9 minute read

How to open a forex trading account in Botswana

from Exness Blog

Understanding Forex Trading

Definition of Forex Trading

Forex trading, also known as foreign exchange trading, involves the buying and selling of currencies to profit from fluctuations in exchange rates. Unlike traditional financial markets with central exchanges, the Forex market is decentralized and operates 24 hours a day, five days a week. Traders in Botswana, as elsewhere, can speculate on the value of currency pairs, such as USD/BWP (US Dollar/Botswana Pula), hoping to buy a currency low and sell it high (or vice versa) to make a profit. This market's vast size and liquidity offer ample opportunities for individuals and institutions alike.

Top 4 Best Forex Brokers in Botswana

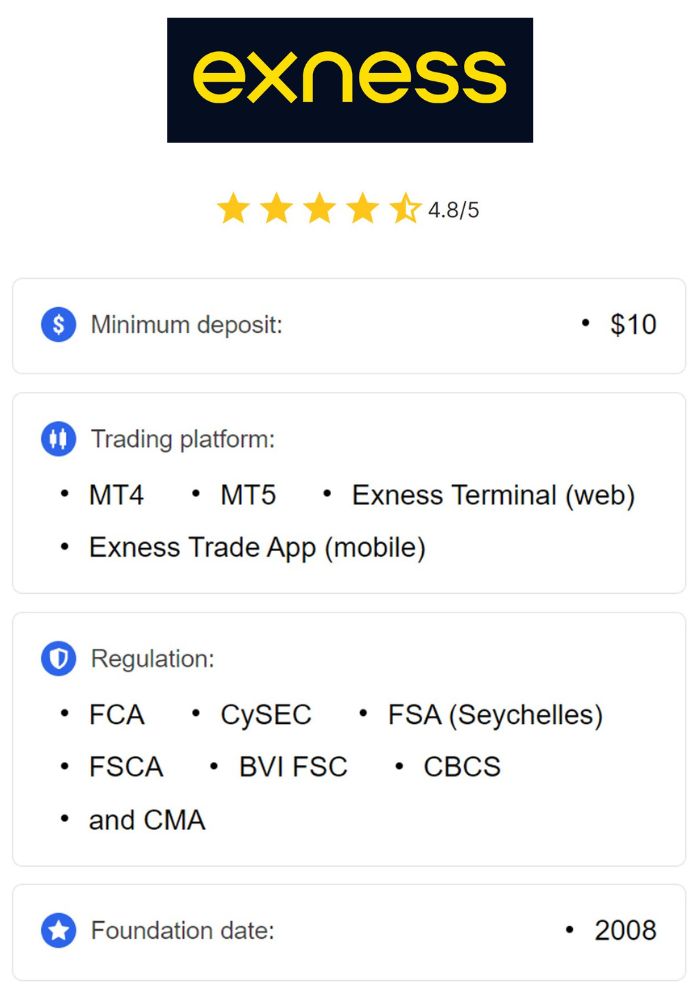

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

Benefits of Forex Trading

Forex trading offers several benefits, including high liquidity, flexibility, and accessibility. Since the Forex market is open around the clock, traders in Botswana can participate in sessions that align with their schedules, whether during the day or night. Additionally, many brokers offer leveraged trading, which allows traders to control larger positions with a relatively small capital investment. This leverage can amplify gains, though it also increases the potential for losses. For many in Botswana, Forex provides a means to diversify income, hedge against currency risks, and participate in the global financial market.

Legal Requirements for Forex Trading in Botswana

Regulatory Bodies Governing Forex Trading

In Botswana, the financial sector is primarily regulated by the Bank of Botswana (BoB). However, unlike other financial sectors, Forex trading doesn’t have a dedicated regulatory framework in the country. This regulatory gap means that many traders rely on international brokers, often regulated by authorities such as the Financial Conduct Authority (FCA) in the UK or the Cyprus Securities and Exchange Commission (CySEC) in the EU. Despite the lack of a specific Forex regulator in Botswana, it’s essential to choose brokers that comply with international regulations to ensure transparency, security, and ethical practices.

Licensing Requirements for Brokers

While Botswana doesn’t have specific licensing requirements for Forex brokers, reputable brokers operating in Botswana typically hold licenses from recognized international regulatory bodies like the FCA, CySEC, or the Australian Securities and Investments Commission (ASIC). These licenses mandate that brokers adhere to strict standards in financial operations, client fund protection, and fair trading practices. For Botswanan traders, it’s crucial to select brokers with a strong regulatory standing to ensure security and legal protection.

Choosing a Reliable Forex Broker

Factors to Consider When Selecting a Broker

Selecting a reliable Forex broker is a critical step for Botswanan traders. Key factors to consider include:

Regulation: Choose brokers regulated by reputable authorities like the FCA or CySEC.

Trading Fees: Compare spreads, commissions, and any other charges that may affect profitability.

Platform Quality: Ensure the broker offers user-friendly platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5) with essential features.

Customer Support: Look for brokers offering reliable customer service, preferably with multilingual support.

Deposit and Withdrawal Methods: Confirm that the broker supports convenient funding options, such as local bank transfers or e-wallets.

Considering these factors will help Botswanan traders find a broker that best suits their needs and trading preferences.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Comparison of Popular Brokers in Botswana

Some international brokers are popular among Botswanan traders due to their reliable services, low fees, and user-friendly platforms. Examples include XM, HotForex, and Exness, all of which offer accounts compatible with the BWP (Botswana Pula) or allow for easy currency conversion. These brokers are also regulated by reputable bodies and provide competitive spreads, high-quality platforms, and responsive customer service. Traders should compare brokers based on their specific needs and preferences to find the best match.

Types of Forex Accounts

Standard Accounts

A standard Forex account is a common choice for experienced traders, allowing for full-size lot trading. With standard accounts, traders can control larger positions and potentially earn higher profits, but they also face higher risk exposure. Standard accounts typically come with competitive spreads and leverage options, making them suitable for those with substantial capital and experience.

Mini and Micro Accounts

Mini and micro accounts are ideal for beginners or traders with limited capital. Mini accounts offer smaller contract sizes (usually one-tenth of a standard lot), while micro accounts are even smaller (one-hundredth of a standard lot). These accounts allow traders to enter the Forex market with minimal risk, making them a practical choice for learning without significant financial exposure.

Managed Accounts

Managed accounts are suitable for individuals who prefer not to trade themselves but want exposure to the Forex market. In a managed account, a professional trader or fund manager trades on behalf of the account holder for a fee or a percentage of profits. Managed accounts offer a passive trading experience, though they often require higher minimum deposits and may involve performance-based fees.

Required Documentation for Account Opening

Personal Identification Documents

When opening a Forex trading account, brokers typically require proof of identity. Acceptable forms include a valid passport, national ID, or driver’s license. These documents verify the trader's identity and prevent fraudulent activity, in line with international KYC (Know Your Customer) regulations.

Proof of Address

Proof of address is another standard requirement, which may include a recent utility bill, bank statement, or rental agreement showing the trader’s name and address. This requirement helps brokers comply with anti-money laundering (AML) regulations, ensuring that each account holder’s information is accurate and traceable.

Financial Information

Some brokers may ask for additional financial information to assess the trader's experience level and financial stability. This information may include income details, employment status, or trading experience. Providing accurate financial information is essential, as it allows brokers to recommend suitable account types and leverage levels.

The Account Opening Process

Step-by-Step Guide to Opening an Account

Opening a Forex account involves several straightforward steps. Most brokers have simplified this process, allowing traders to complete it online. The steps are typically as follows:

Visit the broker’s official website and select the “Open Account” or “Sign Up” option.

Fill in personal details, including full name, email address, phone number, and country of residence.

Select the account type (standard, mini, micro) and preferred trading currency.

Submit identification documents and proof of address as per the broker’s KYC requirements.

Completing the Registration Form

During registration, traders provide information on their trading preferences, risk tolerance, and financial background. Completing this form accurately ensures that the broker can provide the appropriate level of support and suggest suitable leverage settings.

Verification Process

After registration, the broker will verify the documents submitted. This process may take several hours to a few days, depending on the broker. Upon successful verification, the trader’s account will be activated, and they can proceed to fund it and start trading.

Understanding Margin and Leverage

What is Margin?

Margin is the amount of money a trader needs to maintain an open position. For example, with a 1:100 leverage, a trader needs only $10 to control a $1,000 position. Margin acts as a security deposit to cover potential losses. Brokers may issue margin calls if the account’s equity falls below the required margin, prompting the trader to either add funds or close positions.

The Role of Leverage in Forex Trading

Leverage allows traders to control larger positions with less capital, amplifying both potential profits and losses. For example, with 1:100 leverage, a trader can control a $10,000 position with just $100. While leverage offers higher profit potential, it also increases risk exposure, making it essential for traders to use leverage cautiously and apply proper risk management.

Funding Your Forex Account

Available Deposit Methods

Most brokers offer multiple deposit methods, including bank transfers, credit cards, and e-wallets like Skrill or Neteller. For Botswanan traders, local bank transfers and e-wallets may be the most convenient options due to lower fees and faster processing times. Before funding the account, traders should confirm the available methods and any associated fees.

Currency Options for Deposits

Forex accounts can typically be funded in various currencies, such as USD, EUR, and GBP. Some brokers also support local currencies, which eliminates the need for currency conversion fees. Botswanan traders should choose brokers that offer flexible currency options to avoid unnecessary costs.

Setting Up Your Trading Platform

Downloading the Trading Software

Once the account is funded, traders can download the broker’s trading platform, usually available as a desktop application, web version, or mobile app. Popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are commonly supported by brokers and offer essential tools for Forex analysis and trade execution.

Customizing Your Trading Interface

Most platforms allow traders to customize their interface by adding indicators, setting up watchlists, and adjusting chart views. Customizing the interface makes it easier to monitor trades and analyze market trends. For beginners, starting with basic indicators and gradually adding more advanced tools can improve the trading experience.

Developing a Trading Plan

Importance of a Trading Strategy

A trading strategy is essential for consistent Forex trading success. It defines the trader’s approach to entry and exit points, risk management, and trade sizing. By following a structured plan, traders avoid impulsive decisions and improve the likelihood of long-term profitability.

Risk Management Techniques

Effective risk management is crucial in Forex trading. Techniques include setting stop-loss orders, limiting leverage, and diversifying trades. These measures help traders protect their capital and avoid significant losses, especially in a highly volatile market like Forex.

Education and Training Resources

Online Courses and Webinars

Many brokers offer free educational resources, including online courses, webinars, and tutorials. These resources cover essential topics like technical analysis, risk management, and trading psychology. For Botswanan traders, taking advantage of these learning materials can improve trading skills and confidence.

Demo Accounts for Practice

A demo account allows traders to practice with virtual money before trading live. Demo accounts are invaluable for beginners as they provide a risk-free environment to test strategies and understand market mechanics. Botswanan traders should use demo accounts to build confidence and fine-tune their trading approach.

Conclusion

Opening a Forex trading account in Botswana involves selecting a reliable broker, understanding the account options, and familiarizing oneself with the platform and market. With the right preparation, Botswanan traders can enter the Forex market confidently, backed by a solid trading plan and effective risk management strategies. Whether new to Forex or an experienced trader, continuous education and practice are key to achieving long-term success in the market.

Read more: