19 minute read

How to Open Forex Account in Nigeria

How to Open Forex Account in Nigeria is a question that many aspiring traders are asking due to the increasing interest in forex trading as a viable source of income. The currency market has attracted traders from various backgrounds, and Nigeria is no exception. The ability to trade currencies offers both opportunities and challenges, making it essential for beginners to understand the process of opening a forex account and what comes after that.

Top 4 Best Forex Brokers in Nigeria

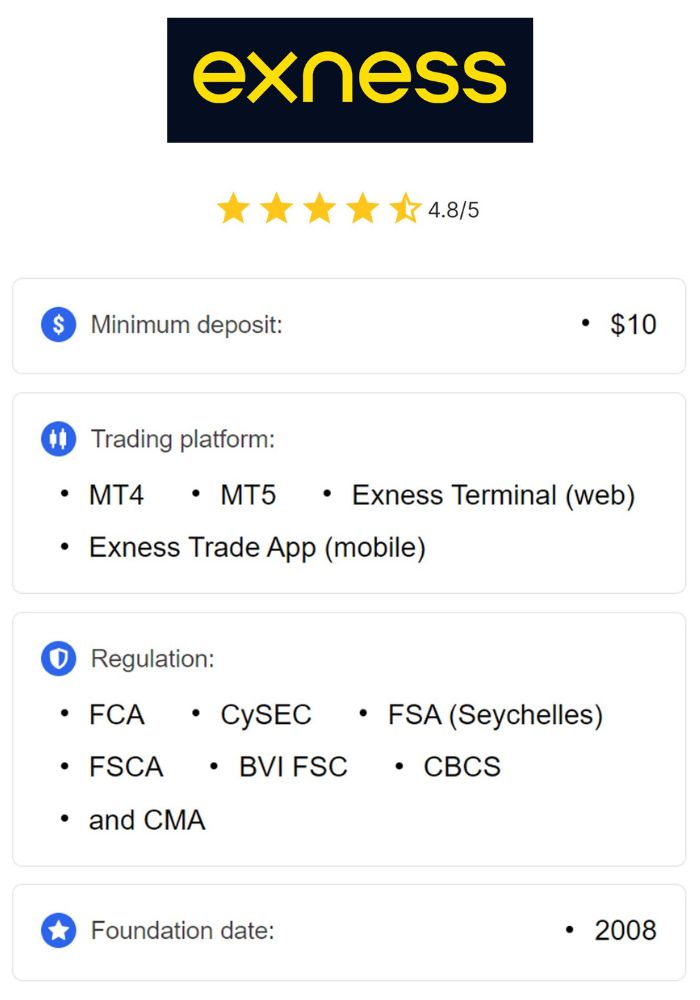

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

Understanding Forex Trading

Forex trading involves the buying and selling of currencies in a decentralized global market. It is known for its high liquidity and accessibility, making it an attractive option for many people looking to diversify their income streams.

Definition of Forex Trading

At its core, forex trading refers to the exchange of one currency for another in a fluctuating marketplace. Participants in this market include banks, financial institutions, corporations, and individual traders. The forex market operates 24 hours a day, five days a week, and it allows participants to leverage their investments by trading large volumes with relatively small amounts of capital.

The essence of forex trading lies in the concept of currency pairs. Each currency pair consists of two currencies, where one is the base currency and the other is the quote currency. When traders speculate on the movement of these pairs, they aim to profit from the differences in exchange rates.

Importance of Forex Trading in Nigeria

Forex trading holds significant importance in Nigeria, given the country’s economic landscape. With a growing number of individuals seeking financial independence, the forex market provides an avenue for wealth creation.

Additionally, forex trading can serve as a hedge against inflation and currency fluctuations that affect the Nigerian economy. As the naira faces volatility against major currencies like the US dollar, many Nigerians turn to forex trading as a way to preserve their purchasing power. Furthermore, the influx of online trading platforms has made forex trading more accessible and convenient for individuals, allowing them to trade from the comfort of their homes.

Types of Forex Accounts

When considering how to open a forex account in Nigeria, it's essential to understand the different types of accounts available. Each type caters to different trading styles, risk tolerances, and capital requirements.

Standard Accounts

A standard account is typically the most common account type offered by forex brokers. It usually requires a higher minimum deposit and allows traders to execute larger trades. Standard accounts provide access to a wide range of trading instruments, including major, minor, and exotic currency pairs.

Traders with standard accounts generally have access to advanced trading tools, educational resources, and customer support. However, due to the increased risk associated with larger trades, standard accounts are often suited for more experienced traders who have a solid understanding of market dynamics.

Mini and Micro Accounts

Mini and micro accounts are designed for beginner traders or those who prefer to start with a smaller capital investment. A mini account usually requires a lower minimum deposit than a standard account, while micro accounts may require even less.

These account types allow traders to engage in the forex market without risking substantial amounts of money. They are ideal for practicing trading strategies and gaining experience, especially for those who want to learn the intricacies of forex trading before moving on to larger trading accounts.

Managed Accounts

Managed accounts involve entrusting your trading capital to a professional trader or a management firm. This type of account caters to individuals who may not have the time or expertise to manage their trading activities actively.

In a managed account, the trader makes all trading decisions on behalf of the investor. While this option can be appealing for busy professionals, it is crucial to choose a reputable asset manager with a proven track record. Transparency and regular performance reports are essential factors to consider when opting for a managed account.

Choosing a Forex Broker

Selecting the right forex broker is a critical step in the journey of how to open a forex account in Nigeria. Your choice of broker will significantly impact your trading experience, so it's essential to conduct thorough research before making a decision.

What to Look for in a Forex Broker

When choosing a forex broker, several factors come into play. First, look for a broker that offers competitive spreads and low transaction costs to maximize your profits. Additionally, consider the variety of trading instruments available; a broker offering a wide range of currency pairs gives you more trading opportunities.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Regulatory compliance is another crucial aspect to evaluate. Ensure that the broker is regulated by a reputable authority, as this adds a layer of security to your funds. Also, check for user-friendly trading platforms, quality customer service, and comprehensive educational resources to help you grow as a trader.

Regulatory Compliance in Nigeria

In Nigeria, the regulation of forex brokers falls under the purview of the Central Bank of Nigeria (CBN) and the Securities and Exchange Commission (SEC). It is vital to select brokers who comply with local regulations to ensure the safety of your investment.

Regulatory compliance helps protect traders from fraudulent practices and ensures that brokers adhere to industry standards. To verify a broker's regulatory status, check their licensing information and read reviews from other traders to gauge their reputation.

Comparing Different Brokers

Once you've identified potential brokers, compare their offerings to find the one that best suits your trading needs. Look at factors such as trading platform features, commission structures, available leverage, and withdrawal methods.

Researching user experiences through online reviews and forums can also provide valuable insights into the reliability of a broker. Keep in mind that the right broker for you will depend on your specific trading style and preferences, so take your time to make an informed decision.

Requirements for Opening a Forex Account

Now that you have a better understanding of forex trading and how to select a broker, let’s delve into the practical aspects of how to open a forex account in Nigeria. There are specific requirements you need to fulfill during this process.

Age and Identification Documents

To open a forex account in Nigeria, you must be at least 18 years old, as this is the legal age for entering contracts. You will be required to provide identification documents, such as a government-issued ID, passport, or driver's license, to verify your identity.

It's essential to ensure that the identification documents you submit are clear and legible. Some brokers may also require you to provide additional identification materials, so be prepared to furnish any requested documentation promptly.

Proof of Address

In addition to identification, brokers typically require proof of address. This can be achieved by submitting recent utility bills, bank statements, or official government correspondence that clearly displays your name and current residential address.

Providing accurate proof of address is crucial for maintaining compliance with anti-money laundering regulations and ensuring the security of your account.

Financial Information

Brokers may also seek financial information related to your trading background and experience level. This can involve questions regarding your trading objectives, risk tolerance, and financial situation. Providing accurate and honest answers will help your broker tailor their services to meet your specific needs.

In some cases, brokers might also inquire about your trading experience, including the types of instruments you've traded and your success rate. This information helps the broker assess whether you qualify for certain account types and leverage options.

The Application Process

Having gathered the necessary information, it’s time to delve into the application process for how to open a forex account in Nigeria. The application process is straightforward but requires attention to detail to ensure a smooth experience.

Online Application Steps

Most brokers offer an online application process that allows you to open a forex account conveniently. You'll begin by filling out an online registration form that typically requires personal information such as your name, email address, phone number, and date of birth.

After submitting the registration form, you will receive an email confirmation along with instructions on how to proceed. Make sure to check your spam folder if you don't see the email in your inbox. Follow the instructions carefully to complete the application process.

Verification of Your Identity

Once you've submitted your application, the next step involves verifying your identity. This step is crucial for ensuring the safety and integrity of the forex trading environment. Most brokers will request that you upload scanned copies of the identification documents and proof of address mentioned earlier.

After you’ve uploaded the required documents, the broker will review your application and may contact you for further verification. Be prepared to respond promptly to any inquiries to expedite the approval process.

Initial Deposit Requirements

Before you can start trading, you'll need to fund your forex account. Most brokers will have a minimum deposit requirement, which can vary depending on the account type you choose. Once your application is approved, you will receive details about how to make your initial deposit.

Funding methods can include bank transfers, credit cards, and e-wallets. It's essential to choose a funding method that works best for you and offers the security and convenience you need.

Funding Your Forex Account

With your forex account set up successfully, the next step is to explore how to fund your account. Understanding accepted payment methods and the associated fees is essential for successful trading.

Accepted Payment Methods

Different brokers may offer a variety of payment methods, including bank transfers, credit and debit cards, and electronic wallets such as PayPal or Skrill. When selecting a payment method, consider factors such as speed, convenience, and any applicable fees.

Bank transfers tend to be slower but are often considered the safest option. Credit and debit cards provide quick funding, while e-wallets often offer instant deposits. Review your broker's terms and conditions regarding each payment method to determine which one suits your needs best.

Currency Conversion and Fees

When funding your forex account, it's essential to be aware of currency conversion rates and any associated fees. If you are funding your account in a currency different from the account’s base currency, your broker may charge a currency conversion fee.

Always take currency conversion into consideration when calculating your overall trading costs. Transparent brokers will clarify any fees associated with different deposit methods, allowing you to make informed decisions.

Ensuring Security During Transactions

Security should be a top priority when funding your forex account. Ensure that your chosen broker employs robust security measures, such as encryption technology, to protect your sensitive financial information during transactions.

Also, avoid using public Wi-Fi networks to access your trading accounts or conduct financial transactions. Always use secure internet connections and enable two-factor authentication wherever possible to add extra layers of protection.

Understanding Leverage and Margin

Leverage and margin are fundamental concepts in forex trading that can amplify profits but also increase risks. It’s essential to familiarize yourself with these concepts before diving into trading.

What is Leverage?

Leverage refers to the ability to control a large position size with a relatively small amount of invested capital. In forex trading, leverage is often expressed as a ratio, such as 100:1 or 500:1. This means that with a leverage ratio of 100:1, a trader can control a position worth $100,000 with just $1,000 in their account.

While leverage allows traders to magnify potential gains, it also escalates the risks. High leverage can result in significant losses, leading to margin calls or the depletion of your trading capital. Therefore, it’s crucial to understand how leverage impacts your trading strategy.

Risks Associated with High Leverage

High leverage can create a false sense of security among traders, leading them to believe that they can achieve substantial profits with minimal investment. However, the reality is that high leverage exposes traders to greater volatility and the potential for catastrophic losses.

It's vital to have a robust risk management strategy in place when trading with leverage. Setting stop-loss orders, limiting position sizes, and diversifying your portfolio can help mitigate the risks associated with leveraged trading.

Margin Requirements Explained

Margin is the amount of capital needed to maintain a leveraged position in trading. When you open a leveraged trade, your broker will require you to deposit a percentage of the total trade value as margin. For example, if you want to open a position worth $10,000 with a leverage of 100:1, you would need to deposit $100 as margin.

Understanding margin requirements is essential to prevent over-leveraging your account. If the market moves against your position and your equity falls below the required margin level, your broker may issue a margin call, requiring you to deposit more funds to keep the position open.

Trading Platforms Overview

In the digital age, the choice of trading platform can greatly influence your trading experience. Various trading platforms cater to different preferences and skill levels, providing traders with unique tools and resources.

Popular Trading Platforms in Nigeria

Some popular trading platforms used by forex traders in Nigeria include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and proprietary platforms offered by brokers. MT4 is particularly favored for its user-friendly interface, extensive charting options, and automated trading capabilities through expert advisors (EAs).

MT5 is the newer version of MT4, offering additional features, including more technical indicators and a broader range of asset classes. Many brokers also provide mobile trading applications, enabling traders to access their accounts and execute trades on the go.

Mobile Trading Applications

Mobile trading applications have gained immense popularity, allowing traders to manage their accounts conveniently from their smartphones or tablets. These applications typically offer essential trading features, including real-time quotes, charts, and order placement.

When choosing a mobile trading application, consider factors such as usability, speed, and security. A well-designed app should provide seamless access to your trading account and allow you to execute trades quickly and efficiently.

Demo Accounts for Beginners

For beginners, demo accounts serve as an invaluable tool for learning the ropes of forex trading without risking real money. Most brokers offer demo accounts, enabling traders to practice their strategies using virtual funds in a simulated trading environment.

Using a demo account allows new traders to familiarize themselves with the trading platform, test different trading strategies, and analyze market behavior. It’s advisable to use demo accounts extensively before transitioning to live trading to build confidence and competence.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Learning Resources for New Traders

Embarking on a journey in forex trading requires continuous education and skill development. Fortunately, there are numerous resources available for traders eager to expand their knowledge.

Educational Courses and Webinars

Many brokers and independent educators offer educational courses and webinars designed to teach the fundamentals of forex trading. These programs can cover a wide range of topics, including technical analysis, fundamental analysis, risk management, and trading psychology.

Participating in webinars can also provide an interactive learning experience, allowing you to ask questions and engage with instructors and fellow traders. Take advantage of these educational opportunities to enhance your trading skills.

Books and E-books on Forex Trading

Several books and e-books delve deeply into forex trading strategies and concepts. Reading literature written by experienced traders can provide valuable insights and broaden your understanding of the market.

Some popular titles include “Currency Trading for Dummies,” “Japanese Candlestick Charting Techniques,” and “Trading in the Zone.” Choose books that resonate with your learning style and interests to make your study more effective.

Online Forums and Communities

Online trading communities and forums can serve as excellent platforms for connecting with fellow traders, sharing experiences, and seeking advice. Engaging in discussions within these communities can expose you to diverse perspectives and trading approaches.

Websites like BabyPips and Trade2Win host thriving communities of traders where you can ask questions, share strategies, and learn from others' successes and setbacks. Becoming an active participant in these forums can significantly enrich your trading journey.

Tips for Successful Forex Trading

Success in forex trading doesn’t happen overnight; it requires dedication, discipline, and a well-thought-out approach. Here are several tips to help you navigate the complexities of the forex market effectively.

Developing a Trading Plan

Creating a comprehensive trading plan is essential for defining your trading goals, strategies, and risk management rules. Your trading plan should outline your preferred trading style, target currency pairs, entry and exit points, and how you intend to manage losses.

By adhering to your trading plan, you can minimize emotional decision-making and maintain a disciplined approach to trading. Regularly review and adjust your trading plan based on market conditions and your evolving trading experiences.

Risk Management Strategies

Effective risk management is crucial for preserving your trading capital. Establishing clear risk parameters, such as the maximum percentage of your account you're willing to risk on a single trade, can help you minimize potential losses.

Utilizing stop-loss orders is a fundamental risk management technique that allows you to automatically exit a trade if it moves against your desired direction. Additionally, diversifying your trading positions can spread risk across multiple assets, reducing the impact of unfavorable market movements.

Keeping Emotions in Check

Emotional trading can lead to irrational decision-making and poor outcomes. To succeed in forex trading, it's vital to maintain emotional discipline and remain focused on your trading strategy.

One effective approach is to practice mindfulness techniques, enabling you to stay calm and composed, especially during periods of market volatility. Keeping a trading journal can also help you reflect on your emotional responses and identify patterns that may hinder your trading performance.

Legal Considerations in Forex Trading

Understanding the legal landscape surrounding forex trading in Nigeria is essential for operating within the law and protecting your rights as a trader.

Tax Implications of Forex Trading

Forex trading may have tax implications, depending on your country's taxation policies. In Nigeria, profits earned from forex trading could be subject to income tax, and it's crucial to maintain accurate records of your trading activities for tax reporting purposes.

Consulting with a tax professional knowledgeable in forex trading can provide clarity on your tax obligations and help you strategize for tax efficiency.

Understanding the Nigerian Financial Law

Familiarizing yourself with Nigerian financial laws governing forex trading is essential for compliance. Regulations set forth by the Central Bank of Nigeria and the Securities and Exchange Commission guide the operation of forex brokers and protect traders from fraud.

Ensure that your chosen broker adheres to these regulations, and be aware of your rights as a trader. Staying informed about changes in financial legislation can also help you navigate the evolving landscape of forex trading in Nigeria.

Consumer Protection Policies

Consumer protection policies aim to safeguard traders from potential exploitation by brokers. Understanding these policies helps you recognize your rights and the recourse available if you encounter issues with your broker.

Before opening an account, review the consumer protection policies provided by your broker, ensuring that they offer adequate measures to protect your funds and maintain transparency in their operations.

Common Challenges Faced by Forex Traders

Navigating the forex market can be rewarding, but it is not without its challenges. Understanding these challenges can help you develop strategies to overcome them.

Market Volatility and Its Effects

Volatility is a double-edged sword in forex trading. While it can present lucrative trading opportunities, excessive volatility can also lead to rapid losses. Factors such as economic news releases, geopolitical events, and changes in market sentiment can trigger price fluctuations.

To adapt to market volatility, consider employing risk management strategies, such as using wider stop-loss orders or trading during more stable market conditions. Stay updated on global events that may impact currency movements to make informed trading decisions.

Psychological Barriers

Psychological barriers can hinder traders from executing their strategies effectively. Fear of loss, greed, and overconfidence can cloud judgment and lead to impulsive choices.

Maintaining awareness of your emotional state and recognizing when emotions are influencing your trading decisions is crucial. Developing a disciplined mindset and sticking to your trading plan will help you combat psychological barriers and improve your overall trading performance.

Technical Issues

Technical issues can arise when trading online, impacting your ability to execute trades in a timely manner. Problems can range from slow internet connections to broker platform outages.

To minimize the potential for technical difficulties, ensure that you have a reliable internet connection and familiarize yourself with your broker's trading platform. Having contingency plans in place, such as backup internet sources or alternative devices, can help you navigate unexpected disruptions effectively.

The Role of Forex Signals

Forex signals can play a pivotal role in enhancing your trading decisions. They provide valuable insights into market movements and potential trading opportunities.

What are Forex Signals?

Forex signals are trade recommendations generated by analysts or algorithmic models, indicating when and how to enter or exit trades. These signals typically include specific details, such as the currency pair, entry price, stop-loss, and take-profit levels.

Traders can either generate signals independently through technical analysis or subscribe to third-party signal providers that offer their insights. Utilizing forex signals can save time and help traders capitalize on potential opportunities.

Using Signals for Better Decision Making

Incorporating forex signals into your trading strategy can enhance your decision-making process. However, it’s important to evaluate the credibility of the signal provider before acting on their recommendations.

Instead of blindly following signals, use them as part of your overall analysis. Combine signals with your market research and chart analysis to develop a well-rounded understanding of potential trade setups.

Evaluating Signal Providers

Not all signal providers are created equal, so it's essential to evaluate their performance and reliability before relying on their insights. Look for providers with a solid track record and transparent results.

Reading reviews, engaging with other traders, and requesting trial periods can help you assess the effectiveness of a signal provider. Ultimately, choose a provider whose strategies align with your trading style and goals.

Conclusion

Embarking on the journey of how to open a forex account in Nigeria can be a transformative experience. By understanding the fundamentals of forex trading, the various types of accounts, and the steps involved in opening an account, you can set a strong foundation for your trading endeavors.

Additionally, keeping abreast of market trends, employing effective risk management strategies, and continuously educating yourself will empower you to navigate the complexities of the forex market with confidence. While challenges abound, the potential rewards of successful forex trading are noteworthy.

Ultimately, the key lies in developing a disciplined approach, leveraging available resources, and remaining adaptable to changes in the market. With determination and ongoing learning, you can achieve your trading goals and thrive in this dynamic financial landscape.

Read more: