21 minute read

Exness vs XTB Comparison: Which is better?

The world of online trading has opened up tremendous opportunities for investors and traders alike. As more individuals turn toward trading as a means of wealth creation, the importance of choosing the right broker cannot be overstated. In this Exness vs XTB Comparison: Which is better?, we aim to provide a comprehensive analysis of two popular trading platforms so that you can make an informed decision based on your unique trading needs.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Online Trading Platforms

Online trading platforms have become the backbone of the financial market, allowing users easy access to various trading instruments. From stocks and forex to commodities and cryptocurrencies, a good trading platform will offer a wide array of options and tools designed to facilitate trades effectively and efficiently.

The choice between brokers can significantly impact trading performance, fees, and overall user experience. This article compares Exness vs XTB in various categories such as regulation, trading instruments, account types, platforms, spreads, leverage, customer support, educational resources, payment methods, mobile trading experiences, and user feedback.

Overview of Exness

Founded in 2008, Exness has quickly gained popularity among retail traders thanks to its user-friendly platform and competitive trading conditions. The broker offers a variety of trading instruments, including forex pairs, cryptocurrencies, indices, and commodities. Known for its transparency and efficient execution of trades, Exness has built a solid reputation in the trading community.

One of the standout features of Exness is its commitment to providing a low barrier of entry for new traders. With multiple account types catering to different levels of experience and capital, it’s easy for beginners to start their trading journey with some guidance. Additionally, Exness is regulated by reputable financial authorities, ensuring a secure trading environment for clients across the globe.

Overview of XTB

XTB, which stands for X-Trade Brokers, was established in 2002 and has evolved into one of the leading forex and CFD brokers in Europe. The platform is distinguished by its cutting-edge technology, offering clients access to advanced trading tools and charting software. XTB provides an extensive range of instruments, including forex, commodities, indices, and shares, making it suitable for traders interested in diversified portfolios.

XTB has received several awards for its trading platform and customer service, which speaks volumes about its focus on providing an exceptional trading experience. The company offers free educational resources, sophisticated analytical tools, and strong customer support that caters to both novice and experienced traders.

Importance of Choosing the Right Broker

Choosing the right broker is paramount for successful trading. A reliable broker ensures that your trades are executed without delays, provides essential tools and resources, and adheres to regulatory standards that protect your funds. Whether you are a beginner or an experienced trader, the right broker should align with your trading strategy, needs, and preferences.

In the coming sections, we’ll delve deeper into crucial aspects of both Exness vs XTB to better understand their offerings and help you answer the question: which is better?

Regulatory Framework

Regulations serve as a safeguard for traders, ensuring that brokers operate within defined laws and guidelines. Both Exness vs XTB are regulated by respected financial authorities, which enhances their credibility and trustworthiness in the eyes of traders.

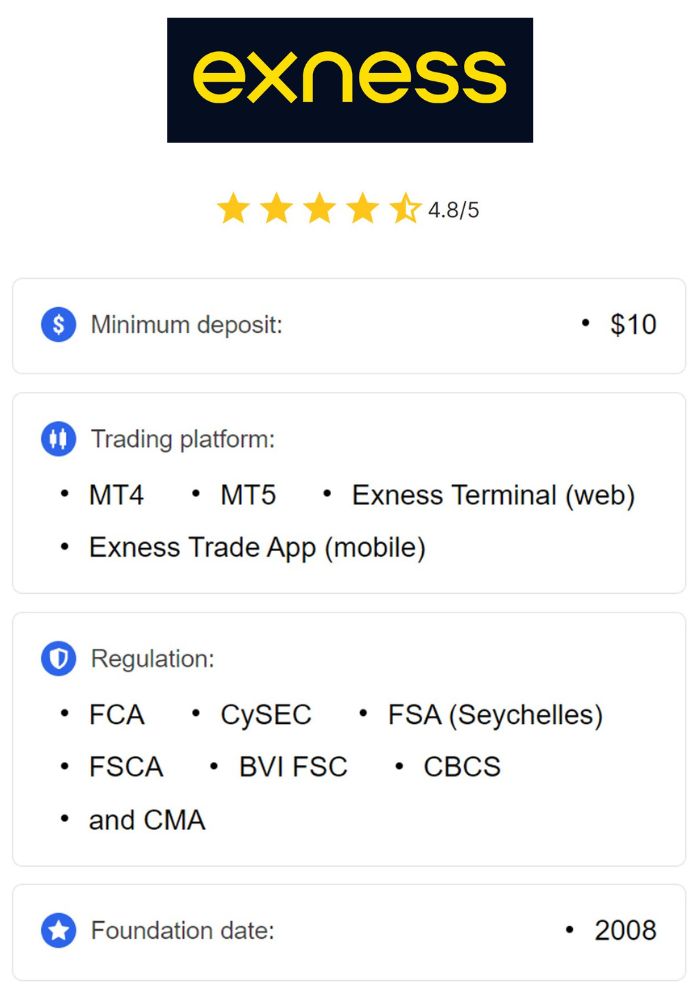

Regulation of Exness

Exness operates under multiple licenses from regulators worldwide, including the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). This multi-regulatory approach allows Exness to offer its services across various regions while complying with local laws.

The FCA and CySEC are known for their stringent requirements regarding client fund protection, risk management, and operational transparency, adding an extra layer of security for Exness clients. This regulation ensures that client funds are kept in segregated accounts and that the broker follows strict reporting guidelines.

Regulation of XTB

Similar to Exness, XTB is also regulated by esteemed bodies, including the FCA, CySEC, and the Polish Financial Supervision Authority (KNF). These regulations ensure that XTB maintains high standards of operation and provides a safe trading environment for its clients.

XTB is well-known for its commitment to transparency, implementing best practices to protect client interests. The firm conducts regular audits and adheres to strict capital adequacy rules, ensuring that it is financially stable and capable of meeting its obligations to clients.

Impact of Regulation on Trading Security

The presence of regulation plays a significant role in fostering trust between brokers and traders. Traders can feel more secure knowing that their broker is accountable to a governing body that enforces fair practices and consumer protections. When evaluating Exness vs XTB, it becomes clear that both brokers uphold excellent regulatory standards.

However, it's worth noting that the specific regulatory framework applicable to each broker may affect trading conditions such as leverage limits and deposit protection schemes. Overall, both Exness vs XTB provide a safe trading environment backed by robust regulations.

Trading Instruments Offered

A diverse range of trading instruments is vital for traders looking to capitalize on various market opportunities. The breadth of instruments available often reflects a broker's capability to cater to different trading styles and strategies.

Forex Trading Options in Exness

Exness is renowned for its extensive forex trading offerings. The broker provides access to over 100 currency pairs, ranging from major pairs like EUR/USD and GBP/USD to exotic pairs. This wide availability enables traders to execute various strategies, from day trading to long-term investing.

Additionally, Exness offers tight spreads and flexible leverage options for forex trading, making it attractive for scalpers and other active traders. The broker frequently updates its liquidity providers, ensuring that clients benefit from competitive pricing and minimal slippage.

Forex Trading Options in XTB

XTB also boasts a robust selection of forex pairs, with more than 50 options available for trading. The firm covers major, minor, and exotic currency pairs, appealing to a broad spectrum of traders. XTB's forex spreads are competitive, further enhancing its attractiveness for those seeking cost-effective trading solutions.

Moreover, XTB provides educational resources specifically tailored for forex trading. The broker emphasizes a solid understanding of market mechanics, which equips traders with the knowledge they need to navigate the complexities of forex markets successfully.

Other Assets and Instruments Available

Both Exness vs XTB offer additional trading instruments beyond forex, which broadens trading opportunities:

Commodities: Exness offers several commodity options, including gold, silver, oil, and agricultural products. This exposure allows traders to hedge against inflation and diversify their portfolios.

Indices: Both brokers provide access to global stock indices, allowing clients to trade on broader market movements without having to buy individual stocks.

Cryptocurrencies: Exness has entered the cryptocurrency market, offering trading options in popular coins like Bitcoin and Ethereum. On the other hand, XTB offers a selection of cryptocurrencies alongside its traditional assets.

Overall, both Exness vs XTB impress with their diverse range of trading instruments, catering to the varying needs of traders.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Account Types and Minimum Deposits

An important consideration when choosing a trading broker is the types of accounts offered and their minimum deposit requirements. Different account types may provide varying benefits depending on a trader's experience level and capital.

Exness Account Types

Exness features several account types, including Standard, Professional, and Cent accounts. Each type caters to different trading styles and experience levels.

Standard Accounts: Ideal for beginners, these accounts require a low minimum deposit and offer commission-free trading with competitive spreads.

Professional Accounts: Designed for experienced traders, professional accounts offer lower spreads and higher leverage options, catering to complex trading strategies.

Cent Accounts: These accounts allow traders to engage in micro trading, where they can trade tiny amounts with a smaller investment, making it an excellent option for practice and strategy testing.

XTB Account Types

XTB offers similar account types but focuses primarily on two main accounts: Standard and Pro.

Standard Accounts: Best suited for beginners, these accounts feature fixed spreads and no commission charges on trades, providing stability for those just starting.

Pro Accounts: Aimed at professional traders, these accounts come with more advantageous trading conditions, including variable spreads and a small commission per trade, ideal for high-frequency traders.

Minimum Deposit Requirements Comparison

When comparing minimum deposits, Exness tends to offer a more flexible approach. It typically starts with a minimum deposit as low as $1 for certain accounts, making it accessible for new traders. Conversely, XTB requires a minimum deposit of around $250, which may deter some novice traders.

Ultimately, the choice between Exness vs XTB regarding account types and minimum deposits will depend on individual preferences. While Exness offers more flexibility and lower costs for new traders, XTB provides a robust framework for experienced traders aiming for higher profitability.

Trading Platforms and Tools

The trading platform is the primary interface through which traders execute their transactions and analyze the market. A good platform should be intuitive, responsive, and equipped with a plethora of tools to facilitate trading.

Exness Trading Platform Features

Exness offers its proprietary trading platform, which is complemented by MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are highly regarded in the industry due to their user-friendly interfaces and advanced features.

The Exness platform comes packed with functionalities, including real-time market quotes, interactive charts, and various technical indicators. It also supports automated trading through Expert Advisors, enabling traders to implement algorithmic trading strategies effortlessly.

XTB Trading Platform Features

XTB places emphasis on its proprietary trading platform, xStation 5, which has garnered praise for its fast execution speeds and comprehensive charting capabilities. xStation 5 provides access to a rich set of tools that include powerful analysis features, customizable dashboards, and a built-in economic calendar.

Traders who prefer mobile trading will find XTB’s mobile app easy to use, maintaining most functionalities of the desktop version. The platform allows for seamless transitions between devices, which is crucial for active traders on the move.

User Experience and Interface Comparison

When comparing user experience, both Exness vs XTB deliver intuitive platforms that cater to different trader preferences. Exness’ MT4 and MT5 platforms are widely familiar among traders, making them easier to navigate for those already accustomed to these systems. However, XTB’s xStation 5 platform stands out for its speed and streamlined design, making it attractive for those who value efficiency.

In conclusion, both brokers excel in providing robust trading platforms, though individual preferences in platform design may sway your decision in the Exness vs XTB comparison.

Spreads and Commissions

Spreads and commissions play a critical role in determining the total cost of trading. Competitive pricing structures can significantly enhance profitability, especially for active traders who execute numerous trades daily.

Spread Structures at Exness

Exness offers competitive spreads across various account types, with the potential for spreads as low as zero pips on specific instruments under particular conditions. The exact spreads depend on the account type and market conditions, but overall, Exness is known for providing favorable trading costs, particularly in the forex market.

Additionally, there are no hidden fees, and the broker prides itself on its transparency regarding spread changes. This makes it easier for traders to calculate their potential costs and profits accurately.

Spread Structures at XTB

XTB also provides competitive spreads, typically starting from 0.1 pips for major currency pairs. However, these spreads may vary depending on market volatility and whether you opt for a Standard or Pro account.

While XTB’s spreads are generally favorable, the addition of commission on the Pro account can slightly elevate trading costs for high-frequency traders. That said, traders should consider the overall trading conditions when evaluating costs.

Commission Comparisons

Regarding commissions, Exness offers commission-free trading on many account types, which is particularly appealing for beginners. However, if traders choose account types with tighter spreads, they might encounter commission fees.

XTB, on the other hand, applies commission rates on its Pro accounts, which are relatively low compared to industry standards. This commission structure may appeal to experienced traders who prioritize lower spreads over commission-free trading.

Overall, when assessing spreads and commissions, Exness appears more favorable for casual traders, while XTB may suit high-volume traders seeking lower spreads even with a commission model.

Leverage Options

Leverage is a powerful tool that can amplify both profits and losses. Understanding the leverage options provided by Exness vs XTB is essential for effective risk management.

Leverage Policies of Exness

Exness offers a flexible leverage policy that varies according to the account type and trading instrument. For standard accounts, leverage can reach up to 1:2000, making it highly appealing for aggressive traders looking to maximize their potential gains.

However, such high leverage also carries significant risks, particularly for inexperienced traders. Exness emphasizes responsible trading and risk management, encouraging clients to fully understand the implications of using high leverage.

Leverage Policies of XTB

XTB provides lower leverage options compared to Exness, with maximum leverage typically capped at 1:500 for retail clients. While this may seem less appealing for traders wanting to maximize their trades, it does contribute to enhanced risk management and capital preservation, particularly for inexperienced traders.

Traders entering the market with limited experience may find XTB’s lower leverage ratios to be a more prudent choice, as they mitigate the risks associated with larger positions.

Risks Associated with High Leverage

While leverage can magnify profits, it also poses significant risks. A small market movement against a highly leveraged position can lead to substantial losses, potentially wiping out a trader’s capital quickly.

Traders must exercise caution, develop sound risk management strategies, and utilize stop-loss orders when engaging in high-leverage trading. Ultimately, the choice between Exness vs XTB regarding leverage options depends on individual trading styles and risk tolerance.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Customer Support Services

Reliable customer support is crucial for any trading platform as it ensures that all queries and issues are addressed swiftly. Both Exness vs XTB have put significant effort into providing quality customer service to their clients.

Exness Customer Support Overview

Exness prides itself on its 24/7 customer support services through multiple channels, including live chat, email, and phone support. The multilingual support team caters to clients from various regions, enhancing accessibility for traders globally.

The responsiveness of Exness’ support staff has garnered positive feedback from clients, with many praising the timely assistance provided during trading hours. With a comprehensive FAQ section and educational resources available, traders can find useful information independently.

XTB Customer Support Overview

XTB also offers robust customer support, available via live chat, phone, and email. The broker is known for its responsive customer service representatives, who are trained to address concerns promptly and effectively.

Additionally, XTB provides an extensive help center filled with educational materials, guides, and tutorials to assist traders in navigating the platform. This commitment to customer support adds another layer of confidence for traders when selecting a broker.

Accessibility and Response Times

Both Exness vs XTB exhibit commendable accessibility and response times in their customer support services. However, user reviews indicate that Exness often has a slight edge in terms of quicker response times across various channels.

Traders should consider their personal preferences in terms of communication methods when weighing the customer support offerings of each broker in the Exness vs XTB comparison.

Educational Resources and Trading Tools

Educational content and trading tools are essential components for traders looking to hone their skills and improve their strategies. Both Exness vs XTB prioritize education, offering a range of resources designed to empower their clients.

Educational Content Offered by Exness

Exness provides an array of educational materials, including webinars, video tutorials, and articles covering trading concepts and technical analysis. The broker regularly hosts live sessions with expert traders, allowing clients to interact and ask questions.

Additionally, Exness offers demo accounts, enabling traders to practice their strategies in a risk-free environment before committing real capital. This aspect of learning allows newer traders to build confidence while familiarizing themselves with the trading platform.

Educational Content Offered by XTB

XTB takes pride in its comprehensive educational resources, encompassing video tutorials, webinars, and written guides on trading strategies, technical analysis, and market insights. Their educational content is structured around various trader profiles, catering to novices and experienced traders alike.

XTB also hosts live trading sessions led by experienced analysts, providing real-time insights into market movements. Furthermore, they offer a demo account feature, allowing traders to practice and refine their skills without financial risk.

Analysis Tools and Market Insights

Both Exness vs XTB equip their clients with various analytical tools for informed decision-making. Exness integrates advanced charting tools along with technical indicators, enabling traders to perform in-depth analysis.

Conversely, XTB’s xStation 5 platform includes advanced analysis features, such as sentiment analysis, economic calendars, and integrated trading signals. This wealth of analytical resources helps traders develop and refine their strategies efficiently.

Ultimately, both brokers offer solid educational resources and trading tools, though XTB may hold a slight advantage in terms of depth and variety.

Payment Methods and Withdrawal Processes

The ability to deposit and withdraw funds conveniently is crucial for any trading platform. A variety of payment options and smooth withdrawal processes can enhance the overall client experience.

Deposit Methods Supported by Exness

Exness supports a wide range of deposit methods, including bank transfers, credit/debit cards, and e-wallets. Popular e-wallet options include Skrill, Neteller, and WebMoney, providing traders with instant deposit capabilities.

Deposits at Exness are typically processed quickly, allowing traders to get started without unnecessary delays. Moreover, most deposit methods are fee-free, which is a significant advantage for traders looking to maximize their investments.

Deposit Methods Supported by XTB

XTB also offers a variety of deposit methods, including bank wire transfers, credit/debit cards, and e-wallets like PayPal. While the range of options may not be as extensive as Exness, XTB still provides sufficient choices for its clients.

Deposit processing times can depend on the method chosen, with most being instantaneous. However, bank transfers may take longer to reflect in the trading account. Thus, users requiring immediate access to funds should consider faster payment options like credit cards or e-wallets.

Withdrawal Processes and Fees

Exness offers swift withdrawal processes, with most methods processed within minutes. However, withdrawal times may vary based on the payment method used. The broker generally imposes no fees for withdrawals, contributing to a seamless experience for clients.

XTB also provides hassle-free withdrawal options, although the process might take longer compared to Exness. Generally, XTB aims to process withdrawal requests within one business day, but this may extend based on internal checks or bank processing times.

Both brokers maintain transparent policies regarding withdrawals. However, Exness’ efficiency and lack of fees make it a more appealing choice in this regard.

Mobile Trading Experience

With the rise of mobile trading, having a well-designed mobile app has become essential for traders on the go. The availability of trading features and functionality on mobile platforms can significantly influence a trader's experience.

Mobile App Features of Exness

Exness offers a mobile application compatible with both iOS and Android devices, allowing traders to manage their accounts on the go. The app incorporates several features found on the desktop version, including real-time quotes, charting tools, and order placement capabilities.

The interface is intuitive, making it easy for both novice and experienced traders to navigate. Users can also access educational resources and receive notifications, ensuring they stay updated on market movements and trading opportunities.

Mobile App Features of XTB

XTB’s mobile app, xStation, is similarly packed with features aimed at optimizing the trading experience for mobile users. The app provides live quotes, advanced charting, and customizable alerts, giving traders a comprehensive toolkit while on the move.

The xStation app is known for its responsive design and user-friendly layout, making it easy to execute trades swiftly. Moreover, traders can access a wealth of information, including news feeds and economic calendars, directly from the app.

Performance of Mobile Trading Platforms

When comparing the mobile trading experiences of Exness vs XTB, both brokers exhibit strengths in delivering powerful apps. However, XTB’s xStation app may stand out due to its sleek design and advanced functionalities that are suitable for active traders.

Ultimately, the preferences for mobile applications will vary among traders, but both Exness vs XTB cater well to those who prefer trading on-the-go.

Pros and Cons of Exness

Evaluating the pros and cons of each broker can provide valuable insights for traders considering their options. Here is a closer look at what Exness has to offer.

Advantages of Choosing Exness

One of the key advantages of Exness is its low minimum deposit requirement, which allows new traders to enter the market with minimal risk.

Additionally, Exness offers a wide range of account types and competitive spreads. The broker's commitment to transparency and quick withdrawals further enhances its appeal.

Exness’ regulatory oversight from respected authorities also assures traders of a secure trading environment.

Disadvantages of Choosing Exness

On the flip side, Exness may not be suitable for those seeking extensive educational resources compared to competitors like XTB. Although the broker provides a range of tools, it may fall short of in-depth training and analysis compared to others.

Additionally, while Exness offers high leverage options, this may expose inexperienced traders to significant risks if not managed responsibly.

Pros and Cons of XTB

Just as with Exness, XTB has its own set of advantages and disadvantages that traders should consider.

Advantages of Choosing XTB

XTB is recognized for its user-friendly trading platform, xStation, which is equipped with a plethora of research and analysis tools. This can be particularly beneficial for traders looking to develop and refine their strategies.

Moreover, XTB's commitment to customer support and comprehensive educational resources makes it an excellent choice for novice traders. The broker also has a reputation for transparency and reliability, bolstered by its strong regulatory oversight.

Disadvantages of Choosing XTB

One potential drawback of XTB might be its higher minimum deposit requirements compared to Exness, which could deter some novice traders.

Furthermore, while the commission structure is competitive, it may not be appealing for traders who prefer commission-free trading options.

Lastly, the lack of as wide a range of deposit methods compared to Exness might limit some users' convenience when funding their accounts.

User Reviews and Feedback

User reviews and feedback can provide a wealth of information when gauging the overall performance and trustworthiness of a broker.

Positive Experiences with Exness

Many traders laud Exness for its efficient execution speeds and reliable customer support. The ability to open accounts with low minimum deposits has been particularly appreciated by novice traders who wish to explore the market without risking large sums of capital.

Users have also commended Exness for its transparent fee structures, helping them gauge trading costs clearly.

Negative Experiences with Exness

Some negative feedback revolves around the limited educational resources and tools compared to competitors. Newer traders sometimes find it challenging to learn effectively without comprehensive training materials.

Also, while the platform is widely praised, occasional technical issues during peak trading hours have been reported by some users.

Positive Experiences with XTB

XTB has received positive feedback for its educational resources and customer support. Many traders appreciate the extensive materials available, which help them improve their trading skills.

Traders also report enjoying the xStation platform’s intuitive design and powerful analytical tools, which make trading more efficient and enjoyable.

Negative Experiences with XTB

On the downside, some traders have expressed dissatisfaction with the higher minimum deposit requirements compared to Exness. Others have mentioned that the withdrawal processes could be improved for faster transaction times.

Despite these criticisms, XTB remains a popular choice among traders, demonstrating a solid record in customer satisfaction.

Final Thoughts and Recommendations

As we conclude our in-depth Exness vs XTB comparison, it’s essential to focus on key considerations when choosing a broker.

Key Considerations When Choosing a Broker

When selecting a trading platform, traders should consider factors such as regulation, trading instruments, account types, spreads, commissions, leverage, customer support, and educational resources. Each trader's needs will vary based on their experience level, trading style, and individual goals.

Summary of Exness vs XTB

Both Exness vs XTB offer compelling trading environments with unique advantages. Exness shines with its low minimum deposits, high leverage options, and competitive spreads, making it great for new and experienced traders. Meanwhile, XTB excels in its educational offerings, user-friendly platform, and customer support, catering well to novice traders.

Conclusion on Which Is Better

Ultimately, the decision of whether Exness or XTB is better hinges on individual preferences and trading objectives. Traders focused on low-cost entry and flexibility may lean towards Exness, while those prioritizing robust educational resources and a sophisticated trading platform may find XTB to be their preferred choice.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Whichever broker you choose, thorough research and understanding of your trading goals will greatly enhance your chances of success in the dynamic world of online trading.

Read more: