8 minute read

Is Exness Legal in Dubai? Review Broker

Overview of Exness

Company Background and History

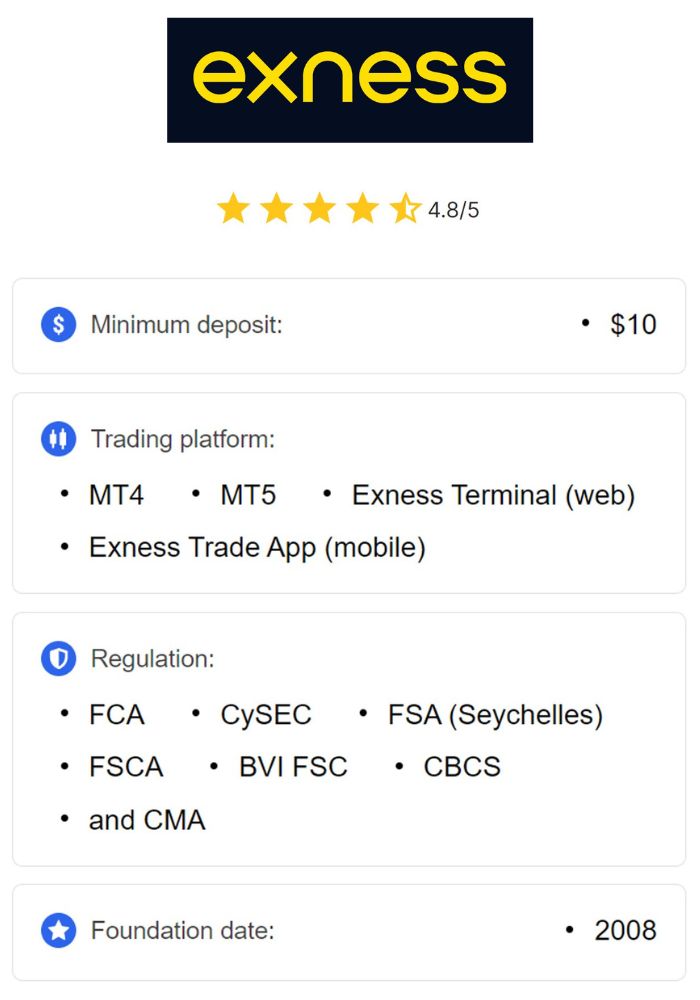

Exness is a globally recognized forex and CFD trading broker, founded in 2008. Over the years, it has established itself as a leading platform offering high-quality trading services to millions of users worldwide. With a focus on transparency, advanced technology, and customer satisfaction, Exness has earned the trust of traders across various markets.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

The company provides a wide array of trading instruments, including forex, commodities, indices, and cryptocurrencies. Known for its competitive trading conditions, Exness offers low spreads, fast order execution, and innovative tools like unlimited leverage. Its consistent commitment to innovation and client support has made it a top choice among traders in the Middle East, including Dubai.

Regulatory Framework and Licenses

Exness operates under the oversight of multiple regulatory authorities globally. It holds licenses from reputable financial regulators such as the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). These licenses ensure that Exness adheres to strict standards for transparency, fairness, and security in its operations.

In Dubai, Exness complies with local regulations to offer its services legally. The broker’s commitment to regulatory compliance is evident through its adherence to anti-money laundering (AML) policies, segregated client funds, and transparent reporting practices. This ensures traders can trust the platform while operating within the legal framework of the UAE.

Understanding Trading Regulations in Dubai

Overview of Financial Markets in Dubai

Dubai is a major financial hub in the Middle East, offering a robust and dynamic environment for trading and investments. Its strategic location and business-friendly policies attract investors and traders from around the globe.

The financial markets in Dubai encompass a range of activities, from stock trading on the Dubai Financial Market (DFM) to forex trading through regulated brokers. With advanced infrastructure and cutting-edge technologies, Dubai supports a thriving trading community while ensuring regulatory safeguards to protect participants.

The Role of the Dubai Financial Services Authority (DFSA)

The Dubai Financial Services Authority (DFSA) is the primary regulatory body responsible for overseeing financial services in the Dubai International Financial Centre (DIFC). It sets strict standards for brokers and financial institutions to ensure market integrity, investor protection, and transparency.

Forex brokers operating under the DFSA must meet rigorous compliance requirements, including maintaining adequate capital, providing fair trading conditions, and implementing robust security measures. The DFSA also ensures that brokers adhere to international best practices, fostering confidence among traders in Dubai.

Legitimacy of Forex Brokers in Dubai

Requirements for Forex Brokers to Operate Legally

For a forex broker to operate legally in Dubai, it must be licensed by an appropriate regulatory authority, such as the DFSA or the UAE Central Bank. These licenses require brokers to comply with financial reporting standards, client fund segregation, and stringent AML and KYC policies.

Legal brokers must also provide clear terms of service and maintain transparency in their operations. This includes offering fair pricing, competitive spreads, and protection against fraudulent activities. Traders are encouraged to verify a broker’s licensing status to ensure they operate within the UAE’s legal framework.

Importance of Regulation for Traders

Regulation is a cornerstone of safe and reliable trading. Regulated brokers are accountable to oversight authorities, which helps ensure fair treatment of clients, protection of funds, and resolution of disputes.

For traders in Dubai, using a regulated broker like Exness provides peace of mind. It reduces the risk of falling victim to scams or fraudulent schemes, which are often associated with unregulated entities. Moreover, regulated brokers offer features like negative balance protection and compensation schemes, further safeguarding traders’ interests.

Exness' Regulatory Status in Dubai

Licensing Information and Compliance

Exness operates in Dubai under the regulatory frameworks applicable to the region. While the broker may not directly hold a DFSA license, it ensures compliance with UAE trading laws by adhering to international standards set by its global regulators, such as CySEC and FCA.

By offering services in Dubai, Exness demonstrates its commitment to maintaining a secure and transparent trading environment. It provides segregated accounts to protect client funds and employs robust security protocols to ensure data safety. These measures align with the expectations of traders in Dubai’s regulated markets.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Comparison with Other Forex Brokers in the Region

Exness stands out among brokers operating in Dubai due to its user-friendly platform, competitive spreads, and innovative offerings like unlimited leverage. Compared to other brokers, Exness provides a more accessible entry point for traders with lower minimum deposits and flexible account options.

While some local brokers may hold DFSA licenses, Exness competes effectively by combining global expertise with localized services. Its robust customer support and advanced trading tools make it a preferred choice for traders seeking reliability and performance.

Benefits of Trading with Regulated Brokers

Investor Protection Measures

Trading with regulated brokers like Exness ensures that client funds are protected through segregation and compensation schemes. In the unlikely event of insolvency, these measures provide traders with financial security and peace of mind.

Moreover, regulatory oversight requires brokers to implement transparent trading practices, reducing the likelihood of unfair pricing or manipulation. This ensures a level playing field for all traders, regardless of their experience level.

Enhanced Security Features

Regulated brokers must adhere to strict security standards, including robust data encryption and secure payment gateways. Exness employs advanced technologies to safeguard client information and ensure secure transactions.

These features are particularly important in a global trading environment, where cyber threats pose significant risks. By prioritizing security, Exness reinforces its commitment to providing a safe and reliable trading experience.

Risks of Trading with Unregulated Brokers

Potential for Fraudulent Activities

Unregulated brokers operate without oversight, increasing the risk of fraudulent activities. These brokers may engage in unfair practices, such as manipulating spreads or refusing to process withdrawals, leaving traders vulnerable to financial losses.

In contrast, regulated brokers like Exness are held accountable for their actions and must comply with strict standards, ensuring transparency and fairness in their operations.

Lack of Consumer Recourse

Trading with unregulated brokers leaves traders without legal protection or recourse in case of disputes. Without a regulatory body to enforce accountability, clients may struggle to recover lost funds or resolve issues.

Choosing a regulated broker ensures access to dispute resolution mechanisms, providing an added layer of protection and trust for traders.

How to Determine If a Broker is Legal or Not

Key Indicators of Legitimacy

A legal broker should display its licensing information prominently on its website and provide verifiable details about its regulatory status. Additionally, the broker’s reputation, customer reviews, and operational transparency are strong indicators of its legitimacy.

Traders should also look for features such as secure payment methods, segregated accounts, and clear terms and conditions, which are hallmarks of regulated brokers like Exness.

Resources for Verifying Broker Regulations

To verify a broker’s regulatory status, traders can consult official websites of regulatory authorities, such as the DFSA or FCA. These platforms provide searchable databases of licensed brokers, allowing traders to confirm their legitimacy.

Using reliable resources ensures that traders can make informed decisions and avoid falling victim to fraudulent schemes.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

User Experiences with Exness in Dubai

Testimonials from Local Traders

Traders in Dubai often praise Exness for its competitive trading conditions, reliable platform, and responsive customer support. Many highlight the broker’s low spreads, fast withdrawals, and advanced tools as key advantages.

These positive experiences reflect Exness’ commitment to meeting the needs of traders in the region, making it a trusted choice for forex trading in Dubai.

Common Concerns and Complaints

While most traders express satisfaction with Exness, some may raise concerns about issues like account verification delays or limited local office presence. However, Exness continuously works to address these challenges and enhance its services to meet client expectations.

Alternatives to Exness for Dubai Traders

Recommended Licensed Forex Brokers

Dubai traders have access to a range of regulated brokers, including those licensed by the DFSA. Brokers such as Saxo Bank and IG Markets offer strong local presence and comprehensive trading solutions.

However, Exness remains competitive due to its global reputation, advanced platform features, and localized services tailored to the needs of Dubai traders.

Comparing Features and Services

When comparing brokers, traders should evaluate factors such as trading conditions, platform usability, and customer support. Exness excels in these areas, offering a seamless trading experience, while other brokers may prioritize local market expertise or additional asset classes.

Conclusion on Exness’ Legality in Dubai

Exness is a legitimate and reliable broker operating in Dubai, adhering to international regulatory standards while ensuring compliance with local laws. Its robust platform, competitive conditions, and commitment to transparency make it a trusted choice for traders in the region.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

By choosing Exness, traders in Dubai gain access to a secure and innovative trading environment backed by global expertise. While alternatives exist, Exness’ reputation and offerings solidify its position as a leading broker in the UAE.

Read more: