14 minute read

Exness Leverage in India: A Comprehensive Guide

Exness leverage in India serves as a vital component for Indian traders who wish to maximize their trading opportunities in the forex market. Understanding how leverage works is crucial for both novice and experienced traders, enabling them to navigate the complexities of forex trading effectively.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Forex Trading

Forex trading has emerged as one of the most dynamic and popular forms of investment in today’s global market. Unlike traditional stock trading, where investors buy shares of companies, forex trading involves exchanging currency pairs. Traders speculate on the price movements of these currencies, aiming to profit from fluctuations in their values. The forex market operates 24 hours a day, offering immense liquidity and countless opportunities for profit.

Overview of Forex Market

The forex market is the largest financial market in the world, with an average daily trading volume exceeding $6 trillion. It encompasses various participants, including banks, corporations, governments, and individual retail traders. Because of its decentralized nature, the forex market allows for flexible trading schedules, which can be particularly appealing for traders with varying availability.

In addition, the accessibility of the forex market has been significantly enhanced by technology. Online trading platforms allow individuals to trade from virtually anywhere, provided they have an internet connection. This democratization of trading attracts an increasing number of participants, each looking to capitalize on the vast opportunities available.

Importance of Leverage in Forex Trading

Leverage is an essential tool in the forex trading arsenal, allowing traders to control larger positions than their account balance would otherwise permit. By borrowing funds from their broker, traders can increase their purchasing power, thereby amplifying both potential profits and losses.

Without leverage, many retail traders would find it challenging to compete with institutional investors who have greater capital. Therefore, understanding how leverage functions is crucial for successfully navigating the forex market. It allows traders to manage risk effectively while maximizing their opportunities.

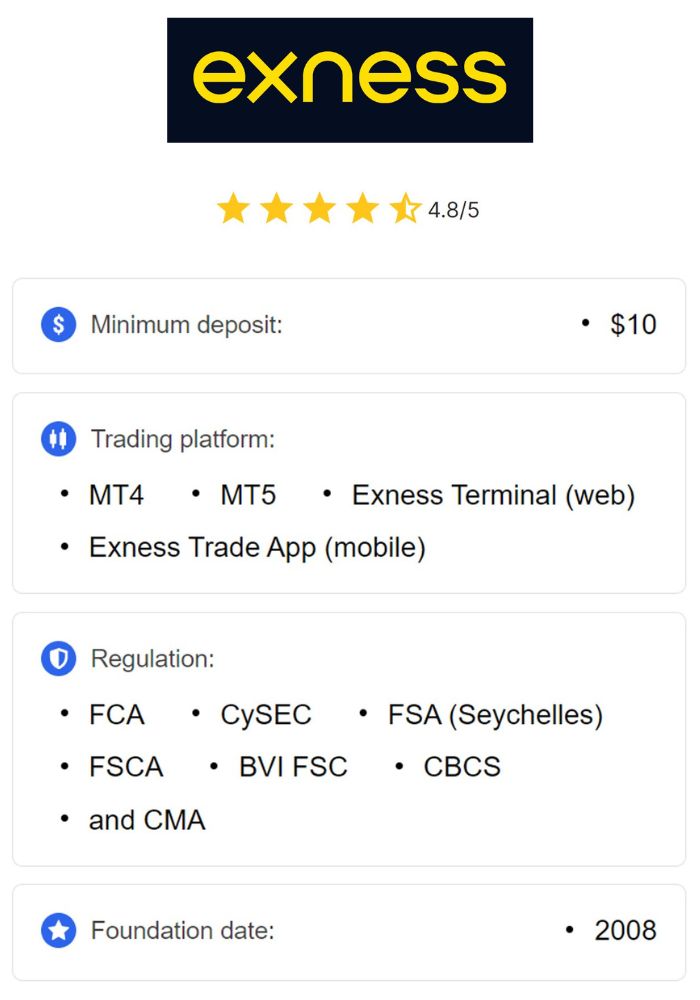

What is Exness?

Exness is a well-established online brokerage firm that has made a substantial impact in the global forex trading arena. Founded in 2008, the company has gained a reputation for delivering exceptional trading conditions, robust customer support, and innovative technology.

Company Background

Exness began its journey with a mission to make trading accessible to everyone, regardless of their financial background. Over the years, it has grown exponentially, attracting millions of clients globally. The firm continually invests in technology and infrastructure to enhance user experience and ensure seamless trading operations.

Today, Exness is not just a trading platform; it represents a community of traders, educators, and analysts dedicated to sharing knowledge and resources. Their commitment to transparency and safety has earned them the trust of traders worldwide, making them a leading choice in the industry.

Exness Global Presence and Reach

With its operational presence in multiple countries, Exness caters to a diverse clientele. The company is licensed and regulated by prominent financial authorities in different jurisdictions, ensuring compliance with international financial standards.

This global reach has allowed Exness to provide localized services tailored to the needs of various markets, including Asia, Europe, and Africa. In essence, Exness stands out as a truly international brokerage that empowers traders from all walks of life, making it an excellent option for Indian traders seeking leverage in forex trading.

Understanding Leverage

To fully grasp the implications of Exness leverage in India, it is vital to understand what leverage is and how it impacts trading decisions.

Definition of Leverage

Leverage refers to the use of borrowed funds to increase one's position size in trading. Instead of using only their own capital, traders can borrow money from their brokers to multiply their potential returns. For instance, if a trader has an account balance of $1,000 and utilizes leverage of 100:1, they can control a position worth $100,000.

This amplification can lead to significant gains when trades are successful. However, it also means that losses can be equally magnified, making risk management even more critical for leveraged trading.

How Leverage Works in Trading

Leverage works by allowing traders to open larger positions than their initial deposit would allow. When a trader opens a leveraged position, they are required to maintain a certain amount of margin in their trading account. This margin serves as collateral for the borrowed funds.

For example, if a trader wishes to open a position worth $10,000 with a leverage ratio of 100:1, they would only need to maintain a margin of $100 in their account. The difference between the position size and the margin requirement constitutes the broker's loan to the trader.

It's vital to note that while leverage can amplify profits, it can also lead to increased losses. Hence, understanding the intricacies of how leverage works is essential for any trader aiming to succeed in the forex market.

Benefits and Risks of Using Leverage

Leverage can provide numerous advantages to forex traders, but it also comes with inherent risks.

The primary benefit lies in the potential for higher returns. With leverage, traders can control significant positions without needing substantial capital upfront. This characteristic makes trading more accessible, especially for retail traders who might not have extensive financial resources.

On the other hand, the risks associated with leverage cannot be overlooked. A minor adverse movement in the market can result in considerable losses, potentially exceeding the trader's initial investment. Therefore, effective risk management strategies must be implemented to safeguard against the dangers of high leverage.

Exness Leverage Features

When it comes to leveraging opportunities, Exness offers a variety of features designed to meet the diverse needs of traders.

Types of Leverage Offered by Exness

Exness provides several types of leverage that cater to various trading styles and risk appetites. These include fixed leverage ratios and variable leverage options that change according to the trader's account balance or trading activity.

While some traders may prefer fixed leverage for consistency, others might choose variable leverage to maximize their trading capacity during favorable market conditions. This flexibility allows traders to align their leverage choices with their overall trading strategies.

Flexible Leverage Options

One of the standout features of Exness is its flexible leverage options. Traders can adjust their leverage ratios based on their preferences and trading goals. This adaptability empowers traders to create personalized trading environments that suit their risk tolerance and market outlook.

Flexibility also means that traders can reduce their leverage during uncertain market conditions, helping to mitigate potential losses. Such customization plays a crucial role in enhancing the overall trading experience.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Maximum Leverage Limits

While Exness offers generous leverage options, it is essential to understand the maximum leverage limits imposed by the broker. These limits vary depending on the type of account and the specific trading instrument being used.

Staying informed about these limits is vital for traders. Choosing the right leverage ratio helps to strike a balance between maximizing profit potential and managing risks effectively.

Leverage Regulations in India

In India, regulatory authorities impose specific guidelines governing leverage in forex trading. Understanding these regulations is crucial for Indian traders, especially those considering using Exness leverage.

Regulatory Authorities Governing Forex Trading

The Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) are the primary authorities overseeing forex trading in the country. They implement regulations aimed at safeguarding traders and maintaining the integrity of the financial system.

These regulatory bodies strive to promote responsible trading practices, ensuring that brokers operate transparently and fairly.

Understanding Leverage Restrictions for Indian Traders

Due to the potential risks associated with high leverage, Indian regulators have put restrictions in place to protect traders. Retail traders often face limited leverage ratios compared to international standards. This limitation ensures that traders do not overextend themselves and incur significant losses.

Understanding these restrictions is key for Indian traders utilizing Exness leverage, as it directly impacts their trading strategy and risk management practices.

How to Use Exness Leverage Effectively

Maximizing the benefits of Exness leverage in India requires a strategic approach. Implementing effective techniques can greatly impact trading success.

Setting Appropriate Leverage Levels

One of the first steps towards effective leverage usage is to set appropriate leverage levels. Traders should assess their risk tolerance, trading style, and market conditions before determining the leverage ratio that best suits them.

Using lower leverage may lead to smaller profits but can also help manage risks better. Conversely, higher leverage can yield significant returns but increases exposure to market volatility. Striking the right balance is imperative for long-term trading success.

Risk Management Strategies

Adopting sound risk management strategies is crucial when trading with leverage. Techniques such as setting stop-loss orders, diversifying trades, and avoiding over-leveraging can safeguard against catastrophic losses.

Regularly reviewing and adjusting risk management strategies based on evolving market conditions can further bolster a trader's resilience to unforeseen events.

Leveraging Technical Analysis

Utilizing technical analysis alongside leverage can enhance trading outcomes. By analyzing charts and indicators, traders can identify entry and exit points that align with their risk profiles.

Technical analysis equips traders with the tools to make informed decisions, effectively integrating leverage into their broader trading strategies.

Advantages of Exness Leverage in India

Using Exness leverage in India provides several advantages that can positively impact traders' performance.

Enhancing Profit Potential

One of the standout advantages of Exness leverage is its potential to enhance profit margins. With the ability to control larger positions than one's account balance would typically allow, traders can capitalize on even minor price movements.

For ambitious traders, this means that consistent small wins can accumulate into substantial gains over time. Effective utilization of leverage transforms opportunities into tangible results.

Accessibility for Retail Traders

Exness's competitive leverage offerings democratize access to forex trading for retail traders in India. By lowering barriers to entry, Exness enables more individuals to engage in the forex market, expanding participation.

This accessibility fosters a vibrant community of traders, resulting in increased competition and innovation within the sector.

Competitive Edge in the Market

With the right leverage strategy, traders can gain a competitive edge in the forex market. Utilizing Exness leverage allows traders to take advantage of short-term price fluctuations and seize opportunities that others may overlook.

This competitive advantage can translate into improved profitability and greater trading success.

Disadvantages and Risks of High Leverage

While leveraging can present numerous advantages, it also carries inherent risks. Understanding these risks is essential for prudent trading.

Margin Calls: What You Need to Know

Margin calls occur when the equity in a trader's account falls below the required margin level. In such cases, brokers may require additional funds or automatically close positions to mitigate potential losses.

Being aware of margin call thresholds and maintaining sufficient equity in the account is essential for traders using high leverage. Knowing when to close positions or add funds can prevent sudden account deficits.

Psychological Factors of Trading with High Leverage

Trading with high leverage can exert psychological pressure on traders. The fear of losing significant amounts of money can lead to emotional decision-making, causing traders to deviate from their strategies.

Developing a disciplined mindset and emotional resilience is necessary for managing stress and making rational choices during volatile market conditions.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Exness Account Types and Their Leverage Options

Exness offers various account types, each designed to cater to different trading preferences and strategies.

Standard Accounts

Standard accounts are ideal for beginners and those looking for straightforward trading conditions. These accounts typically offer lower spreads and higher leverage options, allowing traders to start their trading journey with minimal financial barriers.

Traders can utilize the benefits of Exness leverage while enjoying a user-friendly trading environment.

Pro Accounts

Pro accounts cater to more experienced traders seeking tighter spreads and advanced trading features. These accounts usually come with variable leverage options that allow for customizability.

Traders can leverage their skills and market insights to craft strategies that maximize their profit potential while adhering to prudent risk management principles.

Cent Accounts

Cent accounts are specifically designed for those who are new to trading or wish to practice their skills with a smaller amount of capital. With cent accounts, traders can trade in smaller lot sizes, making them an excellent choice for learning without risking substantial sums.

These accounts still offer leverage options, ensuring that even beginner traders can participate in the market with confidence.

The Process of Opening an Exness Account in India

Opening an account with Exness is a straightforward process, allowing Indian traders to quickly access leverage options.

Registration Requirements

To get started, prospective traders need to complete a registration form on the Exness website. Basic information such as name, email address, and phone number are required. Once submitted, traders will receive a confirmation email to verify their account.

Ensuring that personal details are accurate is essential for smooth account verification and subsequent transactions.

Verifying Your Identity

After registering, traders must verify their identity by providing appropriate documents. This verification process is crucial for maintaining security and compliance with financial regulations.

Commonly required documents include government-issued identification, proof of address, and bank statements. Timely submission of these documents expedites the account activation process.

Choosing Your Account Type

Once verified, traders can select the type of account that aligns with their trading goals. Whether opting for a standard, pro, or cent account, it's vital to consider factors such as leverage, spreads, and fees.

Choosing the right account type enhances the overall trading experience, setting the foundation for future success.

Managing Your Trades with Exness

Effectively managing trades is fundamental when utilizing Exness leverage.

Utilizing MetaTrader Platforms

Exness supports popular trading platforms like MetaTrader 4 and MetaTrader 5, which offer comprehensive tools for trade execution and analysis. These platforms provide user-friendly interfaces, making it easy for traders to execute trades, analyze market data, and monitor their accounts.

Additionally, traders can customize their trading setups using indicators and scripts, tailoring the platforms to their unique preferences.

Setting Stop-Loss and Take-Profit Orders

Implementing stop-loss and take-profit orders is essential for managing risks effectively. These orders enable traders to automate their exit strategies, reducing emotional decision-making during times of market volatility.

By predefining exit points, traders can protect their capital and lock in profits, contributing to a more disciplined trading approach.

Customer Support and Resources

Exness is committed to providing exceptional customer support and resources to its traders.

Accessing Educational Material

A wealth of educational resources is available for traders looking to enhance their skills. Exness offers webinars, tutorials, and articles covering various trading topics, from basics to advanced strategies.

By actively engaging with these materials, traders can expand their knowledge base and improve their overall trading capabilities.

Getting Help from Customer Service

In case of inquiries or issues, Exness maintains a responsive customer service team. Traders can reach out through multiple channels, including live chat, email, and phone support.

Timely assistance is crucial for addressing concerns, especially when trading with leverage, where rapid decision-making is often necessary.

Case Studies: Successful Traders Using Exness Leverage

Examining real-life examples of successful traders can provide valuable insights into leveraging strategies.

Profiles of Notable Indian Traders

Several Indian traders have achieved remarkable success by effectively using Exness leverage. They employ diverse strategies tailored to their strengths, showcasing the importance of personalization in trading.

Understanding their journeys can inspire others and highlight the critical components of success, such as discipline, risk management, and continuous learning.

Strategies That Yielded Results

Successful traders often emphasize the significance of refining their strategies based on market conditions. Adopting a systematic approach, they build trading plans that incorporate risk-reward ratios, leverage management, and market analysis.

By studying their strategies, aspiring traders can glean lessons on how to adapt their trading methodologies to achieve similar success.

Conclusion

Navigating the complexities of forex trading in India requires a thorough understanding of leverage, especially Exness leverage in India. While leverage presents unparalleled opportunities for profit, it also comes with inherent risks that demand careful consideration.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

As traders harness the power of leverage through Exness, they must also prioritize risk management and continuous education. Ultimately, successful trading hinges on the ability to balance ambition with prudence, paving the way for sustainable growth in the ever-evolving forex landscape.

Read more: