16 minute read

Exness Zero Spread Account Review: Is It Worth It for Traders?

from Exness

by Exness_Blog

Introduction to Exness

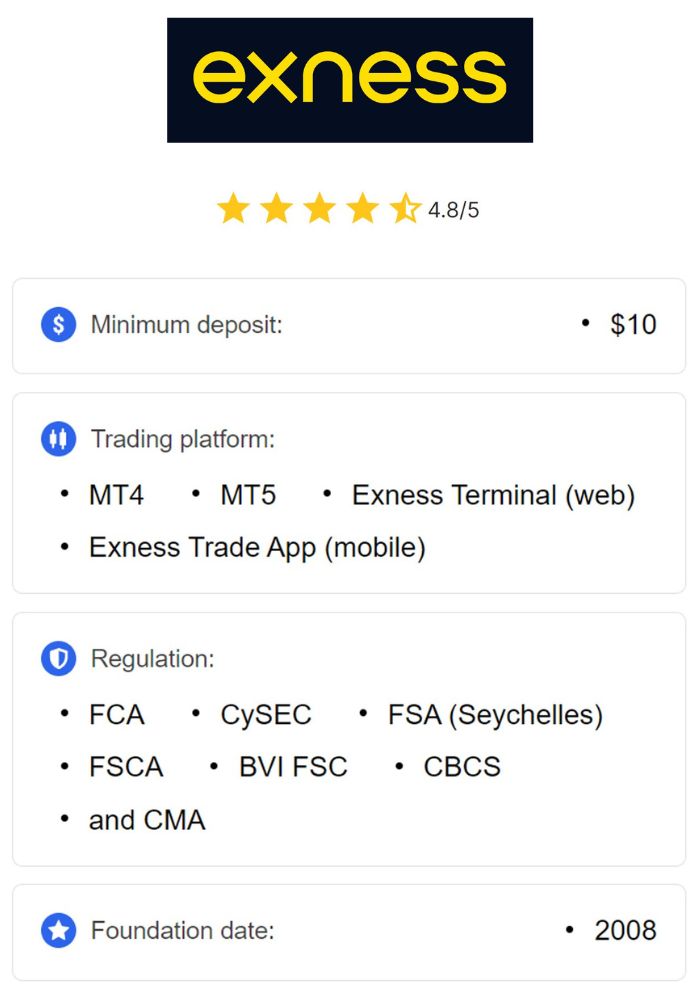

Overview of Exness as a Forex Broker

Exness is a global Forex and financial trading broker that was founded in 2008. Over the years, the company has earned a solid reputation as a reliable platform for retail and institutional traders alike. Exness offers a wide range of trading instruments, including Forex pairs, commodities, cryptocurrencies, and stock indices, making it a popular choice for those interested in diverse financial markets.

1️⃣ Open Exness Zero MT4 Account

2️⃣ Open Exness Zero MT5 Account

The broker operates in over 190 countries and is well-regulated by leading financial authorities, including the UK’s Financial Conduct Authority (FCA) and Cyprus Securities and Exchange Commission (CySEC). Exness provides a seamless trading experience through its user-friendly platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), and is particularly well-known for its competitive spreads, high leverage options, and excellent customer support.

Key Features of Exness

Exness stands out for its transparency, competitive pricing, and variety of account types. Some of the key features that make Exness a top choice among traders include:

Regulatory Compliance: Exness is regulated by several top-tier authorities globally, ensuring a safe and secure environment for traders.

Low-Cost Trading: Exness offers competitive spreads, with its Zero Spread Account being a particularly attractive option for active traders.

Wide Range of Trading Instruments: The broker provides access to a wide range of financial instruments, including Forex, commodities, stock indices, and cryptocurrencies.

Advanced Trading Platforms: Exness supports MetaTrader 4 and MetaTrader 5, both of which are highly regarded in the trading community for their robust features and ease of use.

Multiple Payment Methods: The platform supports numerous deposit and withdrawal methods, including credit/debit cards, e-wallets, and bank transfers.

These features make Exness a versatile and reliable choice for both novice and professional traders.

Understanding Zero Spread Accounts

Definition and Characteristics of Zero Spread Accounts

A Zero Spread Account is a trading account that offers zero spreads on trades. Typically, in traditional accounts, brokers make a profit by charging a spread, which is the difference between the buying and selling price of a currency pair. In a Zero Spread Account, however, there is no spread cost.

Instead of spreads, brokers charge a commission based on the trading volume. This means that traders are not subjected to the usual fluctuations in the spread, which can widen during volatile market conditions. Zero Spread Accounts are particularly attractive to active traders, such as scalpers or day traders, who aim to capitalize on small price movements and require precise cost structures.

How Zero Spread Accounts Work in Trading

In a Zero Spread Account, the key difference lies in the absence of spread costs. Traders are instead charged a fixed commission per lot traded. The absence of spread fluctuations is beneficial for traders, especially those who employ high-frequency strategies or scalping techniques, as it provides consistent pricing.

For example, in regular trading accounts, spreads can vary throughout the day, especially during high volatility periods. This can negatively impact traders who need to enter and exit positions quickly. With a Zero Spread Account, traders know the cost of their trades upfront, making it easier to plan and execute strategies with greater accuracy.

Benefits of Exness Zero Spread Account

Cost Efficiency and Saving on Spreads

One of the main benefits of a Zero Spread Account is cost efficiency. In traditional accounts, the spread can fluctuate, and during volatile market conditions, the spread can widen, making trading more expensive. With a Zero Spread Account, traders avoid this uncertainty and pay a fixed commission.

For high-frequency traders or scalpers, the ability to trade without worrying about fluctuating spreads is a significant advantage. By eliminating this variable cost, traders can focus on their strategies without the added stress of dealing with unpredictable spread changes. This makes the Zero Spread Account an attractive option for those who prioritize cost-efficient trading.

Enhanced Trading Opportunities

With the Zero Spread Account, traders can take advantage of tight market conditions without worrying about the typical cost of spreads. This allows for greater flexibility in executing short-term trades, capturing quick market movements without the additional burden of spread widening.

Additionally, the predictable costs associated with Zero Spread Accounts make it easier for traders to perform in-depth analysis and plan their trades more effectively. Since there are no fluctuations in spread, traders can calculate potential profits and losses with more accuracy, which is crucial for day trading and scalping.

Account Types Offered by Exness

Overview of Different Account Types

Exness offers several types of accounts to cater to traders with varying needs and experience levels. The most popular accounts include:

Standard Account: Ideal for beginners, this account type offers a low minimum deposit, flexible spreads, and no commissions on trades.

Pro Account: This is designed for more experienced traders who need tighter spreads and access to more advanced features.

Zero Spread Account: As described earlier, this account type is designed for active traders, offering zero spreads and a fixed commission structure.

Each account type has its own set of benefits and features, allowing traders to select the account that best fits their trading style and objectives.

Comparison with Standard Accounts

When comparing the Zero Spread Account with the Standard Account, the primary difference lies in the cost structure. While Standard Accounts feature variable spreads that change based on market conditions, the Zero Spread Account charges a fixed commission and eliminates spread costs entirely.

This makes the Zero Spread Account more suitable for active traders, particularly those who engage in scalping or high-frequency trading. On the other hand, the Standard Account is more appropriate for traders who prefer a simpler cost structure and do not require the precision offered by zero spreads.

Registration Process for Exness Zero Spread Account

Step-by-Step Guide to Opening an Account

Opening a Zero Spread Account with Exness is simple and can be done in just a few steps:

Visit the Exness Website: Go to Exness's official website and click on the “Open Account” button.

Provide Personal Information: Fill in basic details such as name, email address, phone number, and country of residence.

Choose Account Type: Select the Zero Spread Account option.

Set Up Trading Platform: Choose between MetaTrader 4 (MT4) or MetaTrader 5 (MT5) as your preferred trading platform.

Make Your First Deposit: After choosing your account type, make your initial deposit using one of the supported payment methods.

1️⃣ Open Exness Zero MT4 Account

2️⃣ Open Exness Zero MT5 Account

Once your account is set up, you can start trading with the Zero Spread Account and benefit from the fixed commission structure.

Verification Requirements and Procedures

To comply with regulatory requirements, Exness requires traders to undergo a verification process. The process involves submitting identification documents to confirm your identity and address.

Proof of Identity: A government-issued photo ID (passport, driver’s license, or national ID card).

Proof of Address: A recent utility bill or bank statement showing your name and address.

The verification process typically takes a few hours to a couple of days, depending on the volume of requests. After verification, your account will be fully activated, and you can start trading.

Trading Platforms Supported by Exness

Overview of MetaTrader 4 and MetaTrader 5

Exness offers two of the most popular and widely-used trading platforms in the world: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are known for their robust features, ease of use, and advanced charting tools.

MT4 is favored by traders who prioritize simplicity and reliability. It offers a wide range of technical analysis tools, automated trading through Expert Advisors (EAs), and multi-timeframe charting.

MT5 builds on the success of MT4, adding additional timeframes, order types, and more advanced charting features, making it an ideal choice for more experienced traders.

Both platforms are available for Windows, Mac, mobile, and web, giving traders flexibility in how they trade.

Mobile Trading Capabilities

Both MT4 and MT5 are available as mobile applications, allowing traders to monitor markets and execute trades on the go. The mobile platforms offer the same advanced features as their desktop counterparts, including real-time price quotes, full charting capabilities, and order management.

Mobile trading is an excellent option for traders who need to stay connected to the markets at all times, whether they are at home, at work, or on the move.

Payment Methods and Deposits

Accepted Payment Methods for Fund Transfers

Exness offers a broad selection of payment methods to facilitate easy deposits and withdrawals for traders. These include traditional options like bank wire transfers, as well as digital payment systems such as Skrill, Neteller, WebMoney, and Perfect Money. Additionally, traders can use cryptocurrencies such as Bitcoin and Ethereum, which is particularly useful for those who prefer a decentralized payment method.

The variety of payment methods gives traders flexibility and convenience when managing their funds. Whether you prefer traditional banking or the ease of e-wallets and cryptocurrencies, Exness ensures that there are multiple options available to suit different preferences and regions. For international traders, the availability of payment options in different currencies also reduces the burden of conversion fees and delays.

Deposit and Withdrawal Processing Times

Exness processes deposits and withdrawals with remarkable efficiency. Deposits made via e-wallets are typically processed instantly, ensuring that traders can quickly fund their accounts and begin trading without delays. For bank transfers, however, deposits may take up to 1-2 business days, depending on the bank's processing time and the region of the trader.

Similarly, withdrawals are processed swiftly. E-wallet withdrawals are generally completed within hours, while bank transfers may take a little longer, often 1-3 business days. Exness has earned a reputation for efficient transactions, making it easier for traders to manage their accounts and access their profits when needed.

Trading Instruments Available

Forex Pairs Offered in Zero Spread Accounts

Exness offers a wide variety of Forex pairs for traders using the Zero Spread Account. This includes major pairs such as EUR/USD, GBP/USD, USD/JPY, and AUD/USD, as well as minor and exotic pairs like USD/ZAR and EUR/TRY. The availability of these pairs allows traders to diversify their portfolios and take advantage of various market conditions.

The Zero Spread Account benefits Forex traders by offering tight pricing without spread fluctuations, especially on the most liquid currency pairs. For active traders who depend on small price movements, the absence of a spread can be an immense advantage, enabling them to maximize profit opportunities in the short-term market.

Other Asset Classes: Commodities, Indices, and Cryptos

In addition to Forex pairs, Exness offers a broad range of other trading instruments, including commodities, indices, and cryptocurrencies. Traders can access popular commodities like gold, silver, and oil, as well as major stock indices like the S&P 500, FTSE 100, and Nasdaq 100. Exness also provides a selection of cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and others, giving traders ample opportunities to diversify their trading strategies.

The inclusion of these asset classes in the Zero Spread Account allows traders to experiment with different markets, broadening their opportunities for profit. Whether you're interested in trading traditional assets like commodities or taking a more modern approach with cryptocurrencies, Exness offers the flexibility to suit a variety of trading styles.

Risk Management in Trading with Exness

Tools and Features for Effective Risk Management

Effective risk management is crucial in trading, and Exness provides several tools to help traders protect their capital. Stop-loss orders and take-profit orders are essential features that allow traders to define their risk and potential profit points before entering a trade. Exness also offers trailing stops, which automatically adjust the stop-loss level as the market moves in the trader’s favor, locking in profits while limiting potential losses.

Additionally, negative balance protection ensures that traders cannot lose more money than they have in their accounts, offering a safety net against unforeseen market events. These risk management tools enable traders to create more structured and disciplined trading strategies, helping them navigate volatile markets with greater confidence.

1️⃣ Open Exness Zero MT4 Account

2️⃣ Open Exness Zero MT5 Account

Strategies to Minimize Losses

In addition to utilizing Exness's risk management tools, traders can adopt specific strategies to minimize their potential losses. One common approach is the proper use of leverage. While leverage can amplify profits, it also increases the potential for losses. Traders should ensure they use leverage cautiously and only trade with amounts they are willing to lose.

Another effective strategy is position sizing, which involves adjusting the size of trades based on the amount of capital in the account. By only risking a small percentage of their trading capital on each trade, traders can avoid significant losses and sustain their trading accounts over the long term. Combining these strategies with Exness's risk management features helps traders stay disciplined and protect their investment.

Customer Support Services

Availability of Support Channels

Exness provides a variety of customer support options to ensure that traders can get assistance whenever needed. The company offers 24/7 support via multiple channels, including live chat, email, and phone support. The availability of these channels allows traders to reach out for help at any time, whether they are dealing with a technical issue or need help with their account.

Exness also offers a dedicated help center on their website, which contains an extensive FAQ section, troubleshooting guides, and tutorials. These resources allow traders to quickly find answers to common questions without having to contact customer support directly. The combination of instant support options and detailed resources ensures that traders have a smooth and hassle-free experience.

Quality of Customer Service Experience

The quality of customer service at Exness is generally highly regarded. Many traders have praised the platform for its responsive and knowledgeable customer support team, which is quick to resolve issues and answer queries. The live chat feature, in particular, is often highlighted for its speed and efficiency, with most inquiries being addressed within minutes.

Exness also offers multi-language support, catering to its diverse global clientele. This ensures that traders from different regions and backgrounds can receive assistance in their preferred language. Overall, Exness is committed to providing excellent customer service, enhancing the overall user experience for traders.

Educational Resources Provided by Exness

Training Programs and Webinars

Exness provides a range of educational resources designed to support traders at all experience levels. These resources include training programs, webinars, and video tutorials that cover a variety of topics related to trading. The content is structured to cater to both beginners and experienced traders, helping them understand market analysis, trading strategies, and effective risk management.

The webinars are often conducted by industry experts and provide valuable insights into market trends, trading techniques, and platform usage. These educational initiatives allow traders to continuously improve their skills and stay updated with the latest developments in the financial markets.

Access to Research and Market Insights

Exness offers comprehensive market analysis and research tools to help traders make informed decisions. The platform provides access to detailed economic calendars, market news, and technical analysis reports. Traders can also use customized charting tools and market sentiment indicators to assist with their trading decisions.

These resources ensure that traders are equipped with the information they need to identify trading opportunities and make well-informed decisions in real-time. Exness’s commitment to providing high-quality research and insights gives traders a significant advantage in navigating the complexities of the markets.

Regulatory Compliance and Security

Overview of Regulatory Bodies

Exness is regulated by several top-tier authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the South African Financial Sector Conduct Authority (FSCA). This regulatory oversight ensures that Exness operates in a secure and transparent environment, providing a safe platform for traders to engage in financial markets.

The regulatory bodies enforce strict standards and guidelines, requiring brokers to maintain a high level of capital reserves, adhere to anti-money laundering (AML) regulations, and ensure that traders' funds are kept in segregated accounts. These regulatory safeguards give traders confidence that Exness is operating in full compliance with global financial regulations.

Safety Measures for Trader Funds

Exness prioritizes the safety of trader funds through several robust measures. The platform ensures that clients' funds are held in segregated accounts with reputable banks, which protects the funds in the event of any financial issues with the broker. Exness also employs advanced encryption technologies to safeguard sensitive personal and financial information.

Additionally, Exness provides negative balance protection, ensuring that traders cannot lose more than the funds they have deposited in their accounts. These measures contribute to a safe and secure trading environment, reassuring traders that their investments are protected.

User Experiences and Feedback

Positive Reviews from Traders

Many traders have shared positive reviews about Exness, particularly regarding its Zero Spread Account. They appreciate the tight spreads, low commission structure, and the ability to trade with high leverage. Traders who engage in scalping or day trading often praise the Zero Spread Account for its cost efficiency, which allows them to execute trades quickly and accurately without the added expense of fluctuating spreads.

Other traders highlight Exness’s excellent customer support, noting that their issues are addressed promptly and professionally. The broker’s educational resources and research tools are also highly regarded by both novice and experienced traders, helping them improve their trading skills.

Common Complaints and Challenges

While Exness has received mostly positive feedback, some traders have raised concerns regarding the platform's withdrawal process, particularly with bank transfers. Some users report that it can take a few days for funds to be processed, although this is largely dependent on the bank and the region.

Another common complaint is the high commission charged on the Zero Spread Account. While the lack of a spread is beneficial for active traders, the commission can be higher compared to other accounts, which may not suit traders with lower volume or those who prefer not to pay extra fees for each trade.

Comparisons with Other Brokers

Competitive Analysis of Zero Spread Accounts

Exness’s Zero Spread Account stands out among competitors for its transparency and cost-effectiveness. Compared to other brokers that offer zero spread accounts, Exness's commission rates are often lower, and the platform’s advanced features, such as negative balance protection and high leverage, provide an edge. Exness also stands out for offering tight spreads on a range of instruments, making it an attractive choice for active traders.

When compared to brokers with similar offerings, Exness provides more flexibility, including access to both MetaTrader 4 and MetaTrader 5 platforms, mobile trading options, and a variety of asset classes. This makes it a top choice for those seeking competitive advantages in the Forex market.

Benchmarking Against Industry Standards

Exness's Zero Spread Account is well-aligned with industry standards when it comes to pricing, leverage, and platform functionality. It provides competitive leverage ratios and allows traders to use advanced trading strategies effectively. In terms of security, Exness is on par with other top-tier brokers, maintaining high standards of regulatory compliance and fund protection.

While some brokers offer zero spreads, Exness differentiates itself with its reliable customer support and robust educational resources, making it a well-rounded choice for both beginner and experienced traders.

Conclusion

Exness’s Zero Spread Account is a powerful tool for active traders, offering cost efficiency, precise execution, and a wide range of trading instruments. With strong regulatory oversight, excellent customer support, and a comprehensive suite of tools for managing risk, Exness provides a secure and user-friendly trading environment.

While there are a few challenges such as commission rates and withdrawal times, the broker’s benefits far outweigh these minor drawbacks, making it a solid choice for traders looking to maximize their potential in the competitive world of Forex and financial markets.

Read more: