19 minute read

XAUUSD vs EURUSD which is better?

from Exness

by Exness_Blog

XAUUSD vs EURUSD: Which is Better?

Understanding XAUUSD: The Gold Standard

XAUUSD represents the price of gold in US dollars. Gold is considered a safe-haven asset, meaning its value tends to rise during periods of economic instability. This makes it a popular choice for hedging against inflation, currency devaluation, and market uncertainty. Gold trading is seen as a long-term investment vehicle, with its price driven by factors such as global economic conditions and central bank policies.

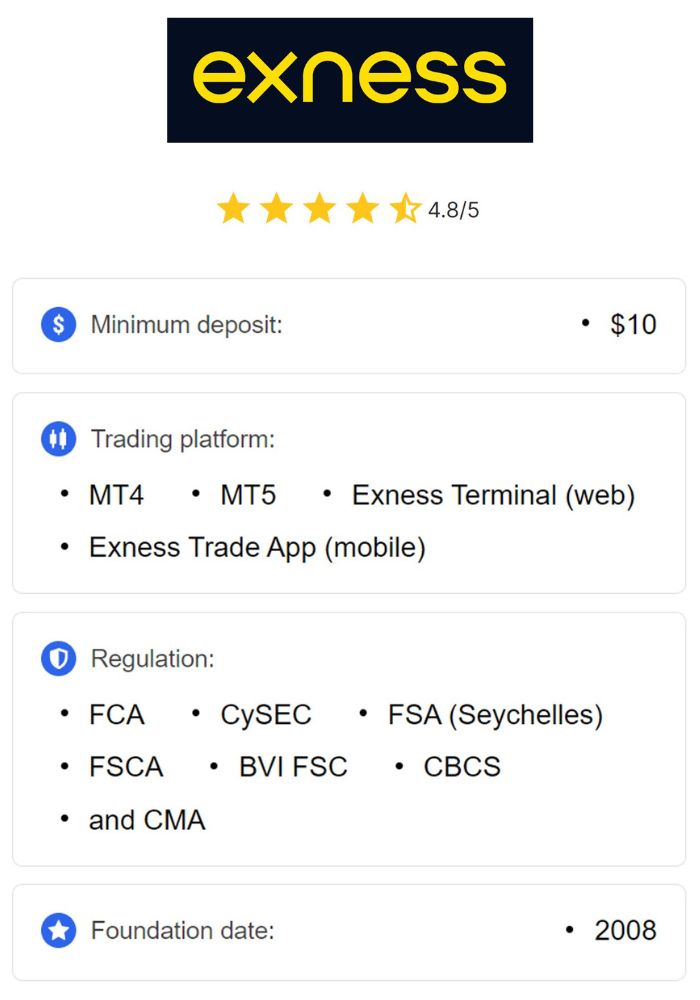

Top 4 Best Forex Brokers

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

As a commodity, gold’s value is not influenced by one country’s economy alone. Instead, it reacts to global events, particularly in relation to inflation, geopolitics, and central bank actions. XAUUSD's market dynamics are therefore influenced by diverse factors, which can make it volatile yet highly sought-after by investors during uncertain times.

Exploring EURUSD: The Euro-Dollar Pair

EURUSD is the world's most traded currency pair, representing the exchange rate between the euro and the US dollar. It reflects the economic strength of the Eurozone and the United States, with both currencies being among the largest and most stable in the world. Factors such as monetary policy decisions from the European Central Bank (ECB) and the US Federal Reserve play a major role in determining the pair's value.

The EURUSD pair is widely favored by traders for its high liquidity and low spreads, making it an ideal choice for day traders and long-term investors alike. The pair’s price movements are largely driven by macroeconomic data, including GDP, inflation rates, and employment figures from both the Eurozone and the US.

Market Overview

Current Trends in the Forex Market

The forex market remains highly active, with various factors driving price movements. In recent years, the global economy has experienced increased volatility, partly due to the COVID-19 pandemic and subsequent economic recovery. As a result, the value of currency pairs, including XAUUSD vs EURUSD, has fluctuated based on investor sentiment, interest rate decisions, and economic recovery efforts.

XAUUSD has benefitted from these periods of uncertainty, as investors have turned to gold as a hedge against inflation and a store of value. EURUSD, however, has been more susceptible to policy changes in both the Eurozone and the US, particularly regarding interest rate hikes and fiscal stimulus measures.

Historical Performance of Gold and the Euro

Gold has traditionally been viewed as a long-term store of value, and its price has historically risen in times of economic downturn. Over the years, gold has been used as a hedge against inflation, with its value often climbing during periods of financial market turbulence. Notably, gold saw significant price increases during the global financial crisis in 2008 and more recently during the COVID-19 pandemic.

EURUSD, on the other hand, has demonstrated more regular price movements, although still subject to volatility. Economic challenges within the Eurozone, such as the debt crises and economic slowdowns, have caused significant fluctuations in the EURUSD pair over the years. Additionally, the USD’s strength against the euro during periods of rising US interest rates has also affected its long-term performance.

Factors Influencing XAUUSD

Economic Indicators Affecting Gold Prices

Gold prices are sensitive to a range of economic indicators. Inflation is a key driver of gold prices, as rising inflation erodes the purchasing power of fiat currencies, prompting investors to flock to gold as a safe-haven asset. Interest rate decisions from central banks, especially the US Federal Reserve, also have a significant impact on gold. When interest rates are low, gold tends to benefit, as it offers a non-yielding alternative to interest-bearing assets.

In addition, economic growth and geopolitical events play an important role in shaping gold prices. Strong economic growth can diminish the demand for gold, as investors might prefer higher-yielding assets. Conversely, political instability or economic downturns typically lead to increased gold buying, as people seek stability in a tangible asset.

Geopolitical Events and Their Impact on Gold

Gold is often regarded as a hedge during geopolitical turmoil. Wars, political instability, and tensions between major powers can drive demand for gold as a safer investment. For example, during the 2008 global financial crisis, gold prices surged as investors sought protection against the collapsing financial markets.

Similarly, current events such as trade wars, military conflicts, or regional instability have a direct impact on gold. When risk perception rises due to geopolitical events, gold tends to experience price increases as investors flock to this precious metal for security. This makes gold a key asset in uncertain global situations.

Factors Influencing EURUSD

Economic Data from the Eurozone

Economic data such as GDP growth, inflation, and unemployment rates in the Eurozone heavily influence the euro’s performance in the EURUSD pair. Strong economic data from the Eurozone tends to push the euro higher, as it signals that the European economy is growing, thus making the euro more attractive to investors.

On the other hand, weaker economic performance in the Eurozone can lead to a depreciation of the euro. For example, poor economic performance in major Eurozone countries like Germany or France can result in negative sentiment towards the euro, affecting the EURUSD exchange rate.

U.S. Federal Reserve Policies and Their Effects on EURUSD

The policies of the US Federal Reserve significantly affect the EURUSD exchange rate. The Fed’s decisions on interest rates and quantitative easing can influence the relative strength of the US dollar. When the Fed raises interest rates, the USD tends to appreciate, leading to a potential decrease in the value of EURUSD.

Conversely, if the Fed cuts rates or engages in expansionary monetary policies, the USD can weaken, which may cause the EURUSD pair to rise. Therefore, US economic policy, including fiscal stimulus packages and monetary policy, plays a central role in shaping the EURUSD exchange rate.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Volatility Comparison

Analyzing Volatility in Gold Trading

Gold is known for its volatility, often experiencing significant price swings based on global events or changes in investor sentiment. This volatility can offer opportunities for traders to profit from short-term price movements, but it also presents risks, particularly for those who do not have risk management strategies in place.

Because gold is seen as a hedge against inflation and a safe haven, its price tends to rise when the market experiences downturns. However, during times of stability, gold can underperform, as investors may prefer more risk-tolerant assets. Understanding gold’s volatility is crucial for traders to navigate its unpredictable nature effectively.

Assessing Volatility in Forex Trading with EURUSD

EURUSD, while less volatile than gold, can still experience significant fluctuations, especially during key economic events. News related to economic indicators such as inflation or GDP growth in both the Eurozone and the US can cause sharp movements in the pair. Additionally, political events such as elections, trade agreements, or changes in central bank policies can lead to volatility in the EURUSD market.

However, because EURUSD is a highly liquid and widely traded pair, its volatility is often more predictable than that of gold. The liquidity in EURUSD allows for smoother price movements and tighter spreads, which can be advantageous for traders who rely on technical analysis and market indicators.

Liquidity Considerations

Liquidity in the Gold Market

Gold is one of the most liquid commodities in the world. It can be traded in large quantities without significantly affecting its price, making it an attractive asset for both institutional and retail traders. Gold’s liquidity increases during times of market uncertainty, as more investors look to secure their wealth in a stable, tangible asset.

The gold market is global and accessible, with major trading hubs across the world. Central banks, governments, hedge funds, and retail investors all actively participate in the market, further enhancing its liquidity. This liquidity makes it easier for traders to enter and exit positions without facing high slippage.

Liquidity in the Forex Market: EURUSD Insights

EURUSD is considered one of the most liquid currency pairs in the forex market. Its high liquidity makes it easier for traders to execute large orders without causing significant price fluctuations. This is particularly beneficial for day traders and institutional traders who need to make quick transactions at favorable prices.

The high liquidity of EURUSD also leads to narrower spreads, which can help reduce trading costs. Because it is so widely traded, the EURUSD pair offers a deep market with substantial volume, making it less prone to sudden price swings compared to other less liquid pairs.

Trading Strategies for XAUUSD

Long-Term Investment Approaches

Long-term investment in XAUUSD generally involves buying and holding gold for extended periods, particularly when market conditions suggest potential for future growth. Investors who take this approach often look at gold as a hedge against inflation and currency risk, holding it as part of a diversified portfolio.

This strategy can be successful if gold prices rise over the long term. However, it also requires patience and the ability to withstand short-term price fluctuations. Investors may choose to buy during periods of market instability, holding on to their gold investments until conditions improve.

Short-Term Trading Techniques

Short-term traders often take advantage of the high volatility in the gold market by using techniques such as technical analysis, trend-following, and breakout trading. By closely monitoring price movements and market sentiment, traders can enter and exit positions quickly, capturing small profits from intraday fluctuations in XAUUSD.

Due to its volatility, short-term trading in gold can be highly profitable, but it also comes with significant risk. Traders need to employ solid risk management techniques, such as stop-loss orders and position sizing, to protect themselves from unexpected price swings.

Trading Strategies for EURUSD

Scalping and Day Trading Tactics

Scalping and day trading are popular strategies in the EURUSD market. Scalping involves making multiple trades in a day to profit from small price changes, while day trading focuses on taking advantage of larger price movements within a single trading session. Both strategies require a keen understanding of market patterns and economic data to identify entry and exit points.

These short-term strategies are popular because of EURUSD’s liquidity and relatively low spreads. Scalpers and day traders often use technical indicators such as moving averages, Bollinger Bands, and oscillators to time their trades.

Swing Trading Methods

Swing trading in EURUSD involves holding positions for several days or weeks, capturing larger price movements compared to day trading. Swing traders typically use a combination of technical and fundamental analysis to predict market trends, aiming to enter trades at optimal price points and ride price swings to maximize profits.

This method requires patience and a solid understanding of market trends. Swing traders often rely on tools such as trend lines, support and resistance levels, and oscillators like the RSI to identify potential reversals and momentum shifts in the EURUSD market.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Technical Analysis in XAUUSD

Key Indicators for Gold Traders

Gold traders often use several technical indicators to help predict price movements. Moving averages, the Relative Strength Index (RSI), and Bollinger Bands are commonly used to determine potential entry and exit points. These indicators help traders assess overbought or oversold conditions, as well as potential trend reversals in the gold market.

Using these indicators in combination with chart patterns and price action can improve the accuracy of gold trading strategies. For example, if the RSI shows that gold is overbought and a bearish reversal pattern appears on the chart, traders may look for selling opportunities in XAUUSD.

Chart Patterns and Trends in Gold Trading

Gold traders pay close attention to chart patterns like head and shoulders, triangles, and double tops or bottoms. These patterns often signal potential trend reversals, helping traders make informed decisions about when to enter or exit the market. Understanding these patterns, along with trend analysis, is essential for anticipating price moves. For instance, a bullish flag pattern suggests that gold prices may continue to rise after a brief consolidation period. Similarly, bearish reversal patterns such as double tops or head and shoulders indicate that gold prices may be about to decline. By recognizing these chart patterns, traders can better predict the future direction of XAUUSD vs adjust their strategies accordingly.

Trend lines are also a key component of gold trading. By identifying upward or downward trends, traders can align their trades with the broader market movement. Gold’s price often follows distinct trends during economic or geopolitical events, providing opportunities for trend-following strategies. Understanding these market dynamics is crucial for successful trading in the gold market.

Technical Analysis in EURUSD

Important Indicators for Forex Traders

Traders in the EURUSD market rely heavily on technical indicators to gauge price movement and market sentiment. Popular indicators include moving averages, the Relative Strength Index (RSI), and Fibonacci retracements. Moving averages help identify the overall trend, with the 50-day and 200-day moving averages being the most widely used. The RSI helps determine if EURUSD is overbought or oversold, which can signal potential reversal points.

Fibonacci retracements are also valuable for identifying key levels of support and resistance. These levels can indicate where EURUSD might reverse its trend or continue moving in the same direction. By combining these indicators, traders can make more informed decisions about when to enter or exit trades, maximizing their chances of success.

Chart Patterns Specific to EURUSD

Like gold, EURUSD also follows specific chart patterns that traders use to anticipate price movements. Patterns such as triangles, double tops, double bottoms, and flags are all commonly observed in EURUSD. These patterns often give clear signals of potential price reversals or continuation trends. For instance, a descending triangle might indicate bearish sentiment, while an ascending triangle could signal bullish movement.

Additionally, candlestick patterns are often analyzed in the EURUSD market to confirm the strength of price moves. Reversal patterns like the hammer, engulfing, or shooting star provide insights into potential trend changes. By combining these chart patterns with other technical indicators, traders can better predict EURUSD price fluctuations and make timely trading decisions.

Risk Management Techniques

Managing Risks in Gold Trading

Gold trading can be highly profitable, but it also involves considerable risk due to its volatility. Effective risk management strategies are essential for protecting capital and maximizing long-term success. Traders often use stop-loss orders to limit potential losses if the market moves against their position. Setting proper stop-loss levels based on market analysis can help prevent catastrophic losses.

Another crucial aspect of risk management in gold trading is position sizing. By determining the appropriate amount of capital to risk on each trade, traders can reduce their exposure to significant losses. Many successful gold traders also employ a risk-to-reward ratio strategy, where they aim for greater rewards than risks, ensuring that the potential gains outweigh the potential losses.

Risk Management Strategies for Forex Trading

In the EURUSD market, risk management strategies are similarly important due to the market's frequent fluctuations. Traders can manage risk by using stop-loss and take-profit orders to automate exits based on predetermined levels of profit or loss. This helps prevent emotional decision-making, ensuring that trades are exited according to the original plan.

Leverage is another factor to consider in forex trading. While leverage can amplify gains, it also increases the potential for significant losses. Traders need to be cautious with their use of leverage and ensure that their risk exposure remains within acceptable levels. Position sizing, again, plays a critical role in managing risk in the forex market, with traders adjusting their trade sizes based on market conditions and personal risk tolerance.

Psychological Aspects of Trading

Behavioral Biases in Gold Trading

Gold traders must be aware of their psychological biases, which can often cloud judgment and affect trading decisions. Common biases include overconfidence, loss aversion, and herd behavior. Overconfidence can lead traders to take excessive risks, while loss aversion may cause them to hold onto losing positions for too long, hoping that the market will reverse in their favor.

Gold traders, in particular, may experience emotional responses to market fluctuations, especially during times of economic or geopolitical uncertainty. These emotions can cause traders to make impulsive decisions, such as buying or selling based on fear or greed rather than sound analysis. Successful gold traders recognize these biases and implement strategies to mitigate their impact, often sticking to pre-determined trading plans and risk management techniques.

Emotional Discipline in Forex Trading

In the EURUSD market, emotional discipline is just as important as technical and fundamental analysis. The forex market can be fast-moving, with price fluctuations occurring rapidly, especially when economic news is released. Traders must maintain emotional control, avoiding impulsive reactions to market events that could lead to poor decision-making.

Developing a trading routine and sticking to it is key to maintaining discipline. Setting clear entry and exit points based on solid analysis and avoiding the temptation to chase the market can help traders stay on track. Additionally, traders should always follow their risk management rules, ensuring that emotions do not override sound risk control principles.

Pros and Cons of Trading XAUUSD

Advantages of Investing in Gold

One of the main advantages of trading XAUUSD is that gold is seen as a safe-haven asset. During times of economic or geopolitical uncertainty, gold prices tend to rise as investors seek security in tangible assets. This makes gold an attractive option for long-term investors looking to hedge against inflation or currency devaluation.

Gold also provides a diversification opportunity within a broader investment portfolio. Because its price movements are often inversely correlated with traditional stocks and bonds, holding gold can reduce overall portfolio risk. Additionally, gold's global appeal means it can be traded worldwide, providing liquidity and accessibility to traders across different markets.

Disadvantages and Risks of Gold Trading

Despite its advantages, gold trading comes with its own set of risks. Gold is highly sensitive to changes in global economic conditions, and its price can be volatile. Sudden shifts in sentiment, particularly due to geopolitical events or central bank policies, can cause sharp price movements, making it difficult to predict gold's future direction.

Additionally, gold does not generate income like stocks or bonds. While it can appreciate in value over time, it doesn’t pay dividends or interest, which may limit its appeal for certain investors. Traders must also be aware of storage and transaction costs associated with physical gold, which can add to the overall expense of investing in the commodity.

Pros and Cons of Trading EURUSD

Benefits of Trading the Euro-Dollar Pair

One of the main advantages of trading EURUSD is its liquidity. As the most widely traded currency pair in the world, EURUSD offers tight spreads, low transaction costs, and high market depth. This makes it an attractive option for both short-term and long-term traders, especially those who prefer a more predictable and stable market.

Another benefit is the availability of information. Since EURUSD is closely watched by analysts, central banks, and financial institutions, there is a wealth of data available to help traders make informed decisions. This includes economic reports, central bank speeches, and geopolitical news, all of which can influence the value of the euro and US dollar.

Potential Drawbacks of EURUSD Trading

Despite its liquidity and stability, there are some drawbacks to trading EURUSD. The primary challenge is that its price can be heavily influenced by both US and Eurozone economic conditions. A surprise policy change from the Federal Reserve or ECB can lead to rapid price fluctuations, making the market unpredictable at times.

Additionally, EURUSD may not be as volatile as some other currency pairs or commodities like gold, which could limit trading opportunities for those who prefer more dynamic price movements. For traders seeking greater volatility, EURUSD might not always provide the level of excitement or potential profit they desire.

Economic Outlook and Predictions

Future Trends in Gold Prices

The future of gold prices is closely tied to global economic conditions. With ongoing inflationary pressures, economic slowdowns, and geopolitical uncertainties, the outlook for gold remains positive in the medium to long term. Central banks around the world, including the US Federal Reserve and the European Central Bank, may continue to implement monetary policies that support gold prices, especially in times of economic uncertainty.

However, gold prices may also face downward pressure if economic growth accelerates, inflation stabilizes, or interest rates rise sharply. For investors, this means that while gold can provide a hedge against inflation, its price could fluctuate based on broader market trends. Traders should keep an eye on global events, such as central bank decisions and geopolitical developments, to predict potential price movements.

Predictions for the EURUSD Pair

The future of the EURUSD pair will largely depend on the relative strength of the US and Eurozone economies. If the Eurozone continues to experience economic challenges, the euro could weaken against the US dollar. On the other hand, if the Eurozone economy improves, the euro may strengthen, pushing EURUSD higher.

US Federal Reserve policies will also play a key role in determining the direction of the EURUSD pair. If the Fed continues to raise interest rates or tighten monetary policy, the US dollar may appreciate, leading to a decline in EURUSD. Conversely, if the Fed eases its policies to support economic growth, the euro may benefit, causing EURUSD to rise.

Conclusion

When comparing XAUUSD vs EURUSD, the decision of which is better depends on the trader’s risk tolerance, investment goals, and market outlook. XAUUSD offers the benefit of being a safe-haven asset, ideal for hedging against inflation and economic uncertainty. However, it comes with high volatility and does not generate income like other investments.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

EURUSD, on the other hand, offers high liquidity, lower transaction costs, and a more stable trading environment. Its performance is closely tied to macroeconomic factors in both the Eurozone and the US, making it a preferred choice for traders focused on currency markets.

Ultimately, both XAUUSD vs EURUSD have their strengths and weaknesses. Traders and investors must carefully consider their individual preferences and market conditions when deciding which asset to trade.

Read more: