15 minute read

Which Exness Account is best? Standard - Pro - Zero

from Exness

by Exness_Blog

When it comes to trading, the choice of account can significantly influence your experience and results. The question remains: Which Exness Account is best? This article will delve into the various accounts offered by Exness, providing a detailed examination of each type and guiding you through the selection process based on personal needs and trading strategies.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Exness Accounts

Exness is a well-regarded platform in the financial trading industry, offering a range of accounts tailored to different levels of expertise and trading preferences. Choosing the right account is crucial as it can determine the cost of trading, access to tools, and overall success in trading endeavors.

Overview of Exness as a Trading Platform

Exness has made a name for itself in the competitive world of online trading platforms by providing user-friendly systems with various features. Founded in 2008, Exness has grown to serve thousands of traders worldwide. The company operates under strict regulatory frameworks, ensuring that client funds are secure and transactions are handled transparently.

Traders can access hundreds of instruments, including forex pairs, commodities, cryptocurrencies, and indices. The platform also offers advanced trading tools and technologies, catering to both novice and experienced traders. With its commitment to customer service and innovative solutions, Exness stands out among other trading platforms.

Importance of Choosing the Right Account

Selecting the right trading account can be the difference between a successful trading journey or a frustrating one. Each account comes with unique features, spreads, leverage options, and commission structures that cater to different trading styles and investment strategies.

In this context, understanding the characteristics of each account type is essential for maximizing potential profits while minimizing risks. In the following sections, we will explore the various types of Exness accounts available and identify which one may suit your trading goals best.

Types of Exness Accounts

Exness provides several types of accounts designed to meet a diverse array of trading requirements. Understanding these account types will guide you toward choosing the best option for your trading journey.

Standard Account

The Standard Account is ideal for beginners or casual traders who prefer a straightforward trading experience.

This account type allows users to trade major currency pairs, commodities, and indices without complicated restrictions. It typically has fixed spreads, making it easier for new traders to understand potential costs associated with trading.

Moreover, the Standard Account comes with a low minimum deposit requirement, which makes it accessible for individuals just starting their trading careers. Another advantage is that it allows for multiple trading strategies, giving traders the flexibility they need as they grow and develop their skills.

Pro Account

For those looking for advanced trading capabilities, the Pro Account offers numerous benefits that can enhance one’s trading experience.

It features tighter spreads and access to additional trading instruments, appealing to more serious traders or those with a higher level of experience. The Pro Account is particularly beneficial for day traders and scalpers who rely on making quick trades based on small price movements, as even minor reductions in spreads can result in significant savings over time.

This account type also enables traders to utilize advanced trading tools and indicators, ultimately allowing for better-informed decisions and improved performance metrics.

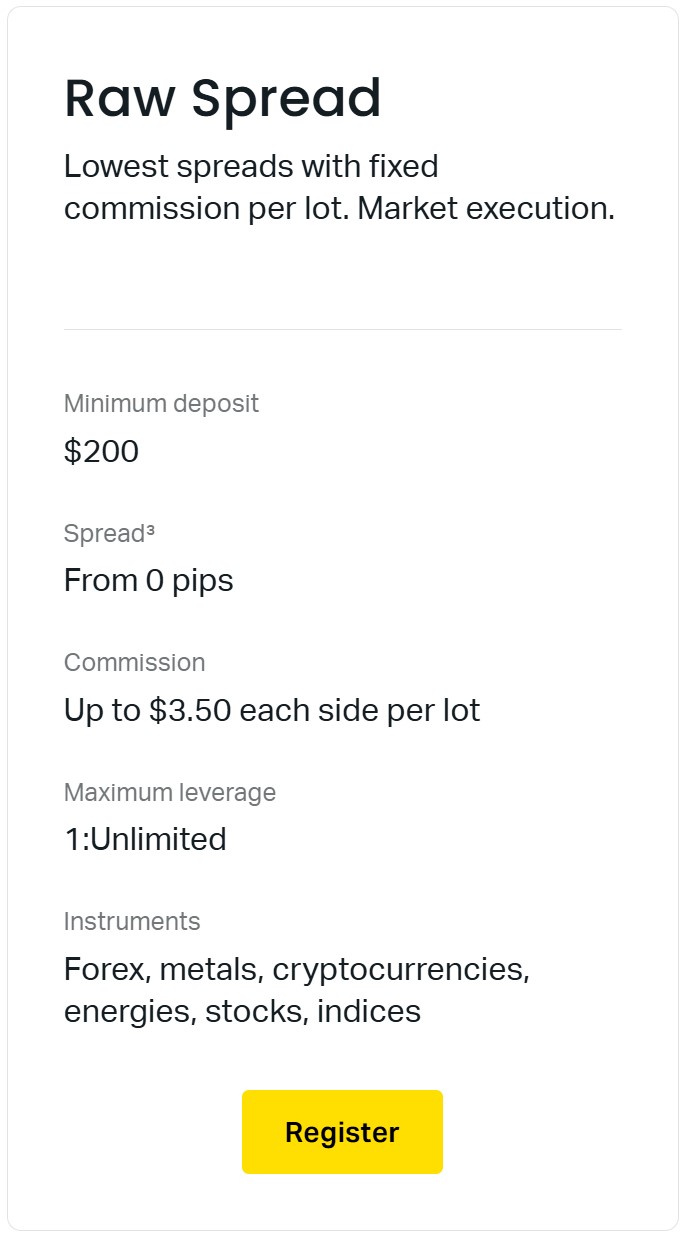

Raw Spread Account

The Raw Spread Account is tailored for experienced traders who seek ultra-low spreads for optimal trading conditions.

As the name suggests, this account provides access to raw spreads directly from liquidity providers, meaning traders can benefit from some of the tightest spreads in the market. However, it’s essential to note that while spreads may be lower, commissions are charged per trade, so traders must consider their overall costs carefully.

This account type is suited for traders who employ sophisticated strategies, such as algorithmic trading or high-frequency trading, where every pip counts towards profitability.

Zero Account

For traders who prefer a no-spread trading environment, the Zero Account could be an attractive option.

This account type offers zero spreads on selected instruments, thus eliminating one of the most common trading costs. However, it’s important to be aware that commission fees apply, which can impact overall trading costs.

The Zero Account is recommended for experienced traders who have a solid understanding of their trading strategies and can effectively manage the associated costs of commission-based trading.

Features of Each Exness Account Type

Each Exness account type comes with specific features that cater to varying trader needs. Let’s take a closer look at what each account offers.

Trading Conditions

Trading conditions differ across Exness accounts, impacting how trades are executed.

For instance, the Standard Account has fixed spreads, which can provide predictability for traders. In contrast, the Pro and Raw Spread Accounts offer variable spreads that can change based on market conditions, enabling skilled traders to capitalize on favorable price movements.

Understanding these conditions can lead to better decision-making when choosing the right account for your trading strategy.

Leverage Options

Leverage can amplify both gains and losses, making it a critical consideration when selecting an Exness account.

All Exness accounts provide various leverage options, allowing traders to control larger positions than their initial capital would allow. For example, beginner traders might find comfort in lower leverage levels, while seasoned traders may opt for higher leverage to maximize potential returns.

Choosing the appropriate leverage not only reflects your trading experience but also aligns with your risk tolerance and investment strategy.

Spreads and Commissions

The spread is the difference between the buying and selling price of a trading instrument, and it can vary significantly among the available accounts.

While the Standard Account operates on fixed spreads, the Pro Account tends to have lower variable spreads. In comparison, the Raw Spread Account features near-zero spreads, albeit with accompanying commission fees. Ultimately, understanding how spreads and commissions interplay can help you make informed cost-benefit analyses while trading.

Minimum Deposit Requirements

Different accounts have varying minimum deposit requirements, shaping accessibility for different traders.

The Standard Account generally requires a lower minimum deposit, making it perfect for novices. Conversely, the Raw Spread and Zero Accounts may require higher initial investments, which could deter beginner traders. Recognizing and understanding these requirements is crucial in determining which account fits your financial situation and trading ambitions.

Benefits of Using a Standard Account

The Standard Account can be a fantastic starting point for many traders, especially those new to the world of trading.

Ideal for Beginners

Beginners often face a steep learning curve when entering the trading arena.

The Standard Account's easy-to-navigate platform and simplistic structure help minimize confusion and stress for newcomers. With fixed spreads, novice traders can easily calculate potential costs, making budgeting and planning more manageable. Additionally, this account allows for a variety of trading strategies, which is advantageous for those still exploring their preferred styles.

1️⃣ Open Exness Standard MT4 Account

2️⃣ Open Exness Standard MT5 Account

User-Friendly Interface

One of the standout features of the Standard Account is its user-friendly interface.

Navigating complex trading platforms can be overwhelming for new traders, but Exness prioritizes user experience. The clean design and straightforward functionalities enable traders to execute orders, monitor their portfolios, and analyze market trends effortlessly. This ease of use fosters greater confidence, empowering beginners to explore the financial markets with less apprehension.

Advantages of the Pro Account

The Pro Account is an excellent option for traders who desire a more competitive edge in their trading activities.

Competitive Spreads

One of the most significant advantages of the Pro Account is its competitive spreads.

With low variable spreads, traders can benefit from more advantageous entry and exit points. This feature is particularly appealing for day traders and scalpers who rely on tight margins to achieve profitable outcomes. Lower spreads mean less slippage and reduced costs, ultimately paving the way for enhanced trading performance.

3️⃣ Open Exness Pro MT4 Account

4️⃣ Open Exness Pro MT5 Account

Access to Advanced Trading Tools

Another benefit of the Pro Account is access to advanced trading tools that cater to more experienced traders.

These tools can include sophisticated charting software, advanced technical indicators, and automated trading systems. Such resources equip traders to make informed decisions based on comprehensive market analysis, helping them enhance their strategies and overall performance.

Analyzing the Raw Spread Account

The Raw Spread Account provides an enticing opportunity for experienced traders seeking ultra-low spreads.

Understanding Raw Spreads

Raw spreads represent the true market prices, as they are sourced directly from liquidity providers.

By using this account, traders can gain access to some of the narrowest spreads available on the market. This feature can be especially advantageous for high-frequency traders who execute numerous trades throughout the day. Understanding the dynamics behind raw spreads can lead to better execution and ultimately improve profitability.

5️⃣ Open Exness Raw Spread MT4 Account

6️⃣ Open Exness Raw Spread MT5 Account

Ideal Conditions for Experienced Traders

The Raw Spread Account is specifically designed for those who have a firm grasp of trading concepts and strategies.

Experienced traders often possess the insights necessary to make swift decisions in fluctuating market conditions. This account type accommodates their demand for precision, allowing them to take advantage of market inefficiencies. Trading with a Raw Spread Account means that savvy traders can optimize their strategies and maintain a competitive edge in the market.

Exploring the Zero Account

The Zero Account offers a unique trading environment characterized by no spreads on select instruments.

No Spread Trading

One of the most appealing features of the Zero Account is the absence of spreads, enabling traders to enter and exit positions without the worry of spread costs.

This allows for potentially greater profit margins, especially for short-term traders and scalpers who execute multiple trades daily. However, traders should remain attentive to the commission structure, which can impact overall costs, especially during periods of high trading volume.

✅ Open Exness Zero MT4 Account

✅ Open Exness Zero MT5 Account

Costs Involved with Commission Fees

Although the Zero Account eliminates spreads, commission fees are a core aspect of this account type.

Traders should evaluate their strategies and frequency of trading to ascertain whether this account will ultimately prove beneficial. Understanding the balance between saved spread costs and commission fees is vital in determining whether the Zero Account aligns with individual trading approaches.

Factors to Consider When Choosing an Exness Account

Choosing the right Exness account hinges on several factors that align with your trading style, experience, and financial goals.

Trading Experience Level

Your experience level plays a fundamental role in determining which Exness account may suit you best.

Beginner traders might benefit from the Standard Account, which offers simplicity and a gentle introduction to trading dynamics. Meanwhile, experienced traders may gravitate towards the Pro, Raw Spread, or Zero Accounts, as these types cater to more advanced trading methods.

Recognizing your skill level allows for a more guided approach when exploring account options.

Capital Investment Capacity

Your financial capacity to invest can influence the choice of account significantly.

Standard Accounts usually have lower minimum deposit requirements, making them accessible for those with limited capital. Conversely, pro-level accounts often necessitate a higher initial investment, which may not be suitable for all aspiring traders. Assessing your investment capacity is vital in avoiding unnecessary financial strain while fostering a conducive trading environment.

Trading Strategy Alignment

Aligning your account choice with your trading strategy is essential for optimizing performance.

Consider the types of trades you plan to execute: do they favor longer-term positions or quick turnovers? Are you inclined towards scalping or swing trading? Each account type has distinct features that can either support or hinder your chosen strategy. Understanding how different accounts correlate with your trading style empowers you to make informed choices that lead to consistent results.

Comparison of Exness Accounts

A comparative analysis of the various Exness accounts can shed light on the differences that set them apart from one another.

Charting the Differences in Features

To make an informed decision, it's essential to compare the features of each account side by side.

Standard Account: Fixed spreads, suitable for beginners, lower minimum deposit.

Pro Account: Competitive variable spreads, advanced tools, designed for experienced traders.

Raw Spread Account: Ultra-low spreads, commission-based trading, aimed at high-frequency traders.

Zero Account: No spread on selected instruments, commission fees apply, ideal for experienced traders.

This concise overview allows traders to visualize how each account differs in key aspects, facilitating a smarter selection process.

Evaluating Performance Metrics

Performance metrics play a pivotal role when comparing the effectiveness of each account type.

Elements such as average execution speed, slippage rates, and overall profitability should be considered when evaluating accounts. For instance, the Raw Spread Account may excel in execution speed due to its direct connection to liquidity providers, while the Standard Account might provide slower execution times but simpler trading conditions.

Understanding these performance metrics can ultimately guide your choice of account, ensuring that you select an option that aligns with your trading objectives.

Customer Support and Resources

Having robust customer support and educational resources can significantly enhance the trading experience.

Availability of Educational Materials

Exness offers a wealth of educational materials, including webinars, tutorials, and articles on various trading topics.

These resources are invaluable for traders of all skill levels, as they provide insights into market trends, trading strategies, and risk management techniques. By engaging with these materials, traders can strengthen their knowledge base and boost their confidence, thereby improving their chances of success on the platform.

Responsiveness of Customer Service

Effective customer service is paramount in the trading realm, where timely assistance can mitigate potential issues.

Exness prides itself on its responsive customer support, which is readily available via chat, email, or phone. Knowing that reliable support is just a click away can provide peace of mind for traders, allowing them to focus on their trading strategies without the worry of unresolved concerns.

Regulatory Considerations

Regulatory considerations are crucial when selecting a trading platform, as they ensure the safety of funds and adherence to trading standards.

Safety of Funds

Exness operates under strict regulations, which safeguard client funds through tier-one banks and segregated accounts.

This practice ensures that traders' deposits are protected against potential insolvency issues, allowing traders to engage with confidence. Moreover, regulatory oversight enforces compliance, transparency, and ethical practices within the platform, further contributing to a secure trading environment.

Trading Regulations by Region

Exness operates in various regions around the globe, each with distinct trading regulations.

Understanding these regional differences is vital before opening an account. Traders should familiarize themselves with the rules and guidelines relevant to their jurisdiction since non-compliance can lead to complications down the line. Staying informed about local regulations empowers traders to operate within legal boundaries while enjoying a seamless trading experience.

User Experiences and Testimonials

User experiences and testimonials can provide valuable insights into what to expect when trading with Exness.

Positive Feedback from Traders

Many traders have expressed satisfaction with the Exness platform, praising its user-friendly interface, extensive educational resources, and responsive customer service.

Positive feedback often highlights the efficiency of order execution and the overall reliability of the platform. Additionally, the availability of various account types caters to different trading needs, proving beneficial for a diverse range of traders.

Common Complaints and Issues

While there is much positive feedback, some traders have raised concerns regarding specific aspects of Exness.

Common complaints often pertain to withdrawal processing times or issues with account verification. Addressing these concerns is vital for maintaining trust and credibility, as prompt resolutions can enhance the overall user experience. Understanding both sides of the coin allows prospective traders to make well-informed decisions.

How to Open an Exness Account

Opening an Exness account is a straightforward process.

Step-by-Step Registration Process

To get started, simply visit the Exness website and navigate to the registration page.

You will need to provide basic information such as your name, email, and phone number. Once registered, you will receive a confirmation link in your email. After confirming your email, you'll be directed to complete your profile and select your preferred account type.

Completing the registration process typically takes just a few minutes, making it easy for traders to begin their journey swiftly.

Verifying Your Account

Account verification is a crucial step in the onboarding process.

To verify your account, you will need to upload identification documents such as a passport or national ID, along with proof of address (e.g., utility bill or bank statement). Verification helps ensure the security of your account and complies with regulatory requirements.

Once your documents are reviewed and approved, you’ll gain full access to your Exness account and will be ready to start trading.

Conclusion

In conclusion, the question of Which Exness Account is best? varies greatly depending on individual trading styles, experience levels, and financial goals.

Each account type—Standard, Pro, Raw Spread, and Zero—has its unique features and benefits that cater to different needs. Understanding these differences is crucial for making an informed choice that aligns with your trading strategy.

Whether you’re a beginner looking for a simple entry point or an experienced trader seeking advanced tools, Exness offers a comprehensive suite of accounts designed to empower traders on their journey. By considering your trading experience level, capital investment capacity, and strategy alignment, you can navigate the selection process with confidence and ultimately enhance your trading success.

Read more: