11 minute read

Is Exness a market maker broker?

from Exness

by Exness_Blog

Understanding Market Makers

Definition of Market Makers

Market makers are entities, typically financial institutions or brokerage firms, that facilitate liquidity in the market by providing both buy and sell quotes for financial instruments. They essentially create a market for traders by ensuring that there is always a buyer for every seller and vice versa. This role is pivotal in maintaining market stability and ensuring smooth trading operations.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Unlike ECN (Electronic Communication Network) or STP (Straight Through Processing) brokers, market makers often act as the counterparty to their clients’ trades. This means that the broker itself may take the opposite position of a trader, which can lead to potential conflicts of interest.

Role in Financial Markets

The primary role of market makers is to enhance liquidity and reduce the time it takes for trades to be executed. They play a critical part in stabilizing financial markets, especially during times of volatility. By continuously providing quotes for both buying and selling, they allow traders to enter and exit positions seamlessly.

Additionally, market makers help bridge the gap between retail traders and the larger financial ecosystem. Without market makers, many trading opportunities would be inaccessible, especially for retail investors with smaller capital.

Differences Between Market Makers and Other Brokers

Market makers differ significantly from ECN and STP brokers. While ECN and STP brokers act as intermediaries connecting traders directly to liquidity providers, market makers operate their trading books, creating liquidity internally. This distinction impacts spreads, execution speeds, and the potential for conflicts of interest.

For example, market makers often offer fixed spreads and faster execution, while ECN and STP brokers provide variable spreads and direct market access. These differences are essential considerations for traders when choosing a broker that aligns with their trading style.

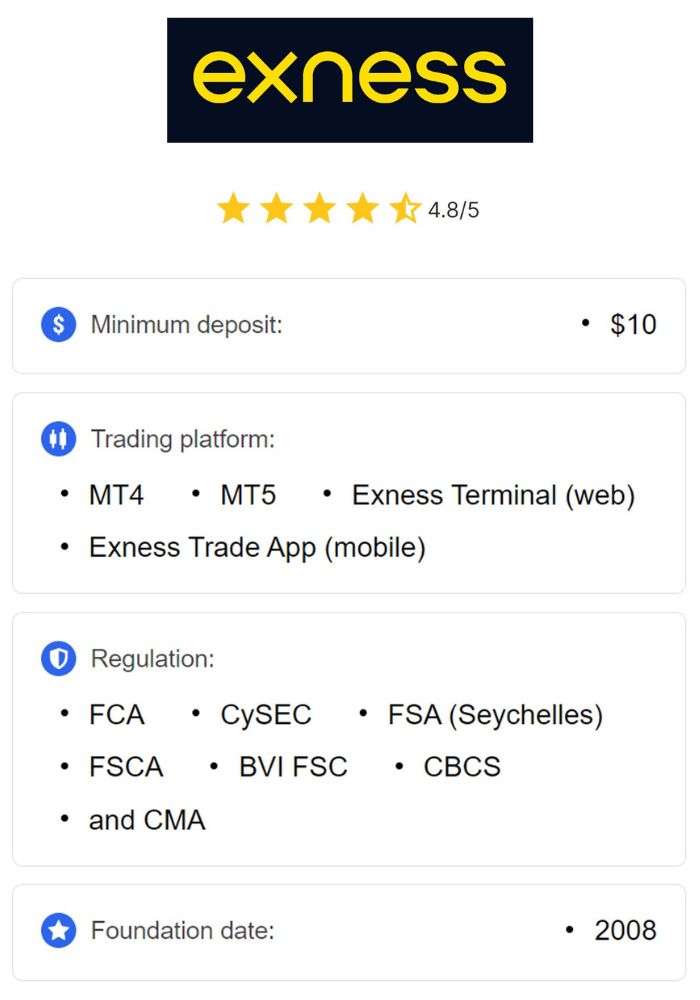

Overview of Exness

Company Background and History

Founded in 2008, Exness is a globally recognized forex and CFD broker that has gained popularity for its user-friendly platforms, competitive spreads, and reliable trading conditions. With a strong presence in multiple countries, Exness serves millions of clients worldwide, offering a variety of trading instruments, including forex, commodities, cryptocurrencies, and indices.

Over the years, Exness has built a reputation for transparency and innovation. The broker continuously invests in technology to provide traders with seamless experiences, including fast order execution and advanced trading tools.

Regulatory Framework and Compliance

Exness operates under strict regulatory oversight from reputable financial authorities. The broker is licensed by entities such as the Financial Services Authority (FSA) of Seychelles and the Financial Conduct Authority (FCA) in the UK. These licenses ensure that Exness adheres to stringent standards of security, transparency, and fair trading practices.

Compliance with regulations also involves safeguarding client funds through segregation and implementing anti-money laundering (AML) protocols. These measures provide traders with added confidence in the broker’s reliability.

Types of Trading Accounts Offered

Exness offers a range of trading accounts designed to cater to the needs of different traders. These include:

Standard Account: Suitable for beginners with low minimum deposit requirements.

Pro Account: Designed for experienced traders, offering tighter spreads and faster execution.

Zero Spread Account: Provides zero spreads on major currency pairs for professional trading strategies.

Raw Spread Account: Features low spreads with a commission-based pricing model.

These account types allow traders to choose conditions that best suit their trading style and objectives.

Types of Brokers Explained

Market Maker Brokers

Market maker brokers operate by creating liquidity for traders within their system. They often quote both bid and ask prices and profit from the spread between these prices. This model ensures that trades are executed quickly, even during times of low market liquidity.

However, since market makers act as the counterparty to trades, there is a potential conflict of interest, as the broker profits when a trader loses. Despite this, many market makers implement strict policies to ensure fair trading practices.

ECN and STP Brokers

ECN brokers connect traders directly to liquidity providers, such as banks and other financial institutions, while STP brokers process orders directly without an intermediary. Both models offer variable spreads and are often preferred by traders seeking transparent pricing and access to interbank liquidity.

These brokers earn money through commissions and markups, rather than taking positions against their clients. This structure eliminates conflicts of interest but may result in slower execution during volatile markets.

Hybrid Brokers

Hybrid brokers combine elements of market maker and ECN/STP models. They may act as market makers for smaller trades while routing larger orders to liquidity providers. This approach allows brokers to cater to a broader range of clients while maintaining flexibility in their operations.

Exness’s Business Model

Execution Methods Used by Exness

Exness primarily uses an STP model for trade execution, ensuring that client orders are processed directly through liquidity providers without intervention. This approach minimizes potential conflicts of interest and provides traders with access to competitive spreads and transparent pricing.

However, in some cases, Exness may act as a market maker for specific instruments, particularly those with low trading volumes. This dual approach allows the broker to maintain liquidity and offer consistent trading conditions.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

How Exness Makes Money

Exness generates revenue through spreads and commissions. For standard accounts, the broker profits from the spread difference between the bid and ask prices. For accounts with tighter spreads, such as the Raw Spread or Zero Spread accounts, Exness charges a small commission per trade.

This transparent pricing model ensures that traders know exactly what costs they incur while trading, fostering trust and long-term relationships.

Analyzing the Spread and Commission Structure

Exness offers competitive spreads across all account types, starting as low as 0.0 pips for Raw Spread and Zero Spread accounts. The commission structure is clearly outlined, enabling traders to calculate their costs accurately.

These conditions make Exness an attractive option for both beginner and experienced traders who value cost efficiency and transparency.

Exness as a Market Maker or ECN Provider

What It Means to Be a Market Maker

Being a market maker means that a broker facilitates trades by providing liquidity within its own system. In this model, the broker takes the opposite position of the trader's order, ensuring that trades are executed instantly without relying on external liquidity providers.

While market makers are often associated with potential conflicts of interest, many regulated brokers adhere to strict policies to ensure fairness. The primary benefit of market makers is the ability to offer fixed spreads and faster execution, making them suitable for traders who prioritize consistent pricing and immediate order fulfillment.

Evidence Supporting Exness's Status

Exness's operational model suggests that it combines elements of both market making and ECN/STP execution. For popular instruments with high liquidity, Exness routes trades through liquidity providers using an STP model. For less liquid instruments, it may act as a market maker to ensure smooth execution.

This dual approach aligns with Exness's goal of providing optimal trading conditions for a diverse range of traders. The company’s transparency regarding its execution methods and regulatory compliance further supports its reputation as a trustworthy broker.

Client Experience and Feedback

Many Exness clients report positive experiences with trade execution and pricing transparency. Traders often praise the platform for its minimal slippage, competitive spreads, and fast withdrawals. While some users may express concerns about the dual execution model, Exness's commitment to fair practices and regulatory oversight addresses most apprehensions.

Client feedback also highlights the broker's ability to accommodate various trading strategies, from scalping to long-term investing, making it a versatile choice for traders worldwide.

Trading Conditions at Exness

Leverage Options Available

Exness offers highly competitive leverage options, ranging from 1:1 to unlimited leverage on specific account types. This flexibility allows traders to choose leverage levels that align with their risk tolerance and trading strategies.

Unlimited leverage is particularly appealing to experienced traders looking to maximize their trading potential with minimal capital. However, Exness provides detailed risk warnings and educational resources to ensure that traders understand the implications of using high leverage.

Spreads and Costs of Trading

Exness is renowned for its tight spreads, starting at 0.0 pips for Raw Spread and Zero Spread accounts. Standard accounts offer slightly wider spreads, catering to traders who prefer a commission-free pricing model.

The broker’s transparent approach to spreads and commissions ensures that traders can make informed decisions about their costs, enhancing overall trading efficiency.

Availability of Different Asset Classes

Exness provides access to a wide range of trading instruments, including forex, indices, commodities, cryptocurrencies, and stocks. This diversity enables traders to build a well-rounded portfolio and explore opportunities across multiple markets.

The availability of both traditional and modern assets, such as cryptocurrencies, reflects Exness's commitment to staying ahead of industry trends and meeting the evolving needs of its clients.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Pros and Cons of Choosing Exness

Advantages of Trading with Exness

Regulatory Compliance: Exness operates under strict regulations, ensuring a secure trading environment.

Competitive Pricing: The broker offers tight spreads and transparent commission structures.

Flexible Leverage: Unlimited leverage options cater to traders with diverse risk profiles.

User-Friendly Platforms: Exness provides intuitive trading platforms, including MetaTrader 4 and 5.

Diverse Instruments: Access to a wide range of assets allows for portfolio diversification.

These advantages make Exness a strong contender for traders seeking reliability, affordability, and versatility.

Disadvantages and Limitations

Dual Execution Model: The combination of market making and STP execution may raise concerns for some traders.

Regulatory Restrictions in Certain Countries: Exness is not available in all regions, limiting its accessibility.

Limited Educational Resources: While the broker provides basic trading materials, advanced educational content may be lacking for beginners.

Despite these limitations, Exness remains a popular choice due to its robust offerings and commitment to transparency.

User Experience and Customer Support

Trading Platform Features

Exness supports industry-standard platforms like MetaTrader 4 and MetaTrader 5, offering advanced charting tools, technical indicators, and customizable interfaces. These platforms are suitable for traders of all experience levels and support automated trading through Expert Advisors (EAs).

Additionally, Exness provides a proprietary web terminal for traders who prefer a simplified experience. The platform's stability and reliability are frequently highlighted in user reviews.

Customer Service Accessibility

Exness offers 24/7 customer support through multiple channels, including live chat, email, and phone. The broker's multilingual support ensures that clients from diverse regions can access assistance in their preferred language.

Prompt response times and knowledgeable representatives contribute to a positive support experience, addressing common trader concerns effectively.

Educational Resources Provided by Exness

Exness provides a range of educational materials, including tutorials, webinars, and market analysis. These resources are designed to help traders enhance their skills and make informed decisions.

However, some users may find the content too basic, particularly advanced traders seeking in-depth insights. Expanding the educational library could further improve the broker's appeal.

Impact of Being a Market Maker on Traders

Implications for Trade Execution

Market makers like Exness can offer faster execution and fixed spreads, benefiting traders who prioritize stability. However, the potential conflict of interest inherent in market making requires brokers to implement robust policies to ensure fair practices.

Exness’s transparency in execution methods and adherence to regulatory standards mitigate these concerns, providing a balanced trading environment for its clients.

Influence on Market Volatility

By acting as a liquidity provider, market makers can stabilize volatile markets, ensuring that traders can execute orders even during periods of uncertainty. This role is crucial for retail traders who may struggle to navigate erratic market conditions.

Exness’s ability to combine market making with STP execution provides a hybrid solution that balances stability and market access.

Potential Conflicts of Interest

The primary criticism of market makers is the potential for conflicts of interest, as the broker benefits from client losses. Exness addresses this issue through regulatory compliance, transparent policies, and a dual execution model that routes trades to external liquidity providers when appropriate.

This approach fosters trust and reduces the likelihood of unfair practices, making Exness a reliable choice for traders.

Conclusion

Exness’s business model incorporates elements of both market making and ECN/STP execution, allowing it to cater to a broad range of traders with diverse needs. The broker’s commitment to regulatory compliance, transparent pricing, and robust client support underscores its reputation as a trusted name in the industry.

For traders seeking a reliable broker with competitive trading conditions and a strong regulatory framework, Exness remains a compelling choice. While the dual execution model may raise questions for some, the broker’s transparency and adherence to fair practices ensure a balanced and secure trading experience.

Read more: