10 minute read

Is Exness withdrawal legal in India? Review Broker

from Exness

by Exness_Blog

Exness is a well-known online forex and CFD trading platform that serves clients around the globe. However, one of the most frequently asked questions by Indian traders is whether Exness withdrawal is legal in India. In this detailed review, we will explore Exness as a trading platform, its withdrawal process, and how it complies with Indian regulations.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Understanding Exness as a Trading Platform

Overview of Exness and Its Services

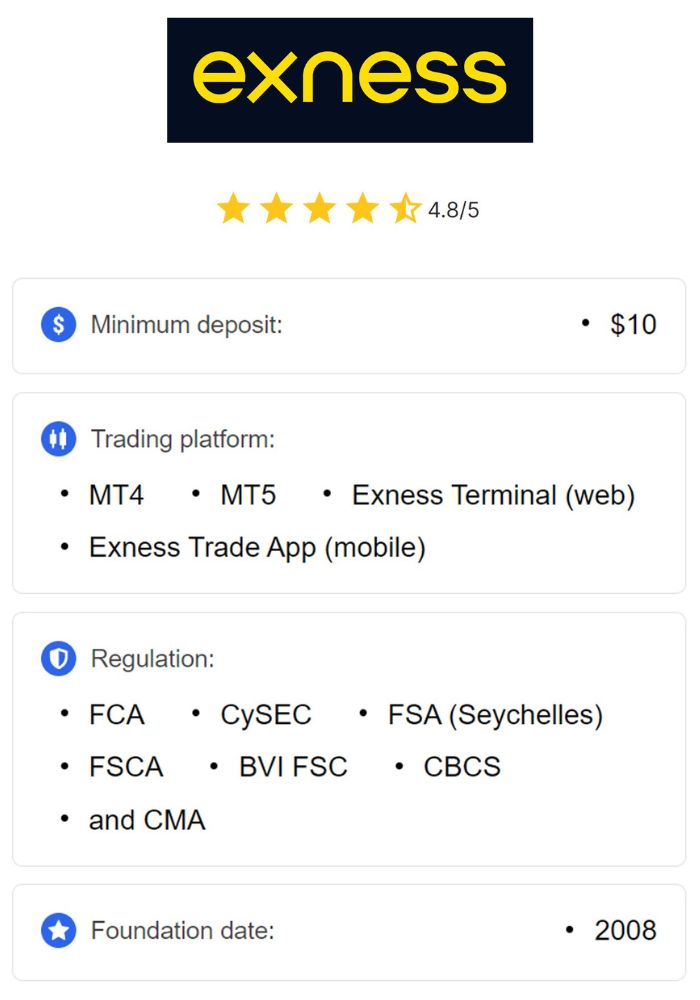

Exness is a global trading platform that offers services in forex trading, CFDs (Contract for Differences), and other financial instruments. Founded in 2008, Exness has grown to become one of the leading brokers in the online trading industry. The platform offers a range of trading services, including Forex trading, stock indices, commodities, cryptocurrencies, and precious metals.

Exness has a strong reputation for offering competitive spreads, high leverage, and a wide range of account types. Traders can access Exness via popular trading platforms such as MetaTrader 4 and MetaTrader 5, as well as through a user-friendly mobile app, making it convenient for traders to trade from anywhere in the world.

Types of Accounts Offered by Exness

Exness offers several types of accounts catering to both new and experienced traders. The primary account types are:

Standard Accounts: These accounts are ideal for beginner traders who want a straightforward trading experience. The spreads are variable, and the account does not require high minimum deposits.

Pro Accounts: Pro accounts are more suited for experienced traders. These accounts offer tighter spreads and the ability to use higher leverage for more advanced trading strategies.

Cent Accounts: Cent accounts are perfect for traders who wish to start with a smaller investment. Traders can deposit and trade with funds measured in cents, making it an excellent choice for those who want to practice and test strategies without significant financial risk.

Regulatory Framework for Forex Trading in India

SEBI and Its Role in Financial Trading

The Securities and Exchange Board of India (SEBI) is the primary regulatory body overseeing the financial markets in India. SEBI's role is to protect investors' interests, promote fair trading practices, and ensure that all market activities are conducted transparently and efficiently.

SEBI is also responsible for regulating forex trading in India. It ensures that the forex market operates smoothly and adheres to legal standards. However, SEBI does not directly regulate offshore brokers like Exness. Despite this, it is important for traders in India to understand the regulations around international forex trading platforms.

Legal Status of Forex Trading in India

Forex trading in India is governed by the Foreign Exchange Management Act (FEMA), which allows residents to trade only in specific currency pairs through authorized brokers. Indian traders can engage in forex trading with international brokers but must do so within the legal framework established by FEMA.

The Indian government does not outright ban the use of offshore brokers such as Exness, but traders must be cautious about the platforms they use. Forex trading is considered legal only when conducted through brokers who are compliant with Indian laws and regulations, which does not necessarily apply to all offshore brokers.

Guidelines for Indian Traders on Offshore Platforms

Although Indian traders can use offshore platforms like Exness, they should be aware of the legal grey areas. The Reserve Bank of India (RBI) and SEBI have not explicitly banned online forex trading, but there are restrictions on how Indian traders can fund their accounts and withdraw funds from overseas platforms. Traders are encouraged to use caution and ensure that their trading activities do not violate FEMA or other applicable laws.

Exness and Its Compliance with International Regulations

Licenses Held by Exness

Exness operates globally and holds licenses from several reputable financial authorities. Some of the key licenses held by Exness include:

Financial Conduct Authority (FCA) – Exness is authorized and regulated by the UK’s FCA, ensuring that it operates under strict guidelines designed to protect traders.

Cyprus Securities and Exchange Commission (CySEC) – Exness is also regulated by CySEC, which oversees financial activities within the European Union. This license ensures that Exness adheres to EU financial regulations.

Australian Securities and Investments Commission (ASIC) – Exness is licensed by ASIC, which adds an extra layer of credibility for Australian traders.

These licenses mean that Exness is subject to stringent regulations designed to safeguard traders and ensure that the broker operates transparently and securely. Although Exness is licensed in several jurisdictions, Indian traders should still verify the legal implications of withdrawing funds to comply with Indian regulations.

Safety Measures for Clients' Funds

Exness takes security seriously and implements various measures to ensure that traders' funds and personal data are kept safe. The platform uses bank-level encryption, including SSL certificates, to protect users' data from unauthorized access. Additionally, Exness segregates clients' funds from its operational funds, meaning that traders’ money is kept in separate accounts to ensure its safety.

Exness also offers two-factor authentication (2FA) for added security, ensuring that traders' accounts are protected from unauthorized access. These safety measures are crucial in building trust, but Indian traders must also be aware of how these practices align with local regulations.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

The Withdrawal Process at Exness

Step-by-Step Guide to Withdrawing Funds

Withdrawing funds from Exness is a straightforward process, but it’s important for Indian traders to follow the proper steps to ensure smooth transactions. Here’s how to withdraw funds:

Log in to Your Exness Account: Start by logging into your Exness account using your credentials.

Go to the Withdrawal Section: Navigate to the ‘Withdrawal’ section in your account dashboard.

Select Withdrawal Method: Choose your preferred withdrawal method, such as bank transfer, credit/debit card, or e-wallet.

Enter the Withdrawal Amount: Specify the amount you wish to withdraw.

Complete the Withdrawal Request: Submit your withdrawal request. The platform may require additional verification steps depending on the method selected.

Available Withdrawal Methods for Indian Traders

Indian traders have several withdrawal options available, including:

Bank Transfers: Direct bank transfers are one of the most popular methods for withdrawing funds. Exness allows withdrawals to Indian bank accounts, although processing times may vary.

E-wallets: Traders can also withdraw funds via popular e-wallets like Neteller and Skrill, which are faster than bank transfers.

Credit/Debit Cards: Withdrawing funds to a credit or debit card is another available option for traders, but it may take a few business days for the transaction to be processed.

Each method has different processing times and fees, so it’s important for traders to choose the one that suits their needs.

Withdrawal Fees and Processing Times

Exness does not charge any fees for withdrawals, but certain payment providers (such as banks or e-wallets) may charge a processing fee. Typically, bank transfers take 3-5 business days to complete, while e-wallets can be processed within 24 hours. Credit card withdrawals may take 3-7 business days, depending on the bank and card provider.

It’s essential for Indian traders to be aware of these timelines and fees before initiating a withdrawal to avoid any surprises.

Tax Implications of Trading with Exness in India

Income Tax on Forex Earnings

In India, forex earnings are subject to income tax under the Income Tax Act. Traders must report any profits made from forex trading as part of their income when filing their taxes. The rate at which these earnings are taxed will depend on whether they are classified as short-term or long-term capital gains, which is determined by the duration for which the trader held the position.

While forex trading is legal in India, the tax authorities closely monitor trading activities, and it’s essential for Indian traders to report their earnings accurately to avoid penalties or legal issues.

Reporting Requirements for Indian Traders

Indian traders are required to report their forex earnings in their Annual Income Tax Returns (ITR). It is advisable to maintain proper records of trading transactions, including deposits, withdrawals, and profits, for tax reporting purposes. In case of large profits, traders might need to submit additional documentation, such as bank statements and transaction records, to substantiate their claims.

User Experiences and Reviews of Exness Withdrawals

Common Issues Faced During Withdrawal

Some traders have reported facing issues when withdrawing funds from Exness. These issues may include delays in processing, particularly when using bank transfers. Other common issues include challenges related to account verification and withdrawal limits.

Exness recommends that traders ensure their account is fully verified before initiating a withdrawal to avoid delays. This includes providing identification documents and proof of address.

Customer Support Response Times

Exness provides responsive customer support through various channels, including live chat, email, and phone. Traders who experience issues with withdrawals can contact customer support for assistance. Many users have reported positive experiences with Exness customer support, noting that the platform is quick to respond to withdrawal-related queries.

However, some traders have reported longer-than-expected response times during peak periods, which can be frustrating.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Comparing Exness with Other Forex Brokers

Advantages of Using Exness for Indian Traders

Exness offers several advantages for Indian traders, including multiple withdrawal methods, low fees, and fast processing times. Additionally, Exness is highly regarded for its regulatory compliance, which ensures that it operates safely and transparently. The platform's competitive spreads and the ability to trade with high leverage also make it an attractive option for traders.

Alternative Brokers and Their Withdrawal Legality

There are several alternative brokers to Exness that Indian traders can consider. Some brokers, such as IC Markets and FBS, offer similar withdrawal methods and have strong reputations in the industry. However, traders should ensure that any broker they choose is SEBI-compliant and allows legal withdrawals for Indian residents.

Risks Associated with Trading on Offshore Platforms

Potential Legal Consequences

Indian traders who use offshore platforms like Exness should be aware of potential legal consequences. Although forex trading itself is legal, trading on unregulated platforms may expose traders to risks such as fraud, non-compliance with tax laws, and difficulty withdrawing funds.

Traders are encouraged to carefully review the platform's terms and conditions to ensure they comply with Indian regulations.

Impact on Investor Protection

While Exness complies with international regulations, Indian traders may not receive the same level of protection as traders from regulated jurisdictions. This means that in the case of disputes, traders might face challenges when seeking legal recourse. Therefore, it is vital to ensure that any trading activities comply with the legal framework in India to ensure protection.

Best Practices for Safe Withdrawals from Exness

Verifying Your Account Information

Before making withdrawals, Indian traders should ensure their account is fully verified. This includes providing identity proof, address proof, and other relevant documentation. Verification ensures a smooth withdrawal process and helps prevent issues with fund transfers.

Regular Monitoring of Transactions

Traders should regularly monitor their trading accounts and withdrawal history. Keeping an eye on transactions can help identify potential issues early and allow traders to take corrective actions before any problems escalate.

Conclusion

Exness is a legitimate platform that offers a wide range of trading services and withdrawal options for Indian traders. However, it is important for Indian traders to ensure that their activities comply with Indian regulations and to carefully consider any legal implications of withdrawing funds from offshore platforms.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

By understanding the withdrawal process, staying informed about tax implications, and using best practices for account security, Indian traders can safely and legally withdraw funds from Exness while minimizing potential risks.

Read more: