8 minute read

How much do i need to start forex trading in South Africa?

Forex trading has become increasingly popular in South Africa, attracting thousands of new traders looking to capitalize on the foreign exchange market. One of the most frequently asked questions by beginners is:

"How much money do I need to start Forex trading in South Africa?"

The answer is not straightforward, as it depends on multiple factors such as:✔️ Your trading goals✔️ Risk tolerance✔️ Broker requirements✔️ Leverage and position sizing✔️ Your chosen trading strategy

Top 4 Best Forex Brokers in South Africa

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

In this comprehensive guide, we will explore:

✅ The minimum capital required for different trading styles✅ How leverage affects your initial deposit✅ The best brokers and their minimum deposit requirements✅ Risk management techniques to protect your investment✅ A step-by-step guide to getting started with Forex trading in South Africa

By the end of this article, you will have a clear idea of how much money you need to start Forex trading in South Africa effectively and safely.

1. Understanding Forex Trading Capital Requirements

What is Forex Trading?

Forex (foreign exchange) trading involves buying and selling currencies such as USD/ZAR, EUR/USD, and GBP/USD to profit from fluctuations in exchange rates.

The Forex market is the largest financial market in the world, operating 24 hours a day, five days a week, with a daily trading volume exceeding $7.5 trillion.

Forex trading is attractive due to its high liquidity, low entry barriers, and flexible trading hours. However, success in Forex requires capital, strategy, and discipline.

How Much Money Do You Need to Start?

While some brokers allow you to start trading with as little as $5 (±90 ZAR), this is not recommended for long-term success.

Your recommended starting capital depends on your trading style and risk appetite:

2. Minimum Deposit Requirements for Forex Brokers in South Africa

To trade Forex, you need a broker to provide access to the market.

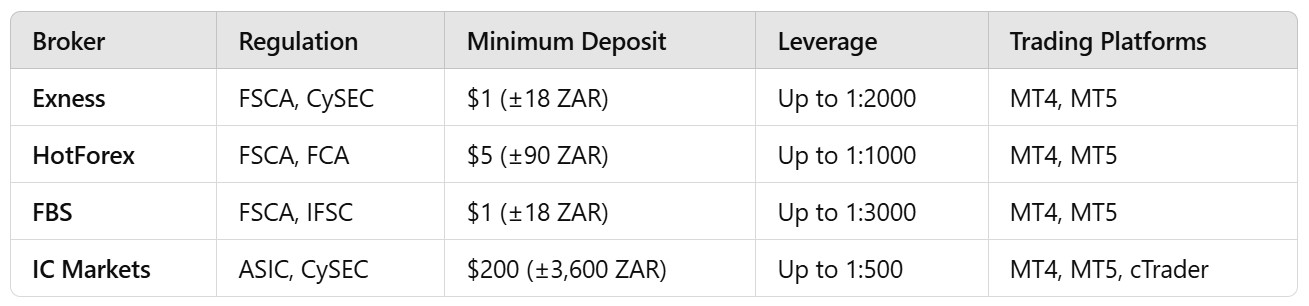

Best Forex Brokers in South Africa & Their Minimum Deposits

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Pro Tip: Always choose a regulated broker to ensure fund security and fair trading conditions.

3. Factors That Influence Your Starting Capital in Forex Trading

1️⃣ Leverage & Margin Requirements

Leverage allows you to trade larger positions with a small amount of money.

For example, with 1:100 leverage, a $100 deposit can control a $10,000 trade.

However, higher leverage increases risk. Beginners should use a maximum leverage of 1:100 to minimize losses.

2️⃣ Trading Strategy

Your capital requirements depend on your trading strategy:✔️ Scalping – Requires small capital but high leverage.✔️ Swing Trading – Needs a larger capital to withstand market fluctuations.✔️ Long-term Investing – Requires the highest capital but is less risky.

3️⃣ Risk Management

Good risk management means never risking more than 1-2% of your account per trade.

For example:✔️ If you have $1,000 (±18,000 ZAR), you should risk $10 - $20 per trade.✔️ If you have $100 (±1,800 ZAR), you should risk $1 - $2 per trade.

4. How to Choose the Right Amount to Start Forex Trading in South Africa

Choosing the right amount to start Forex trading in South Africa is a critical decision that can impact your trading success. The ideal starting capital depends on multiple factors, including your trading experience, financial stability, trading goals, and risk appetite.

Below, we explore key considerations that will help you determine the right amount to start with.

1️⃣ Assess Your Experience Level

Your level of experience plays a significant role in deciding how much capital you should invest:

Beginner Traders: If you're new to Forex trading, it's best to start with a demo account before using real money. This allows you to practice without financial risk. When transitioning to a live account, consider starting with a small amount (e.g., $100 - $500) to get comfortable with real market conditions.

Intermediate Traders: If you have some experience, you might start with $500 - $1,000, which allows for slightly larger trades and better risk management.

Experienced Traders: If you’re confident in your trading strategy, a starting capital of $5,000 or more can provide better profitability and flexibility.

2️⃣ Define Your Trading Style

Different trading styles require different amounts of starting capital:

3️⃣ Consider Your Financial Situation

Never invest money you cannot afford to lose. Before funding your trading account, ask yourself:

✔️ Do I have emergency savings?✔️ Am I financially stable?✔️ Will losing this money affect my daily life?

It’s always best to start with an amount that won’t cause financial stress in case of losses.

4️⃣ Use Proper Risk Management Techniques

Successful Forex trading is about capital preservation, not just making profits. The amount you start with should allow you to use proper risk management techniques, such as:

Never risk more than 1-2% of your capital per trade

Use stop-loss orders to limit potential losses

Start with small position sizes and scale up gradually

For example, if you start with $1,000, risking 2% per trade means your maximum loss per trade would be $20. This approach helps ensure long-term sustainability in the market.

5. Step-by-Step Guide to Start Forex Trading in South Africa

If you're ready to start Forex trading in South Africa, follow these step-by-step instructions to set up your trading journey successfully.

Step 1: Choose a Reputable Forex Broker

The first step in Forex trading is choosing a regulated and trustworthy broker. In South Africa, brokers should be regulated by the FSCA (Financial Sector Conduct Authority) for safety and compliance.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Step 2: Open a Trading Account

Once you have selected a broker, you need to register and verify your account. Brokers will typically ask for:

✔️ A copy of your ID or passport✔️ Proof of residence (utility bill or bank statement)✔️ Banking details for deposits and withdrawals

Step 3: Deposit Funds into Your Trading Account

Most brokers allow deposits via:✔️ Bank transfer✔️ Credit/Debit card✔️ E-wallets (Skrill, Neteller, PayPal, etc.)

Start with an amount you are comfortable losing, following the capital recommendations discussed earlier.

Step 4: Learn the Basics of Forex Trading

Before placing real trades, it’s crucial to understand:✔️ Currency Pairs (e.g., USD/ZAR, EUR/USD, GBP/USD)✔️ Market Analysis (Technical vs. Fundamental Analysis)✔️ Order Types (Market orders, limit orders, stop-loss, take-profit)

Step 5: Start with a Demo Account

Most brokers offer demo accounts, which allow you to trade with virtual money in real market conditions. Practicing on a demo account helps you:✔️ Understand market movements✔️ Test different trading strategies✔️ Gain confidence before investing real money

Step 6: Transition to a Live Account and Start Trading

Once you’re comfortable, switch to a real account and start trading with small amounts. Use proper risk management techniques and gradually increase your position sizes as you gain experience.

6. Common Mistakes to Avoid When Starting Forex Trading in South Africa

🚫 Starting with too little capital – Underfunded accounts can lead to quick losses.🚫 Trading without a plan – A trading strategy is essential for long-term success.🚫 Using too much leverage – High leverage can wipe out your account quickly.🚫 Ignoring risk management – Never risk more than 2% of your capital per trade.🚫 Letting emotions control trading – Fear and greed often lead to bad trading decisions.

7. Frequently Asked Questions (FAQs) about Forex Trading Capital in South Africa

Q1: Can I Start Forex Trading in South Africa with R100?

Yes, some brokers allow a minimum deposit of R100 ($5-10), but this amount is too small to trade effectively. It’s best to start with at least $100 - $500 for a better trading experience.

Q2: Is $100 (±1,800 ZAR) Enough for Forex Trading?

Yes, $100 is a decent starting amount for micro-lot trading. However, you need to use proper risk management and avoid excessive leverage.

Q3: How Much Do Professional Traders Invest?

Professional traders typically start with $5,000 or more to allow for better trade management, stability, and long-term profitability.

Q4: Do I Need to Pay Taxes on Forex Profits in South Africa?

Yes, Forex profits are considered taxable income under South African Revenue Service (SARS) regulations. It’s important to keep records of your earnings and consult a tax professional.

Q5: Can I Trade Forex Without a Broker?

No, Forex trading requires a broker to provide access to the global Forex market. Always choose a regulated broker for security.

8. Conclusion – How Much Should You Start With?

The amount you need to start Forex trading in South Africa depends on your trading style, experience, and financial situation.

✔️ You can start Forex trading in South Africa with as little as $10 (±180 ZAR), but it’s not ideal.✔️ A realistic starting amount is $100 - $1,000 (±1,800 - 18,000 ZAR) depending on your strategy.✔️ Always practice risk management and trade responsibly to increase your chances of success.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Read more: