16 minute read

Exness vs Bybit Comparison: Best Forex Broker for You?

from Exness Blog

The world of online trading is dynamic and ever-evolving, with countless platforms vying for traders’ attention. Among the top contenders are Exness vs Bybit, two brokers that have carved out significant reputations in the forex and cryptocurrency trading spaces. But which one is the best forex broker for you? In this in-depth Exness vs Bybit comparison, we’ll explore their features, fees, platforms, regulatory frameworks, and more to help you make an informed decision. Whether you’re a beginner dipping your toes into forex or a seasoned trader seeking advanced tools, this guide will provide clarity on which platform aligns with your trading goals.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction: Why Compare Exness vs Bybit?

Choosing the right forex broker is a critical decision that can impact your trading success. With the rise of online trading platforms, traders have more options than ever, but this abundance can lead to confusion. Exness vs Bybit are two platforms that cater to different types of traders, yet both have strengths that make them appealing for forex trading.

· Exness is a globally recognized forex broker, founded in 2008, known for its competitive spreads, robust regulation, and extensive range of forex pairs.

· Bybit, primarily a cryptocurrency exchange, has gained traction for its derivatives trading and user-friendly interface, appealing to traders interested in both crypto and forex markets.

This article will break down the key differences and similarities between Exness vs Bybit, focusing on factors like trading platforms, fees, asset diversity, customer support, and security. By the end, you’ll have a clear understanding of which broker suits your trading style and objectives.

1. Overview of Exness vs Bybit

Exness: A Forex Powerhouse

Founded in 2008 and headquartered in Cyprus, Exness has grown into one of the largest forex brokers globally, boasting over $4.5 trillion in monthly trading volume. Regulated by multiple authorities, including the Financial Conduct Authority (FCA) and Cyprus Securities and Exchange Commission (CySEC), Exness is a trusted name for forex traders. It offers a wide range of financial instruments, including over 90 forex pairs, commodities, indices, and cryptocurrencies, accessible via platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary Exness Terminal.

Exness is particularly popular among forex traders due to its:

· Low spreads starting from 0.0 pips on certain accounts.

· High leverage options, up to unlimited leverage in some jurisdictions.

· User-friendly interface suitable for both beginners and professionals.

Bybit: The Crypto Trading Giant

Launched in 2018, Bybit is a Singapore-based cryptocurrency exchange that has rapidly gained popularity for its derivatives trading, particularly in crypto markets. While Bybit is best known for offering up to 100x leverage on crypto pairs like BTC/USD and ETH/USD, it has expanded its offerings to include forex trading, making it a competitor to traditional brokers like Exness. Bybit operates a proprietary trading platform and supports MetaTrader 4, appealing to traders who want exposure to both crypto and forex markets.

Key features of Bybit include:

· A focus on cryptocurrency derivatives with high leverage options.

· A sleek, mobile-friendly platform for trading on the go.

· Limited regulation, as it operates as a self-regulated entity, which may appeal to risk-tolerant traders.

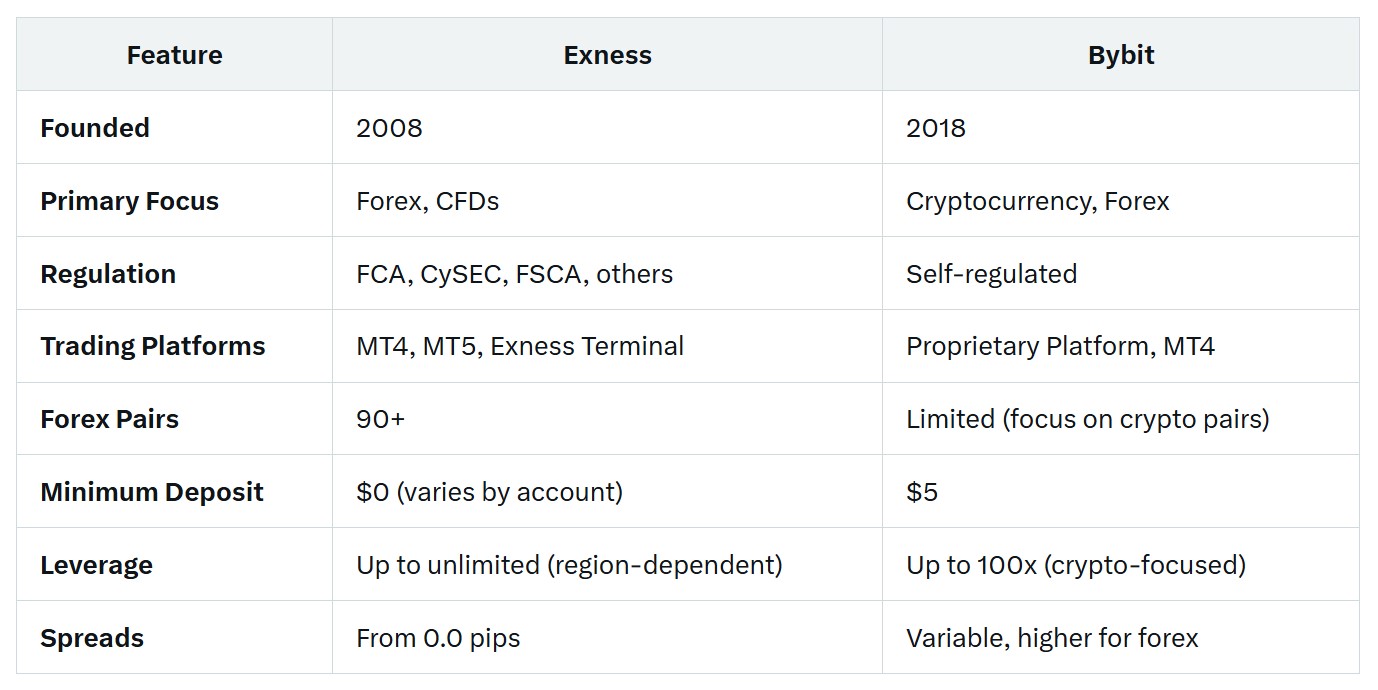

Key Differences at a Glance

Before diving deeper, here’s a quick comparison of Exness vs Bybit:

2. Regulation and Security: Which Broker is Safer?

Safety is a top priority when choosing a forex broker. Regulatory oversight ensures that your funds are protected and that the broker adheres to strict financial standards.

Exness: Robust Regulation

Exness is one of the most heavily regulated brokers in the industry, holding licenses from:

· Financial Conduct Authority (FCA) in the UK.

· Cyprus Securities and Exchange Commission (CySEC) in the EU.

· Financial Sector Conduct Authority (FSCA) in South Africa.

· Financial Services Authority (FSA) in Seychelles, among others.

This multi-jurisdictional regulation ensures that Exness complies with international standards, including Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols. Exness also offers negative balance protection, meaning your account cannot go below zero, even in volatile markets. Additionally, the broker is a member of the Financial Commission, providing an external dispute resolution mechanism for clients.

Exness enhances transparency by publishing monthly reports on its trading volumes and financials, which builds trust among traders. For those prioritizing security, Exness is a clear frontrunner.

Bybit: Limited Regulation

Bybit operates as a self-regulated platform, which means it does not fall under the oversight of major financial regulators like the FCA or CySEC. While this allows Bybit to offer higher leverage and more flexible trading conditions, it also introduces a higher level of risk. Traders who value regulatory oversight may find Bybit’s lack of formal regulation concerning.

However, Bybit has implemented security measures to protect user funds, including:

· Cold wallet storage for cryptocurrencies, keeping the majority of assets offline.

· Two-factor authentication (2FA) for account security.

· Regular proof-of-reserves audits using Merkle Tree and zk-SNARKs to verify asset holdings.

While these measures provide some reassurance, Bybit’s self-regulated status may deter traders who prioritize strict oversight.

Verdict: Safety

For traders who value regulatory compliance and transparency, Exness is the safer choice due to its multiple licenses and adherence to global standards. Bybit, while secure in its crypto operations, lacks the regulatory backing that Exness provides, making it better suited for risk-tolerant traders.

3. Trading Platforms: Ease of Use and Functionality

The trading platform is your gateway to the markets, and its design, functionality, and tools can significantly impact your trading experience. Let’s compare the platforms offered by Exness vs Bybit.

Exness: Versatile and User-Friendly

Exness offers a range of trading platforms to suit different trader preferences:

· MetaTrader 4 (MT4): A classic platform favored by forex traders for its customizable charts, technical indicators, and support for automated trading via Expert Advisors (EAs).

· MetaTrader 5 (MT5): An advanced version of MT4, offering additional features like more timeframes, order types, and access to multiple asset classes, including stocks and futures.

· Exness Terminal: A proprietary web-based platform designed for simplicity, with one-click trading, sentiment indicators, and integration with Trading Central for technical analysis.

· Exness Trade App: A mobile app for iOS and Android, offering seamless trading on the go with real-time market data and account management features.

Exness’s platforms are known for their intuitive design, making them accessible to beginners while providing advanced tools for experienced traders. The inclusion of Trading Central signals and a currency converter for live forex rates adds value for forex-focused traders.

Bybit: Crypto-Centric with Forex Support

Bybit primarily operates through its proprietary trading platform, which is optimized for cryptocurrency derivatives but also supports forex trading. The platform is available on:

· Web: A sleek, browser-based interface with advanced charting tools and order types.

· Mobile App: Available for iOS and Android, Bybit’s mobile app is highly rated for its user-friendly design and fast execution.

· MetaTrader 4: Bybit recently introduced MT4 support, allowing forex traders to use a familiar platform with Bybit’s asset offerings.

Bybit’s platform is designed with crypto traders in mind, offering features like spot trading, contract trading, and high-leverage derivatives. However, its forex trading capabilities are less developed compared to Exness, with fewer currency pairs and less focus on forex-specific tools.

Verdict: Trading Platforms

Exness takes the lead for forex traders due to its versatile platform options, including MT4, MT5, and the user-friendly Exness Terminal. Bybit’s proprietary platform is excellent for crypto trading but lags in forex functionality, despite the addition of MT4 support.

4. Asset Diversity: Forex and Beyond

The range of tradable assets is a key consideration when choosing a broker. A diverse selection allows traders to explore multiple markets and diversify their portfolios.

Exness: Forex-Focused with Broad Appeal

Exness offers over 220 CFD markets, including:

· Forex: Over 90 currency pairs, including major, minor, and exotic pairs, with competitive spreads and high liquidity.

· Commodities: Gold, silver, oil, and other metals and energies.

· Indices: Major global indices like the S&P 500, NASDAQ, and FTSE 100.

· Cryptocurrencies: A growing selection, including BTC/USD, ETH/USD, and LTC/USD.

· Stocks: CFDs on major global stocks.

Exness’s extensive forex offerings make it a go-to choice for currency traders, while its additional asset classes provide opportunities for diversification.

Bybit: Crypto-Centric with Limited Forex

Bybit’s primary focus is on cryptocurrency trading, offering:

· Crypto Pairs: Over 100 cryptocurrencies, including BTC/USD, ETH/USD, XRP/USD, and more, with up to 100x leverage.

· Forex: A limited selection of forex pairs, primarily major pairs like EUR/USD and USD/JPY.

· Commodities and Indices: Minimal offerings compared to Exness.

Bybit’s strength lies in its cryptocurrency derivatives, making it ideal for traders focused on digital assets. However, its forex offerings are limited, which may disappoint traders seeking a comprehensive forex experience.

Verdict: Asset Diversity

Exness excels in providing a wide range of forex pairs and other asset classes, making it suitable for traders who want diversity. Bybit is better for crypto enthusiasts but falls short for forex-focused traders due to its limited currency pair offerings.

5. Fees and Spreads: Which Broker is More Cost-Effective?

Trading costs, including spreads, commissions, and other fees, directly impact your profitability. Let’s compare the fee structures of Exness vs Bybit.

Exness: Competitive Spreads and Low Fees

Exness is known for its cost-effective trading conditions:

· Spreads: Start from 0.0 pips on Raw Spread and Zero accounts, with Standard accounts offering spreads from 0.2 pips.

· Commissions: No commissions on Standard accounts; Raw Spread and Zero accounts charge commissions (e.g., $3.5 per lot per side on Raw Spread).

· Swap Fees: Swap-free trading is available for most instruments, including forex majors and cryptocurrencies, ideal for long-term traders.

· Other Fees: No inactivity fees, deposit fees, or withdrawal fees, though some payment processors may charge nominal fees.

Exness’s fee structure is particularly appealing for high-volume forex traders, with tight spreads and no hidden costs.

Bybit: Higher Costs for Forex

Bybit’s fee structure is tailored to crypto trading:

· Spreads: Variable and generally higher for forex pairs compared to Exness, as forex is not Bybit’s primary focus.

· Commissions: Maker-taker fees apply for crypto trading (e.g., 0.01% maker, 0.06% taker), but forex trading commissions are less transparent.

· Swap Fees: Bybit charges overnight funding fees for leveraged positions, which can be significant for long-term trades.

· Other Fees: Deposits and withdrawals are typically free, but crypto transactions may incur blockchain network fees.

Bybit’s fees are competitive for crypto trading but less favorable for forex, where spreads and transparency lag behind Exness.

Verdict: Fees

Exness offers lower spreads and a more transparent fee structure, making it the more cost-effective choice for forex traders. Bybit’s fees are better suited for crypto derivatives trading.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

6. Leverage: High-Risk, High-Reward

Leverage allows traders to control larger positions with smaller capital, but it also increases risk. Both Exness vs Bybit offer high leverage, but their approaches differ.

Exness: Unlimited Leverage

Exness is renowned for its unlimited leverage option (available in certain jurisdictions, such as Seychelles), allowing traders to maximize their exposure. In regulated regions like the EU and UK, leverage is capped at 1:30 for retail clients due to regulatory restrictions. Key points:

· Forex: Up to unlimited leverage on major pairs.

· Cryptocurrencies: Up to 1:200.

· Risk Management: Exness provides negative balance protection and margin call alerts to mitigate risks.

Unlimited leverage is a double-edged sword, offering high potential returns but requiring strict risk management.

Bybit: Crypto-Focused Leverage

Bybit offers leverage up to 100x on cryptocurrency pairs, which is among the highest in the industry. For forex pairs, leverage is typically lower, around 1:50 to 1:100, depending on the pair. Key points:

· Crypto: Up to 100x leverage on BTC/USD and ETH/USD.

· Forex: More conservative leverage compared to Exness.

· Risk Management: Bybit provides stop-loss and take-profit tools, but its high leverage is riskier for inexperienced traders.

Verdict: Leverage

Exness offers more flexible and higher leverage options, especially for forex trading, making it ideal for traders comfortable with high-risk strategies. Bybit shines for crypto traders seeking extreme leverage but is less competitive for forex.

7. Account Types: Flexibility for All Traders

Both brokers offer multiple account types to cater to different trading styles and experience levels.

Exness: Diverse Account Options

Exness provides five main account types:

· Standard: No commissions, spreads from 0.2 pips, ideal for beginners.

· Standard Cent: Designed for micro-trading with smaller lot sizes, perfect for testing strategies.

· Raw Spread: Ultra-low spreads (from 0.0 pips) with a fixed commission, suited for scalpers.

· Zero: Zero spreads on top 30 instruments for 95% of the trading day, with commissions, ideal for high-volume traders.

· Pro: Tailored for professional traders with customized conditions and advanced tools.

Exness also offers swap-free Islamic accounts and demo accounts for practice.

Bybit: Simplified Account Structure

Bybit’s account structure is simpler, with a focus on crypto trading:

· Unified Trading Account: A single account for spot, futures, and forex trading, with customizable leverage.

· Demo Account: Not always available, which may disadvantage beginners looking to practice.

Bybit’s accounts are designed for crypto traders, with less emphasis on forex-specific features.

Verdict: Account Types

Exness offers greater flexibility with its diverse account types, catering to beginners, professionals, and Islamic traders. Bybit’s unified account is convenient for crypto trading but lacks the variety needed for forex-focused traders.

8. Customer Support: Accessibility and Responsiveness

Reliable customer support is essential for resolving issues quickly and efficiently.

Exness: 24/7 Multilingual Support

Exness provides 24/7 customer support in 16 languages via:

· Live Chat: Fast response times, often within minutes.

· Phone: Direct support for urgent queries.

· Email: Responses typically within 24 hours.

Exness’s support team is known for being knowledgeable and helpful, with a focus on trader satisfaction.

Bybit: Limited Support Options

Bybit offers support through:

· Live Chat: Available 24/7 but with slower response times compared to Exness.

· Email/Ticket System: Responses can take longer, especially during high demand.

· Help Center: A comprehensive FAQ section for self-help.

Bybit’s support is adequate for crypto traders but may not meet the expectations of forex traders accustomed to faster responses.

Verdict: Customer Support

Exness provides superior customer support with faster response times and more contact options, making it the better choice for traders needing assistance.

9. Educational Resources: Empowering Traders

Educational resources are crucial for beginners and intermediate traders looking to improve their skills.

Exness: Comprehensive Learning Hub

Exness offers a robust Exness Academy with:

· Webinars: Regular live sessions on forex trading strategies.

· Tutorials: Step-by-step guides on using MT4, MT5, and the Exness Terminal.

· Market Analysis: Insights from Trading Central and in-house analysts.

· Economic Calendar: A tool for tracking market-moving events.

These resources make Exness an excellent choice for traders looking to learn and grow.

Bybit: Crypto-Focused Education

Bybit’s educational resources are geared toward cryptocurrency trading:

· Bybit Learn: Articles and videos on crypto trading strategies.

· Tutorials: Guides on using the Bybit platform and MT4.

· Market Updates: Crypto-specific news and analysis.

Bybit’s resources are valuable for crypto traders but lack the depth needed for forex education.

Verdict: Education

Exness provides more comprehensive and forex-focused educational resources, making it ideal for traders seeking to master currency trading. Bybit is better for crypto-focused learning.

10. Deposits and Withdrawals: Convenience and Speed

The ease of funding and withdrawing from your trading account is a practical consideration.

Exness: Flexible and Fee-Free

Exness offers a variety of payment methods, including:

· Bank Cards: Visa, Mastercard.

· E-Wallets: Skrill, Neteller, Perfect Money.

· Cryptocurrencies: Bitcoin, Ethereum, USDT.

· Bank Transfers: Local and international options.

Key features:

· No deposit or withdrawal fees (though third-party processors may charge).

· Instant deposits and fast withdrawals (often within hours).

· No minimum deposit for Standard accounts, though other accounts may require $500+.

Bybit: Crypto-Centric Funding

Bybit focuses on cryptocurrency transactions:

· Cryptocurrencies: BTC, ETH, USDT, and others.

· Fiat Deposits: Limited support via third-party providers.

· Withdrawals: Processed via the Bybit app, with blockchain fees for crypto transactions.

Key features:

· Low minimum deposit ($5).

· Fast crypto withdrawals, but fiat withdrawals are less streamlined.

· No withdrawal fees for most transactions, except network fees.

Verdict: Deposits and Withdrawals

Exness offers more flexible and fee-free payment options, making it easier for forex traders to manage funds. Bybit is convenient for crypto transactions but less practical for fiat-based forex trading.

11. Pros and Cons: A Balanced View

Exness

Pros:

· Highly regulated by FCA, CySEC, and others.

· Competitive spreads starting from 0.0 pips.

· Wide range of forex pairs (90+) and other assets.

· Unlimited leverage in certain regions.

· Comprehensive educational resources and 24/7 support.

Cons:

· Limited stock CFD offerings compared to some competitors.

· Unlimited leverage carries high risk for inexperienced traders.

Bybit

Pros:

· High leverage (up to 100x) for crypto trading.

· User-friendly proprietary platform and mobile app.

· Strong focus on cryptocurrency derivatives.

· Low minimum deposit ($5).

Cons:

· Limited forex pair offerings.

· Self-regulated, lacking oversight from major authorities.

· Higher spreads and less transparency for forex trading.

12. Who Should Choose Exness?

Exness is the ideal choice for:

· Forex traders seeking a wide range of currency pairs and low spreads.

· Beginners who value user-friendly platforms and educational resources.

· Risk-averse traders prioritizing regulatory oversight and transparency.

· High-volume traders looking for competitive fees and advanced tools.

13. Who Should Choose Bybit?

Bybit is best suited for:

· Crypto traders interested in high-leverage derivatives.

· Traders comfortable with self-regulated platforms.

· Mobile traders who prefer a sleek, app-based experience.

· Those with a primary focus on cryptocurrencies rather than forex.

14. Conclusion: Exness vs Bybit – Which is the Best Forex Broker?

After a thorough comparison, Exness emerges as the superior choice for forex traders in 2025. Its robust regulation, extensive forex pair offerings, low spreads, and versatile platforms make it a well-rounded broker for beginners and professionals alike. Exness’s commitment to transparency, competitive fees, and comprehensive educational resources further solidify its position as a top forex broker.

Bybit, while an excellent platform for cryptocurrency trading, falls short in the forex space due to its limited currency pair offerings, higher spreads, and lack of regulatory oversight. It’s a great option for traders focused on crypto derivatives but less ideal for those prioritizing forex trading.

Ultimately, the best broker depends on your trading goals. If forex is your primary focus, Exness is the clear winner. If you’re a crypto enthusiast looking to dabble in forex, Bybit may suffice. Consider your priorities—whether it’s regulation, fees, or asset diversity—and choose the platform that aligns with your needs.

15. FAQs

Is Exness better than Bybit for forex trading?

Yes, Exness is generally better for forex trading due to its wider range of currency pairs, lower spreads, and robust regulation.

Can I trade cryptocurrencies on Exness?

Yes, Exness offers CFDs on cryptocurrencies like BTC/USD and ETH/USD, though its crypto offerings are less extensive than Bybit’s.

Is Bybit safe for trading?

Bybit is considered safe for crypto trading with measures like cold wallet storage and 2FA, but its self-regulated status may concern some traders.

What is the minimum deposit for Exness?

Exness has no minimum deposit for Standard accounts, though other account types may require $500 or more.

Does Bybit offer a demo account?

Bybit does not consistently offer a demo account, which may disadvantage beginners compared to Exness’s demo account availability.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: