12 minute read

Exness Forex Trading Legal in India

Understanding Forex Trading

Definition and Basics of Forex Trading

Forex trading, short for foreign exchange trading, involves buying and selling global currencies in pairs to make a profit from fluctuations in their exchange rates. Unlike traditional stock markets, Forex operates as a decentralized market, accessible 24 hours a day, five days a week. Common currency pairs, such as USD/INR (U.S. Dollar to Indian Rupee), EUR/USD, or GBP/USD, are traded with the goal of buying a currency when its value is low and selling it when the price increases.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

In India, Forex trading has become increasingly popular among investors, as they look for opportunities to diversify their portfolios. However, regulatory bodies have set certain restrictions on Forex trading to ensure safe practices for Indian citizens. Understanding these guidelines is critical for anyone interested in trading Forex in India.

Importance of Regulations in Forex Trading

Forex regulations protect traders by enforcing transparency, fair practices, and ethical standards. For Indian traders, knowing which platforms and brokers are compliant with local laws can prevent unnecessary legal risks and protect investments. Regulatory bodies like the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) play a key role in ensuring that Forex trading aligns with Indian financial standards and regulations.

Working with regulated brokers provides Indian traders with a safer trading environment and the assurance that their investments are protected. Regulations also prevent fraudulent practices by requiring brokers to operate transparently and ethically, with safeguards in place for traders' funds.

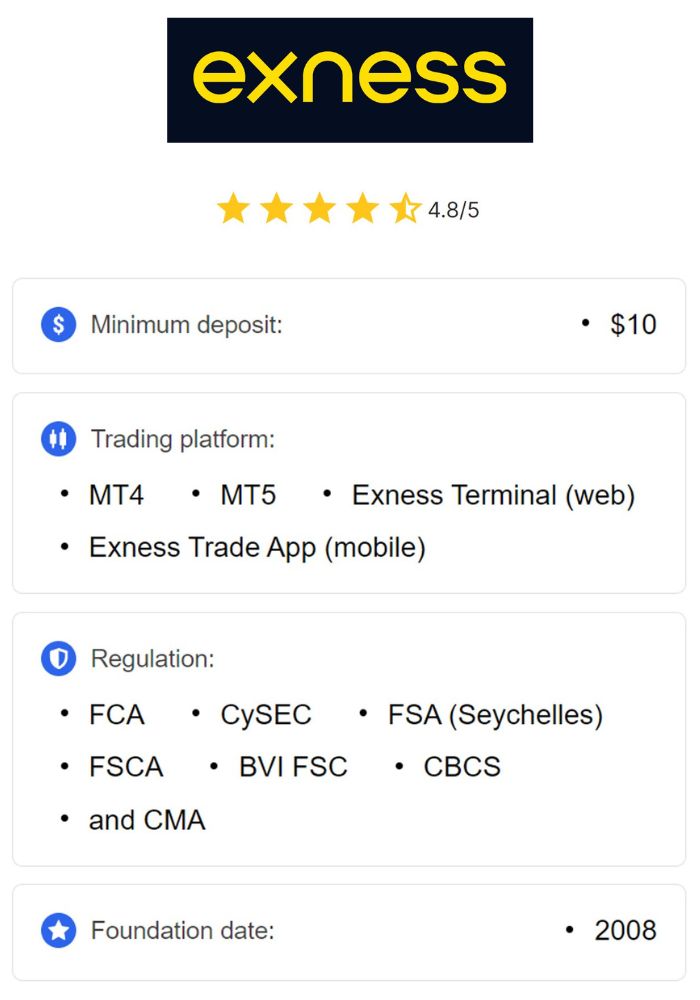

Overview of Exness

Company Background and History

Exness is a globally recognized Forex broker founded in 2008, known for providing a reliable and user-friendly trading platform. Headquartered in Cyprus and the Seychelles, Exness has expanded its services to many countries, including India. The company’s commitment to transparency and innovative technology has helped it build a solid reputation among traders worldwide. Exness offers a range of financial instruments beyond Forex, including CFDs on stocks, indices, and commodities.

Key Features of Exness Trading Platform

Exness offers various account types, low spreads, and high leverage options, making it accessible for both beginner and experienced traders. Its platform supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5), widely regarded as industry-standard trading platforms. Exness provides features such as automated trading, technical analysis tools, and a highly customizable interface. With its advanced risk management tools, Exness ensures that traders can manage their positions effectively, even in volatile markets.

Exness also offers Indian traders the convenience of multiple payment options, fast deposit and withdrawal processing times, and 24/7 multilingual support, making it a popular choice among Indian Forex traders.

Legal Framework for Forex Trading in India

Reserve Bank of India (RBI) Guidelines

The Reserve Bank of India (RBI) regulates Forex trading activities in India. According to RBI guidelines, Indian citizens are allowed to trade currency pairs that involve the Indian Rupee (INR) on registered exchanges like the NSE, BSE, and MSE. Cross-currency pairs that do not involve INR, such as EUR/USD or GBP/USD, are restricted for Indian residents, primarily due to concerns over money laundering and capital flight.

Indian traders interested in Forex trading must ensure that they are trading on pairs involving INR to comply with RBI rules. Trading with offshore brokers on cross-currency pairs is technically prohibited, though many traders still choose to engage in it due to the wider range of trading options available.

Foreign Exchange Management Act (FEMA)

The Foreign Exchange Management Act (FEMA) is a key law governing foreign exchange and Forex trading in India. Under FEMA, the Indian government restricts foreign exchange activities that do not align with specific guidelines, ensuring that capital flows are monitored and regulated. FEMA imposes strict rules on cross-border Forex trading, prohibiting Indian residents from trading foreign exchange through international brokers.

Traders interested in using Exness or similar platforms must understand that if they engage in trading pairs that don’t involve INR, it may conflict with FEMA regulations. However, for traders who comply with the permitted pairs and RBI guidelines, Forex trading can still be a viable and legal option.

Is Exness Regulated?

Regulatory Authorities Overseeing Exness

Exness is a regulated broker with licenses from multiple authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Services Authority (FSA) of Seychelles. These regulatory bodies impose strict standards on brokers, ensuring transparency, client protection, and operational integrity.

While Exness itself is not regulated specifically by SEBI or RBI, its compliance with internationally recognized regulators offers Indian traders a level of security and accountability. Indian traders can be confident that Exness adheres to international best practices in client fund protection and ethical trading.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Compliance with International Standards

Exness’s compliance with FCA and CySEC regulations means that it follows high standards in terms of financial reporting, client fund segregation, and dispute resolution mechanisms. These regulations protect client assets, requiring brokers to keep client funds in separate accounts and ensuring that they are not used for company expenses. This level of compliance with international standards makes Exness a safer option for Indian traders.

However, Indian traders should be aware that while Exness is regulated internationally, trading on it with cross-currency pairs that don’t involve INR may still be technically restricted in India.

Exness Trading Features for Indian Traders

Account Types and Their Benefits

Exness offers multiple account types tailored to different levels of trading experience, including Standard, Pro, and Zero accounts. The Standard account is suitable for beginners, providing low minimum deposit requirements and access to essential trading features. The Pro and Zero accounts cater to more experienced traders, offering tighter spreads, higher leverage, and faster execution.

Each account type comes with specific benefits, allowing traders to select an option that best suits their financial goals and trading experience. The availability of both MetaTrader 4 and MetaTrader 5 on Exness makes it convenient for Indian traders to leverage industry-leading tools and analytics.

Leverage and Margin Trading Options

One of Exness’s appealing features is its high leverage options, which allow traders to control larger positions with minimal capital. Leverage of up to 1:2000 is available, though Indian traders should exercise caution when using high leverage due to the increased risk of significant losses. Exness also offers flexible margin requirements and advanced risk management tools, making it suitable for traders who want to explore different strategies.

Deposit and Withdrawal Methods

Payment Options Available for Indian Traders

Exness offers a wide range of deposit and withdrawal options tailored to the needs of Indian traders. Common methods include bank transfers, credit and debit cards, as well as e-wallets like Skrill, Neteller, and UPI (Unified Payments Interface). By providing these localized options, Exness ensures that Indian traders can transfer funds with ease and efficiency.

For Indian traders, selecting a payment method that aligns with their financial preferences and banking options is essential for seamless fund management. Using local payment solutions can also reduce transaction fees, allowing traders to maximize their capital for trading activities.

Processing Times and Fees

One of Exness’s advantages is its commitment to fast and transparent processing times. Deposits are generally instant, allowing traders to access funds immediately and take advantage of market opportunities as they arise. Withdrawal processing times vary depending on the method used, but Exness strives to minimize delays, with most withdrawals processed within 24 hours.

Exness maintains a low-fee structure, often covering transaction costs on its end. However, some fees may be associated with specific payment methods, particularly international transfers. It is recommended that Indian traders review any potential fees with their chosen payment provider to avoid unexpected charges. This fast and affordable transaction model is especially appealing to traders aiming for frequent withdrawals or deposits.

Tax Implications for Forex Trading in India

Income Tax on Forex Gains

In India, profits earned from Forex trading are classified as business income and are subject to income tax under the Income Tax Act. Indian traders are required to report their Forex earnings as part of their annual income tax filings. The specific tax rate applied depends on the trader’s income tax bracket, with rates varying from 5% to 30% depending on the total taxable income.

To avoid penalties or legal complications, Indian traders should maintain detailed records of all trading activities, including profits, losses, and any transaction fees. Proper documentation not only ensures compliance but also helps in accurately calculating net income, which is essential for precise tax reporting.

GST Considerations

Goods and Services Tax (GST) may also apply to Forex trading transactions in India, depending on the nature of the services provided by the broker. For example, certain service fees or transaction charges may incur GST, especially if they are charged by an offshore broker. Indian traders should consult a tax professional to understand their GST obligations and ensure full compliance.

Understanding the potential GST implications can help traders factor in any additional costs associated with Forex trading and avoid unexpected tax liabilities. Traders should also verify if their broker charges GST on specific transactions to better manage their trading budget.

Risks Associated with Forex Trading

Market Volatility and Its Impact

Forex trading is inherently volatile, with prices affected by a variety of factors, including economic indicators, political events, and market sentiment. This volatility creates opportunities for profit but also presents substantial risks, particularly for traders with limited experience. For Indian traders using Exness, it is essential to remain aware of global events and economic data that may impact currency pairs.

A sudden shift in the market can lead to rapid price movements, which may result in significant gains or losses. Using risk management tools like stop-loss orders, setting realistic profit targets, and limiting trade sizes are effective strategies for navigating market volatility and preserving capital over time.

Leverage Risks Specific to Exness

While Exness offers high leverage options, with ratios up to 1:2000, leverage magnifies both potential profits and losses. For Indian traders, high leverage may be tempting due to the possibility of larger returns; however, it also increases exposure to risk. Trading with high leverage without proper risk management can lead to significant losses, especially in a volatile Forex market.

Indian traders are advised to use leverage conservatively, especially if they are new to Forex. Setting appropriate stop-loss levels and gradually increasing leverage as trading experience grows can help mitigate risks associated with over-leveraging.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Customer Support and Education Resources

Availability of Multilingual Support

Exness provides 24/7 multilingual customer support, ensuring that traders from various regions, including India, receive timely assistance. The availability of English and other widely spoken languages makes it easy for Indian traders to communicate with the support team about any technical issues, account queries, or trading-related questions.

Exness’s responsive customer service, accessible through live chat, email, and phone, helps traders resolve issues efficiently. This level of support is especially beneficial for beginner traders who may require more guidance as they navigate the Forex trading landscape.

Educational Materials for Indian Traders

Exness offers a variety of educational resources tailored to both beginner and advanced traders. These resources include webinars, tutorials, articles, and in-depth guides on topics ranging from technical analysis to risk management. For Indian traders, Exness’s educational materials can enhance their understanding of Forex trading concepts, helping them make informed decisions and improve their trading strategies.

The broker’s commitment to trader education supports the development of Indian traders by providing tools and insights essential for effective trading. With access to these resources, Indian traders can build their knowledge base, refine their skills, and approach the market with confidence.

User Experience and Reviews

Feedback from Indian Forex Traders

Exness has received generally positive feedback from Indian traders, especially regarding its user-friendly platform, quick deposit and withdrawal options, and reliable customer support. Indian traders often highlight the ease of account setup, the availability of high leverage options, and the intuitive nature of the MetaTrader 4 and MetaTrader 5 platforms.

However, some traders have noted concerns about regulatory limitations in India, particularly related to the trading of non-INR pairs, which may conflict with local laws. Despite this, Exness remains a popular choice among Indian traders who value its low fees, fast processing times, and robust trading tools.

Comparison with Other Forex Brokers

Compared to other brokers operating in India, Exness stands out for its extensive range of features, including a wide variety of account types, high leverage, and low spreads. Many Indian traders prefer Exness due to its cost-effective fee structure and reliable customer service. In terms of platform usability, Exness’s MetaTrader support and customizable trading tools make it highly competitive in the Indian market.

When choosing a Forex broker, Indian traders are advised to compare the specific features, fee structures, and regulatory compliance of different options to find the broker that best suits their needs.

Conclusion

Exness provides Indian traders with a comprehensive, globally recognized Forex trading platform equipped with advanced tools, high leverage options, and reliable customer support. However, while Exness is regulated by several international authorities, traders in India should remain mindful of local laws governing Forex trading, particularly those set forth by the Reserve Bank of India (RBI) and the Foreign Exchange Management Act (FEMA).

For Indian traders interested in Forex, trading currency pairs involving the Indian Rupee (INR) through regulated exchanges is the most straightforward way to stay compliant with Indian regulations. For those using Exness, focusing on risk management, leveraging educational resources, and maintaining compliance with local laws will help them navigate the Forex market responsibly.

As always, successful Forex trading requires a balanced approach—Indian traders should prioritize building their skills, managing risk effectively, and making informed decisions to enhance their trading experience on Exness.

Read more: