15 minute read

Is It Legal To Trade In Exness In India?

Forex trading offers a wealth of opportunities for traders across the globe, and platforms like Exness have made it easier to access these opportunities. However, before engaging in forex trading, especially with an international broker like Exness, it is important to understand the regulatory framework and legality of such activities in India. This article will explore whether it is legal to trade on Exness in India, discuss relevant regulations, tax implications, and guide you through the process of trading on Exness.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Understanding Forex Trading and Its Legality in India

Definition of Forex Trading

Forex trading, or foreign exchange trading, involves buying and selling currencies with the aim of making a profit from fluctuations in exchange rates. The forex market is the largest financial market in the world, with a daily turnover exceeding $6 trillion. Traders speculate on the value of one currency relative to another, such as the USD against the EUR, or the INR against the USD. Forex trading can be done on various platforms, and traders can leverage their positions to magnify potential profits.

In India, forex trading can be legal under specific circumstances. While it is legal to trade in foreign currencies for investment purposes, restrictions apply to certain types of transactions. These restrictions are mainly enforced by the Reserve Bank of India (RBI) and other regulatory bodies, ensuring that the trading complies with the country’s laws and regulations.

Overview of Global Forex Markets

The global forex market operates 24 hours a day, five days a week, and it is not confined to a specific physical location. It is decentralized, meaning that trades occur directly between parties or through financial institutions. Forex trading involves currency pairs such as USD/EUR, USD/GBP, and USD/INR, among others.

The forex market is essential for global trade and investment as currencies are exchanged for goods, services, and financial instruments. As one of the most liquid markets in the world, forex trading allows individuals to profit from currency fluctuations, but it requires a deep understanding of global economic factors that influence currency values.

Regulatory Framework for Forex Trading in India

Role of the Reserve Bank of India (RBI)

The Reserve Bank of India (RBI) is the central authority responsible for regulating foreign exchange markets in India. It controls the flow of foreign exchange under the Foreign Exchange Management Act (FEMA) and oversees policies related to currency exchange. RBI ensures that foreign exchange transactions are conducted legally and that they contribute to the country's economic stability.

Forex trading activities are regulated under the guidance of RBI’s policies, and they monitor all transactions involving the exchange of Indian Rupees (INR) for foreign currencies. In India, it is important to comply with these regulations to ensure legal participation in the forex market.

Foreign Exchange Management Act (FEMA)

FEMA is an important piece of legislation that governs forex trading and foreign exchange transactions in India. It aims to facilitate external trade and payments while also promoting the orderly development of the foreign exchange market. FEMA regulates the exchange and trading of currencies within India and imposes restrictions on certain types of forex trading.

Under FEMA, forex trading is permitted only on recognized exchanges, and residents can trade currencies against foreign currencies. However, trading forex directly with international brokers like Exness is subject to strict rules and regulations. Exness or any other international broker must comply with FEMA regulations to be legally accessible to Indian traders.

Securities and Exchange Board of India (SEBI) Regulations

SEBI (Securities and Exchange Board of India) is the primary regulatory body overseeing the securities market in India, including activities related to forex trading. SEBI's regulations ensure that all market participants, including brokers and traders, operate transparently and adhere to ethical trading practices. While SEBI primarily regulates the securities market, its guidelines also affect forex trading platforms that Indian traders may use.

Although SEBI oversees the broader financial markets, it does not directly regulate international forex brokers. Therefore, Indian traders must be cautious and ensure that any broker they choose, such as Exness, adheres to Indian regulations when facilitating trading.

Exness: An Introduction to the Brokerage

Company Background and History

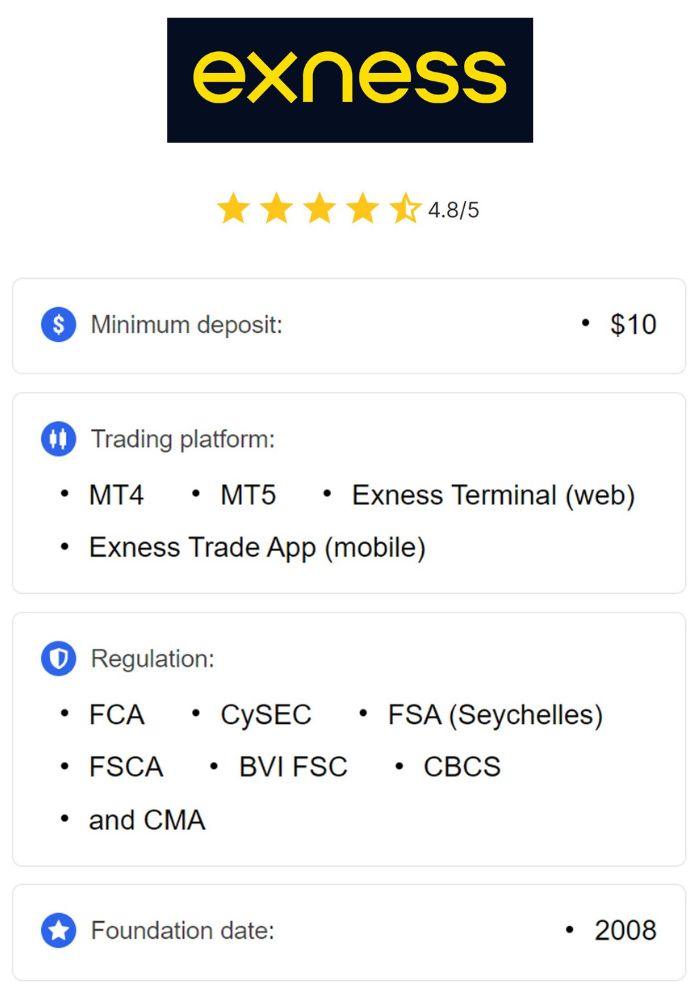

Exness is a well-established forex and financial services broker, founded in 2008. The company offers a wide range of trading instruments, including forex, commodities, stocks, and cryptocurrencies. Exness has a reputation for providing an advanced trading platform, competitive spreads, and flexible leverage options.

Exness operates globally and is known for its transparency and commitment to meeting regulatory standards. It holds licenses from multiple international regulatory authorities, which ensures that it complies with local and global standards, providing a secure and regulated trading environment for its clients.

Types of Trading Accounts Offered by Exness

Exness offers a variety of trading accounts tailored to different trading needs. These include Standard accounts for beginners, as well as Professional accounts designed for experienced traders who need advanced tools and features. Additionally, Exness offers Islamic accounts for traders who adhere to Shariah law.

Each account type offers different spreads, leverage options, and commission structures. Indian traders can choose the account that best suits their trading style and goals, ensuring flexibility and access to a wide range of trading options on the platform.

The Legality of Trading with Exness in India

Exness' Licensing and Regulation

Exness holds licenses from several global regulatory authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC). These licenses ensure that Exness operates according to strict financial standards and offers a safe and regulated trading environment for its clients worldwide.

Although Exness is licensed and regulated in several jurisdictions, it is important to note that it is not directly regulated by Indian authorities like the RBI or SEBI. Therefore, while trading with Exness can be legal under specific conditions, Indian traders should be aware of the local regulations governing forex trading and how they may apply to trading on an international platform.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Compliance with Indian Laws

Exness must comply with Indian laws regarding forex trading. While Indian traders are allowed to trade with international brokers, they must ensure that they are not violating any legal restrictions, especially under FEMA. Exness offers forex trading in a manner compliant with international regulations, but Indian traders should be cautious of the rules and the risks associated with trading foreign currencies outside of recognized Indian exchanges.

To ensure compliance with Indian laws, it is advisable for Indian traders to check if their trades align with FEMA's guidelines. Additionally, traders should consult legal professionals if they have any concerns regarding the legality of trading with an international broker like Exness.

Tax Implications of Forex Trading in India

Income Tax on Forex Gains

Forex trading gains in India are subject to income tax. The Indian Income Tax Act classifies forex trading as a speculative activity when conducted in currencies other than INR. This means that profits from forex trading are taxed as business income under Section 28 of the Income Tax Act.

Indian traders are required to report their forex trading gains when filing their taxes. The tax rate depends on whether the gains are short-term or long-term, with short-term gains being taxed at a higher rate.

Goods and Services Tax (GST) Considerations

In addition to income tax, forex trading activities in India may also attract Goods and Services Tax (GST). GST is levied on services, and forex brokers charge GST on their fees and commissions. Indian traders should be aware of the GST rates and ensure they comply with the tax regulations when engaging in forex trading.

Risks Associated with Trading on International Platforms

Market Risks and Volatility

Forex trading is inherently risky due to the high volatility of currency markets. Factors such as economic data releases, geopolitical events, and interest rate changes can cause significant fluctuations in currency values. Traders can profit from these fluctuations, but they can also incur substantial losses if the market moves unfavorably.

Indian traders should be aware of the risks associated with trading on international platforms like Exness, as market conditions can be unpredictable, and it is essential to employ risk management strategies to protect investments.

Regulatory Risks

One of the main risks of trading with international brokers like Exness is the lack of direct regulation by Indian authorities. While Exness is regulated in multiple jurisdictions, traders should be mindful of the regulatory environment in India. If the Indian government imposes stricter regulations on forex trading or international brokers, it may impact the ability of Indian traders to continue trading on these platforms.

Benefits of Trading with Exness

Access to Global Markets

Exness provides Indian traders with access to a wide range of global markets. Traders can participate in the forex market as well as trade commodities, indices, stocks, and cryptocurrencies. This diversity of markets allows traders to take advantage of opportunities across various sectors and regions, without being restricted to domestic financial markets.

Moreover, the ability to trade on international markets gives Indian traders exposure to global economic conditions. Whether it's trading major currency pairs like EUR/USD or investing in commodities like gold or oil, Exness offers flexibility and options for traders to diversify their portfolios. This can enhance trading strategies and provide numerous profit avenues.

Competitive Spreads and Leverage Options

One of the key advantages of trading with Exness is its competitive spreads and flexible leverage options. Exness offers low spreads on major currency pairs, which helps traders to reduce trading costs. This is particularly advantageous for active traders who place numerous trades throughout the day and are looking for cost-effective options to maximize their returns.

Additionally, Exness offers high leverage, allowing traders to control larger positions with a relatively small amount of capital. While leverage can amplify profits, it also increases the risk of potential losses. Therefore, Indian traders should use leverage cautiously and implement proper risk management strategies to protect their capital.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Common Misconceptions About Forex Trading in India

Myths vs. Facts

There are several myths surrounding forex trading in India. One common misconception is that forex trading is illegal in the country. However, this is not true. While the Reserve Bank of India (RBI) has restrictions on certain types of forex trading, trading on recognized international platforms like Exness is legal as long as it complies with Indian regulations. Traders must adhere to the Foreign Exchange Management Act (FEMA) and ensure that their transactions align with the country’s guidelines.

Another myth is that forex trading is only for experts. In reality, many beginners in India are successfully trading currencies and other assets on platforms like Exness. With proper education, practice, and risk management, new traders can also participate in forex trading. Exness provides various educational resources to help traders learn and improve their skills.

Understanding Online Trading Risks

While forex trading can be profitable, it also comes with significant risks. Many beginners fail to understand the volatility of the forex market and the importance of risk management. The forex market can be unpredictable, and currency pairs can experience sudden fluctuations based on global economic factors. Without a solid understanding of these risks, traders may face substantial losses.

To mitigate risks, traders should focus on building a strong foundation in both technical and fundamental analysis. Utilizing stop-loss orders, managing leverage wisely, and developing a disciplined trading strategy can help reduce the potential for significant financial loss. Exness offers various tools to assist traders in managing risk and improving their trading strategies.

How to Start Trading on Exness from India

Account Registration Process

To start trading on Exness from India, the first step is to create a trading account. The registration process is straightforward and involves providing basic personal information such as name, address, and email. Once the trader has completed the registration, Exness may require identity verification documents to ensure compliance with international anti-money laundering regulations. This verification process helps protect both the trader and the broker.

After registration and verification, traders can select the type of trading account that suits their needs. Exness offers various account types with different features such as Standard and Professional accounts. Once the account is set up, traders can access the Exness trading platform and begin placing trades.

Funding Your Exness Account

To begin trading on Exness, traders must fund their accounts. Exness supports a variety of payment methods, including bank transfers, credit/debit cards, and e-wallets such as Skrill and Neteller. Indian traders can easily fund their accounts using local payment options, such as UPI or bank transfers. Once the deposit is made, traders can start trading in the forex market and other available instruments.

Exness offers competitive deposit and withdrawal policies with minimal fees. Depending on the payment method chosen, deposits are typically processed instantly, while withdrawals may take a few business days. Indian traders should always ensure that they are aware of any potential fees or delays associated with their payment method.

Customer Support and Resources Provided by Exness

Availability of Local Language Support

Exness understands the importance of providing excellent customer support to traders across the globe, including India. The broker offers support in multiple languages, including Hindi and English, making it easier for Indian traders to navigate the platform and resolve any issues they may encounter. Local language support ensures that traders can receive assistance in a language they are comfortable with, which enhances the overall user experience.

In addition to phone and email support, Exness provides a live chat feature for instant communication with their support team. Whether it's a technical issue or a general inquiry, traders can reach out to Exness at any time, ensuring that their concerns are addressed promptly.

Educational Resources for New Traders

Exness is committed to helping new traders succeed by offering a variety of educational resources. The platform provides training materials such as webinars, tutorials, eBooks, and articles covering various aspects of forex trading. These resources are designed to help Indian traders, from beginners to more advanced traders, understand the fundamentals of the forex market and improve their trading skills.

Furthermore, Exness offers demo accounts that allow traders to practice trading without risking real money. This feature enables new traders to familiarize themselves with the trading platform and test their strategies in a risk-free environment. With Exness’ comprehensive educational offerings, Indian traders can develop their knowledge and confidence before diving into live trading.

Alternatives to Exness for Indian Traders

Overview of Other Popular Brokers

While Exness is a well-known and trusted broker, Indian traders may also consider other popular brokers that cater to the Indian market. Some of these brokers include IC Markets, AvaTrade, and XM, all of which offer competitive spreads, leverage, and access to a wide range of trading instruments. Indian traders should research different brokers and compare their features, platforms, and regulations to find the one that best fits their trading style.

Each broker has its strengths, and the choice will depend on the trader's preferences regarding account types, payment methods, and customer support. Traders should also take into account the broker’s regulatory status, as operating under strong regulations ensures the safety and security of their funds.

Comparison of Features and Regulations

When comparing Exness to other brokers, traders should consider key factors such as regulation, spreads, leverage, and available trading instruments. Exness stands out for its competitive spreads, variety of trading instruments, and robust regulation from multiple international bodies. Other brokers may offer similar features but could have different fee structures or regulatory environments.

Indian traders should also consider the ease of funding their accounts, the availability of local customer support, and the platform's user interface. Ultimately, the right broker will depend on individual preferences, risk tolerance, and trading goals.

Future of Forex Trading in India

Potential Regulatory Changes

The forex trading landscape in India is subject to ongoing changes, and it is important for traders to stay informed about potential regulatory updates. The Reserve Bank of India (RBI) and other authorities may introduce new regulations that impact how Indian traders can engage with international brokers like Exness. While the current legal framework allows for forex trading, stricter regulations could be implemented in the future.

Traders should monitor government announcements and be prepared to adapt to any changes in the regulatory environment. Staying compliant with Indian laws will help mitigate risks and ensure that traders can continue their forex trading activities without facing legal issues.

Increasing Popularity Among Retail Investors

The popularity of forex trading in India is on the rise, with more retail investors entering the market. This growth can be attributed to factors such as increased internet access, the availability of advanced trading platforms, and the desire for diversification in investment portfolios. As more individuals become familiar with online trading and the potential profits from forex trading, the market for retail investors is expected to expand.

With the growing interest in forex trading, brokers like Exness are likely to continue developing user-friendly platforms, educational resources, and localized support to cater to the needs of Indian traders. This trend will contribute to the overall development of the forex market in India.

Conclusion

Trading on Exness in India is legal under specific regulations, and the platform provides numerous benefits, such as access to global markets, competitive spreads, and flexible leverage options. However, it is essential for traders to understand the regulatory framework in India, including the Foreign Exchange Management Act (FEMA) and the guidelines set by the Reserve Bank of India (RBI). By ensuring compliance with local laws and using proper risk management strategies, Indian traders can enjoy a safe and profitable trading experience on Exness.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Read more: