19 minute read

Exness Raw Spread vs Zero Account Review: Pros and Cons

from Exness

by Exness_Blog

In the ever-evolving landscape of online trading, choosing the right trading account is a pivotal decision that can greatly influence a trader's success. The Exness Raw Spread vs Zero Account Review aims to provide comprehensive insights into two of Exness's prominent account offerings—Raw Spread vs Zero Accounts. Both accounts cater to different trader profiles and preferences, making it essential for traders to understand their features, costs, and overall suitability in order to make an informed choice.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Exness Trading Accounts

When embarking on a trading journey, one of the first steps is selecting a trading account that aligns with individual goals and trading styles. Exness understands that no two traders are alike; therefore, it offers a variety of account types that accommodate diverse needs.

Traders can choose between accounts designed for specific strategies, whether they prefer dealing with tight spreads and commissions or fixed spreads without commissions. As we delve deeper into the characteristics of the Raw Spread vs Zero Accounts, it becomes apparent how each caters to distinct trading strategies and personas.

Overview of Exness as a Broker

Exness has carved out a niche for itself in the online trading arena since its inception in 2008. With various regulatory bodies, including the FCA, CySEC, and FSC overseeing its operations, the broker is synonymous with reliability and trustworthiness.

The platform is widely recognized for its user-friendly interface, extensive educational resources, and advanced trading tools. Exness provides access to various financial instruments, including forex pairs, commodities, indices, cryptocurrencies, and more, making it a versatile choice for both novice and professional traders.

Moreover, Exness emphasizes transparency, ensuring clients have a clear understanding of trading costs, spread structures, and potential risks associated with trading activities. This commitment to customer satisfaction further reinforces Exness’s reputation as a reputable broker within the industry.

Importance of Account Types in Trading

The significance of account types cannot be overstated, as they form the foundation upon which traders build their strategies. Each account type comes equipped with unique features that cater to different trading styles and risk appetites.

For high-frequency traders who thrive on executing numerous trades with minimal margins, an account with tight spreads is paramount. Conversely, beginners may benefit from an account offering fixed spreads and enhanced support, allowing them to acclimatize to the market without feeling overwhelmed.

Understanding the details of different accounts enables traders to tailor their approach to suit their personal ambitions and increase their chances of achieving profitable outcomes. In this review, we will explore the unique attributes of both the Exness Raw Spread vs Zero Accounts, helping you identify which account best aligns with your trading profile.

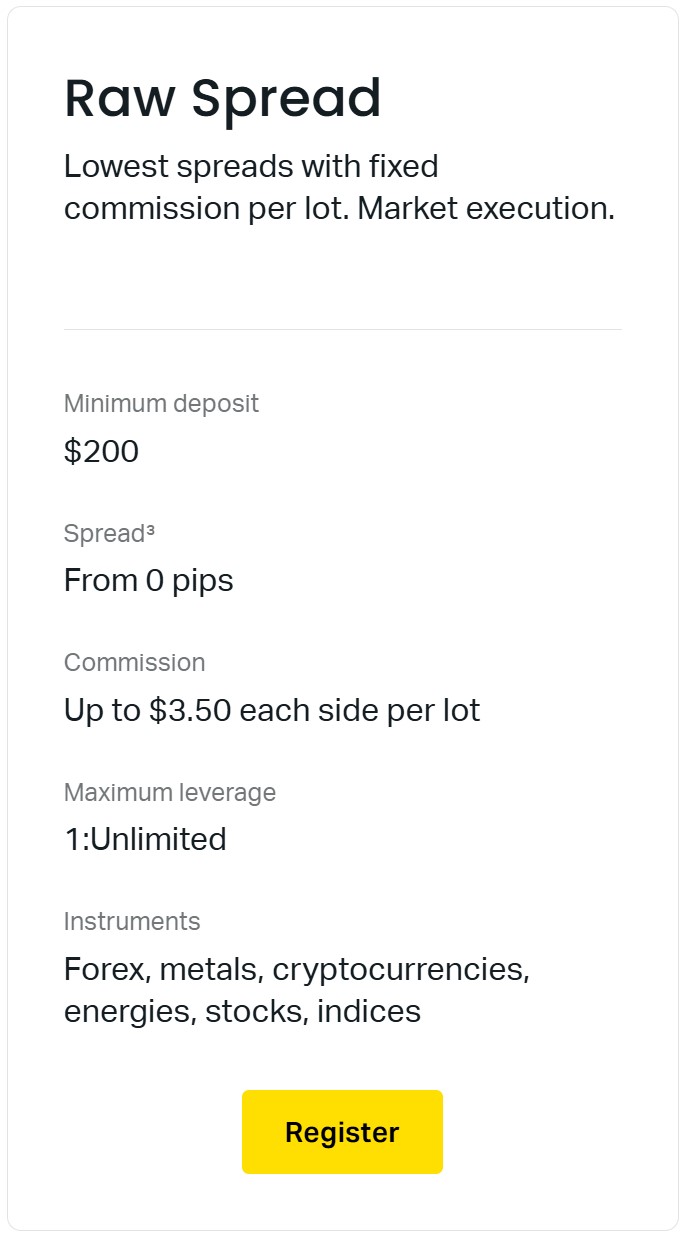

Understanding the Raw Spread Account

The Exness Raw Spread account is designed for experienced traders who demand the purest market prices and are comfortable paying commissions for their trades. This account type allows traders to access raw interbank prices, resulting in potentially substantial cost savings in favorable market conditions.

Key Features of the Raw Spread Account

One of the standout features of the Raw Spread account is its extremely tight spreads. Traders can benefit from direct access to the interbank market, where prices reflect the most competitive rates available.

Additionally, while this account type does not impose markup fees on spreads, traders should expect to pay a commission for each trade executed. This combination of low spreads and transparent commission structures promotes efficient trading, particularly for those who are active in the market.

Traders utilizing the Raw Spread account can also take advantage of higher leverage options, amplifying their potential gains (as well as their losses). Moreover, accessibility to major trading platforms, such as MetaTrader 4 and MetaTrader 5, ensures that traders can execute trades efficiently and benefit from advanced analytical tools.

1️⃣ Open Exness Raw Spread MT4 Account

2️⃣ Open Exness Raw Spread MT5 Account

Trading Conditions and Limitations

While the Raw Spread account provides appealing features, it comes with certain considerations. Active traders must account for commission payments that can significantly affect overall trading costs. For high-frequency traders, these commissions can accumulate rapidly, making it crucial to weigh transaction volume against the advantages of tight spreads.

Additionally, the Raw Spread account is primarily geared toward active traders. Those who engage in less frequent trading might find that the benefits of this account type do not translate into a significant edge over other account options.

Finally, it’s essential for traders to develop a clear understanding of spreads and commission structures. Accurate calculations can help traders avoid unexpected costs and optimize their trading strategies effectively.

Target Audience for the Raw Spread Account

The Raw Spread account is tailored for specific trader profiles, primarily targeting experienced individuals who possess a solid understanding of forex trading fundamentals and strategies. These traders are typically:

Scalpers and Day Traders: Individuals who execute numerous trades within short timeframes to capitalize on small price movements.

High Volume Traders: Traders who operate with large transaction volumes, significantly offsetting the impact of commissions through their strategy.

Professional Traders: Experienced participants in the forex market who prioritize liquidity and seek the purest market pricing for their trading operations.

Overall, the Raw Spread account suits those who actively engage in trading and require an environment conducive to realizing quick returns on investment.

Understanding the Zero Account

In contrast to the Raw Spread account, the Exness Zero account is designed for a broader range of traders, including beginners and those looking for a simplified trading structure. With this account type, traders enjoy fixed spreads, providing predictability and ease of understanding when it comes to trading costs.

Key Features of the Zero Account

A defining feature of the Zero account is its fixed spreads across various currency pairs, which eliminates commission fees associated with trade volumes. This translates into a straightforward pricing model that fosters transparency, especially beneficial for novice traders who may be intimidated by complex fee structures.

While fixed spreads may not be as tight as those offered by the Raw Spread account, they remain competitive across varying market conditions. The Zero account also offers flexible leverage options, allowing traders to align their strategies with their risk tolerance and capital availability.

Similar to the Raw Spread account, traders using the Zero account have access to advanced trading platforms like MetaTrader 4 and MetaTrader 5, empowering them with the tools necessary for effective execution and analysis.

3️⃣ Open Exness Zero MT4 Account

4️⃣ Open Exness Zero MT5 Account

Trading Conditions and Limitations

Despite its attractive features, the Zero account does come with limitations that traders should consider. First, the fixed spreads on the Zero account can be slightly wider than those seen in the Raw Spread account, which could impact profitability for certain trading styles.

Moreover, while the spreads are fixed, they can still fluctuate based on market conditions, particularly during periods of high volatility or economic news releases. Traders may want to keep an eye on these fluctuations, as they can affect the overall cost of executing trades.

The Zero account may not be ideal for high-frequency traders or scalpers aiming for ultra-tight spreads, but it remains an excellent choice for those who prefer simplicity and predictability in their trading costs.

Target Audience for the Zero Account

The Zero account caters to several trader profiles, including:

Beginner Traders: Newcomers to the forex market looking for a simple and transparent pricing structure without the added complexity of commissions.

Swing Traders and Position Traders: Traders who hold positions for more extended periods and place less emphasis on minute-to-minute price movements.

Scalpers with Lower Trade Volumes: Traders implementing a scalping strategy, albeit at a lower frequency, may find the Zero account provides a better fit compared to the Raw Spread account.

Ultimately, the Zero account serves those who value uncomplicated pricing models without the intricacies of commission structures, allowing them to focus on developing their trading skills.

Comparing Spread Costs

A crucial factor distinguishing the Raw Spread account from the Zero account lies in their spread structures. By evaluating their differences, traders can assess which account type aligns best with their trading strategies.

Raw Spreads vs. Zero Spreads

As mentioned earlier, the Raw Spread account provides extremely tight spreads, reflecting direct access to interbank pricing. In contrast, the Zero account offers fixed spreads, which, despite being slightly wider than Raw Spreads, promote stability in trading costs.

The performance of each account type hinges on market conditions. During periods of low volatility, where spreads tend to narrow, the Raw Spread account can offer lower overall costs per trade. However, in scenarios characterized by heightened volatility, the fixed spreads of the Zero account can become advantageous, as traders face consistent entry and exit costs regardless of market fluctuations.

Ultimately, a trader’s choice between Raw Spreads and Zero Spreads should take into account their trading frequency, volume, and preferred market conditions. Recognizing the circumstances where one spread structure shines over the other can lead to improved decision-making.

How Spreads Affect Trading Profitability

Spreads play an integral role in shaping a trader's overall profitability. A wider spread necessitates a larger price movement for the trader to generate profits, as the cost of entering and exiting a trade increases. Conversely, tighter spreads allow traders to profit from smaller price shifts, bolstering their edge in a highly competitive market.

The difference in a few pips can compound over multiple trades, resulting in significant impacts on total profits generated over a trading period. Hence, traders must carefully evaluate the spread structures offered by each account type and align them with their trading approaches.

Understanding how spreads affect break-even points and potential profits is vital for any trader seeking to optimize their strategies and enhance their experience in the forex market.

Commission Structures

Another critical aspect to consider when comparing the Raw Spread vs Zero Accounts is their respective commission structures. The implications of these charges can directly affect a trader's overall costs and profitability.

Commission Charges for Raw Spread Accounts

The Raw Spread account employs a straightforward commission structure based on the traded volume. Usually, a fixed commission rate applies to each currency pair, and this charge is incurred upon both opening and closing trades.

This transparency enhances efficiency for traders, allowing them to anticipate and calculate costs accurately. For high-frequency traders, managing commission expenses effectively can bolster overall profitability and facilitate smoother trading experiences.

Commission Charges for Zero Accounts

Conversely, the Zero account uniquely eliminates commission fees altogether. Therefore, traders do not incur additional costs based on their trade volume. Instead, the Zero account features slightly wider fixed spreads to compensate for the absence of commissions.

This structure proves advantageous for traders who prefer to bypass the complexities of commission calculations. However, it's important to evaluate how this affects overall trading costs, particularly if spreads widen during high volatility periods.

Impact of Commissions on Overall Trading Costs

Commissions can profoundly influence a trader's overall costs and profitability. High-volume traders or scalpers, in particular, need to consider the cumulative effect of commissions on their trading strategies. The impact of commissions can be particularly pronounced where spreads are already tight, leading traders to assess the balance between spread costs and commission rates.

By comparing the different accounts' spread costs and commissions, traders can determine which option offers the best value based on their individual trading style and volume.

Leverage Options Available

Leverage is a powerful tool in trading, allowing traders to amplify their exposure to the market with a fraction of the capital. However, it comes with inherent risks that traders must manage effectively.

Leverage for Raw Spread Accounts

The Raw Spread account provides access to high leverage options, enabling traders to enhance their potential returns significantly. This leverage can be particularly appealing for experienced traders who recognize the associated risks and have honed their risk management strategies.

With the ability to control larger positions with limited capital, traders can leverage market opportunities, aligning their strategies for maximum impact. Nonetheless, the potential for increased losses also underscores the importance of prudent risk management practices

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Leverage for Zero Accounts

Similarly, the Zero account also offers flexible leverage options, catering to a diverse range of trading strategies. New traders can leverage their accounts according to their comfort levels, promoting a gradual understanding of market dynamics without exposing themselves to excessive risk.

Regardless of the account type, traders must remain vigilant regarding leverage usage. While financial markets present opportunities for profit, improper use of leverage can lead to significant losses, reinforcing the necessity of sound risk management tactics.

Risks Associated with High Leverage

High leverage can be a double-edged sword, allowing traders to maximize gains but also posing the risk of magnifying losses. It is imperative for traders to maintain a disciplined approach and set appropriate stop-loss orders to mitigate potential adverse outcomes.

Additionally, new traders should exercise caution when venturing into leveraged trading, as even minor market fluctuations can result in considerable financial consequences. Ultimately, a balanced perspective on leveraging will enhance a trader's overall experience and foster sustainable growth.

Trading Platforms Offered

Trading platforms serve as the backbone of the trading experience, providing users with the necessary tools to analyze the market, execute trades, and monitor their investments efficiently.

Platforms Available for Raw Spread Account Traders

Traders using the Raw Spread account can access leading trading platforms such as MetaTrader 4 and MetaTrader 5. These platforms boast advanced charting capabilities, sophisticated technical indicators, and algorithmic trading options.

The user-friendly interface and customizable features cater to traders of all experience levels, empowering them to implement robust strategies effectively. Furthermore, traders can seamlessly switch between demo and live accounts to refine their skills without the pressure of real-money trading.

Platforms Available for Zero Account Traders

Similar to the Raw Spread account, Zero account holders can utilize MetaTrader 4 and MetaTrader 5, benefiting from the same advanced trading functionalities. Whether engaging in technical analysis or utilizing automated trading systems, both account types deliver a top-tier trading experience.

Moreover, the platforms are accessible on various devices, including desktop, web, and mobile applications, further enhancing flexibility and convenience for traders. Being able to trade on-the-go can be a game-changer for those whose schedules require adaptability.

User Experience and Functionality Comparison

While both account types provide access to the same platforms, the user experience may vary depending on individual preferences and trading styles. The intuitive design of the MetaTrader platforms allows traders to navigate easily and customize their layouts to optimize efficiency.

Ultimately, the choice of trading platform plays a significant role in determining a trader’s effectiveness. Identifying personal preferences in terms of functionality, tools, and overall experience can contribute to enhanced trading performance.

Market Access and Instruments

Market access and the variety of trading instruments available significantly influence a trader's ability to diversify their portfolio and capitalize on opportunities.

Available Trading Instruments for Raw Spread Accounts

The Raw Spread account provides access to a wide array of trading instruments, including forex pairs, precious metals, energies, indices, and cryptocurrencies. This diversity allows traders to construct tailored portfolios aligned with their risk appetites and trading strategies.

Furthermore, having access to raw interbank prices means that traders can explore various instruments without worrying about additional markups affecting their trading costs. This feature enhances the appeal of the Raw Spread account for those seeking to leverage liquidity across multiple asset classes.

Available Trading Instruments for Zero Accounts

The Zero account mirrors the same extensive range of trading instruments, offering traders ample opportunities to diversify their portfolios. From major currency pairs to emerging markets, traders can find instruments that suit their strategies and objectives.

However, the fixed spreads on the Zero account may slightly alter cost dynamics, particularly during volatile market conditions. Nevertheless, traders can still pursue a wide spectrum of opportunities while enjoying the simplicity of predictable pricing.

Market Access and Liquidity Considerations

Both account types ensure access to global markets, fostering liquidity and enhancing trade execution speeds. Such access is crucial for traders aiming to capitalize on price movements quickly.

Traders should also remain cognizant of market liquidity when choosing their instruments. Higher liquidity typically translates to tighter spreads and reduced slippage, contributing to more favorable trading conditions.

Customer Support Services

Customer support is a vital component of the trading experience, contributing to seamless interactions and prompt assistance whenever needed.

Support Options for Raw Spread Account Holders

Exness provides multiple support channels for Raw Spread account holders, including live chat, email, and telephone support. Traders can access assistance around the clock, ensuring they can resolve issues promptly, especially during critical trading periods.

The responsiveness and professionalism of the support team can significantly enhance a trader's experience, enabling them to focus on executing their strategies rather than navigating obstacles.

Support Options for Zero Account Holders

Similarly, Zero account holders benefit from the same comprehensive support services. Exness prioritizes customer service, ensuring that all clients receive timely and effective assistance regardless of their account type.

Whether encountering technical difficulties or needing clarification on trading conditions, traders can count on Exness’s dedicated support team for guidance.

Response Times and Service Quality

Evaluating the quality of customer support can help traders gauge the level of service they can expect. Exness has cultivated a positive reputation for its responsive support, with many users reporting expedient resolutions to inquiries.

Traders should feel confident knowing that robust support channels are in place, allowing them to address questions or concerns confidently as they navigate the complexities of the forex market.

User Feedback and Community Insights

User feedback and community insights provide valuable perspectives on the strengths and weaknesses of each account type, informing prospective traders about the experiences of others.

Reviews from Raw Spread Account Users

Users of the Raw Spread account often highlight the advantages of tight spreads and access to true market prices. Many experienced traders appreciate the transparency of commission structures and the ability to execute trades based on real-time data.

Nevertheless, some users express concerns regarding the cumulative nature of commission payments. Active traders with high transaction volumes sometimes find that commission costs can accumulate, impacting their overall profitability.

Reviews from Zero Account Users

Zero account users frequently commend the simplicity of fixed spreads and the absence of commissions. For beginner traders, the straightforward pricing model instills confidence and allows for a more manageable introduction to forex trading.

However, some users note that while fixed spreads offer predictability, they can be slightly wider than the raw spreads, occasionally limiting profit potential during specific market conditions.

Common Experiences and Trends

Across both account types, common themes emerge regarding user experiences. Many traders emphasize the importance of selecting the appropriate account based on individual trading styles and objectives.

Overall, the collective insights from users underscore the significance of conducting thorough research before settling on an account type, ensuring that traders align their choices with their unique preferences and risk profiles.

Pros and Cons of Raw Spread Account

Like any trading account, the Raw Spread account has its advantages and disadvantages that traders should consider before committing.

Advantages of Choosing Raw Spread

Extremely tight spreads: Access to raw interbank prices allows traders to exploit minimal price movements effectively.

Transparent commission structure: The clarity surrounding commission rates fosters cost awareness, enabling traders to strategize effectively.

High liquidity: Direct access to the interbank market enhances liquidity, reducing slippage during trade executions.

Disadvantages of Choosing Raw Spread

Commission costs: Traders must contend with commission fees that can accumulate for high-frequency trading.

Requires active trading: The benefits of the Raw Spread account are most impactful for those actively engaging in the market.

Complexity: Understanding commission structures and spreads may pose challenges for novice traders.

Pros and Cons of Zero Account

Similarly, the Zero account presents its own set of pros and cons that traders should evaluate as they make their decision.

Advantages of Choosing Zero Account

Fixed spreads: Predictable pricing simplifies the trading process, allowing traders to focus on strategy development.

No commission fees: Eliminating commission charges provides cost savings for traders, particularly for those with lower trading volumes.

Suitable for beginners: The straightforward pricing model appeals to newcomers seeking a simpler trading experience.

Disadvantages of Choosing Zero Account

Slightly wider spreads: Compared to Raw Spreads, fixed spreads may limit profit potential during certain market conditions.

Less suitable for high-frequency traders: The structure may not appeal to those relying on ultra-tight spreads for profit generation.

Potential variability: Although spreads are fixed, they can fluctuate during high volatility events, necessitating careful attention.

Read more: How to open a real account on Exness

Which Account is Right for You?

Determining the right account type requires careful consideration of individual trading goals, risk tolerance, and experience levels.

Factors to Consider When Choosing an Account

When deciding between the Raw Spread vs Zero accounts, traders should assess their trading styles, frequency of trades, and overall budget for commissions. Evaluating the impact of spreads and commissions on profitability can significantly influence this decision.

Additionally, personal preferences regarding platform usability, support quality, and access to instruments should also play a role in the selection process.

Ideal Profiles for Each Account Type

Raw Spread Account: This account is ideal for experienced and high-frequency traders seeking access to tight spreads and willing to embrace commission structures.

Zero Account: New traders and those preferring straightforward pricing without the complexities of commissions should gravitate toward the Zero account. Swing traders and position traders may also find this account type suitable due to its fixed pricing model.

Ultimately, recognizing personal trading objectives and aligning them with the unique features of each account type will pave the way for a more fruitful trading experience.

Conclusion

In the quest for successful trading, the decision between the Exness Raw Spread vs Zero Accounts is a critical one that hinges on individual preferences, trading strategies, and risk profiles.

The Exness Raw Spread vs Zero Account Review elucidates the key features, advantages, and limitations of both accounts, allowing traders to make informed decisions tailored to their unique needs.

By assessing aspects such as spread structures, commissions, trading conditions, and customer support, traders can align their choices with their goals and pave the way for enhanced trading performance. Ultimately, understanding the nuances of these accounts is instrumental in navigating the dynamic world of online trading successfully.💥 Trade with Exness now: Open An Account or Visit Brokers 🏆