17 minute read

How to trade Exness in INR: A Comprehensive Guide

from Exness

by Exness_Blog

When considering how to trade Exness in INR, it’s essential for traders, especially those in India, to understand the comprehensive features and benefits that come with this broker. This guide will delve into various aspects of trading with Exness, ensuring you are equipped with all the necessary knowledge to navigate the Indian forex market successfully.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Exness

In recent years, Exness has emerged as a prominent player in the online trading realm. With a commitment to providing an unparalleled trading experience, this brokerage caters particularly to retail traders around the globe.

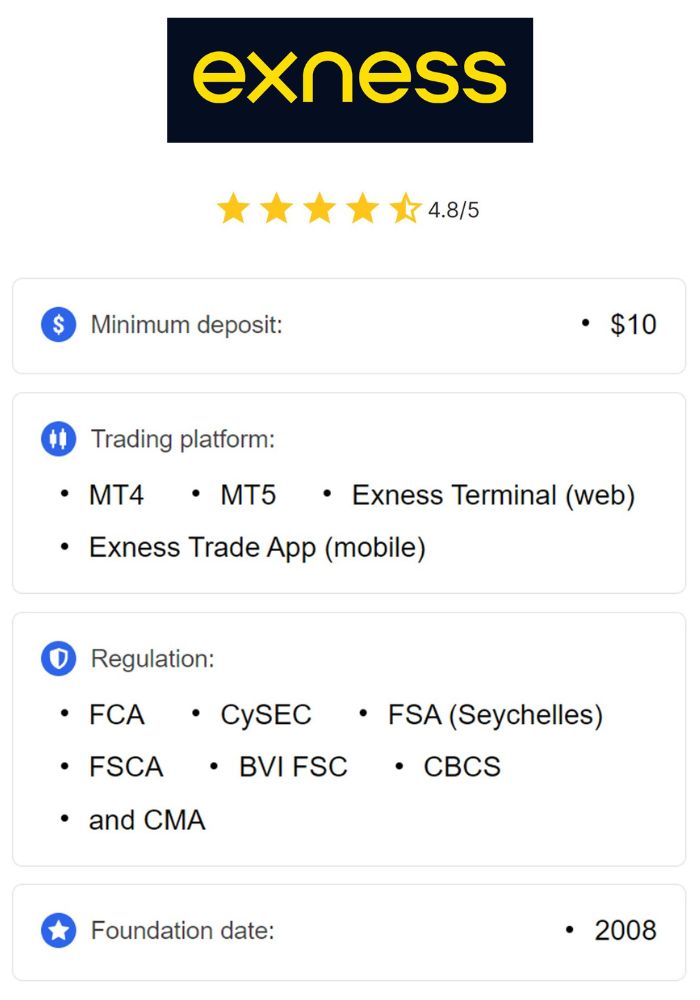

Overview of Exness Broker

Founded in 2008, Exness has built a solid reputation within the forex industry thanks to its diverse offerings and exceptional customer service. Operating under strict regulatory supervision, it provides a secure environment for traders of all levels.

Exness stands out in the crowded world of online brokers due to its user-friendly platforms, competitive spreads, and extensive asset classes. Traders can access various instruments, including forex, commodities, cryptocurrencies, indices, and shares. The broker's global reach ensures that clients from different regions can easily participate in international markets.

Key Features and Benefits of Trading with Exness

One of the key draws for traders choosing Exness is its low entry barriers. The broker offers a range of accounts suitable for both novice and professional traders, meaning anyone can start with a minimum deposit that fits their budget.

Moreover, Exness provides several trading platforms to accommodate different trading styles—from novice to expert. Coupled with robust educational resources and market analysis tools, Exness empowers traders to make informed decisions.

The provision for flexible leverage options further enhances trading potential. Traders can take advantage of high leverage ratios, allowing them to amplify their position sizes without needing substantial capital upfront.

Understanding the Indian Forex Market

To effectively trade Exness in INR, it's crucial to have a firm grasp of the Indian forex market. Understanding the nuances of local regulations, currency pairs, and market dynamics will put you in a better position to succeed.

Overview of Forex Trading in India

Forex trading in India primarily revolves around the exchange of currencies, aimed at profiting from changes in their values. The Indian Rupee (INR) is the primary currency traded against other currencies such as USD, EUR, and GBP.

Investors and traders participate in the forex market to hedge against currency risks, engage in speculative trading, or conduct international business transactions. Despite some restrictions on forex trading domestically, the market has grown significantly in recent years, mainly due to increased access to online trading platforms like Exness.

Regulatory Environment for Forex Trading in India

The Reserve Bank of India (RBI) governs forex trading in India, imposing certain regulations to protect investors. While trading in major currency pairs is permitted, trading in exotic and non-deliverable currencies is subjected to specific restrictions.

Additionally, the Securities and Exchange Board of India (SEBI) plays a role in regulating forex derivatives and ensuring transparency in the foreign exchange market. Traders need to familiarize themselves with these regulations, as operating outside of guidelines may result in penalties or account restrictions.

Setting Up Your Exness Account

Creating an Exness trading account is relatively straightforward, but it’s vital to follow the correct procedures to set yourself up for success.

Step-by-Step Account Registration Process

The registration process on Exness begins with visiting their official website. Here, potential traders can find the "Open Account" button prominently displayed. Upon clicking this, a registration form will appear, asking for basic details such as email and phone number.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

After inputting your information, you will receive a confirmation link via email, which must be verified to proceed with the setup. Following verification, traders can choose the type of account they wish to create—either a Standard or Pro account, depending on their trading style and preferences.

Verifying Your Identity and Documents

Once your account is created, Exness requires identity verification to comply with global KYC (Know Your Customer) standards. This involves submitting scanned copies of identification documents, which may include a government-issued ID, proof of address, and any relevant financial documentation.

This verification process typically takes a few hours, although it may vary depending on the volume of applications being processed. It’s essential to ensure that all submitted documents are clearly readable and meet the broker's requirements to avoid any delays.

Funding Your Exness Account in INR

Funding your Exness account in INR opens up broader avenues for trading. Understanding the available methods and fees associated with deposits will facilitate better financial management.

Available Deposit Methods for INR

Exness supports multiple deposit methods tailored for Indian traders, including bank transfers, e-wallets like Skrill and Neteller, and credit/debit cards. Each method has its own processing time and convenience level, so traders should choose based on their immediate needs.

Among these options, e-wallets usually provide the fastest transaction times, allowing traders to fund their accounts almost instantly. Conversely, bank transfers might take longer but are an attractive option for larger sums of money.

Understanding Currency Conversion Fees

When funding your Exness account in INR, it’s vital to keep an eye on potential currency conversion fees, especially if you decide to trade in other currencies. These fees can eat into your profits over time, so selecting deposit methods that minimize conversion costs is crucial for cost-effective trading.

Traders are encouraged to review Exness’s fee structure carefully, as well as any charges imposed by payment processors, to gain a clear understanding of how much capital they will actually have available for trading.

Choosing the Right Trading Platform

Selecting a suitable trading platform is a significant aspect of your trading journey. Exness offers various platforms to cater to different trader preferences and technological accessibility.

Overview of Exness Trading Platforms

Exness provides access to several trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms boast user-friendly interfaces, advanced charting capabilities, automated trading options, and compatibility with various devices.

MT4 is particularly popular among forex traders due to its extensive library of indicators and expert advisors, making it ideal for algorithmic trading. Meanwhile, MT5 offers additional functionalities, such as more timeframes and extended reporting features, appealing to traders interested in analyzing complex market data.

Mobile vs. Desktop Trading Platforms

As the demand for mobile trading grows, Exness ensures that traders can access their accounts seamlessly across devices. The mobile version of MT4 and MT5 retains many desktop features, allowing users to monitor positions, execute trades, and analyze charts on the go.

Desktop platforms tend to offer more extensive analytical tools and a larger screen for detailed charting. However, the mobile app provides flexibility, enabling traders to capitalize on market opportunities anytime and anywhere.

Types of Trading Accounts Offered by Exness

Understanding the different types of trading accounts offered by Exness is vital in determining which one aligns with your trading goals.

Standard vs. Pro Accounts

Exness features two primary account types: Standard and Pro accounts. The Standard account is designed for beginner traders, offering lower spreads and no commission on trades. This account is optimal for those who prefer simplicity and a straightforward trading experience.

On the other hand, Pro accounts are geared towards experienced traders who require deeper liquidity and lower spreads. These accounts typically attract commissions based on the volume traded, making them suitable for high-frequency or scalping strategies.

ECN Accounts Explained

Exness also offers ECN accounts, which provide direct market access to institutional liquidity providers. Traders using this account benefit from raw spreads and minimal slippage, making it ideal for professional traders seeking to execute large volumes quickly.

However, while the advantages of ECN accounts are evident, they do come with a higher requirement for initial deposits and may not be suitable for beginners still finding their footing in trading.

Understanding Leverage and Margin

Effective use of leverage can greatly enhance your trading potential, but it’s crucial to understand how it operates within the context of forex trading.

What is Leverage in Forex Trading?

Leverage refers to the ability to control a larger position size with a smaller amount of capital. Exness offers high leverage ratios, often reaching up to 1:2000, depending on the account type and financial instrument being traded.

While leverage can amplify profits, it also heightens risk. Therefore, traders must exercise caution, utilizing leverage judiciously to prevent significant losses.

Calculating Margin Requirements

Margin represents the amount of capital required to open and maintain a leveraged position. Understanding margin calculations is critical for effective risk management in forex trading.

For instance, with a leverage of 1:100, a trader only needs to deposit 1% of the total position value as margin. However, should the market move unfavorably, the margin can be depleted quickly, potentially leading to a margin call. Traders must know their margin requirements and maintain adequate funds in their accounts to avoid liquidation of their trades.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Developing a Trading Strategy

A well-defined trading strategy acts as a roadmap for traders navigating the dynamic forex landscape.

Importance of a Trading Plan

Having a trading plan is paramount for success in forex trading. It serves as a guiding principle to help traders stay disciplined amidst market volatility. A comprehensive trading plan should encompass entry and exit strategies, risk management techniques, and clear objectives.

By adhering to a trading plan, traders can avoid emotional decision-making and impulsive trades—all common pitfalls in the unpredictable world of forex. Regularly revisiting and refining your plan based on performance analysis can lead to continuous improvement.

Popular Trading Strategies for Beginners

Several trading strategies can benefit beginners looking to establish a foothold in the forex market. One popular strategy is trend following, where traders identify prevailing market trends and align their positions accordingly.

Another strategy is range trading, characterized by identifying support and resistance levels. This strategy allows traders to buy at lower price points and sell at higher ones, maximizing profit potential during sideways market movements.

Combining both approaches can yield effective results, with traders able to adapt their strategies based on current market conditions.

Technical Analysis in Forex Trading

Technical analysis is a fundamental aspect of forex trading that involves studying historical price movements to forecast future trends.

Key Indicators Used in Technical Analysis

Various technical indicators can assist traders in making informed decisions. Some widely used indicators include moving averages, Relative Strength Index (RSI), and Bollinger Bands.

Moving averages smooth out price data to identify trends, while RSI helps determine overbought or oversold conditions in the market. Bollinger Bands indicate market volatility and can signal potential reversals or breakouts.

Understanding how to interpret these indicators can empower traders to spot opportunities and develop entry and exit points.

Chart Patterns Every Trader Should Know

Recognizing chart patterns is essential for effective technical analysis. Some common chart patterns include head and shoulders, double tops and bottoms, and flags and pennants.

These formations can provide insights into potential market reversals or continuations, aiding traders in anticipating price movements. The key lies in combining these patterns with other analytical tools to build a comprehensive trading strategy.

Fundamental Analysis and Its Role

While technical analysis is vital for short-term trading, understanding fundamental analysis is equally important for assessing long-term trends.

Economic Indicators Impacting Forex Markets

Fundamental analysis focuses on economic indicators that can influence currency values. Key indicators include Gross Domestic Product (GDP), unemployment rates, inflation data, and interest rate decisions made by central banks.

By monitoring these indicators, traders can gain insights into economic health and anticipate potential currency fluctuations. Being aware of scheduled economic releases and news events is crucial for successful trading strategies.

News Trading and Its Relevance

News trading is a popular approach where traders exploit market volatility created by significant news events. Global economic reports, central bank announcements, and geopolitical developments can drastically impact currency prices.

Traders engaging in news trading should prepare by having a clear strategy, as the rapid changes in prices during news releases can lead to both opportunities and risks. Planning for potential outcomes gives traders a better chance of capitalizing on market moves while managing risk appropriately.

Risk Management Techniques

Success in trading hinges not just on generating profits, but also on managing risks effectively.

Importance of Risk Management

Risk management entails implementing strategies to minimize potential losses while maximizing chances of profitability. Effective risk management protects capital, allowing traders to remain active in the market despite inevitable downturns.

A common rule is to risk no more than a small percentage of your total trading capital on each trade. By understanding personal risk tolerance, traders can make calculated decisions about position sizing and stop-loss orders.

Common Risk Management Strategies

Several risk management strategies can help safeguard your trading portfolio. One of the most effective techniques is implementing stop-loss orders, which automatically close a trade once a predetermined price level is reached.

Another approach is diversifying your trading portfolio by investing in different currency pairs or asset classes. This minimizes exposure to any single position and spreads risk across multiple instruments.

Regularly reviewing both winning and losing trades can aid in refining risk management practices, helping traders identify areas for improvement.

Placing Your First Trade on Exness

With all the knowledge gained, placing your first trade on Exness might feel daunting yet exciting.

Navigating the Trading Interface

Exness’s trading interface is designed with simplicity in mind, making it accessible even for beginners. After logging into your account, you'll encounter a dashboard displaying various asset classes, market quotes and performance graphs.

Familiarizing yourself with the interface should be your first step. Take time to explore features like market analysis tools, order placement options, and trade history to ensure you're comfortable before executing your first trade.

Executing Market Orders vs. Pending Orders

When placing trades, traders can opt for either market orders or pending orders. A market order executes immediately at the current market price, ideal for those looking to enter the market swiftly.

Conversely, pending orders allow traders to set specific price levels at which they want to enter or exit trades. This feature is particularly useful for capturing market movements without having to monitor positions constantly.

Monitoring and Adjusting Trades

Once trades are placed, ongoing monitoring is vital to adapt to changing market conditions.

Utilizing Stop Loss and Take Profit

Implementing stop-loss and take-profit orders is crucial for managing risk and securing profits. A stop-loss order limits potential losses by automatically closing trades when a specified loss threshold is reached.

Similarly, a take-profit order locks in profits by closing a trade once a target profit level is achieved. Together, these tools allow traders to manage their positions effectively without needing constant supervision.

When to Close a Trade

Determining the right time to close a trade is essential for maximizing potential returns. Traders should consider factors such as market sentiment, technical analysis signals, and upcoming economic events before deciding to exit a position.

Establishing a clear exit strategy as part of your trading plan can help eliminate emotional biases and improve overall trading performance.

Leveraging Tools and Resources from Exness

Exness goes beyond just offering trading platforms; it provides a variety of tools and resources that can enhance a trader’s experience.

Educational Resources for Traders

Exness recognizes the importance of education in developing successful traders. The broker offers a wealth of educational materials, including webinars, video tutorials, articles, and eBooks covering various aspects of forex trading.

These resources cater to traders of all skill levels, empowering them to build their knowledge and skills. Engaging with educational content can lead to improved trading strategies and greater confidence in executing trades.

Using Analytical Tools Provided by Exness

Analytical tools are indispensable for traders seeking to gain an edge in the market. Exness provides comprehensive market analysis, economic calendars, and real-time news updates to keep traders informed.

By integrating these tools into your trading routine, you can make data-driven decisions that contribute to more successful trading outcomes.

Withdrawal Process from Exness in INR

Understanding the withdrawal process is crucial for ensuring that profits are efficiently converted back into your local currency.

Available Withdrawal Methods

Exness offers several withdrawal methods for Indian traders, including bank transfers, e-wallets, and credit/debit card withdrawals. Selecting your preferred method may depend on factors like convenience, processing speeds, and fees involved.

It’s advisable to familiarize yourself with each withdrawal option, as they may have varying processing times and limits on withdrawal amounts.

Processing Times and Fees

Withdrawal processing times can differ significantly based on the chosen method. While e-wallets typically provide near-instant processing, bank transfers may take several business days.

Traders should also be aware of potential fees associated with withdrawals, as these can vary depending on the method and may impact overall profitability. Reading through Exness's fee schedule will shed light on applicable charges.

Exploring the Exness Affiliate Program

For those looking to expand their involvement in the forex market, becoming an affiliate can present lucrative opportunities.

Benefits of Joining the Exness Affiliate Program

The Exness Affiliate Program allows individuals to earn commissions by referring new traders to the platform. Affiliates can enjoy generous commission structures, promotional materials, and dedicated support from the Exness team.

Engaging with the affiliate program is an excellent way for traders to supplement their income while sharing their passion for trading with others.

How to Get Started as an Affiliate

Getting started as an Exness affiliate is straightforward. Interested individuals need to register for the affiliate program through the Exness website. Once approved, affiliates can access marketing materials and start promoting their referral links.

Consistent engagement with your audience and providing valuable insights can increase the likelihood of attracting new traders to the platform. Success in the affiliate program hinges on building trust and credibility among your referrals.

Common Challenges Faced While Trading

Trading in the forex market can be rewarding but also presents challenges that traders must navigate.

Emotional Trading and Its Pitfalls

Emotional trading is a common challenge faced by many traders, often leading to impulsive decisions. Fear and greed can cloud judgment, causing traders to deviate from their established plans.

To mitigate emotional trading, traders should cultivate discipline and stick to their strategies. Developing a routine for monitoring and adjusting trades can help maintain focus and reduce the influence of emotions on trading decisions.

Dealing with Market Volatility

Market volatility can create uncertainty, making it difficult to predict price movements. Sudden fluctuations can trigger unwanted losses and stress for traders.

To cope with volatility, traders can employ risk management strategies, such as setting wider stop-loss orders or avoiding high-risk trades during periods of uncertainty. Staying informed about market developments can also help traders anticipate potential shifts in volatility.

Frequently Asked Questions about Trading with Exness

As with any trading platform, new traders often have questions regarding how to trade effectively using Exness.

Clarifying Misconceptions about Forex Trading

Forex trading is often surrounded by misconceptions, such as it being akin to gambling or only accessible to wealthy individuals. In reality, forex trading is a legitimate financial activity that involves strategic analysis, risk management, and market participation.

Educating yourself about the realities of forex trading can dispel these myths and foster a healthy view of the market.

Addressing Common Concerns of New Traders

New traders often express concerns about issues such as broker reliability, safety of funds, and market unpredictability. To alleviate these concerns, it’s essential to select a reputable broker like Exness, which operates under strict regulatory frameworks and prioritizes client security.

Additionally, new traders should recognize that losses are a natural part of trading and focus on learning from experience rather than fearing failure.

Conclusion

Navigating the world of forex trading with Exness in INR can be a rewarding endeavor with the right knowledge and preparation. By understanding the intricacies of account setup, funding, market analysis, and risk management, you can elevate your trading experience.

Utilizing the extensive resources offered by Exness, combined with a well-defined trading strategy, can significantly enhance your chances of success in the forex market. Remember to continually educate yourself, adapt to evolving market conditions, and practice disciplined trading for the best results.

Read more: