17 minute read

How to open zero spread account in Exness

from Exness

by Exness_Blog

How to open zero spread account in Exness is a crucial inquiry for traders looking to maximize their profitability while minimizing costs. A zero spread account allows traders to enter and exit positions without the burden of spreads, potentially enhancing their trading experience significantly.

✅ Open Exness Zero MT4 Account

✅ Open Exness Zero MT5 Account

Understanding Zero Spread Accounts

A zero spread account is a unique trading account that provides traders with the ability to execute trades at market prices without any spread. This means that the distance between the bid and ask price is effectively eliminated, allowing for more precise entry and exit points.

This type of account is attractive to various types of traders, especially scalpers and day traders, who thrive on quick trades and small price movements. By understanding how these accounts operate, traders can better leverage their strategies while increasing their potential profitability.

Definition of Zero Spread Accounts

Zero spread accounts are designed to give traders an edge by removing the cost typically associated with spreads in forex trading. In traditional trading accounts, the spread is the difference between the buying (ask) price and the selling (bid) price. This gap can be considered a cost to the trader since it can affect overall profits and losses.

In zero spread accounts, this cost is essentially nullified. However, it’s essential to note that brokers may charge commissions per trade instead, so understanding the full cost structure is vital. This setup allows traders to react swiftly to market changes without the additional cost of wider spreads.

Benefits of Trading with Zero Spread Accounts

Trading with a zero spread account offers several distinct advantages.

Firstly, it allows for enhanced precision in trading. When spreads are removed, traders can execute orders at exact market prices, making it ideal for strategy that relies on tight margins.

Secondly, zero spread accounts can lead to increased profitability. Since the cost of trading is reduced, even small price movements can contribute positively toward your bottom line.

Lastly, the flexibility offered by zero spread accounts makes them suitable for high-frequency trading strategies. Traders can capitalize on minute price changes that would otherwise be swallowed up by standard spreads, thus maximizing their earning potential.

Comparison with Traditional Spread Accounts

When comparing zero spread accounts to traditional spread accounts, it becomes evident how the structure of these accounts affects trading outcomes. Traditional spread accounts come with variable or fixed spreads, which can widen during volatile market conditions. This unpredictability can hinder trader performance and impact profit margins.

Conversely, zero spread accounts provide a constant trading environment where costs do not fluctuate with market conditions. This stability can be particularly advantageous for traders employing automated systems, as it permits predictable execution parameters.

However, it should be noted that while zero spreads are enticing, they often come with higher commissions. Thus, it's critical for traders to weigh the cost implications against their trading style and financial goals.

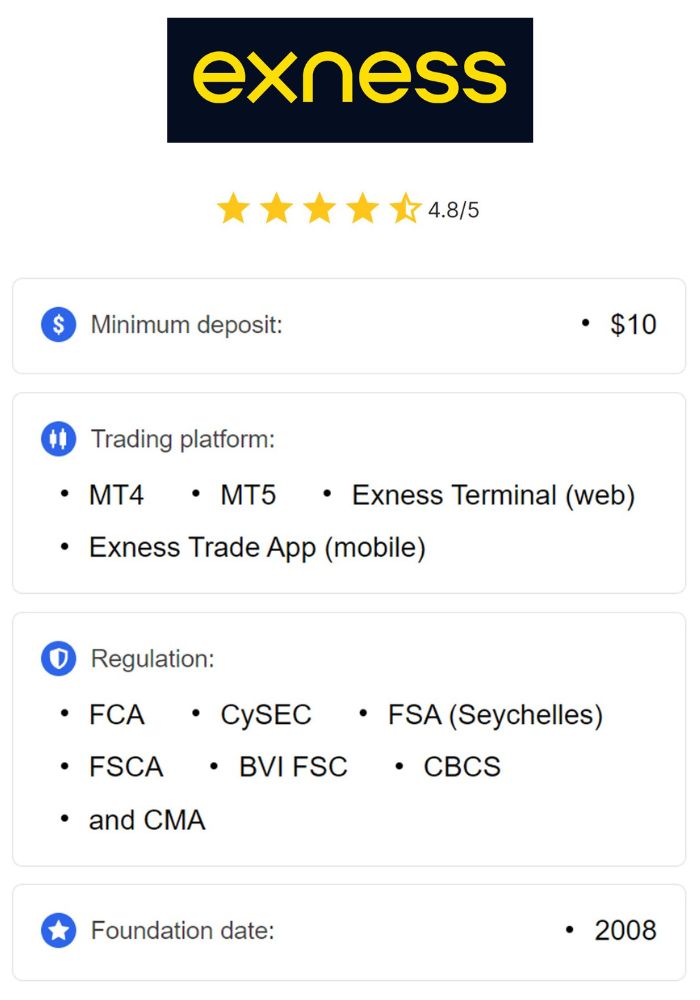

Overview of Exness as a Broker

Exness has grown to be one of the most prominent online brokers in the industry, providing a platform for forex, CFDs, and various other financial instruments. Its reputation for transparency and customer service has made it a preferred choice for many traders worldwide. Understanding the broker's foundation will help you appreciate what they offer concerning zero spread accounts.

History and Reputation of Exness

Founded in 2008, Exness has established itself as a reputable broker in the online trading space. With over a decade of operational experience, Exness has garnered positive reviews from its diverse clientele due to its commitment to innovation and customer satisfaction.

The broker has continuously evolved, reflecting the changing dynamics of the financial markets and client needs. Their user-friendly platforms and advanced trading tools cater to both novice and experienced traders alike, while their transparent fee structure reinforces trust among users.

Regulatory Status and Compliance

Exness operates under multiple regulatory authorities, ensuring compliance with international trading standards. This regulatory oversight not only bolsters the broker’s credibility but also provides traders with the assurance that their funds are secure.

By adhering to strict regulatory guidelines, Exness assures traders of fair access to the markets and protection of client funds. Additionally, being regulated gives traders recourse in case of disputes, further adding to the broker's reliability.

Available Trading Instruments

Exness offers a wide range of trading instruments, including forex pairs, commodities, cryptocurrencies, indices, and shares. This diversity allows traders to create a well-rounded portfolio suited to their individual preferences and risk tolerance.

With hundreds of available instruments, traders can explore various opportunities across different markets. The extensive asset range coupled with competitive trading conditions enables traders to implement diverse strategies tailored to their specific objectives.

Eligibility Criteria for Opening a Zero Spread Account

Before venturing into opening a zero spread account with Exness, it’s crucial to understand the eligibility criteria set forth by the broker. Meeting these criteria will ensure a seamless registration process and facilitate efficient trading.

Age and Residency Requirements

To open a trading account with Exness, applicants must be at least 18 years old. This age requirement aligns with legal trading regulations and ensures that all clients have the legal capacity to engage in financial transactions.

Additionally, Exness accepts clients from a wide range of countries, but certain restrictions may apply based on local laws. It is advisable for potential clients to verify whether their country of residence qualifies before proceeding with the registration process.

Required Documentation

To comply with regulatory requirements, Exness mandates that clients submit identification documents when opening a trading account. Typically, this includes a government-issued ID such as a passport or driver’s license, along with proof of residency like a utility bill or bank statement.

Providing accurate documentation is critical as it not only speeds up the verification process but also safeguards your account against fraud and unauthorized access.

Financial Knowledge and Experience

While there are no formal educational criteria for opening a zero spread account, having a solid understanding of financial markets and trading principles is highly beneficial. Traders should assess their own knowledge and experience levels to determine if they are adequately prepared to trade in a zero spread environment.

Being familiar with various trading strategies, market analysis, and risk management will enhance your chances of success. Seeking educational resources, whether from Exness or other avenues, can bolster your trading skills and confidence in navigating the markets.

✅ Open Exness Zero MT4 Account

✅ Open Exness Zero MT5 Account

Types of Accounts Offered by Exness

As a versatile broker, Exness provides various trading account types to suit the needs of different traders. Understanding these different accounts will aid aspiring traders in selecting the option that best aligns with their goals.

Standard Accounts

Standard accounts are ideal for beginners due to their straightforward approach and moderate trading conditions. These accounts typically feature fixed spreads and no commission fees. They provide an accessible starting point for those new to trading, allowing traders to gain experience without feeling overwhelmed.

Moreover, standard accounts allow for micro lot trading, making them suitable for individuals with limited capital. This flexibility enables new traders to experiment with different strategies while learning the intricacies of the markets.

Pro Accounts

Pro accounts are designed for more experienced traders seeking tighter spreads and additional features. Unlike standard accounts, pro accounts may involve lower spreads but charge a commission per trade, making them suitable for those aiming for higher trade volumes.

These accounts often come with advanced trading tools and features such as increased leverage options, making them appealing to traders looking to maximize their returns. Nevertheless, the complexity may require a deeper understanding of trading strategies and market movements.

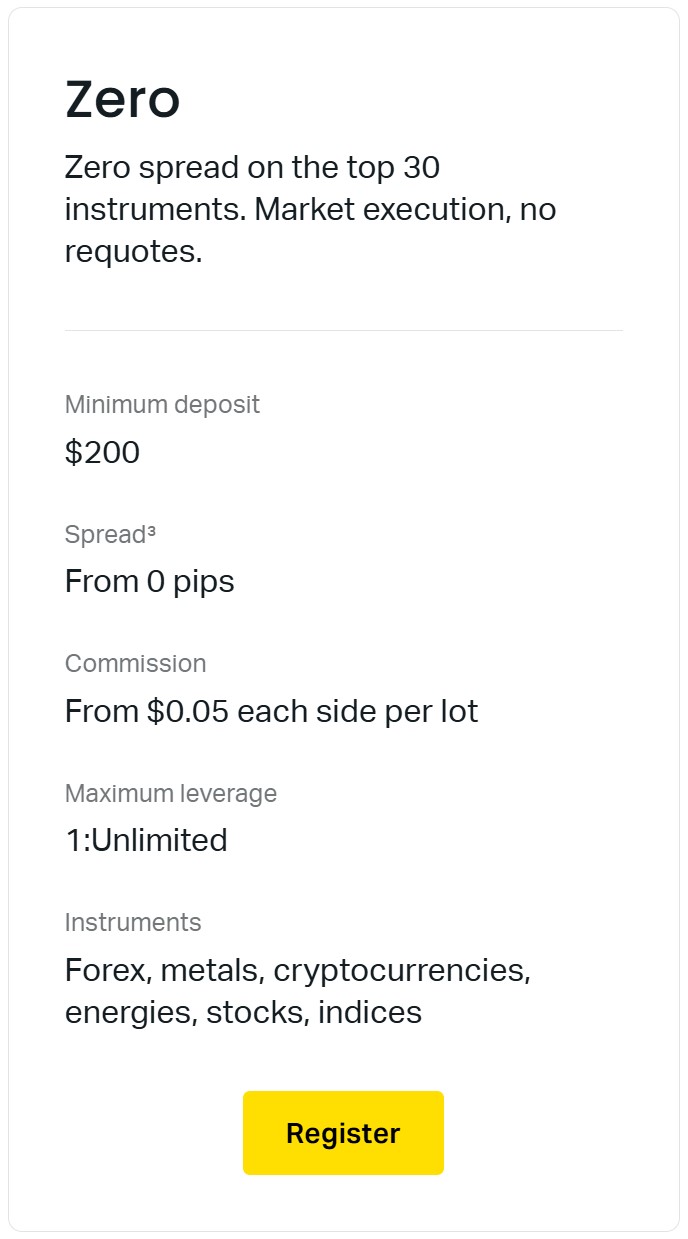

Zero Spread Accounts

Zero spread accounts are specifically tailored for traders who prioritize cost-effectiveness and precision in trading. These accounts eliminate spreads entirely, allowing traders to enter and exit positions at market prices.

However, it is important to note that zero spread accounts typically come with commission fees that reflect the broker's service. Despite this, many traders find that the benefits of trading without spreads outweigh the associated commissions, particularly for high-frequency trading strategies.

Step-by-Step Guide to Opening a Zero Spread Account

Opening a zero spread account with Exness involves several simple steps that guide you through the registration process. Familiarizing yourself with each step can streamline your journey and prepare you for trading.

Visiting the Exness Website

The first step toward opening a zero spread account is visiting the official Exness website. This site serves as the gateway to all trading services provided by the broker. Ensure you're accessing the legitimate website to avoid potential scams or phishing attempts.

✅ Open Exness Zero MT4 Account

✅ Open Exness Zero MT5 Account

Once on the homepage, you will find information about the brokerage and the various account types available, including zero spread accounts. Take a moment to familiarize yourself with their offerings and choose the account that best suits your trading style.

Selecting the Account Type

After gathering information, navigate to the section dedicated to account creation. Here, you will have the option to select a zero spread account. Clicking on this option will usually redirect you to the registration form.

Make sure to review all the features associated with a zero spread account, including trading conditions, fees, and available instruments, to ensure it aligns with your expectations and trading strategies.

Completing the Registration Form

Upon selecting the account type, you will need to fill out a registration form. This form requires personal details such as your name, email address, phone number, and country of residence. Accuracy is crucial, as any discrepancies may delay the verification process.

In addition to personal information, you'll likely be prompted to create a secure password for your account. Choose a strong password to safeguard your account from unauthorized access.

Verifying Your Identity

Following the completion of the registration form, verification of identity is the next critical step. This process is necessary to comply with regulatory standards and to protect both the broker and the trader from fraudulent activities.

You’ll need to provide the required documentation, such as a government-issued ID and proof of address. Once submitted, the verification team will review your documents. This process can take anywhere from a few minutes to a couple of days, depending on the volume of applications.

Fund Your Zero Spread Account

Once your account is verified, the next step is funding your zero spread account. Having sufficient capital will enable you to start trading effectively, so understanding the various deposit methods and requirements is essential.

Accepted Deposit Methods

Exness offers a range of deposit methods to accommodate the preferences of global traders. These methods may include bank transfers, credit/debit cards, e-wallets, and cryptocurrency deposits.

Each method comes with its advantages and disadvantages, particularly related to processing time and fees. For instance, while bank transfers might take longer to process, e-wallets tend to offer instant deposits, making them popular among traders looking to start quickly.

Minimum Deposit Requirements

The minimum deposit requirement for a zero spread account with Exness is relatively low compared to other brokers. This accessibility encourages traders with varying budget sizes to participate in the markets.

However, it's important to consider your personal financial situation and risk tolerance before deciding on an initial deposit amount. Starting with too little may limit your trading capabilities, while depositing too much without sufficient knowledge may expose you to unnecessary risks.

Processing Times for Deposits

Understanding the processing times for deposits can help manage your expectations and trading timeline. Most deposit methods offered by Exness are processed quickly, often within minutes to a few hours. However, bank transfers can take longer, sometimes a few business days, depending on the banking institution involved.

It’s crucial to keep in mind that while deposits are typically swift, withdrawals may have different processing times. Therefore, planning ahead and ensuring you have enough funds in your account to facilitate trading is advisable.

Setting Up Your Trading Platform

Once your zero spread account is funded, the next step is setting up your trading platform. This stage is vital for ensuring you have a smooth and effective trading experience.

Downloading the Trading Software

Exness provides access to several trading platforms, with MetaTrader 4 (MT4) and MetaTrader 5 (MT5) being the most popular. Both platforms offer a robust interface and advanced trading tools, making them suitable for traders of all experience levels.

To start trading, download the software compatible with your device—whether desktop, laptop, or mobile. Installation is straightforward, and Exness offers guides to assist in this process. After installation, launch the application to begin configuring your account settings.

Configuring Your Account Settings

Once you’ve downloaded the trading software, the next step involves logging into your zero spread account. You’ll need to enter your account login credentials, which you received during the registration process.

After logging in, take a moment to familiarize yourself with the interface, settings, and customization options. You can adjust chart types, timeframes, and indicators according to your trading preferences. Properly configuring your settings will enhance your efficiency and improve your trading experience.

Navigating the Trading Interface

After setting up your account, exploring the trading interface is essential. Both MT4 and MT5 come equipped with numerous features that can help you analyze market trends and execute trades effectively.

Spend some time understanding how to place trades, set stop-loss and take-profit levels, and utilize technical indicators. Familiarizing yourself with these functionalities will boost your confidence and readiness when you begin trading.

Understanding Trading Conditions on Zero Spread Accounts

Expanding your knowledge about the trading conditions that govern zero spread accounts is essential for optimizing your trading experience. Each element contributes to how you manage your trades and risk.

Leverage Options

One of the significant attractions of trading with Exness is the availability of high leverage options. Leverage allows traders to control larger positions than their initial capital would permit, amplifying both potential profits and risks.

For zero spread accounts, leverage options can vary, so it’s crucial to understand the implications of using high leverage. While it can magnify gains, it can equally lead to substantial losses if not managed correctly. Hence, developing a sound risk management strategy is essential.

✅ Open Exness Zero MT4 Account

✅ Open Exness Zero MT5 Account

Margin Requirements

Margin requirements refer to the amount of capital needed to open and maintain positions. Understanding margin requirements is essential for avoiding margin calls or liquidations, especially in a zero spread trading environment where the costs may differ.

Calculating required margins helps in determining how much of your balance will be allocated to various trades. Keeping track of your margin level and maintaining sufficient funds in your account will ensure sustained trading activity.

Commission Fees

Although the key feature of a zero spread account is the absence of spreads, it typically comes with commission fees per trade. Understanding and calculating these fees is crucial for evaluating your overall trading costs.

Be diligent in assessing the commission structure outlined by Exness for zero spread accounts. This awareness will allow you to strategize effectively while accounting for all trading expenses. Knowing how commissions affect your trade outcomes will ultimately influence your profitability.

Trading Strategies for Zero Spread Accounts

Having a solid trading strategy is crucial for anyone operating a zero spread account. The nature of these accounts allows for specific strategies that can be particularly effective in maximizing profits while managing risks.

Scalping Techniques

Scalping is a popular trading strategy that involves making numerous trades throughout the day to capture small price movements. Given that zero spread accounts eliminate spread costs, they are particularly suitable for scalpers who rely on quick entries and exits.

Implementing a scalping strategy in a zero spread environment necessitates discipline and rapid decision-making. Traders should focus on volatile currency pairs and employ technical analysis to identify potential entry points. Additionally, considering transaction costs is essential; thus, utilizing platforms with fast execution speeds is advisable.

Day Trading Approaches

Day trading involves holding positions within the same day and closing them before the market closes. Zero spread accounts are conducive to day trading because the absence of spreads allows traders to react promptly to market fluctuations.

Successful day traders often rely on news events, technical patterns, and pre-market data to make informed decisions. Leveraging advanced trading tools and executing trades quickly can elevate your chances of success. Always be prepared to adjust your strategy in response to market shifts to optimize your results.

Risk Management Strategies

Effective risk management is paramount when engaging in trading strategies, particularly in a zero spread account. Given the high potential for losses with leverage, implementing proper risk management techniques can safeguard your capital.

Traders should define their risk tolerance, set appropriate stop-loss levels, and diversify their portfolios to mitigate risks. Utilizing risk-reward ratios can help evaluate potential trades, ensuring that the possible rewards outweigh the risks. Moreover, continuous analysis of past trades can provide invaluable insights for future improvements.

Common Mistakes to Avoid When Opening a Zero Spread Account

Even seasoned traders can make errors that may hinder their trading experience. Being aware of common mistakes can help minimize risks and pave the way for a successful trading journey.

Not Understanding Trading Costs

One mistake traders often make is underestimating the actual costs associated with trading. Although zero spread accounts eliminate spread costs, commission fees can still accumulate and impact profitability.

It’s crucial for traders to conduct thorough research and understand the fee structures related to zero spread accounts. Analyzing how trading costs align with your strategies can provide valuable insights into your trading performance.

Overleverage Risks

Another pitfall is the temptation to use excessive leverage. While high leverage can amplify profits, it also significantly increases the risk of losses. Many traders fall into the trap of believing that high leverage guarantees profits, leading to reckless trading behavior.

To mitigate overleverage risks, establish clear rules for leveraging your trades. It's prudent to limit your exposure and maintain a balanced approach to achieve sustainable long-term success.

Ignoring the Importance of Market Research

Failing to conduct regular market research and analysis can lead to uninformed trading decisions. Markets are constantly evolving, and remaining attuned to economic news, geopolitical developments, and market sentiment is essential for success.

Traders should dedicate time to studying market trends and utilizing analytical tools to make informed decisions. Engaging in continuous education and staying updated on relevant news will enhance your trading prowess and adaptability.

Customer Support and Resources

A reliable broker should provide ample support and resources to assist traders on their journey. Understanding how to access these resources can significantly enhance your trading experience with Exness.

Accessing Help from Exness Support

Exness offers various channels for customer support, ranging from live chat to email assistance. Traders can easily reach out to the support team for inquiries or issues faced during their trading experience.

The responsiveness and quality of customer service play a pivotal role in establishing a trader's comfort level. If you encounter issues or have questions regarding your zero spread account, don’t hesitate to reach out for assistance.

Educational Materials Provided by Exness

Exness places a strong emphasis on educating its clients, offering numerous resources such as webinars, tutorials, articles, and market analyses. These educational materials cater to traders of all skill levels, from novices to advanced traders.

Taking advantage of the wealth of knowledge offered by Exness can enhance your trading strategies and instill greater confidence in your decisions. Continuous learning is key to adapting to ever-changing market conditions.

Community and Forum Engagement

Engaging with fellow traders through community forums and discussion groups can be incredibly beneficial. Exness has an active trading community where members share insights, strategies, and experiences.

Participating in discussions allows traders to broaden their perspectives and learn from peers. Building a network within the trading community can also provide emotional support and motivation throughout your trading journey.

Conclusion

Opening a zero spread account in Exness can be a game-changer for traders seeking to enhance their trading experience and profitability. Understanding the ins and outs of zero spread accounts, the broker's offerings, and the trading landscape is essential for making informed decisions.

By following the outlined steps, knowing the trading conditions, and honing effective strategies, traders can maximize their potential in the financial markets. Avoiding common pitfalls and leveraging available resources will further equip you for success in your trading endeavors.

So, if you're ready to take the plunge, follow the guiding principles discussed in this article on how to open a zero spread account in Exness, and embark on your trading journey with confidence!

Read more: