14 minute read

Exness Broker Review in India: Legit, Safe, Is a good broker?

In the dynamic world of forex trading, a broker's reputation and credibility play a crucial role in ensuring traders can operate with peace of mind. One such broker that has been gaining attention is Exness. This review aims to explore the various aspects of Exness broker services in India, analyzing its legitimacy, safety measures, and overall user experience.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Exness Broker

In this section, we will delve into the core elements of what makes Exness a popular choice among forex traders. From its inception to the present day, understanding the journey of Exness provides valuable insight into its operational ethos and market presence.

Overview of Exness

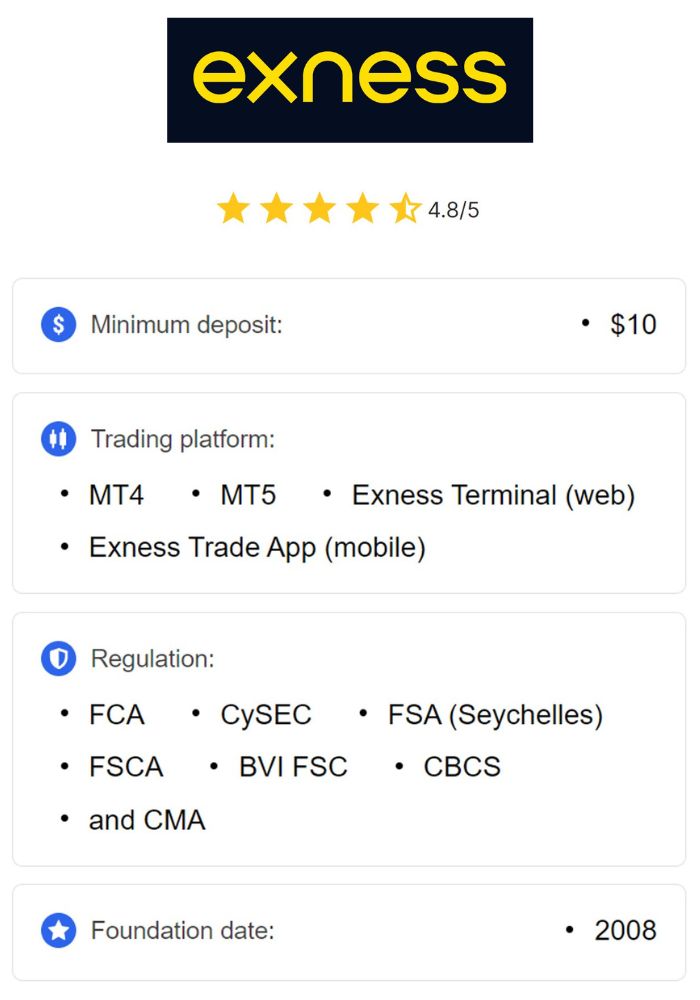

Exness was founded in 2008 and quickly established itself as a leading online trading platform catering to clients across the globe. With an emphasis on transparency and customer-centric services, Exness has built a reputation for offering competitive trading conditions tailored to both novice and experienced traders.

The company’s primary focus is on forex trading, but it also provides access to a wide range of trading instruments, including commodities, indices, and cryptocurrencies. The commitment to continuous improvement and innovation has helped Exness maintain a strong position in a highly competitive market.

History and Background of the Company

Exness began its operations with a vision to democratize financial trading and provide everyone access to the global markets. Over the years, it has expanded its reach, establishing a strong presence in regions like Asia, Europe, and Africa.

The company’s history reflects its adaptability and willingness to embrace new technologies. From launching advanced trading platforms like MetaTrader 4 and MetaTrader 5 to conducting regular market analyses and webinars, Exness continuously strives to enhance the trading experience for its users.

Regulatory Framework

To determine whether Exness is a good broker, it's essential to consider its regulatory standing. A robust regulatory framework signifies a broker's commitment to adhering to industry standards and protecting traders' interests.

Licensing and Regulation

Exness operates under multiple regulatory authorities, including the Financial Services Authority (FSA) of Seychelles and the Cyprus Securities and Exchange Commission (CySEC). These licenses indicate that Exness adheres to strict guidelines concerning client funds, reporting, and market conduct.

Regulatory oversight ensures that brokers maintain a certain level of professionalism and ethical practices, thus enhancing the overall trustworthiness of the platform. Exness’s compliance with these regulations gives traders peace of mind and ensures they are protected while trading.

Compliance with Indian Financial Regulations

As a growing player in the Indian market, Exness is cognizant of local regulations. Although forex trading remains largely unregulated in India, Exness takes proactive steps to ensure that its operations align with best practices in customer protection and transparency.

By complying with international regulatory standards, Exness cultivates a safer trading environment for Indian traders. This approach strengthens trader confidence, cementing Exness as a trustworthy option in the Indian forex landscape.

Safety and Security Measures

Safety measures are paramount in establishing broker legitimacy. Traders must know their funds are secure and their personal information is protected.

Fund Protection and Segregation

Exness employs stringent fund protection protocols by segregating client funds from company funds. This means that your trading capital remains separate from the broker's operating expenses, ensuring that it can be returned to you even in the unlikely event of company insolvency.

Additionally, Exness participates in investor compensation schemes, providing further assurance to clients. Such initiatives highlight Exness's commitment to safeguarding client interests and maintaining financial stability.

Data Security Protocols

In an age of increasing cyber threats, data security is critical. Exness employs advanced encryption technologies and security protocols to protect sensitive customer data. Two-factor authentication and secure socket layer (SSL) technology ensure that your personal information remains confidential and secure.

Regular audits and compliance checks further ensure that the brokerage maintains high-security standards, fostering trust among traders who prioritize data protection.

Customer Support and Dispute Resolution

Effective customer support is vital for addressing client concerns and fostering long-term relationships. Exness offers comprehensive customer support through various channels, including live chat, email, and phone support.

The availability of multi-lingual support is particularly beneficial for Indian traders, making communication seamless. Moreover, Exness has outlined clear dispute resolution procedures, ensuring that any issues arising during the trading process can be addressed promptly and fairly.

Trading Platforms Offered

A broker’s trading platform is the lifeline of their operations. It directly impacts the trading experience, so understanding the features offered by Exness is crucial.

MetaTrader 4 Features

MetaTrader 4 (MT4) is one of the most widely used trading platforms globally, and Exness provides full access to its features. MT4’s user-friendly interface, extensive charting tools, and automated trading capabilities make it popular among traders.

With MT4, Exness users can customize their trading setup according to their preferences, applying technical indicators and expert advisors. The platform supports various order types, enabling traders to execute strategies efficiently.

MetaTrader 5 Advantages

Building upon the success of MT4, MetaTrader 5 (MT5) introduces additional features that enhance the trading experience. MT5 supports more timeframes, advanced analytical tools, and greater asset classes, allowing traders to diversify their portfolios effectively.

Traders who enjoy algorithmic trading will appreciate the improved functionality of MT5, which allows for advanced order management and automated trading strategies. This versatility makes MT5 suitable for both beginner and professional traders alike.

Web and Mobile Trading Capabilities

Exness recognizes the need for flexibility in trading, providing web-based and mobile trading options. The web platform allows users to trade directly from any browser without needing to download software, making it convenient for traders on the go.

The mobile application for both Android and iOS devices offers a seamless trading experience, enabling traders to monitor their positions and execute trades anywhere, anytime. This level of accessibility ensures that traders remain connected to the markets, allowing them to capitalize on opportunities as they arise.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Account Types Available

Understanding the different account types offered by Exness can help traders select the one that best suits their trading style and needs.

Standard Account Overview

The Standard Account is designed for beginners looking to enter the world of forex trading. This account type offers a user-friendly experience with low minimum deposit requirements and no commission fees.

With variable spreads, the Standard Account allows traders to engage in cost-effective trading, making it an excellent starting point for those new to the market. Additionally, it provides access to a diverse range of trading instruments, ensuring that traders can explore various options as they develop their skills.

Pro Account Benefits

For more experienced traders, the Pro Account offers several advantages, including lower spreads and access to commission-based trading. This account type is ideal for those who prefer to leverage their knowledge and skills in executing trades with precision.

With the Pro Account, traders can benefit from tighter spreads, promoting cost-efficient trading. The account is suitable for scalpers and day traders who require a fast execution speed and optimal trading conditions.

Other Specialized Accounts

Exness offers several other specialized account types, catering to various trading preferences. For example, the Cent Account allows traders to start with smaller amounts, making it perfect for risk-averse individuals or those wanting to practice without significant capital.

Additionally, the ECN account provides direct access to interbank liquidity, allowing for enhanced trading conditions. These specialized accounts demonstrate Exness's commitment to accommodating diverse trading styles and preferences.

Trading Instruments and Asset Classes

An expansive portfolio of trading instruments allows traders to diversify their investments. Exness offers a rich array of assets, making it possible to create a well-rounded trading strategy.

Forex Trading Options

Forex trading is the cornerstone of Exness's offerings, with hundreds of currency pairs available for trading. The wide selection includes major, minor, and exotic currency pairs, catering to various trading preferences.

This variety enables traders to capitalize on fluctuations in currency markets effectively. Exness's competitive spreads and leveraging options further enhance the appeal of forex trading, attracting both novices and seasoned professionals.

CFDs and Commodities

In addition to forex, Exness provides access to Contracts for Difference (CFDs) on various commodities, including gold, silver, and oil. Trading commodities within the Exness environment allows traders to hedge against inflation and market volatility.

The ability to trade commodities adds another layer of diversification to traders’ portfolios, as they can engage in both traditional financial markets and commodity markets simultaneously.

Indices and Cryptocurrencies

Exness also offers indices and cryptocurrencies, broadening the scope of trading options available to clients. Traders can invest in popular indices like the S&P 500 and NASDAQ, allowing for exposure to broader market trends.

Moreover, Exness has embraced the growing cryptocurrency trend, offering trading opportunities in some of the most sought-after digital currencies, including Bitcoin, Ethereum, and Ripple. This inclusion appeals to traders eager to explore emerging markets and innovations in finance.

Fees and Commissions

Cost considerations play a pivotal role in a trader's choice of broker. Analyzing Exness's fee structure helps determine whether it aligns with traders' financial goals.

Spread Comparisons

Exness offers competitive spread rates across different account types. The spreads vary based on market conditions and account type; however, they generally remain attractive compared to many competitors.

For instance, the Standard Account features variable spreads that can begin at low levels, enabling traders to minimize costs while maximizing potential profits. This characteristic attracts cost-conscious traders seeking to optimize their trading strategies.

Commission Structures

Traders using the Pro Account will encounter a commission-based structure alongside tighter spreads. While commission fees may apply per trade, the overall cost can still remain favorable due to the reduced spread rates.

Understanding the commission structures enhances traders' decision-making, allowing them to choose the account type that best suits their trading volume and style.

Withdrawal and Deposit Fees

Another crucial factor in evaluating a broker is the withdrawal and deposit fees. Exness prides itself on offering free deposits and withdrawals across multiple payment methods, which is a significant advantage for traders looking to maximize their profitability.

The availability of various payment options, including local bank transfers, e-wallets, and credit cards, ensures that traders can easily manage their funds without incurring additional charges.

Leverage and Margin Requirements

Leverage can significantly amplify profits, but it also comes with increased risk. Understanding Exness’s leverage policies is essential for traders aiming to utilize this tool effectively.

Maximum Leverage Offered

Exness offers high maximum leverage ratios, which can be appealing to traders looking to maximize their trading potential. Depending on the account type and trading instrument, leverage can reach up to 1:2000.

While high leverage can enhance profit potential, traders must exercise caution and implement sound risk management strategies to avoid excessive losses.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Margin Call and Stop Out Levels

Exness employs clear margin call and stop-out levels to protect traders from significant losses. When the margin level falls below a predetermined threshold, a margin call is issued, prompting traders to add funds or close positions.

Understanding these levels helps traders manage their risk exposure effectively, ensuring they remain informed about their account status and can take necessary actions to safeguard their investments.

Educational Resources and Tools

Education is a key component of successful trading. Exness provides a wealth of resources aimed at empowering traders to improve their skills and knowledge.

Trading Academy Offerings

Exness features a comprehensive trading academy that encompasses a wide range of educational materials. These resources cover fundamental and technical analysis, trading strategies, and market psychology.

Webinars, video tutorials, and eBooks cater to varying learning styles, ensuring that users can access valuable information regardless of their experience level. This commitment to education demonstrates Exness's dedication to supporting traders on their journey.

Market Analysis and Insights

To keep traders informed, Exness regularly publishes market analysis and insights covering global events, economic indicators, and forex trends. By staying updated on market developments, traders can make informed decisions when entering and exiting positions.

The incorporation of expert opinions and analyses enriches the trading experience, guiding users toward effective strategies and increased profitability.

Trading Tools and Calculators

Exness also provides an array of trading tools and calculators, such as pip calculators, profit/loss calculators, and margin calculators, all of which facilitate better decision-making. These resources simplify the complexities of trading, enabling traders to analyze their positions and manage their risks more effectively.

User Experience and Interface

The overall user experience significantly contributes to traders' satisfaction with a broker. Exness places great emphasis on creating an intuitive and user-friendly platform.

Platform Usability

Both the web and mobile trading platforms are designed with user experience in mind. The clean and organized interface, coupled with easy navigation, allows traders to find relevant information and execute trades smoothly.

Customization options enable users to tailor their trading environment according to their preferences, making it easier to access frequently used tools and features.

Mobile App Experience

The Exness mobile app delivers an exceptional trading experience on-the-go. Its well-structured design facilitates seamless navigation, ensuring that traders can monitor their accounts, analyze charts, and manage their trades with ease.

Push notifications keep users informed about market movements and important updates, contributing to a proactive trading approach. The mobile app's performance and reliability reflect Exness's commitment to providing top-notch service, meeting the demands of modern traders.

Customer Reviews and Feedback

Real user experiences offer invaluable insight into the strengths and weaknesses of a broker. Examining customer feedback on Exness can paint a clearer picture of its standing in the forex trading community.

Positive User Experiences

Many traders commend Exness for its competitive trading conditions, responsive customer support, and comprehensive educational resources. Several users highlight the effectiveness of the trading platforms and the variety of instruments available for trading.

Moreover, positive testimonials often emphasize the ease of deposit and withdrawal processes, along with the absence of hidden fees. These aspects contribute to a positive overall trading experience, encouraging traders to remain loyal to the platform.

Common Complaints and Issues

Despite its many strengths, Exness does receive criticism from some users related to slippage during high volatile market periods and occasional delays in customer support responses. Understanding these concerns allows prospective traders to set realistic expectations when engaging with the platform.

Additionally, some users may find the complexity of advanced trading tools challenging, particularly if they are new to trading. Exness continues to address these issues through ongoing improvements, demonstrating a commitment to enhancing the user experience.

Comparison with Other Brokers

When considering a broker, comparing its offerings with others in the market is essential. Evaluating Exness against local competitors and global giants sheds light on its unique selling points.

Exness vs. Local Competitors

In the Indian market, Exness stands out among local competitors due to its extensive range of account types, competitive trading conditions, and focus on trader education. Many local brokers may have limitations regarding asset classes or higher fees, making Exness an attractive alternative.

Furthermore, Exness's reputation for safety and regulatory compliance enhances its standing in a market where such assurances are critical to building trust with clients.

Exness vs. Global Giants

When compared to global giants like IG and OANDA, Exness demonstrates its strengths in affordability and user-friendliness. While larger brokers may offer a broader range of research tools and premium services, Exness remains competitive by delivering a solid trading experience at lower costs.

Exness’s focus on the Indian market also allows it to cater specifically to local traders, thereby adapting its services to meet regional needs better than some global competitors.

Conclusion

In conclusion, this Exness Broker Review in India: Legit highlights the numerous benefits of trading with Exness, including comprehensive safety measures, a user-friendly trading experience, and a commitment to education. As a popular choice among traders, Exness prioritizes transparency and quality service, making it a viable option for both novice and experienced traders in India.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Understanding the features and offerings of Exness allows traders to make informed decisions about their trading journeys. Whether you seek competitive fees, diverse trading instruments, or reliable customer support, Exness's robust platform and commitment to trader satisfaction position it favorably in the crowded forex brokerage landscape.

Read more: