17 minute read

Exness is legal or illegal in India?

Introduction to Exness

Overview of Exness as a Trading Platform

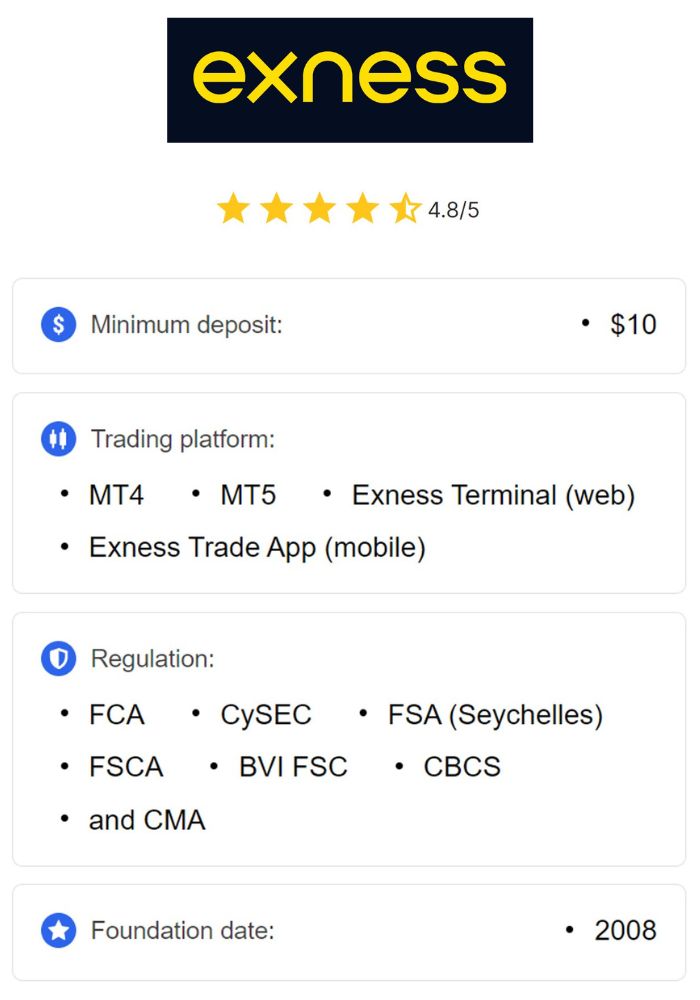

Exness is an international trading platform established in 2008 that has grown significantly over the years. Known for its user-friendly features and competitive trading conditions, Exness offers a wide range of trading instruments, including forex, cryptocurrencies, indices, and commodities. It provides traders with the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are highly regarded for their reliability and advanced trading tools. Exness is popular among traders worldwide due to its flexibility and transparent pricing.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

For Indian traders, Exness offers opportunities to participate in the global forex market. The platform's features include flexible leverage options, tight spreads, and fast trade execution, making it attractive to both novice and experienced traders. However, questions regarding the legality of using Exness in India remain due to India's strict regulatory environment for forex trading.

Key Features and Services Offered by Exness

Exness provides a wide array of features designed to enhance the trading experience. Key features include high leverage ratios, allowing traders to control large positions with a relatively small deposit, competitive spreads, and no hidden fees on most accounts. Exness offers various account types, such as Standard, Pro, and Cent Accounts, each tailored to different trading needs and experience levels. Additionally, the platform supports automated trading, enabling traders to use bots and scripts to execute trades based on specific criteria.

Exness also stands out for its commitment to transparency, offering real-time market data, advanced charting tools, and educational resources. For Indian users, Exness supports multiple deposit and withdrawal methods, making it convenient to fund accounts and withdraw earnings. The platform's dedication to security, reliable customer support, and extensive educational materials further enhance its appeal.

Understanding Forex Trading in India

The Basics of Forex Trading

Forex trading, or foreign exchange trading, involves the buying and selling of currencies to profit from exchange rate fluctuations. In forex trading, currency pairs (e.g., EUR/USD, USD/INR) are traded based on the relative value between two currencies. Forex trading is a global market with high liquidity, and traders can access it 24 hours a day due to overlapping trading sessions across time zones. The potential for profit, combined with access to leveraged positions, makes forex trading popular among retail traders.

However, forex trading in India is subject to specific regulatory restrictions. According to Indian law, traders are permitted to engage in forex trading only through currency pairs that involve the Indian Rupee (INR) on authorized exchanges. These restrictions limit the availability of forex pairs and influence the options available to Indian traders interested in platforms like Exness.

Regulatory Environment for Forex Trading in India

India has a tightly regulated financial environment, with strict rules governing forex trading. Forex trading involving foreign currency pairs (non-INR pairs) is restricted for Indian residents due to the Foreign Exchange Management Act (FEMA) and guidelines issued by the Reserve Bank of India (RBI). Indian residents are only permitted to trade INR-based currency pairs on domestic exchanges like the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE), and international brokers are not authorized to offer non-INR pairs within India.

Violating these regulations can lead to legal consequences, including fines and other penalties. Therefore, it’s crucial for Indian traders to understand the limitations and comply with local laws when trading forex. Platforms like Exness, which offer a wide range of currency pairs including non-INR options, present a regulatory gray area for Indian traders.

Regulatory Bodies Governing Forex Trading in India

Reserve Bank of India (RBI)

The Reserve Bank of India (RBI) is India’s central banking authority, responsible for regulating the country's monetary policy, overseeing currency exchange, and managing the country’s forex reserves. The RBI plays a critical role in overseeing forex trading regulations within India, aiming to ensure financial stability and prevent unauthorized foreign exchange transactions. Under FEMA, the RBI sets restrictions on the types of currency pairs that Indian residents can legally trade.

The RBI has warned Indian residents against trading forex through unauthorized offshore platforms, reiterating that Indian residents should only trade currency pairs involving INR on Indian exchanges. This regulation impacts the legality of trading on platforms like Exness, which, although regulated internationally, operates outside RBI’s jurisdiction.

Securities and Exchange Board of India (SEBI)

The Securities and Exchange Board of India (SEBI) regulates financial markets in India, including stock exchanges and authorized brokers. SEBI ensures market integrity, protects investors, and enforces financial compliance among Indian brokers. SEBI’s regulations impact forex trading by authorizing certain brokers to offer INR-based currency pairs through domestic exchanges.

While SEBI plays an indirect role in forex regulation, it’s a key regulatory body for Indian traders. SEBI-approved brokers are permitted to offer limited forex services within the legal framework, which excludes most international platforms offering non-INR currency pairs. This adds another layer of restriction for Indian residents interested in trading with Exness.

Legal Status of International Forex Brokers in India

Definition of International Forex Brokers

International forex brokers are companies based outside India that provide forex and CFD (Contract for Difference) trading services to clients worldwide. Many international brokers, including Exness, offer access to a range of forex pairs, commodities, indices, and cryptocurrencies, often with high leverage and competitive trading conditions. These brokers are regulated by international authorities, such as the FCA or CySEC, rather than Indian regulators like RBI or SEBI.

For Indian traders, international brokers provide an opportunity to access global markets and non-INR currency pairs. However, as these brokers operate outside India’s regulatory jurisdiction, Indian residents face legal restrictions when trading on these platforms.

Rules and Regulations Impacting International Forex Brokers

According to FEMA and RBI guidelines, Indian residents are not permitted to engage in leveraged trading of foreign currency pairs on international platforms. Trading forex through offshore brokers offering non-INR pairs is considered a violation of FEMA regulations, as these transactions bypass the authorized currency pairs and exchanges in India. Indian traders using platforms like Exness to trade non-INR pairs may face legal penalties if caught.

However, some Indian traders still access international platforms by funding accounts through e-wallets or cryptocurrency, which can be harder to track. Despite these workarounds, trading forex on international platforms remains a regulatory gray area, and traders are advised to consider the potential legal consequences before proceeding.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Exness and Its Regulatory Compliance

Licenses and Regulations Held by Exness

Exness operates under the regulation of respected international bodies, such as the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). These licenses ensure that Exness adheres to strict financial standards, including transparent trading practices, secure client fund management, and compliance with anti-money laundering (AML) regulations. Exness’s compliance with international standards makes it a trusted platform for many traders worldwide.

While Exness is regulated internationally, it is not registered with Indian regulatory bodies like RBI or SEBI. Therefore, it operates outside the regulatory framework set for Indian residents, which limits its legal accessibility in India.

Reputation and Trustworthiness of Exness

Exness has built a solid reputation in the global trading community due to its transparent operations, reliable platform, and commitment to user security. The broker’s regulatory compliance with FCA and CySEC standards reinforces its credibility, as these authorities are known for their stringent requirements. Exness’s reputation is further supported by positive user reviews, customer support quality, and educational resources, making it a popular choice among traders worldwide.

However, Indian traders should be aware that Exness’s compliance with international regulations does not extend to India’s regulatory framework. Therefore, although Exness is a trustworthy platform, using it from India may expose traders to regulatory risks under Indian law.

How Exness Operates in the Indian Market

User Registration Process for Indian Traders

Indian traders can register on Exness by completing an online registration process that includes providing personal information, verifying identity documents, and selecting an account type. The registration process is straightforward and similar to international standards, ensuring that traders meet the platform’s compliance requirements. However, Indian residents should keep in mind that trading non-INR currency pairs on Exness may not align with Indian regulations.

During registration, Indian traders should carefully consider the legal implications and ensure that they fully understand the risks involved in trading on an international platform. Verifying documents is standard, but some Indian traders use alternative funding methods to avoid regulatory scrutiny, which still carries risks.

Payment Methods Available for Indian Users

Exness supports multiple payment methods, including bank transfers, e-wallets, and cryptocurrencies, allowing Indian users to fund their accounts easily. However, certain methods may bypass local regulatory oversight, such as using e-wallets or cryptocurrencies instead of direct bank transfers. This flexibility in funding methods provides Indian traders with options but does not eliminate the risks associated with non-compliant trading.

For Indian traders, it’s essential to choose payment methods that align with their needs while being mindful of the potential legal consequences. Using non-bank methods may offer privacy but still does not exempt traders from local regulations.

Pros and Cons of Using Exness in India

Advantages of Trading with Exness

One of the primary advantages of using Exness for Indian traders is the platform’s flexible account types, which cater to different experience levels and trading styles. Exness provides accounts with low minimum deposits, making it accessible to beginners, while also offering professional-grade accounts with tighter spreads and faster execution speeds for advanced traders. Additionally, Exness offers competitive leverage options, which can help traders maximize potential profits by allowing them to control larger positions with minimal capital.

Another significant advantage is Exness’s advanced trading tools, including MetaTrader 4 and MetaTrader 5, which offer technical analysis, customizable indicators, and algorithmic trading options. The platform’s transparency and real-time market data help Indian traders make informed decisions. Furthermore, Exness’s customer support is available 24/7, ensuring that traders can resolve issues promptly. For traders in India, these features provide a comprehensive trading experience that rivals those offered by many other international brokers.

Disadvantages and Risks Involved

While Exness offers numerous advantages, Indian traders should be aware of the associated risks, particularly regarding regulatory compliance. Since Exness is not regulated by Indian authorities like SEBI or RBI, trading on the platform may violate Indian forex regulations. Engaging in forex trading on an unregulated platform can lead to legal consequences, such as penalties, account freezes, or fines, especially if authorities discover unauthorized forex transactions.

Another potential downside is the high risk associated with trading on a leveraged account, which can lead to significant losses if the market moves unfavorably. Exness’s high leverage options may be attractive, but they require careful risk management, particularly for novice traders. Additionally, currency conversion fees and fluctuating exchange rates can increase trading costs for Indian users, impacting overall profitability. These challenges highlight the need for Indian traders to carefully weigh the pros and cons before trading with Exness.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Currency Conversion and Transaction Issues

Impact of Currency Conversion on Trading

For Indian traders, one of the main issues with trading on Exness is the currency conversion between Indian Rupees (INR) and foreign currencies like USD or EUR. When Indian traders deposit funds in INR, they often incur conversion fees that may reduce the overall deposit amount. Additionally, fluctuations in exchange rates can impact the profitability of trades and affect withdrawal amounts.

Currency conversion fees and changing exchange rates are important considerations, as they can lead to unexpected costs. Traders should regularly monitor exchange rates and understand the impact of currency conversion on their capital, as these fluctuations can influence both initial deposits and final profits. For Indian traders, these fees are an unavoidable aspect of trading with an international broker and should be factored into trading expenses.

Common Transaction Challenges Faced by Indian Traders

Indian traders may face certain challenges when depositing and withdrawing funds on Exness. Transaction delays are common, especially when using bank transfers, as international transactions can take several days to process. Additionally, some banks may block transactions associated with international forex platforms, given the RBI’s restrictions on foreign forex trading. This may lead to declined transactions or additional verification requirements.

Another issue arises when using e-wallets or cryptocurrencies, as these methods, while faster, may carry additional fees or lack the same level of transparency as bank transfers. Indian traders should choose transaction methods carefully, considering speed, costs, and ease of access. Understanding the potential transaction issues can help traders plan their deposits and withdrawals effectively, reducing the likelihood of interruptions in trading activities.

Tax Implications for Indian Traders Using Exness

Understanding Capital Gains Tax on Forex Trading

In India, any profits generated from forex trading are subject to capital gains tax. If an Indian trader earns profits from trading on Exness, they may need to declare these gains in their income tax return and pay the applicable tax. Capital gains tax in India varies based on the holding period: short-term capital gains (for assets held less than 36 months) are taxed at the individual’s income tax rate, while long-term capital gains are taxed at a reduced rate with indexation benefits.

For Indian traders, it’s essential to maintain accurate records of trades, profits, and losses to calculate capital gains accurately. Tax obligations may differ depending on the trader’s income bracket and the nature of the trading activity. Consulting with a tax professional can help traders comply with tax laws and avoid penalties, as failure to report forex trading profits accurately can lead to scrutiny from tax authorities.

Reporting Foreign Income and Assets

According to Indian tax laws, residents are required to disclose foreign income and assets in their tax returns, which includes profits from international forex trading platforms like Exness. For Indian traders, this means reporting any income generated from trading activities conducted through foreign brokers. In addition, traders may need to provide information about their account balances on international platforms, particularly if these assets exceed specified thresholds.

Non-compliance with reporting requirements can lead to significant penalties and may result in an investigation by tax authorities. For Indian traders using Exness, understanding these obligations and ensuring that they report foreign income accurately is critical. Consulting a tax advisor with experience in foreign income reporting can provide guidance on staying compliant and minimizing tax liabilities.

Customer Support and Resources Provided by Exness

Availability of Local Language Support

Exness provides customer support in multiple languages, catering to its diverse international clientele. While Exness does not currently offer support in all Indian languages, it provides assistance in English, which is widely understood in India. The customer support team is available 24/7 through various channels, including live chat, email, and phone, allowing traders to receive timely help with account issues, deposit inquiries, or platform troubleshooting.

For Indian traders, having access to English-speaking support is beneficial, as it enables them to resolve issues efficiently. Exness’s responsive support ensures that traders have assistance whenever needed, making the trading experience smoother and more accessible. Although local language support could enhance accessibility further, Exness’s current offerings are sufficient for English-speaking traders in India.

Educational Resources for Indian Traders

Exness offers a wide range of educational resources, including webinars, video tutorials, articles, and market analysis reports, to help traders improve their skills. These resources cover topics such as technical analysis, risk management, and forex market fundamentals, making them valuable for both beginners and experienced traders. Exness’s educational content empowers Indian traders to make informed decisions and develop effective trading strategies.

Additionally, Exness provides access to economic calendars and real-time market data, which can help Indian traders stay informed about global economic events and plan their trades accordingly. For traders in India, utilizing these resources can enhance their knowledge and help them navigate the forex market confidently, despite regulatory complexities.

User Experiences and Testimonials

Positive Feedback from Indian Traders

Exness has received positive feedback from Indian traders for its user-friendly platform, low deposit requirements, and flexible account options. Many traders appreciate the platform’s fast execution speeds, tight spreads, and variety of trading instruments. The availability of multiple payment options and quick withdrawals are also commonly praised, as they simplify transactions and make Exness accessible for Indian users.

Traders have also highlighted Exness’s transparent fee structure and reliable customer support as significant advantages. For beginners, the educational resources and demo accounts provide a smooth learning curve, allowing new traders to familiarize themselves with the platform before investing real funds. Overall, the positive experiences of Indian traders contribute to Exness’s reputation as a favorable option for forex trading.

Negative Experiences and Concerns Raised

While Exness has many positive aspects, some Indian traders have reported concerns, particularly regarding regulatory risks. Since Exness operates outside of India’s regulatory framework, traders are sometimes worried about the legal implications of using an international platform. Issues with currency conversion fees, transaction delays, and occasional difficulty with bank transfers have also been noted by Indian users.

Additionally, some traders have raised concerns about high leverage, as it can lead to substantial losses if not managed carefully. Although Exness provides tools to mitigate risk, high leverage still poses challenges for less experienced traders. Understanding both the positive and negative aspects can help Indian traders make an informed decision about whether Exness aligns with their trading goals and risk tolerance.

Alternatives to Exness for Indian Traders

Comparison with Other International Forex Brokers

Several international forex brokers compete with Exness in offering forex trading services to Indian residents. Brokers such as XM, HotForex, and FXTM also provide low minimum deposits, competitive spreads, and multiple account types, making them attractive alternatives for Indian traders. Like Exness, these brokers are regulated internationally but do not fall under Indian regulatory bodies, placing them in a similar regulatory gray area.

Each broker has its unique strengths. For instance, XM offers extensive educational resources, while FXTM provides advanced trading tools and competitive commissions. Comparing features, trading conditions, and user feedback for each broker can help Indian traders choose a platform that best meets their needs.

Local Indian Forex Brokers Worth Considering

For Indian traders concerned about compliance, opting for a local broker regulated by SEBI can be a safer alternative. SEBI-regulated brokers, such as Zerodha and Upstox, offer forex trading limited to INR-based currency pairs, ensuring full compliance with Indian regulations. While local brokers do not provide access to as many currency pairs as Exness, they offer a legitimate and secure trading experience.

Choosing a local broker allows Indian traders to avoid the regulatory risks associated with international brokers and simplifies the tax reporting process. Although local brokers may have fewer trading options and slightly higher fees, they provide a transparent and legally compliant way to engage in forex trading within India’s regulatory framework.

Conclusion

The question of whether Exness is legal or illegal in India is complex, primarily due to India’s strict forex trading regulations. While Exness is a reputable international broker, its services fall outside the regulatory jurisdiction of Indian authorities like SEBI and RBI. Indian traders may access Exness, but they should be aware that trading non-INR currency pairs on international platforms could be considered a violation of FEMA guidelines, potentially leading to legal consequences.

For Indian traders interested in Exness, understanding the regulatory risks, tax implications, and transaction challenges is essential. By weighing the pros and cons, traders can make an informed decision about whether Exness aligns with their trading objectives. Alternatives, such as local SEBI-regulated brokers, may provide a safer option for those who prioritize compliance.

While Exness offers an attractive platform with many advantages, it is crucial for Indian residents to remain cautious, stay informed about local regulations, and consider legal implications before trading on international forex platforms.

Read more: