7 minute read

Does Exness Have Synthetic Indices? Everything You Need to Know

If you’re wondering, “Does Exness have synthetic indices?” the short answer is no, Exness does not offer synthetic indices as part of its trading portfolio. But don’t click away just yet! In this article, we’ll dive deep into what synthetic indices are, why Exness doesn’t offer them, what you can trade instead, and whether this broker still suits your trading needs. Whether you’re a newbie or a seasoned trader, let’s break it down in a way that’s clear, engaging, and actionable.

✅ Trade with Exness now: Open An Account or Visit Brokers 👈

What Are Synthetic Indices, Anyway?

Before we get into the nitty-gritty of Exness, let’s clarify what synthetic indices are. Unlike traditional indices like the S&P 500 or Nasdaq, which track real-world stocks, synthetic indices are algorithm-driven financial instruments. They mimic market movements but aren’t tied to actual assets. Think of them as simulated markets that run 24/7, unaffected by real-world events like economic reports or geopolitical drama.

Here’s what makes synthetic indices unique:

24/7 Availability: Trade anytime, even on weekends or holidays.

Predictable Volatility: Their price movements are generated by algorithms, offering consistent volatility levels.

No External Influence: News, earnings reports, or global events don’t impact their prices, making them ideal for technical traders.

Popular examples include the Volatility 75 Index (VIX 75), Crash and Boom Indices, and Step Indices, often offered by brokers like Deriv or IQ Option. These indices attract traders who love high-volatility environments and the flexibility of round-the-clock trading.

Why Doesn’t Exness Offer Synthetic Indices?

Exness, a global forex and CFD broker founded in 2008, is a heavyweight in the trading world, known for its competitive spreads, fast execution, and diverse asset offerings. So why haven’t they jumped on the synthetic indices bandwagon? Here are a few reasons:

Focus on Real Markets: Exness prioritizes real-world assets like forex, commodities, cryptocurrencies, stocks, and traditional indices (e.g., US30, UK100). Their business model revolves around providing access to markets driven by actual economic conditions, which aligns with their regulatory framework and client base.

Regulatory Considerations: Exness is regulated by top-tier authorities like the FCA (UK) and CySEC (Cyprus). Offering synthetic indices, which rely on proprietary algorithms, might require additional regulatory scrutiny or compliance, something Exness may not see as strategic yet.

Client Demand: While synthetic indices are gainingMSP, they may not be Exness’s primary focus. Exness caters to traders interested in forex and traditional markets, and synthetic indices might not align with their core audience’s needs.

Specialized Product: Synthetic indices are a niche product, often offered by brokers like Deriv that specialize in algorithm-driven instruments. Exness seems to stick to more conventional CFD trading.

That said, the trading industry is dynamic, and client demand could push Exness to consider synthetic indices in the future. For now, though, they’re not part of the lineup.

✅ Trade with Exness now: Open An Account or Visit Brokers 👈

What Can You Trade on Exness Instead?

No synthetic indices? No problem! Exness offers a robust range of trading instruments that can satisfy most traders. Here’s a quick look at what’s available:

Forex: Over 100 currency pairs, including majors like EUR/USD and minors like AUD/CAD, with leverage up to 1:2000.

Commodities: Trade metals like gold and silver, or energies like oil, with competitive spreads.

Cryptocurrencies: Access popular cryptos like Bitcoin, Ethereum, and more, available 24/7.

Stocks: Trade CFDs on big names like Apple, Tesla, and Amazon, with trading hours from Monday to Friday.

Indices: Speculate on major global indices like US30 (Dow Jones), US500 (S&P 500), and UK100 (FTSE 100). Leverage is fixed at 1:400 for US30, US500, and USTEC, and 1:200 for others.

While these instruments don’t offer the 24/7 availability or algorithm-driven predictability of synthetic indices, they provide exposure to real-world markets, which many traders prefer for fundamental analysis or macroeconomic trading strategies.

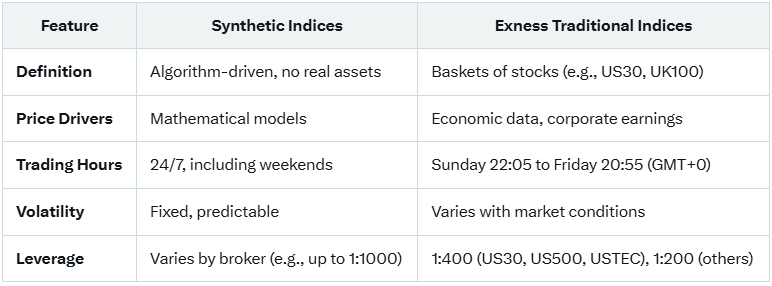

Comparing Synthetic Indices to Exness’s Traditional Indices

To help you decide if Exness’s offerings can replace synthetic indices, let’s compare them:

If you’re after the constant availability and controlled volatility of synthetic indices, Exness’s traditional indices won’t fully replicate that experience. However, if you enjoy trading based on real-world events or prefer a regulated broker with a broad asset range, Exness is a solid choice.

Benefits of Trading with Exness

Even without synthetic indices, Exness has plenty to offer:

Competitive Spreads: Exness boasts some of the tightest spreads in the industry, especially on forex and indices, with spreads as low as 0.1 pips on major pairs for Professional Accounts.

Fast Execution: Orders are executed in milliseconds, with a 98% slippage-free rate for pending orders.

Flexible Leverage: Up to 1:2000 for forex, though indices have fixed leverage to manage risk.

Risk Management Tools: Stop-loss, take-profit, and trailing stops help you manage volatile markets effectively.

User-Friendly Platforms: Trade on MetaTrader 4, MetaTrader 5, or the proprietary Exness Terminal, all with advanced charting and technical indicators like RSI and Bollinger Bands.

Demo Account: Practice trading with virtual funds to test strategies without risking real money.

24/7 Support: Exness’s multilingual support team is available round-the-clock via live chat, email, or phone.

Alternatives for Synthetic Indices Trading

If synthetic indices are a must-have, you’ll need to look beyond Exness. Here are two reputable brokers that offer them:

Deriv:

Offerings: Volatility Indices (VIX 75), Crash and Boom Indices, Step Indices.

Features: 24/7 trading, leverage up to 1:1000, proprietary platform with fast execution.

Why Choose It: Specializes in synthetic indices, ideal for traders seeking predictable volatility.

IQ Option:

Offerings: Synthetic indices like Volatility Indices and others.

Features: User-friendly platform, low minimum deposit, and 24/7 trading.

Why Choose It: Great for beginners and traders looking for simplicity.

These brokers focus on synthetic indices, but they may not match Exness’s regulatory credibility or breadth of real-market assets. Always research and compare brokers to find the best fit for your trading style.

Should You Choose Exness?

Exness may not offer synthetic indices, but it’s still a top-tier broker for traders who value reliability, transparency, and diverse assets. Here’s a quick guide to help you decide:

Choose Exness if:

You prefer trading real-world assets like forex, stocks, or traditional indices.

You value tight spreads, fast execution, and top-tier regulation.

You want a broker with a strong reputation and 24/7 support.

Look Elsewhere if:

Synthetic indices are your primary focus.

You need 24/7 trading availability for all instruments.

You prefer algorithm-driven markets over real-world exposure.

Tips for Trading on Exness Without Synthetic Indices

If you decide to stick with Exness, here are some tips to maximize your trading experience:

Use Technical Indicators: Leverage tools like Fibonacci retracements, moving averages, and RSI on indices like US30 or US500 to spot trends.

Manage Risk: Set stop-loss and take-profit orders to protect your capital, especially in volatile markets.

Practice with a Demo Account: Test strategies on Exness’s demo account before going live.

Stay Informed: Unlike synthetic indices, Exness’s assets are influenced by economic events. Keep an eye on news and earnings reports to anticipate market moves.

Optimize Leverage: Use Exness’s flexible leverage wisely, but avoid over-leveraging to minimize risk.

Could Exness Add Synthetic Indices in the Future?

The trading industry evolves quickly, and brokers often adapt to client demand. Given the rising popularity of synthetic indices, Exness might consider adding them if enough traders request it. However, this would depend on regulatory feasibility and whether it aligns with Exness’s focus on real-market trading. For now, there’s no official word on synthetic indices joining the Exness platform.

Final Thoughts

So, does Exness have synthetic indices? Nope, they don’t. Exness focuses on real-world assets like forex, commodities, stocks, and traditional indices, offering a reliable and regulated platform for traders worldwide. While synthetic indices provide 24/7 trading and predictable volatility, Exness’s diverse offerings, competitive spreads, and fast execution make it a strong contender for most traders.

✅ Trade with Exness now: Open An Account or Visit Brokers 👈

Read more: