execution make it ideal for automated trading strategies.

· High-Volume Traders: Traders with large transaction volumes can capitalize on tight spreads to reduce overall costs.

· Experienced Traders: Those comfortable with commission-based pricing and market volatility will find this account advantageous.

What is the Exness Zero Account?

The Exness Zero Account is tailored for traders who prioritize predictable trading costs and zero spreads on select instruments. Instead of charging spreads, Exness applies a commission-based model, with fees starting as low as $0.05 per lot per side on major instruments. This account is designed for both beginners and professionals who prefer cost stability, especially for short-term trading strategies like scalping.

Key Features of the Zero Account

· Spreads: Zero spreads on the top 30 instruments for 95% of the trading day, with near-zero spreads on other instruments.

· Commission: Variable, starting from $0.05 per lot per side, depending on the instrument (e.g., up to $7 per lot round turn for GBP/USD).

· Execution: Market execution with no requotes for seamless trade processing.

· Leverage: Up to 1:unlimited (subject to regional regulations).

· Minimum Deposit: Starts at $500 (may vary by region).

· Instruments: Includes forex, metals, cryptocurrencies, energies, stocks, and indices.

· Platforms: Supports MT4, MT5, Exness Terminal, and Exness Trade app.

Pros of the Zero Account

· Zero Spreads: No spreads on major instruments for 95% of the trading day provide cost certainty, ideal for scalping and short-term trades.

· Low Commissions: Starting at $0.05 per lot per side, commissions are competitive, especially for major currency pairs.

· Predictable Costs: Fixed spreads eliminate the uncertainty of spread widening during volatile market conditions.

· Beginner-Friendly: The straightforward pricing model is easier for novice traders to understand and manage.

· Flexible Leverage: High leverage options allow traders to align strategies with their risk tolerance.

· Comprehensive Asset Access: Trade a wide range of instruments, from forex to cryptocurrencies, on advanced platforms.

Cons of the Zero Account

· Higher Commissions on Some Instruments: Commissions for certain pairs (e.g., GBP/USD) can be higher than the Raw Spread Account, impacting profitability for high-volume traders.

· Limited Zero Spread Instruments: Zero spreads are only available on the top 30 instruments, with other assets having near-zero spreads that may fluctuate.

· Minimum Deposit: The $500 minimum deposit may be a barrier for beginners with limited capital.

· Volatility Risks: While spreads are fixed, commissions can still add up during high-frequency trading.

Who Should Choose the Zero Account?

The Zero Account is ideal for:

· Scalpers and Short-Term Traders: Zero spreads ensure minimal costs for frequent trades.

· Traders Seeking Predictability: Those who prefer fixed costs over variable spreads will appreciate the transparency.

· Beginners and Intermediate Traders: The straightforward pricing model is easier to navigate for less experienced traders.

· Major Pair Traders: Traders focusing on major currency pairs like EUR/USD and GBP/USD benefit from zero spreads.

✅ Join Exness now! Open An Account or Visit Brokers 👈

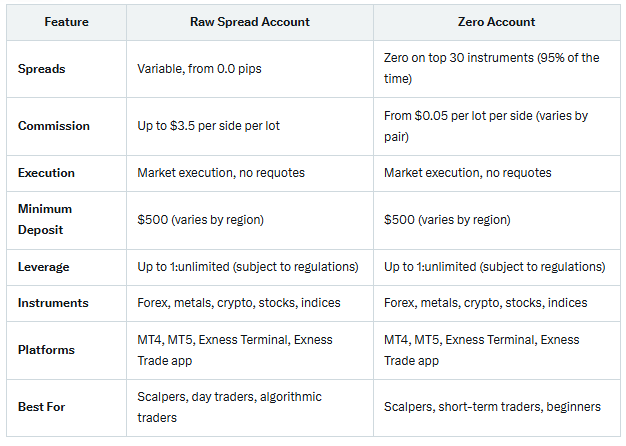

Exness Raw Spread vs Zero Account: A Side-by-Side Comparison

To help you decide between the Raw Spread vs Zero Account, here’s a detailed comparison of their key features:

Spreads and Commissions

· Raw Spread Account: Offers variable spreads starting from 0.0 pips, with a fixed commission of up to $3.5 per side per lot. Spreads can widen during volatile market conditions, which may increase costs.

· Zero Account: Provides zero spreads on major instruments for 95% of the trading day, with variable commissions starting at $0.05 per lot per side. This ensures predictable costs but may result in higher commissions for certain pairs.

Execution and Speed

Both accounts use market execution with no requotes, ensuring fast and reliable trade processing. This makes them suitable for high-frequency trading strategies like scalping and day trading.

Leverage and Margin

Both accounts offer unlimited leverage (subject to regional restrictions), allowing traders to amplify their positions. However, high leverage increases risk, so proper risk management is essential.

Minimum Deposit

Both accounts require a $500 minimum deposit, which may be a barrier for beginners or traders with limited capital. However, this is competitive compared to other brokers offering similar low-spread accounts.

Which Account is Better for You?

Choosing between the Raw Spread vs Zero Account depends on your trading style, experience level, and financial goals. Here are some scenarios to guide your decision:

Choose the Raw Spread Account If:

· You’re a high-frequency trader who executes multiple trades daily and benefits from ultra-low spreads.

· You prefer transparency and direct access to interbank market pricing.

· You trade a diverse range of instruments, including cryptocurrencies and indices.

· You’re comfortable with variable spreads and fixed commissions.

Choose the Zero Account If:

· You prioritize predictable trading costs and zero spreads on major currency pairs.

· You’re a beginner or intermediate trader looking for a straightforward pricing model.

· You focus on major forex pairs like EUR/USD or GBP/USD.

· You want to avoid spread widening during volatile market conditions.

Tips for Choosing the Right Account

· Assess Your Trading Style: Scalpers and day traders may prefer the Raw Spread Account for its low spreads, while swing traders or beginners may opt for the Zero Account’s predictability.

· Test with a Demo Account: Exness offers demo accounts for both Raw Spread vs Zero Accounts, allowing you to practice without risking real capital.

· Use Exness’s Trading Calculator: Estimate spreads and commissions for your preferred instruments to understand potential costs.

· Monitor Market Conditions: Spreads on the Raw Spread Account may widen during news events, while the Zero Account offers more cost stability.

· Leverage Wisely: High leverage can amplify profits but also increases risk. Use proper risk management strategies.

· Stay Informed: Follow Exness’s blog, webinars, and social media for updates on account features and market insights.

Exness’s Additional Features and Support

Exness goes beyond account types to provide a comprehensive trading experience. Here are some additional benefits that enhance both the Raw Spread vs Zero Accounts:

Trading Platforms

Both accounts support MT4, MT5, Exness Terminal, and the Exness Trade app, offering advanced charting, technical indicators, and algorithmic trading capabilities. These platforms are user-friendly and customizable, catering to traders of all levels.

Educational Resources

Exness offers a wealth of educational materials, including:

· Webinars and Seminars: Learn from industry experts about market trends and trading strategies.

· Trading Guides: Comprehensive articles on technical analysis, risk management, and more.

· Market Insights: Stay updated with real-time market analysis and news.

Customer Support

Exness provides 24/7 customer support in multiple languages via live chat, email, and phone. This ensures traders can resolve issues quickly and focus on their strategies.

Regulation and Security

Regulated by top-tier authorities like the FCA, CySEC, and FSCA, Exness prioritizes fund safety and transparency. Features like negative balance protection and segregated client funds provide peace of mind.

Conclusion: Raw Spread vs Zero Account – Which Should You Choose?

The Exness Raw Spread vs Zero Account are both excellent choices for professional traders seeking low-cost, high-efficiency trading environments. The Raw Spread Account is ideal for high-frequency traders who value ultra-low spreads and direct market access, while the Zero Account suits those who prefer predictable costs and zero spreads on major instruments. By assessing your trading style, capital, and goals, you can choose the account that best aligns with your needs.

To make an informed decision, consider testing both accounts using Exness’s demo feature. This allows you to experience their performance in real market conditions without risking capital. Whichever account you choose, Exness’s robust platforms, competitive conditions, and reliable support make it a top choice for traders worldwide.

✅ Join Exness now! Open An Account or Visit Brokers 👈

FAQs

1. What is the minimum deposit for Exness Raw Spread vs Zero Accounts?Both accounts require a minimum deposit of $500, though this may vary by region.

2. Can beginners use the Raw Spread vs Zero Account?While both accounts are designed for professional traders, the Zero Account’s predictable pricing makes it more beginner-friendly.

3. Do spreads widen on the Zero Account?Zero spreads are available on the top 30 instruments for 95% of the trading day, but other instruments may have near-zero spreads that can fluctuate.

4. Which account is better for scalping?Both accounts are suitable for scalping, but the Raw Spread Account is preferred for its ultra-low spreads, while the Zero Account offers cost predictability.

5. Does Exness offer demo accounts for testing?Yes, Exness provides demo accounts for both Raw Spread vs Zero Accounts, allowing traders to practice without risking real funds.

Read more: