8 minute read

How to Open a Forex Account in South Africa

from Exness India

by Exness_India

Opening a forex account in South Africa is an important step for individuals looking to dive into the dynamic world of foreign exchange trading. The forex market is known for its high liquidity,24-hour accessibility, and potential for significant gains. However, it also comes with its own set of risks and complexities. Understanding how to open a forex account in South Africa is crucial for new traders aiming to navigate this intricate landscape effectively.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Understanding Forex Trading in South Africa

Before delving into the specifics of opening a forex account, it's essential to grasp the fundamentals of forex trading within the South African context.

Overview of Forex Trading

Forex trading involves the buying and selling of currency pairs, aiming to leverage price fluctuations for profit. In South Africa, the forex market operates under the regulatory oversight of the Financial Sector Conduct Authority (FSCA), which ensures a level playing field for traders and protects against fraudulent activities.

The allure of forex trading lies in its availability; traders can engage in transactions at any time of day, given the market's global nature. South Africans have embraced this opportunity, leading to a significant growth in local forex brokers offering diverse trading platforms and educational resources.

Popular Currency Pairs Traded

In the South African forex market, popular currency pairs typically include:

USD/ZAR: The exchange rate between the US dollar and the South African rand, often influenced by domestic economic indicators and global events.

EUR/ZAR: Representing the euro against the South African rand, this pair is affected by European economic conditions and local factors in South Africa.

GBP/ZAR: The British pound compared to the rand, usually subject to volatility based on geopolitical developments and economic data releases.

Understanding these pairs helps traders identify opportunities and strategize their trading approaches effectively.

Key Regulations Affecting Forex Trading

The FSCA plays a vital role in regulating forex trading in South Africa. As a trader, it’s crucial to familiarize yourself with the regulations that govern forex brokers, including licensing requirements, capital adequacy standards, and consumer protection policies. Such knowledge will ensure you choose a reputable broker and operate within a safe trading environment.

Choosing the Right Forex Broker

When you decide to open a forex account in South Africa, selecting the right broker is paramount. Your broker serves as the intermediary through which all your trades are executed.

Factors to Consider in Selecting a Broker

Several factors should guide your choice of a forex broker:

Regulatory Compliance Ensure that the broker is registered with the FSCA or other recognized regulatory bodies. Regulated brokers are required to maintain minimum capital reserves, segregate client funds, and adhere to fair trading practices. This compliance significantly reduces the risk of fraud and enhances trust.

Trading Platform

A broker's trading platform must be user-friendly, stable, and equipped with necessary tools for analysis. Look for platforms that offer demo accounts, allowing you to practice without risking real money. Additionally, consider mobile trading options if you prefer managing your trades on the go.

Trade Execution Speed

In forex trading, speed matters. Delays in order execution can lead to slippage, where a trade is filled at a different price than expected. Opt for brokers that provide speedy trade execution to capitalize on market movements effectively.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Evaluating Additional Features

Apart from the primary factors, consider additional features such as:

Leverage Options

Leverage allows you to control a larger position with a smaller amount of capital. While higher leverage can amplify profits, it also escalates the risk of losses. Evaluate the leverage ratios offered by brokers and determine what aligns with your risk tolerance.

Customer Support

Reliable customer support is crucial, especially for beginners who may need assistance navigating the platform or resolving issues. Test the responsiveness of the broker's support team via email, live chat, or phone before committing to an account.

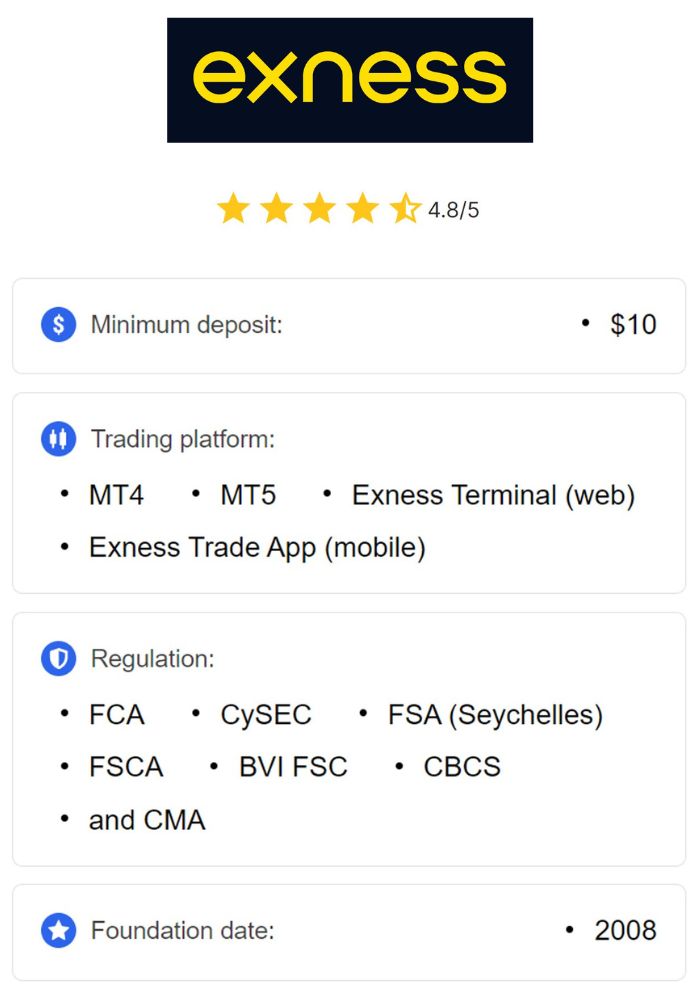

Reading Reviews and Ratings

Do thorough research by reading reviews and ratings from existing clients. Online forums, social media platforms, and unbiased review websites can provide insights into the experiences of other traders with specific brokers. This information is invaluable in making an informed decision when selecting a forex broker.

The Process of Opening a Forex Account

Having chosen your ideal broker, the next step is understanding the process involved in opening a forex account.

Types of Accounts Offered

Most brokers offer various types of trading accounts designed to cater to different skill levels and trading strategies:

Standard Accounts These accounts are suitable for most traders, providing access to typical trading features. Standard accounts generally require a minimum deposit and allow you to trade multiple currency pairs.

Mini and Micro Accounts

Mini and micro accounts are ideal for beginners who wish to start trading with smaller amounts of capital. These accounts enable traders to learn the ropes of forex trading while minimizing risks associated with larger investments.

Islamic Accounts

Islamic accounts comply with Sharia Law, meaning they do not incur interest charges. Traders who adhere to Islamic finance principles can opt for these accounts without compromising their beliefs.

Required Documentation

To open a forex account in South Africa, you'll need to provide several documents, including:

Proof of Identity

A valid government-issued ID, such as a passport or driver's license, is typically required to verify your identity. Ensure the document is clear and legible.

Proof of Address

Utility bills, bank statements, or lease agreements can serve as proof of your residential address. Make sure the document reflects your name and current address.

Tax Identification Number

Depending on the broker, you may be asked to provide your tax identification number for compliance purposes.

Completing the Application Form

Once you have gathered the necessary documentation, visit the broker's website and fill out the application form. You will need to provide personal information, including your full name, contact details, and trading experience.

After submitting the application, the broker will review your documents and may reach out for further verification. Once approved, you will receive confirmation, and your account will be activated.

Fund Your Account

Funding your forex account is the final step before you can start trading. Most brokers offer various deposit methods, including:

Bank Transfers

Traditional bank transfers are secure but may take several days to process.

Credit/Debit Cards

Credit and debit card deposits are usually instantaneous, making them a popular option among traders.

E-wallets

Services like PayPal, Skrill, and Neteller offer seamless funding options. Check with your broker to see which e-wallets they accept.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Developing a Trading Strategy

With your forex account up and running, the next crucial step is developing a robust trading strategy.

Types of Trading Strategies

Traders employ different strategies based on their goals, risk tolerance, and market analysis techniques. Some popular trading strategies include:

Day Trading

Day traders open and close positions within the same trading day, aiming to capitalize on short-term price movements. This strategy requires constant monitoring of the markets and quick decision-making skills.

Swing Trading

Swing traders hold positions for several days or weeks, looking to profit from medium-term trends. This approach allows traders to ride out short-term volatility while capturing larger price movements.

Position Trading

Position trading is a long-term strategy where traders maintain positions for months or even years. This method focuses on fundamental analysis and broader economic trends rather than short-term price fluctuations.

Risk Management Techniques

Implementing effective risk management techniques is crucial in protecting your trading capital. Here are some key concepts to integrate into your strategy:

Setting Stop-Loss Orders

A stop-loss order automatically closes a position when the market reaches a specified price, limiting losses. Establishing stop-loss levels before entering a trade helps mitigate risk.

Position Sizing

Position sizing determines how much capital you allocate to a particular trade based on your overall portfolio size and risk tolerance. Avoid risking more than a small percentage of your trading capital on a single trade to safeguard against significant losses.

Diversification

Diversifying your trades across various currency pairs can help reduce risk. By spreading your investments, you minimize the impact of adverse price movements in any one asset.

Continuous Learning and Adaptation

The forex market is dynamic, requiring traders to continuously learn and adapt their strategies. Engage in ongoing education through webinars, trading courses, and market analysis. Join online trading communities to share insights and learn from experienced traders.

Recognize that no strategy is foolproof; the markets can behave unpredictably. Embrace a mindset of continuous improvement, evaluating your trades to understand what worked and what didn’t.

Conclusion

Opening a forex account in South Africa is a gateway to exploring the exciting possibilities of the forex market. By understanding the intricacies of forex trading, selecting the right broker, navigating the account opening process, and developing a sound trading strategy, you can embark on your trading journey with confidence. Remember to prioritize education, risk management, and continuous adaptation as you strive to achieve your trading goals. With dedication and persistence, you can harness the potential of forex trading and work towards financial independence.

Read more: