9 minute read

Is Exness available to investors in India?

from Exness Blog

Forex trading has surged in popularity across India, with thousands of retail investors seeking opportunities in the global financial markets. Among the many brokers vying for attention, Exness stands out as a globally recognized platform known for its competitive trading conditions, user-friendly interface, and robust regulatory framework. But the key question remains: Is Exness available to investors in India? This article dives deep into Exness’s availability, regulatory status, trading features, and how Indian traders can leverage this platform to achieve their financial goals in 2025. We’ll also explore alternatives, user experiences, and tips for safe trading, ensuring this guide is both informative and optimized for search engines.

What is Exness?

Founded in 2008, Exness is a global online forex and CFD (Contract for Difference) broker headquartered in the Republic of Seychelles. With a client base exceeding millions worldwide, Exness has earned a reputation for transparency, low spreads, and advanced trading technology. The platform offers access to a wide range of financial instruments, including forex currency pairs, commodities, indices, cryptocurrencies, and stocks. Exness operates under multiple regulatory licenses, ensuring a secure trading environment for its users.

For Indian investors, Exness provides a seamless trading experience through its support for popular platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary Exness Trade app. But before diving into the specifics, let’s address the core question: Can Indian traders legally use Exness?

Is Exness Available to Investors in India?

The short answer is yes, Exness is available to investors in India. Indian traders can open accounts, deposit funds, and trade a variety of financial instruments through Exness’s platform. However, there are nuances to consider, particularly regarding regulation and compliance with Indian laws.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Regulatory Status in India

Exness is not directly registered with Indian regulatory bodies like the Securities and Exchange Board of India (SEBI) or the Reserve Bank of India (RBI). Instead, it operates as an offshore broker, regulated by several reputable international authorities, including:

CySEC (Cyprus Securities and Exchange Commission): Ensures compliance with European financial standards.

FCA (Financial Conduct Authority, UK): A top-tier regulator known for stringent oversight.

FSA (Financial Services Authority, Seychelles): Governs Exness’s operations in non-EU regions.

FSCA (Financial Sector Conduct Authority, South Africa), FSC (Financial Services Commission, Mauritius), and others.

These licenses enhance Exness’s credibility, as they require adherence to strict financial standards, such as client fund segregation and anti-money laundering (AML) protocols. For Indian traders, this means that while Exness is not regulated by SEBI, it still offers a high level of security and transparency. However, traders should be aware that they won’t have access to SEBI’s Investor Protection Fund, which applies only to brokers registered with Indian exchanges.

Legal Considerations for Indian Traders

Forex trading in India is legal but heavily regulated. SEBI and RBI allow trading in currency pairs like EUR/INR, GBP/INR, JPY/INR, and USD/INR through SEBI-registered brokers. Trading CFDs or other currency pairs via offshore brokers like Exness is technically in a gray area, as these activities fall outside SEBI’s jurisdiction. Despite this, many Indian traders use offshore brokers due to their competitive offerings, provided they comply with RBI’s Liberalised Remittance Scheme (LRS), which caps overseas remittances at $250,000 per year.

Indian traders must also declare their forex trading earnings as part of their taxable income to comply with Indian tax laws. Consulting a tax professional is advisable to navigate these obligations.

How Indian Traders Can Start with Exness

Getting started with Exness is straightforward for Indian investors. Here’s a step-by-step guide:

Sign Up: Visit the official Exness website Open An Account or Visit Brokers 🏆. You’ll need to provide basic details like your name, email, and phone number.

Complete KYC Verification: Submit Proof of Identity (POI) and Proof of Residence (POR) documents, such as an Aadhaar card, passport, or utility bill. Verification typically takes a few hours but may extend to 24 hours for manual checks.

Choose an Account Type: Exness offers various account types tailored to different trading styles:

Standard Account: Ideal for beginners with a low minimum deposit ($1).

Standard Cent Account: Suitable for micro-trading with smaller lot sizes.

Pro, Raw Spread, and Zero Accounts: Designed for experienced traders with tighter spreads and higher minimum deposits ($200).

Deposit Funds: Exness supports multiple payment methods for Indian traders, including:

Bank transfers

Credit/debit cards (Visa, MasterCard)

E-wallets (Skrill, Neteller, UPI)

Cryptocurrencies (Bitcoin, Tether) Deposits are usually instant or processed within hours. Exness covers most transaction fees, making it cost-effective.

Start Trading: Access trading platforms like MT4, MT5, or the Exness Trade app to begin trading forex, commodities, indices, or cryptocurrencies.

Why Choose Exness for Trading in India?

Exness offers several advantages that make it appealing to Indian investors:

1. Competitive Trading Conditions

Low Spreads: Exness is known for some of the lowest spreads in the industry, particularly on its Raw Spread and Zero accounts. For example, spreads on major currency pairs like EUR/USD can be as low as 0.0 pips.

High Leverage: Exness offers flexible leverage up to 1:2000, though this depends on the account type and asset. High leverage can amplify profits but also increases risk, so caution is advised.

No Deposit/Withdrawal Fees: Exness covers third-party transaction fees, ensuring cost-efficient fund management.

2. Wide Range of Financial Instruments

Indian traders can diversify their portfolios with:

Over 100 forex currency pairs (major, minor, and exotic).

Commodities like gold, silver, and oil.

Indices such as US30, US500, and UK100.

Cryptocurrencies like Bitcoin, Ethereum, and Ripple.

Stock CFDs from major global exchanges (e.g., Apple, Tesla, Amazon).

3. Advanced Trading Platforms

Exness supports industry-leading platforms:

MetaTrader 4 and 5: Known for advanced charting, technical indicators, and Expert Advisors (EAs) for automated trading.

Exness Trade App: A mobile-friendly app optimized for trading on the go, with real-time market data and order management.

Exness Terminal: A proprietary web-based platform with enhanced functionality, such as drag-and-drop order modifications.

4. 24/7 Customer Support

Exness provides multilingual support, including English and Hindi, via live chat, email, and phone. This ensures Indian traders can resolve issues promptly, even without a local office.

5. Educational Resources

Exness offers a wealth of educational materials, including:

Webinars and video tutorials on trading strategies.

Daily and weekly market analysis.

Articles on risk management and market psychology.

6. Security and Transparency

Fund Segregation: Client funds are kept separate from Exness’s operational funds.

Regulatory Compliance: Adherence to international standards and regular audits.

Advanced Security: Multi-factor authentication and encryption protect user data.

Trading Hours for Indian Investors

Exness aligns its trading hours with global markets, adjusted for Indian Standard Time (IST, UTC+5:30). Here’s a breakdown:

Forex Market: Operates 24/5 from Monday morning (Sydney session) to Saturday morning (New York session close). The best trading window for Indian traders is the London-New York session overlap (6:30 PM to 10:30 PM IST) due to high liquidity.

Stock CFDs: Available during the operating hours of major exchanges (e.g., NYSE, NASDAQ, LSE). For Indian traders, this typically means evening and night trading.

Commodities: Gold, silver, and oil trading hours align with exchanges like the Chicago Mercantile Exchange (CME), often in the evening IST.

Cryptocurrencies: Available 24/7, offering flexibility for Indian traders.

Challenges and Risks of Using Exness in India

While Exness is accessible and feature-rich, Indian traders should be aware of potential challenges:

Regulatory Gray Area: As an offshore broker, Exness operates outside SEBI’s oversight, which may limit recourse in disputes.

Tax Implications: Forex trading profits are taxable, and using an offshore broker may complicate tax reporting.

High Leverage Risks: Leverage up to 1:2000 can lead to significant losses if not managed properly.

Market Volatility: Forex and CFD trading carry inherent risks, especially during economic announcements or geopolitical events.

To mitigate these risks, traders should:

Use risk management tools like stop-loss orders.

Start with a demo account to practice.

Stay informed about Indian regulations and tax obligations.

Exness vs. Competitors for Indian Traders

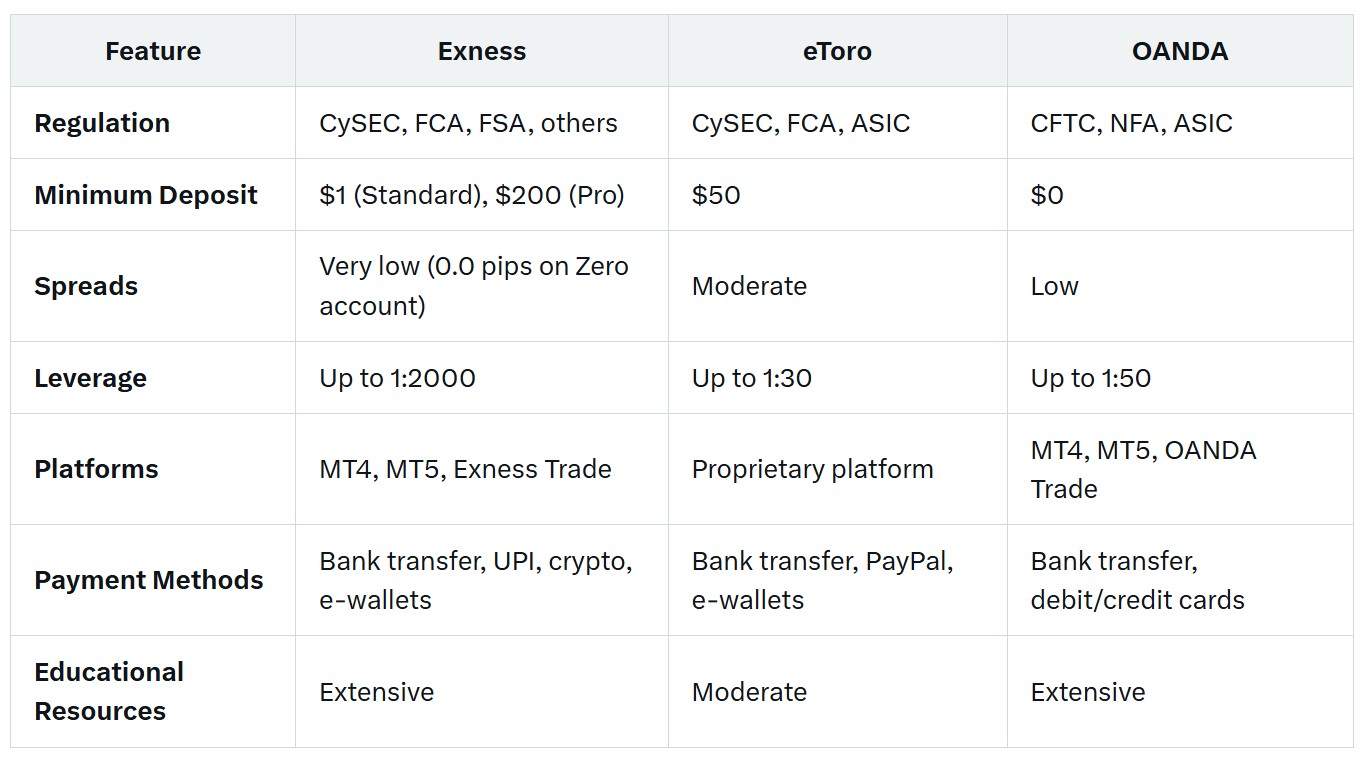

How does Exness stack up against other brokers available to Indian investors? Here’s a quick comparison with two popular alternatives:

eToro is popular for social trading and copy trading, making it ideal for beginners who want to follow experienced traders. However, its spreads are higher, and leverage is limited compared to Exness. OANDA offers robust tools for technical analysis but has fewer payment options for Indian traders. Exness stands out for its low costs, high leverage, and diverse instrument offerings.

User Experiences with Exness in India

Indian traders generally praise Exness for its:

Ease of Use: The intuitive interface of MT4/MT5 and the Exness Trade app.

Fast Withdrawals: Funds are typically processed within hours.

Customer Support: Responsive and available in multiple languages.

However, some users note challenges, such as:

Limited investor protection due to the lack of SEBI regulation.

Occasional delays in verification for new accounts.

Overall, Exness enjoys a strong reputation among Indian traders, with a safety score of 10/10 from some reviewers due to its regulatory oversight and fund protection measures.

Future Outlook for Exness in India (2025)

As India’s forex market continues to grow, Exness is well-positioned to maintain its appeal. However, evolving SEBI and RBI regulations may impact offshore brokers. In 2025, SEBI introduced stricter rules on leverage and margin trading, which could prompt Exness to adjust its offerings for Indian clients. For instance, leverage limits may decrease, requiring traders to adapt their strategies.

Exness’s commitment to compliance and innovation—such as enhancing its mobile app and expanding educational resources—suggests it will remain a viable option. Traders should stay updated on regulatory changes and Exness’s announcements to ensure uninterrupted access.

Tips for Safe Trading with Exness in India

Start Small: Begin with a Standard or Cent account to minimize risk while learning.

Use Demo Accounts: Practice strategies without financial exposure.

Leverage Educational Resources: Take advantage of Exness’s webinars and tutorials.

Monitor Tax Obligations: Keep records of your trades and consult a tax advisor.

Stay Informed: Follow market news and regulatory updates to adapt to changes.

Conclusion

Exness is indeed available to investors in India, offering a secure, user-friendly, and cost-effective platform for forex and CFD trading. While it operates as an offshore broker outside SEBI’s jurisdiction, its international regulations, low spreads, and diverse offerings make it a top choice for Indian traders in 2025. By understanding the legal and tax implications, leveraging Exness’s tools, and practicing sound risk management, Indian investors can unlock significant opportunities in the global markets.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: