11 minute read

Is Exness Regulated in Pakistan? Review Broker

from Exness

by Exness_Blog

In the world of forex trading, regulation is crucial to ensuring that brokers operate with integrity and transparency, providing a safe environment for traders to execute their trades. Many traders, especially in emerging markets like Pakistan, are increasingly concerned about whether the brokers they choose are regulated by trusted authorities. One such broker that has attracted attention in Pakistan is Exness, a global forex broker that provides access to the foreign exchange market and offers a wide range of trading tools and services. This article aims to address a fundamental question: Is Exness regulated in Pakistan?

We will explore Exness's regulatory status, the importance of trading with regulated brokers, and what it means for traders in Pakistan. By the end of this article, you will have a better understanding of Exness’s regulatory situation and how it impacts Pakistani traders. We will also explore alternative options and resources for finding regulated brokers in Pakistan.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Exness

Overview of Exness as a Forex Broker

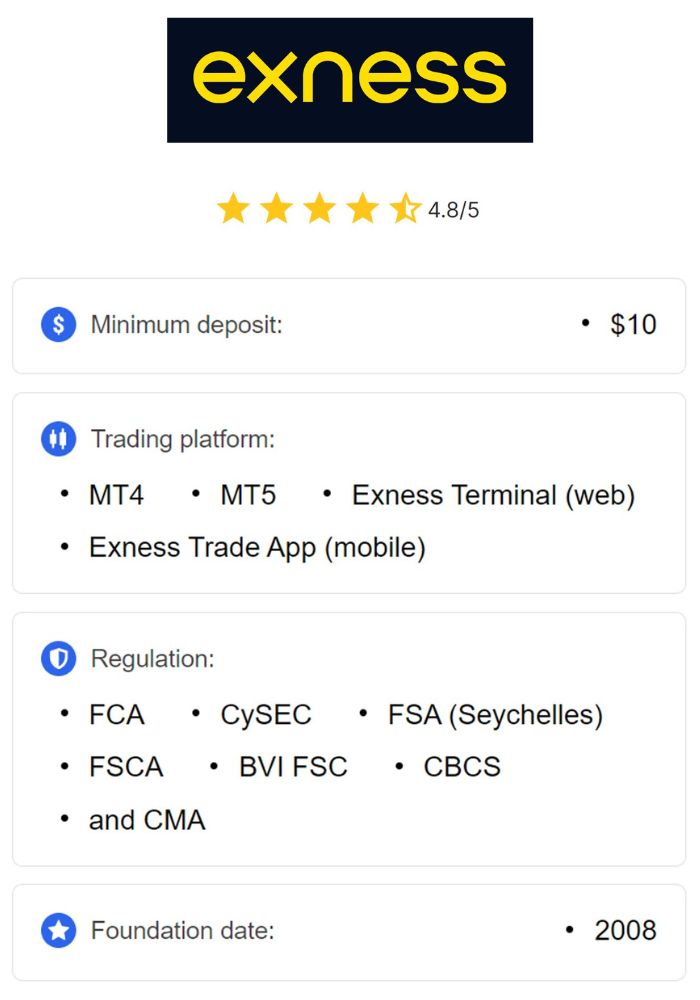

Exness is a well-established online forex and CFDs (Contract for Differences) broker, founded in 2008. Since its inception, Exness has gained a reputation for providing robust and user-friendly trading platforms, such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary Exness Trader. It caters to retail and institutional clients across the globe, offering a range of financial instruments for trading, including forex, commodities, indices, and cryptocurrencies.

What sets Exness apart from many other brokers is its commitment to transparency, competitive trading conditions, and accessible account types. The broker operates with a high level of customer service, offering multilingual support and a variety of educational resources. Exness also boasts low spreads, fast execution speeds, and no minimum deposit requirements for certain account types.

Services Offered by Exness

Exness offers a range of services aimed at both novice and experienced traders. The primary services include access to the forex market, where traders can trade major, minor, and exotic currency pairs. Additionally, Exness provides access to CFDs on commodities, stock indices, and precious metals, such as gold and silver.

The broker offers various account types, including standard accounts, professional accounts, and ECN accounts. Each account type caters to different levels of traders, with features like varying leverage, spreads, and commissions. Exness also provides a range of educational materials, including webinars, tutorials, and market analysis, which can be helpful for both new and seasoned traders.

Understanding Regulation in the Forex Market

The Importance of Regulation for Forex Brokers

Regulation is one of the most critical aspects of the forex market. It ensures that brokers operate in a fair and transparent manner, protecting traders from fraud, mismanagement, and unethical practices. Regulatory authorities enforce strict rules to ensure that brokers follow a set of industry standards and provide a safe trading environment for their clients.

For traders, choosing a regulated broker is crucial, as it guarantees that their funds are safeguarded in case the broker faces financial issues. Regulatory bodies also help resolve disputes between brokers and traders, providing a layer of protection in case of issues with trading conditions, withdrawals, or other contractual matters.

In addition to investor protection, regulation also promotes trust and confidence in the broker. It ensures that brokers provide accurate information about their services, maintain proper liquidity, and do not engage in manipulative practices.

Common Regulatory Authorities Worldwide

Forex brokers are typically regulated by financial authorities in their home countries or regions. Some of the most well-known regulatory bodies include:

FCA (Financial Conduct Authority) in the United Kingdom

ASIC (Australian Securities and Investments Commission) in Australia

CySEC (Cyprus Securities and Exchange Commission) in Cyprus

NFA (National Futures Association) in the United States

FSCA (Financial Sector Conduct Authority) in South Africa

These authorities impose stringent rules on forex brokers to ensure the safety and security of investors. For instance, the FCA and ASIC require brokers to maintain a minimum level of capital, segregate client funds from operational funds, and follow a code of conduct that prioritizes fair treatment of traders.

In addition to these major regulatory bodies, many brokers, including Exness, are also regulated in several other jurisdictions, allowing them to offer services globally while adhering to local laws and regulations.

Exness Regulatory Status

Licenses and Regulations Held by Exness

Exness operates with several regulatory licenses from various reputable financial authorities worldwide. The broker is licensed and regulated by:

Cyprus Securities and Exchange Commission (CySEC)

Financial Conduct Authority (FCA) in the UK

Seychelles Financial Services Authority (FSA)

These licenses ensure that Exness adheres to high standards of financial operations, client fund protection, and transparent business practices. As an EU-regulated broker, Exness is bound by strict EU financial regulations that protect clients' funds and ensure that the company adheres to ethical trading practices.

However, while Exness is well-regulated in many jurisdictions, there is no specific regulation for the broker in Pakistan at the moment. This means that, although Exness operates in compliance with global regulations, it does not fall under the jurisdiction of any Pakistani regulatory authority.

Comparison with Other Regulated Brokers

When compared to other brokers, Exness’s regulatory status is competitive, as it holds licenses from some of the most trusted authorities in the forex industry, including the FCA and CySEC. However, the lack of regulation in Pakistan means that Pakistani traders must exercise additional caution when trading with Exness.

Other brokers that are regulated in Pakistan include FXTM and OctaFX, which are registered with local authorities such as the Securities and Exchange Commission of Pakistan (SECP). These brokers may offer additional confidence to Pakistani traders because they operate under the direct oversight of local regulators, ensuring that traders have a recourse for disputes and issues with trading conditions.

The Regulatory Environment in Pakistan

Overview of Financial Regulation in Pakistan

In Pakistan, the Securities and Exchange Commission of Pakistan (SECP) is the primary regulatory authority for the financial markets, including the forex market. The SECP is responsible for regulating brokers, ensuring that they adhere to local laws, and providing a framework for investor protection.

Although the SECP regulates financial markets within the country, including the stock market, there is no specific regulatory framework in place for forex brokers operating in Pakistan. This creates a grey area for retail forex traders, as they may have to rely on international brokers who are regulated in other jurisdictions.

Key Regulatory Bodies in Pakistan

Securities and Exchange Commission of Pakistan (SECP): The SECP is the chief regulator for the financial markets in Pakistan. It is responsible for overseeing the capital markets, ensuring fair trading practices, and regulating brokers and financial institutions operating in the country.

State Bank of Pakistan (SBP): The SBP regulates banking and monetary policies, but it does not directly regulate forex trading. However, it does have policies in place regarding the remittance of foreign currency.

While the SECP regulates the local capital markets, there are currently no specific laws or regulations for forex brokers in Pakistan. This makes it even more important for traders to carefully assess brokers’ regulatory status before engaging in trading activities.

Is Exness Regulated in Pakistan?

Current Regulatory Status of Exness in Pakistan

Exness is not regulated in Pakistan. While the broker holds licenses in other jurisdictions, including Cyprus, the UK, and Seychelles, it does not have a specific regulatory license in Pakistan. This means that Pakistani traders do not have the protection of local regulations when trading with Exness.

The absence of local regulation could potentially expose traders to additional risks, as they cannot rely on the oversight of Pakistani financial authorities. However, traders can still access Exness’s services, but they should be aware that any disputes or issues may be more difficult to resolve due to the lack of local oversight.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Implications of Lack of Local Regulation

The lack of local regulation means that Pakistani traders who choose Exness as their broker may not have the same level of recourse as they would with a locally regulated broker. In the event of a dispute or issues with withdrawals, traders may have to rely on international channels to resolve the situation, which could be time-consuming and complex.

Moreover, without local regulation, traders cannot rely on the same investor protection measures that exist with regulated brokers in Pakistan. This highlights the importance of carefully considering the regulatory status of a broker before deciding to trade.

Benefits of Trading with Regulated Brokers

Investor Protection Measures

Regulated brokers are subject to stringent financial regulations that are designed to protect traders. These measures typically include the segregation of client funds, ensuring that traders' money is kept separate from the broker’s operational funds. Additionally, regulated brokers must maintain a minimum capital reserve to cover potential client claims, further ensuring the safety of client funds.

Moreover, regulated brokers are required to provide transparent trading conditions and have mechanisms in place for dispute resolution. In cases of fraud, mismanagement, or unethical behavior, traders can seek recourse from the regulatory authority that oversees the broker.

Transparency and Accountability

Regulated brokers are held to high standards of transparency and accountability. They must regularly report their financial standing and comply with audits conducted by regulatory authorities. This transparency allows traders to verify the broker’s operations and ensure they are dealing with a legitimate, trustworthy firm.

Moreover, regulated brokers are subject to strict conduct rules, which means that they must provide accurate information, advertise truthfully, and follow fair practices. This reduces the risk of scams and ensures that traders have a fair trading experience.

Risks of Trading with Unregulated Brokers

Potential for Fraud and Mismanagement

Trading with unregulated brokers can expose traders to various risks, including the potential for fraud, mismanagement, and unethical practices. Since there are no regulatory authorities overseeing the operations of the broker, there is no guarantee that the broker will operate in a fair and transparent manner.

Some unregulated brokers may engage in fraudulent activities such as manipulating price feeds, refusing withdrawals, or misappropriating client funds. Traders who choose unregulated brokers should be aware of these risks and exercise caution.

Legal Recourse Challenges

Without regulation, traders have limited legal recourse if they encounter problems with their broker. Unlike regulated brokers, where traders can file complaints with the relevant financial authorities, unregulated brokers may not have a dedicated dispute resolution process. This makes it harder for traders to recover their funds or resolve issues with the broker.

How to Verify Broker Regulation

Steps to Check the Regulation Status of a Broker

To verify a broker’s regulatory status, traders should:

Check the broker’s website: Regulated brokers typically display their licenses and regulatory bodies on their website. Traders can verify these details by visiting the website of the relevant regulatory authority.

Look for regulatory numbers: Licensed brokers often provide their regulatory registration numbers. Traders can use these numbers to confirm the broker’s license status with the regulatory body.

Read reviews and research: Researching reviews from other traders can provide insight into the broker’s reputation and compliance with regulations.

Resources for Finding Regulated Brokers

Traders can use the following resources to find regulated brokers:

Financial Conduct Authority (FCA) website

Cyprus Securities and Exchange Commission (CySEC) website

National Futures Association (NFA) database

These platforms provide comprehensive lists of regulated brokers, allowing traders to cross-check the status of any broker they are considering.

Alternatives for Pakistani Traders

List of Regulated Forex Brokers Available in Pakistan

While Exness is not regulated in Pakistan, several brokers operate with local regulations or licenses from well-known financial authorities. Examples of regulated brokers available in Pakistan include FXTM, HotForex, and OctaFX, which are licensed in jurisdictions such as Cyprus or the UK.

Pros and Cons of Using International Brokers

Using international brokers provides access to a wider range of trading platforms and financial instruments. However, trading with international brokers that are not regulated in Pakistan means traders may not have the same protections available with locally regulated brokers. Traders should weigh the benefits of global access against the risks of trading without local regulatory oversight.

Conclusion

While Exness offers a wide range of services and holds multiple regulatory licenses globally, it is not regulated in Pakistan. This means that Pakistani traders who choose Exness must understand the potential risks associated with trading with an unregulated broker in their local jurisdiction.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Traders should consider the benefits of trading with regulated brokers, such as enhanced protection and transparency, and weigh these against the potential challenges of using an unregulated broker. By carefully researching and verifying a broker’s regulatory status, traders can make more informed decisions about where to trade.

Read more: