13 minute read

How to make money through forex trading in Kenya

Introduction to Forex Trading in Kenya

Understanding Forex Trading

Forex trading, also known as foreign exchange trading, involves the buying and selling of currencies in a global marketplace. It operates 24 hours a day, five days a week, making it the largest financial market in the world with a daily trading volume exceeding $6 trillion. In forex trading, currencies are traded in pairs, such as EUR/USD or GBP/JPY, and traders speculate on the price movements of these currencies to make a profit. Forex trading is characterized by its vast liquidity and accessibility, allowing individuals from various backgrounds to participate.

Top 4 Best Forex Brokers in Kenya

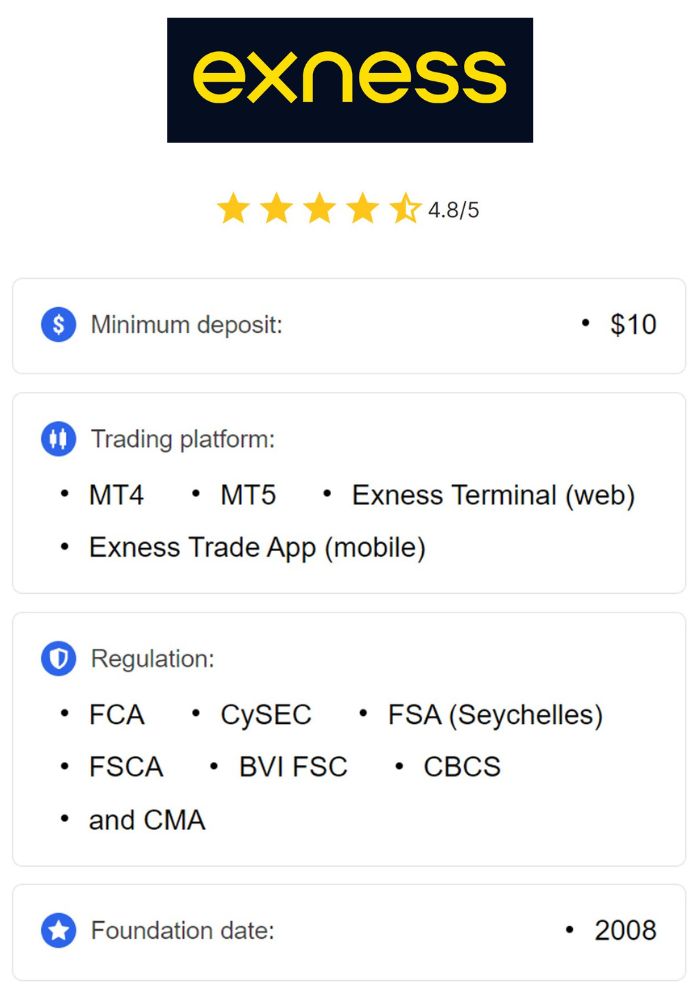

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

In Kenya, the popularity of forex trading has surged in recent years. Many individuals are recognizing it as a viable investment avenue, driven by the potential for high returns, ease of access through online platforms, and the ability to trade from anywhere with an internet connection.

The Growing Popularity of Forex in Kenya

The increasing interest in forex trading in Kenya can be attributed to several factors:

Increased Internet Connectivity: With the rise of mobile technology and internet access, more Kenyans are able to trade online, making forex trading more accessible than ever before.

Financial Literacy Programs: There has been a concerted effort to improve financial education in Kenya, leading to a greater understanding of investment opportunities, including forex trading.

Regulatory Support: The Capital Markets Authority (CMA) regulates forex trading in Kenya, ensuring that brokers adhere to necessary standards and practices, which helps build trust among traders.

Economic Opportunities: As the Kenyan economy continues to grow, more individuals are looking for alternative income streams, and forex trading presents an attractive option.

Getting Started with Forex Trading

Choosing a Reliable Forex Broker

The first step to successful forex trading in Kenya is selecting a reputable broker. The right broker will provide the tools and support you need to succeed. Consider the following factors when choosing a broker:

Regulation: Ensure that the broker is regulated by the Capital Markets Authority (CMA) or another relevant regulatory body. This provides a level of security and protection for your investments.

Trading Platforms: Look for brokers that offer user-friendly trading platforms with robust features, such as technical analysis tools, charting capabilities, and mobile trading options.

Spreads and Commissions: Evaluate the cost of trading by looking at the spreads and commissions charged by the broker. Lower costs can enhance profitability.

Customer Support: Choose a broker with responsive customer service that can assist you with any issues or queries.

Setting Up Your Trading Account

Once you have chosen a broker, the next step is to open a trading account. The process typically involves the following steps:

Registration: Fill out the online registration form on the broker's website, providing necessary personal information and financial details.

Verification: Most brokers will require you to verify your identity by submitting identification documents, such as a passport or national ID, along with proof of address.

Funding Your Account: After your account is verified, you can deposit funds using the available payment methods. Many brokers accept local payment options, including bank transfers and mobile money services.

Understanding the Currency Pairs

In forex trading, currencies are traded in pairs, meaning you are simultaneously buying one currency while selling another. Understanding the major currency pairs, such as EUR/USD, GBP/USD, and USD/JPY, is essential for making informed trading decisions. Each currency pair has its unique characteristics and influences, so being knowledgeable about them will enhance your trading strategy.

Essential Forex Trading Strategies

Fundamental Analysis in Forex

Fundamental analysis involves evaluating economic indicators, news events, and geopolitical developments that can impact currency values. Key indicators to monitor include:

Interest Rates: Central bank interest rate decisions influence currency strength. Higher rates typically attract foreign investment, increasing demand for that currency.

Inflation Rates: Rising inflation can erode purchasing power and impact currency strength. Traders should pay attention to inflation reports and consumer price indexes.

Economic Growth Indicators: GDP growth, employment figures, and manufacturing data can signal the overall health of an economy and influence currency movements.

Technical Analysis Techniques

Technical analysis involves using historical price data and chart patterns to forecast future price movements. Important tools and techniques include:

Support and Resistance Levels: Identifying key support and resistance levels helps traders make informed decisions about entry and exit points.

Chart Patterns: Recognizing patterns such as head and shoulders, flags, and triangles can indicate potential market reversals or continuations.

Technical Indicators: Utilizing indicators like Moving Averages, RSI, and MACD can provide valuable insights into market trends and help traders identify optimal trading opportunities.

Risk Management Strategies

Effective risk management is crucial for long-term success in forex trading. Here are key strategies to implement:

Setting Stop-Loss Orders: A stop-loss order automatically closes a trade at a predetermined price to limit potential losses. Setting stop-loss orders helps protect your capital and minimize emotional decision-making.

Position Sizing: Determining the appropriate position size based on your account balance and risk tolerance is vital for managing risk. Avoid risking more than a small percentage of your account on a single trade.

Diversification: Diversifying your trading portfolio by trading multiple currency pairs can reduce risk exposure. This strategy can help mitigate losses when one currency pair experiences volatility.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Leveraging Technology in Forex Trading

Trading Platforms and Software

Choosing the right trading platform is crucial for effective trading. Many brokers offer platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which provide advanced charting tools, technical indicators, and user-friendly interfaces. These platforms are widely recognized and trusted in the forex trading community.

User-Friendly Interface: A good trading platform should be intuitive, allowing traders to execute trades quickly and efficiently.

Customizability: Traders should look for platforms that allow for customization of charts, indicators, and layouts to suit their trading styles.

Utilizing Mobile Trading Applications

With the rise of mobile technology, many forex brokers now offer mobile trading applications that enable traders to access the market anytime, anywhere. Mobile trading apps allow users to monitor their accounts, place trades, and receive real-time notifications, providing flexibility and convenience.

Automation and Algorithmic Trading

Traders can utilize algorithmic trading systems to automate their trading strategies. These systems execute trades based on predetermined criteria, removing emotional decision-making from the trading process. Automated trading can enhance efficiency and allow traders to take advantage of market movements even when they are not actively monitoring their accounts.

Developing a Successful Trading Plan

Importance of a Trading Strategy

A well-defined trading strategy is crucial for success in forex trading, especially for beginners. A trading strategy outlines the specific methods and rules you will follow to make trading decisions, helping to reduce emotional trading and providing a structured approach. This plan should include your trading goals, the currency pairs you intend to trade, your entry and exit points, and the methods you will use to analyze the market.

Having a trading strategy helps in the following ways:

Consistency: A trading plan provides a consistent approach to trading, making it easier to follow your strategy and avoid impulsive decisions based on market emotions.

Measurable Goals: By setting clear objectives, you can measure your progress and make adjustments to your strategy as necessary. For instance, you might aim to achieve a specific percentage return each month.

Risk Management: A trading strategy inherently includes risk management techniques, which are vital for protecting your capital and ensuring that you do not expose yourself to excessive risk.

Setting Realistic Goals and Expectations

Setting realistic goals and expectations is a key component of your trading plan. New traders often have lofty ambitions, but it's important to remember that forex trading involves risks and may not always yield immediate profits. When creating your goals, consider the following:

Timeframe for Achieving Goals: Determine how long you plan to trade before assessing your performance. It could be weeks, months, or even years. Setting short-term and long-term goals can help you stay focused and motivated.

Profit Targets: Establish realistic profit targets based on your trading style and risk tolerance. Aim for small, consistent gains rather than trying to hit home runs with every trade.

Learning Goals: As a beginner, your initial goals might focus on learning and understanding the market rather than solely on profit. Aim to improve your knowledge of trading strategies, analysis techniques, and market behavior.

Keeping a Trading Journal

Maintaining a trading journal is a beneficial practice for any trader, especially for those just starting. A trading journal helps you track your trades, analyze your performance, and identify areas for improvement. Here’s what you should include in your journal:

Trade Details: Record details of each trade, including the currency pair, entry and exit points, trade size, and the rationale behind entering the trade.

Performance Analysis: After closing a trade, evaluate its outcome. Was it profitable? What worked well, and what could have been done differently? This reflection helps you learn from your experiences.

Emotional State: Document how you felt before, during, and after each trade. Understanding your emotional responses can help you manage psychological factors that affect trading decisions.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Understanding Market Influences

Economic Indicators Affecting Forex

Economic indicators play a critical role in influencing forex prices. These indicators provide insights into the economic health of a country and can lead to currency appreciation or depreciation. Some of the most important economic indicators include:

Gross Domestic Product (GDP): GDP measures the total economic output of a country. A growing GDP often leads to a stronger currency, while a declining GDP can weaken it.

Inflation Rates: High inflation can erode purchasing power, impacting currency strength. Central banks often adjust interest rates in response to inflation, influencing currency valuations.

Employment Data: Reports on employment, such as non-farm payrolls in the U.S., can significantly affect market sentiment and currency prices. A strong employment report usually boosts the corresponding currency.

Political Factors Impacting Currency Values

Political stability and government policies are also crucial factors affecting currency values. Events such as elections, changes in government, and international relations can create uncertainty in the forex market. Here are some ways political factors influence currencies:

Government Policies: Decisions made by central banks, such as changing interest rates or implementing quantitative easing, directly impact currency strength. Traders should keep an eye on monetary policy announcements and government fiscal policies.

Geopolitical Events: Events such as wars, trade agreements, and diplomatic relations can lead to fluctuations in currency prices. Understanding the broader political landscape helps traders make informed decisions.

Managing Risks in Forex Trading

The Importance of Stop-loss Orders

Implementing stop-loss orders is a fundamental aspect of risk management in forex trading. A stop-loss order automatically closes a position when it reaches a certain price, limiting potential losses. The advantages of using stop-loss orders include:

Loss Limitation: By setting a stop-loss order, you can define the maximum amount you are willing to lose on a trade, protecting your capital.

Reduced Emotional Stress: Knowing that a stop-loss order is in place allows you to trade with more confidence, as it minimizes the emotional burden associated with potential losses.

Diversification in Currency Trading

Diversifying your trading portfolio by engaging in multiple currency pairs can reduce risk exposure. When one currency pair experiences volatility, losses can be mitigated by profits in other positions. A well-diversified portfolio can also help ensure consistent returns over time.

Correlation Awareness: Understanding the correlation between different currency pairs can guide your diversification efforts. For example, if two pairs move together, exposure to both may increase risk rather than reduce it.

Spreading Risk: By trading various pairs, you spread risk across multiple positions, which can lead to more stable overall performance.

Learning from Experience

Analyzing Past Trades for Improvement

Analyzing your past trades is vital for growth as a trader. By reviewing your trading history, you can identify what strategies worked well and which ones did not. This process involves:

Identifying Patterns: Look for trends in your successful and unsuccessful trades. Are there specific setups or conditions that consistently lead to profits or losses?

Adjusting Strategies: Use insights gained from your analysis to refine your trading strategies. This may involve tweaking your approach or even changing currency pairs to trade.

Continuous Education and Training Opportunities

The forex market is always evolving, and continuous education is crucial for staying ahead. Engaging in ongoing learning can help you keep your skills sharp and adapt to changing market conditions. Consider the following resources:

Webinars and Online Courses: Many brokers and financial institutions offer educational webinars and courses that cover various aspects of forex trading.

Books and Articles: Reading books written by successful traders and reputable financial authors can provide valuable insights and strategies.

Networking with Other Traders: Joining trading communities and forums can help you connect with experienced traders who can share their knowledge and experiences.

Common Mistakes to Avoid in Forex Trading

Overtrading and Emotional Trading

One of the most prevalent mistakes in forex trading is overtrading, which can lead to substantial losses. Emotional trading can also hinder decision-making. To avoid these pitfalls:

Set Trading Limits: Establish daily or weekly limits for the number of trades you will make. This helps prevent impulsive decisions driven by emotions.

Stick to Your Plan: Adhere to your trading plan and avoid deviating from it due to fear or greed. Having a clear plan reduces the likelihood of emotional trading.

Ignoring Economic News and Data

Economic data releases can have significant impacts on currency prices. Failing to monitor these releases can lead to unexpected losses. To avoid this mistake:

Follow Economic Calendars: Stay informed about upcoming economic events by regularly checking economic calendars.

Analyze Reports: Understand how specific economic reports can influence the currency pairs you are trading. Adjust your strategies based on this information.

Legal Considerations for Forex Trading in Kenya

Regulatory Framework and Compliance

Forex trading in Kenya is regulated by the Capital Markets Authority (CMA), which ensures that brokers adhere to legal standards and practices. It is essential for traders to choose brokers that are registered and regulated by the CMA to protect their investments.

Broker Licensing: Verify that your broker holds the necessary licenses to operate in Kenya. This will help ensure a level of security and transparency in your trading activities.

Taxes on Forex Earnings

Traders in Kenya must also be aware of the tax implications of their forex earnings. The Kenyan Revenue Authority (KRA) has guidelines regarding taxation on income generated from forex trading.

Tax Compliance: Ensure that you keep accurate records of your trading activities and report your earnings to the KRA as required.

Resources for Aspiring Forex Traders

Recommended Books and Online Courses

For those looking to enhance their knowledge, several books and online courses are available that cover various aspects of forex trading. Some notable titles include:

"Currency Trading for Dummies" by Kathleen Brooks and Brian Dolan: A great introduction to forex trading concepts, strategies, and market analysis.

"Trading in the Zone" by Mark Douglas: A book focused on the psychology of trading, helping traders develop the right mindset.

Forex Trading Communities and Forums

Engaging with fellow traders can provide support and enhance your learning experience. Online forums and communities such as BabyPips and Forex Factory are excellent resources for connecting with other traders, sharing experiences, and learning from each other.

Conclusion

Making money through forex trading in Kenya requires a solid understanding of the market, a reliable trading plan, and effective risk management strategies. As you embark on your trading journey, it is essential to educate yourself continuously and stay informed about market influences and regulatory changes.

By leveraging the right tools, implementing sound trading strategies, and learning from your experiences, you can navigate the complexities of the forex market and increase your chances of achieving financial success. With dedication, patience, and the right mindset, you can make the most of the opportunities available in forex trading and build a profitable trading career in Kenya.

Read more: