16 minute read

Is forex trading legal in Sri Lanka? Comprehensive Guide

Introduction to Forex Trading

What is Forex Trading?

Forex trading, or foreign exchange trading, involves the buying and selling of global currencies in pairs, with the aim of profiting from fluctuations in exchange rates. This decentralized market operates globally, enabling participants to trade currencies across borders 24 hours a day. Traders in the forex market speculate on the movement of currency pairs such as USD/LKR (US Dollar/Sri Lankan Rupee) based on various economic indicators, interest rates, and geopolitical events.

Top 4 Best Forex Brokers in Sri Lanka

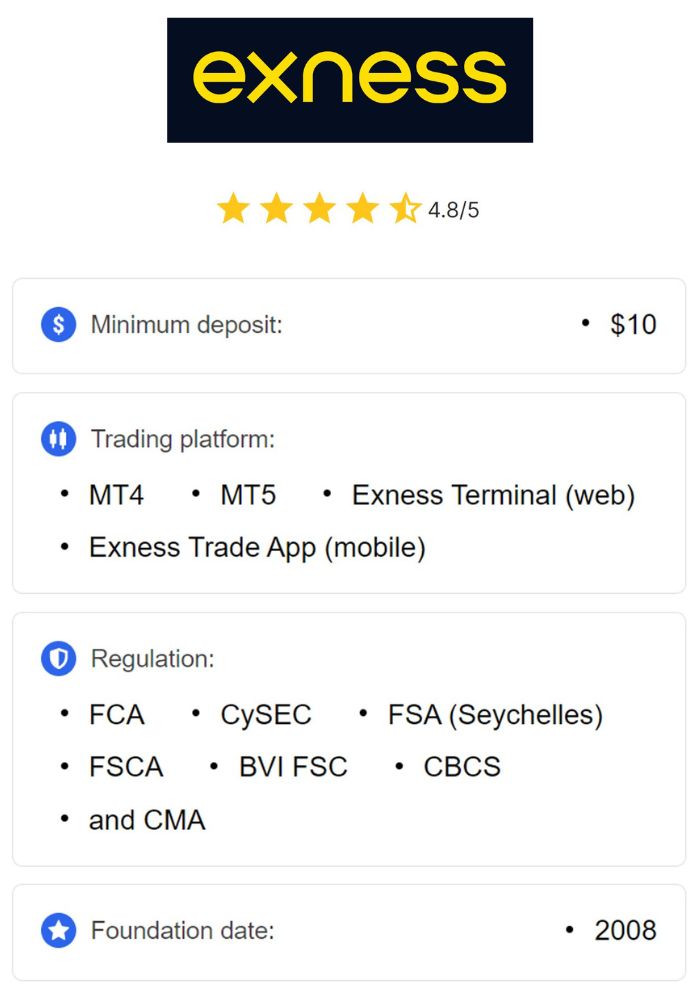

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

The forex market is the largest financial market worldwide, with daily trading volumes reaching trillions of dollars. It attracts a diverse range of participants, including individual traders, financial institutions, and governments. Forex trading has grown in popularity because of its accessibility, high liquidity, and potential profitability, making it an appealing choice for those interested in alternative investment options.

Popularity of Forex Trading in Sri Lanka

Forex trading has gained traction in Sri Lanka as a growing number of individuals explore opportunities to participate in international markets. The appeal of forex trading lies in its accessibility; traders only need an internet connection and a registered account with a broker to start. As the Sri Lankan economy evolves, there is an increasing interest among residents to engage in forex trading as a means of diversifying investments and potentially generating income.

The popularity of forex trading in Sri Lanka has also been fueled by the availability of trading platforms, educational resources, and mobile trading apps that make trading more convenient. Despite regulatory limitations, many Sri Lankans are drawn to forex for its flexible hours, the possibility of high returns, and the chance to engage with the global financial market.

Is Forex Trading Legal in Sri Lanka?

Yes, forex trading is legal in Sri Lanka, but it is subject to specific regulations set forth by the Central Bank of Sri Lanka. Sri Lankan residents are permitted to participate in forex trading provided they adhere to local laws, including any limitations on currency exchanges and investment in foreign markets. Local traders are encouraged to engage only with regulated brokers to ensure compliance with financial standards and to protect their investments.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

While forex trading is legal, the Central Bank has issued specific guidelines and restrictions on foreign currency transactions to maintain financial stability. Sri Lankan traders are advised to understand these regulations fully to avoid engaging in prohibited activities. By adhering to the legal framework, residents can trade forex responsibly and within the boundaries established by Sri Lankan authorities.

Understanding the Central Bank's Stance

Role of the Central Bank of Sri Lanka

The Central Bank of Sri Lanka (CBSL) is the primary regulatory authority overseeing the country’s financial system. It plays a crucial role in ensuring economic stability, regulating currency exchanges, and setting policies to protect Sri Lanka’s financial environment. In terms of forex trading, the CBSL has implemented regulations to control foreign currency transactions and prevent market abuse.

The CBSL’s oversight aims to ensure that financial activities, including forex trading, align with Sri Lanka’s economic policies. By setting these controls, the CBSL seeks to balance currency stability with the benefits of participating in global markets. For Sri Lankan forex traders, understanding the CBSL’s role and adhering to its regulations is essential for legal compliance and responsible trading.

Guidelines Issued by the Central Bank

The CBSL has established guidelines that govern foreign exchange transactions and restrict unauthorized forex activities. These guidelines include measures to prevent money laundering, control foreign currency outflows, and ensure that forex trading activities comply with national economic interests. The CBSL periodically issues updates to these guidelines, which traders should follow closely to ensure legal compliance.

One of the main requirements is for traders to use regulated brokers that adhere to CBSL policies. By following these guidelines, Sri Lankan traders can reduce their exposure to regulatory risks and operate within the CBSL’s legal framework. Awareness of these guidelines is critical for anyone interested in forex trading in Sri Lanka to avoid penalties and ensure safe trading practices.

Licensing Requirements for Forex Brokers

Types of Licenses Available

Forex brokers operating in Sri Lanka must obtain a license to offer trading services legally. The CBSL provides specific licenses to financial institutions that meet the criteria for offering forex trading services. There are generally two types of licenses for brokers: those that allow only limited forex services, such as currency conversion, and those that enable full-scale forex trading activities for institutional clients and retail traders.

International brokers may also serve Sri Lankan clients, provided they have licenses from recognized regulatory bodies like the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC). Sri Lankan traders are advised to choose brokers with valid licenses from reputable authorities, as this ensures compliance with global financial standards and enhances the security of their investments.

Process for Obtaining a License

The licensing process for forex brokers in Sri Lanka involves meeting the regulatory standards set by the CBSL. Brokers must demonstrate financial stability, maintain transparent operations, and implement security measures to protect clients’ funds. Additionally, brokers are required to adhere to anti-money laundering (AML) policies and comply with periodic audits to ensure ongoing compliance.

Obtaining a license from the CBSL or other reputable authorities is an extensive process that involves thorough documentation and verification. Sri Lankan traders are encouraged to verify a broker’s licensing status before investing, as this helps safeguard their funds and reduces the risk of fraud. Working with licensed brokers provides assurance that the broker operates within a legal framework and prioritizes client protection.

Risks Associated with Forex Trading

Market Risks

Forex trading carries inherent market risks due to the volatility of currency prices, which can fluctuate based on economic data, geopolitical events, and market sentiment. These fluctuations can lead to both profits and losses, and traders must be prepared for the potential impact of sudden market changes. For Sri Lankan traders, market risks can be particularly pronounced when trading major currency pairs with high volatility.

To mitigate market risks, traders are encouraged to practice proper risk management strategies, such as setting stop-loss orders and diversifying their portfolios. By understanding the factors that drive currency prices, Sri Lankan traders can make informed decisions and reduce the impact of market volatility on their investments.

Regulatory Risks

Regulatory risks refer to the potential changes in laws and regulations that may impact forex trading activities. In Sri Lanka, the CBSL’s guidelines and restrictions on foreign currency transactions play a significant role in shaping the trading environment. Any changes in these regulations could affect traders’ access to currency markets or impose additional compliance requirements.

Sri Lankan traders should stay informed about regulatory updates from the CBSL and ensure they comply with existing guidelines. Adapting to regulatory changes helps traders avoid potential penalties and ensures they operate within legal boundaries. Understanding regulatory risks is crucial for anyone involved in forex trading, as non-compliance can result in severe consequences.

Advantages of Forex Trading in Sri Lanka

Economic Opportunities

Forex trading provides Sri Lankan traders with the opportunity to participate in the global economy and potentially profit from currency movements. By trading major currency pairs, traders can take advantage of economic events and monetary policies in other countries. Forex trading offers an alternative investment avenue that can contribute to income generation and wealth diversification.

In addition to the potential for profit, forex trading fosters economic awareness, as traders must stay informed about international events and economic indicators. For Sri Lankans, engaging in forex trading offers a unique way to interact with global markets and access opportunities beyond traditional investments.

Accessibility and Technology

The rise of online trading platforms has made forex trading accessible to individuals across Sri Lanka. With a stable internet connection, traders can access real-time data, advanced charting tools, and educational resources, all from a single platform. This accessibility, coupled with mobile trading applications, allows traders to manage their portfolios on the go, making forex trading convenient for those with busy schedules.

Technology has also enabled the automation of trading strategies through algorithms and bots, allowing traders to execute trades with precision. For Sri Lankan traders, the integration of technology in forex trading offers flexibility, ease of access, and enhanced tools for making informed trading decisions.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Disadvantages of Forex Trading in Sri Lanka

Potential for Losses

Forex trading, while lucrative, carries a significant risk of losses, especially for those who are new to the market or fail to use proper risk management strategies. Due to the high leverage offered by forex brokers, traders can control large positions with relatively small capital, amplifying both potential profits and losses. This leverage, if not carefully managed, can lead to substantial losses, even resulting in traders losing more than their initial investment.

For Sri Lankan traders, understanding the risks associated with leverage—such as using too much leverage or failing to set stop-loss orders—is essential. Without a sound trading plan and disciplined approach, traders can experience significant financial losses, which underscores the importance of education and risk management in forex trading.

Lack of Investor Protections

One of the challenges faced by Sri Lankan traders is the limited local regulatory protections specific to retail forex trading. While the CBSL regulates aspects of foreign exchange, individual investors may find fewer protections compared to those trading in heavily regulated regions like the UK or EU. This limited regulatory oversight can make it challenging for traders to resolve disputes or recover funds if issues with brokers arise.

To mitigate this risk, Sri Lankan traders are encouraged to choose brokers that are regulated by well-established international regulatory bodies. Regulated brokers follow strict guidelines designed to protect investors and ensure fair trading practices, reducing the risks associated with limited local protections.

The Impact of International Law on Forex Trading

How Global Regulations Affect Local Traders

Forex trading is a global market influenced by regulations in major financial hubs such as the US, UK, and the EU. Changes in international forex regulations, like leverage limits or anti-money laundering requirements, can impact brokers worldwide, including those serving Sri Lankan traders. For example, if a broker is regulated by the European Securities and Markets Authority (ESMA), it must comply with ESMA’s restrictions on leverage, which also apply to Sri Lankan clients using that broker.

Sri Lankan traders should stay informed about global regulatory changes that could affect their trading conditions. Understanding how international laws influence trading environments can help traders choose brokers wisely and ensure they comply with international standards, protecting their interests in a globalized market.

Compliance with International Standards

Compliance with international standards is crucial for Sri Lankan traders, particularly when working with foreign brokers. Reputable brokers must adhere to regulatory standards regarding transparency, fund protection, and ethical practices. Brokers regulated by authorities like the FCA or CySEC are required to implement anti-money laundering policies, secure client funds in segregated accounts, and undergo regular audits to maintain their licenses.

For Sri Lankan traders, choosing a broker that complies with international standards ensures they are working with a provider committed to safety and fairness. This adherence to global regulations enhances trust and security, providing traders with a safer trading experience and reducing risks associated with less-regulated brokers.

Tax Implications of Forex Trading

Understanding Capital Gains Tax

Profits earned from forex trading are generally considered taxable income in many countries, and Sri Lanka is no exception. Sri Lankan traders are expected to report their earnings from forex trading as part of their taxable income, and these earnings may be subject to capital gains tax. The exact tax rate can depend on factors such as the trader’s income bracket, duration of holding, and other financial circumstances.

Keeping track of trading profits and losses is essential for tax purposes. Sri Lankan traders are encouraged to maintain detailed records of all transactions to simplify tax filing and ensure compliance with local tax laws. Consulting a tax advisor can also help traders understand their specific tax obligations related to forex trading.

Reporting Requirements for Traders

Sri Lankan forex traders must adhere to local tax reporting requirements to avoid potential penalties. All profits from trading should be accurately reported, and traders are advised to track their earnings meticulously to comply with Sri Lankan tax regulations. In addition to profits, traders should keep records of expenses related to trading, such as broker fees, which may be deductible.

Staying compliant with reporting requirements not only protects traders from potential legal issues but also demonstrates a commitment to operating within the legal framework. By consulting a tax professional familiar with forex trading, Sri Lankan traders can fulfill their tax obligations and avoid potential issues with tax authorities.

Best Practices for Forex Trading in Sri Lanka

Choosing a Regulated Broker

Selecting a regulated broker is one of the most critical decisions for any forex trader. Regulated brokers are bound by strict standards that prioritize client protection, transparency, and financial security. Sri Lankan traders should look for brokers regulated by credible international bodies, such as the FCA, ASIC, or CySEC, as these regulators enforce stringent guidelines to ensure fair and secure trading.

A regulated broker provides a layer of security, as it is obligated to keep client funds in segregated accounts and follow ethical practices. By choosing a regulated broker, Sri Lankan traders can reduce risks associated with fraud and gain confidence in their trading environment, allowing them to focus on their strategies without worry.

Implementing Risk Management Strategies

Effective risk management is essential for success in forex trading. Sri Lankan traders should implement strategies such as setting stop-loss and take-profit orders to limit potential losses and lock in profits. Diversifying investments across various currency pairs and avoiding over-leveraging are additional measures that help traders manage risk effectively.

By prioritizing risk management, traders can protect their capital, reduce emotional stress, and make more objective trading decisions. For Sri Lankan traders, incorporating risk management into their trading plan is vital to navigating the volatile forex market and maintaining long-term profitability.

Notes

Importance of Due Diligence

Conducting due diligence is a crucial step before starting forex trading. Sri Lankan traders should research brokers, understand the regulatory landscape, and familiarize themselves with the market’s mechanics. Thorough research helps traders identify trustworthy brokers, avoid scams, and select trading platforms that suit their needs and preferences.

Due diligence also includes studying the currency pairs they intend to trade, understanding market trends, and developing a solid trading strategy. For Sri Lankan traders, performing due diligence not only safeguards investments but also increases the chances of achieving consistent returns in the forex market.

Keeping Abreast of Regulatory Changes

Regulations in the forex market are subject to change, and staying updated is essential for legal compliance. Sri Lankan traders should monitor updates from the CBSL or relevant regulatory bodies to ensure they adhere to the latest rules. Changes in regulations can affect trading conditions, such as leverage limits or tax obligations, impacting traders’ strategies.

Keeping informed of regulatory updates protects traders from inadvertently violating new rules and helps them adapt to changing market environments. By staying current with regulations, Sri Lankan traders can trade with confidence, knowing they are operating within legal boundaries.

Mistakes to Avoid

Trading Without a Plan

One of the most common mistakes in forex making is entering the market without a well-defined trading plan. Trading without a plan often leads to impulsive decisions, inconsistent results, and unnecessary losses. A trading plan should outline entry and exit points, risk management strategies, and profit goals to guide traders in making informed decisions.

Sri Lankan traders are encouraged to develop a structured trading plan and stick to it, even during volatile market conditions. Having a plan promotes discipline and ensures traders make objective choices that align with their goals, improving their chances of long-term success.

Ignoring Regulatory Updates

Ignoring regulatory updates can lead to compliance issues and potential penalties. As forex regulations evolve, it is crucial for Sri Lankan traders to stay informed about changes affecting trading activities. Failing to comply with new rules, such as restrictions on leverage or capital requirements, can have legal and financial consequences.

Sri Lankan traders should regularly check for updates from the CBSL or consult with professionals to ensure they remain compliant. By paying attention to regulatory changes, traders can avoid penalties and continue trading without disruptions.

Overleveraging Your Account

Using too much leverage is a common pitfall among forex traders, as it increases both potential profits and risks. Overleveraging can lead to substantial losses, especially during sudden market shifts. Sri Lankan traders should be cautious with leverage and choose levels that align with their risk tolerance and account size.

Limiting leverage and setting stop-loss orders helps traders protect their accounts from significant losses. For Sri Lankan traders, avoiding overleveraging ensures greater financial stability and promotes sustainable trading practices, reducing the emotional stress that comes with large, risky positions.

Frequently Asked Questions

Is forex trading legal for individuals?

Yes, forex trading is legal for individuals in Sri Lanka as long as they comply with the Central Bank’s guidelines and use regulated brokers. Sri Lankan residents are allowed to participate in forex trading for personal investment purposes, provided they follow all legal requirements and adhere to currency transaction regulations.

Individual traders should ensure that they operate within the CBSL’s framework to avoid penalties and stay compliant. Trading through licensed brokers helps individuals meet legal requirements and engage in secure forex trading.

What should I look for in a forex broker?

When choosing a forex broker, Sri Lankan traders should prioritize regulation, transparency, and customer support. Working with a regulated broker ensures compliance with industry standards, protecting traders’ funds and personal information. Traders should also consider the platform’s features, available currency pairs, fees, and ease of use.

Additionally, a reliable broker offers excellent customer support and educational resources, enhancing the trading experience. By selecting a broker with a strong reputation and robust platform, Sri Lankan traders can trade confidently and achieve better trading outcomes.

Can I trade forex without a license?

Individual Sri Lankan traders do not require a personal license to trade forex, but they must use licensed brokers for legal and secure trading. Unauthorized forex trading or using unlicensed brokers can result in penalties. By working with licensed brokers, Sri Lankan traders can ensure compliance with local regulations and avoid potential legal issues.

Using regulated brokers provides additional protections, as these brokers must follow strict guidelines and uphold transparent practices. Trading without a license through a licensed broker enables individuals to participate in forex legally and responsibly.

Conclusion

Forex trading is legal in Sri Lanka, offering individuals the opportunity to participate in the global financial market while adhering to local regulations. By working with licensed brokers, following the Central Bank’s guidelines, and implementing effective risk management strategies, Sri Lankan traders can navigate the forex market securely and responsibly.

For Sri Lankan traders, success in forex trading depends on a combination of due diligence, staying informed of regulatory updates, and practicing disciplined trading strategies. With the right approach, forex trading can be a valuable investment avenue, providing flexibility and access to a dynamic, global market.

Read more: