19 minute read

Exness Account Opening India: A Comprehensive Guide

from Exness

by Exness_Blog

Exness Account Opening India is an important topic for traders looking to navigate the financial markets with a reliable platform. As one of the prominent brokerage firms in the online trading sphere, Exness provides various account options to cater to distinct trading styles and preferences. Understanding how to open an Exness account in India can empower traders to take advantage of global market opportunities effectively.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Exness

Exness has emerged as a well-regarded brokerage firm, known for its commitment to providing traders with tools and resources that enhance their trading experience. With a user-friendly platform and competitive trading conditions, Exness has gained traction among both novice and experienced traders worldwide.

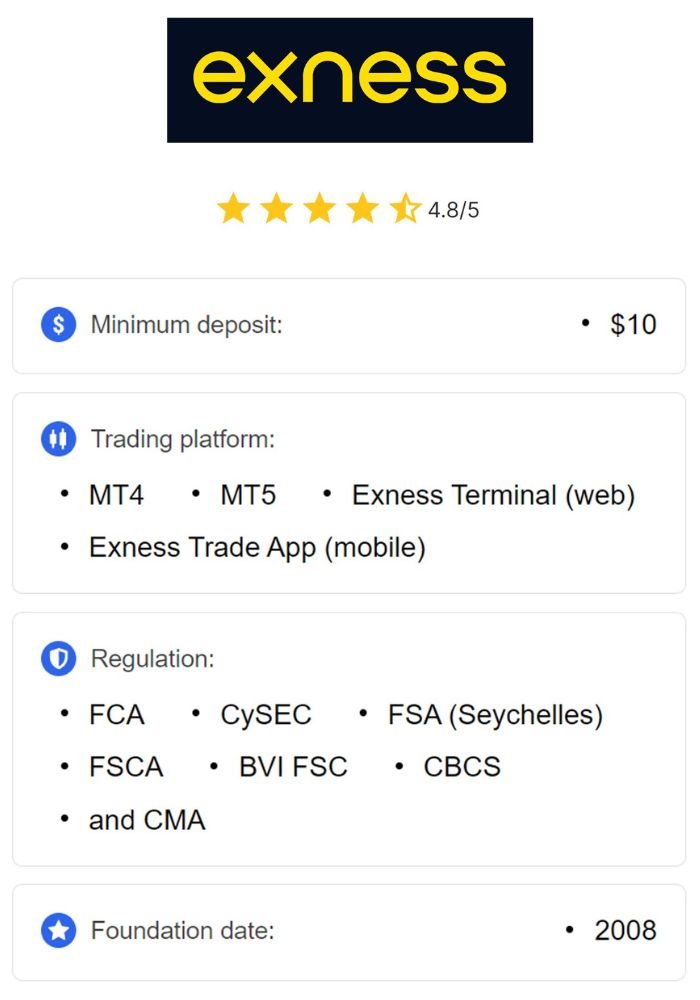

Overview of Exness as a Brokerage Firm

Founded in 2008, Exness has built a reputation for transparency and innovation in the online trading industry. The firm offers access to a wide range of financial instruments, including forex, commodities, indices, and cryptocurrencies. The company operates under a unique business model that allows it to maintain low spreads and high leverage, making it an attractive option for traders looking to maximize their profits.

One of the key strengths of Exness is its dedication to customer satisfaction. The firm has developed a robust client support system and provides extensive educational resources to help traders improve their skills. This combination of features positions Exness as a go-to broker for anyone interested in trading.

Regulatory Compliance and Security Measures

Exness understands the importance of regulatory compliance and operates within stringent guidelines set by financial authorities. The firm is regulated by multiple entities, including the Financial Services Authority (FSA) in Seychelles and the Cyprus Securities and Exchange Commission (CySEC). These licenses ensure that Exness adheres to international standards, promoting a secure trading environment.

Safety is a top priority for Exness. The firm employs various security measures to protect client funds and personal information. This includes segregating client deposits from operational funds and using bank-level encryption technologies to safeguard data transmission. Such practices instill confidence in traders, knowing their investments are in safe hands.

Importance of an Online Trading Account

An online trading account serves as a gateway to the financial markets, enabling traders to execute trades, manage their portfolios, and analyze market trends. Given the dynamic nature of trading, having a reliable account is crucial for success.

Advantages of Online Trading

Online trading has revolutionized how individuals participate in the financial markets. Unlike traditional methods, online trading facilitates instant access to real-time market data, allowing traders to respond quickly to price movements. Moreover, the convenience of trading from anywhere at any time has made it increasingly popular among investors.

Another significant advantage of online trading is the availability of advanced tools and resources. Traders can utilize technical analysis, charting software, and automated trading systems to make informed decisions. Access to these tools can significantly enhance a trader's ability to forecast market trends effectively.

The Role of a Broker in Online Trading

Brokers act as intermediaries between traders and the financial markets. Their primary function is to provide access to trading platforms where clients can execute buy and sell orders. A reputable broker like Exness ensures a seamless trading experience and offers features such as competitive spreads, leverage options, and an extensive selection of trading instruments.

Furthermore, brokers often provide educational materials and support to help traders enhance their skills. This holistic approach can be particularly beneficial for beginners who are still navigating the complexities of trading.

Eligibility Criteria for Opening an Exness Account in India

Opening an Exness account in India requires meeting specific eligibility criteria to ensure compliance with both local laws and international regulations. Prospective traders must understand these requirements to facilitate a smooth account opening process.

Age Requirements

To open an account with Exness, applicants must be at least 18 years old. This age requirement aligns with legal standards governing financial transactions in most jurisdictions. By ensuring that only adults participate in trading activities, Exness promotes responsible trading practices.

For those under the age of 18, it is advisable to wait until reaching the legal age or consider involving a parent or guardian in managing the account until they reach adulthood. This helps to ensure that trading activities are conducted responsibly and within the bounds of the law.

Identification Documents Needed

To verify identity and ensure compliance with anti-money laundering regulations, Exness requires traders to submit identification documents during the account opening process. Typically, applicants need to provide a government-issued ID such as a passport or national identification card, along with proof of address, which could include utility bills or bank statements.

Having these documents prepared ahead of time can simplify the registration process. It's essential for traders to ensure that all submitted documentation is clear and legible, as this will expedite the verification process.

Types of Accounts Offered by Exness

Exness caters to a diverse clientele by offering various types of trading accounts designed to meet the needs of different traders. Understanding these account types is vital for choosing the right one that aligns with your trading strategy.

Standard Account

The Standard Account is an ideal choice for beginner traders seeking a straightforward trading experience. With no commissions on trades and relatively low spreads, this account type provides an accessible entry point into the world of online trading. Additionally, the Standard Account allows for flexible leverage options, catering to individual risk tolerance levels.

This account type also supports a wide range of trading instruments, providing users with ample opportunities to diversify their portfolios. Beginners can benefit from the simplicity of this account while learning the mechanics of trading without overwhelming complexity.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Pro Account

For more experienced traders, the Pro Account offers enhanced features to accommodate advanced trading strategies. This account type typically boasts tighter spreads and lower commission rates, making it suitable for those who engage in high-frequency trading. Furthermore, the Pro Account provides access to additional liquidity, ensuring quicker execution of trades.

Traders using the Pro Account can benefit from sophisticated tools and resources, empowering them to conduct thorough market analyses and execute complex trading strategies. This account is tailored for those who demand precision and flexibility in their trading operations.

See more: Exness Standard vs Pro Account Review

Cent Account

The Cent Account is designed for traders who prefer to start small while gaining hands-on experience in the market. This account type allows traders to deposit and trade in cents rather than dollars, making it possible to test strategies and learn about trading dynamics with minimal financial risk.

The Cent Account is particularly advantageous for new traders who want to experiment with different trading strategies without committing significant capital. It provides a risk-managed environment where users can build confidence before transitioning to larger accounts.

Step-by-Step Guide to Opening an Exness Account

Opening an Exness account might seem daunting initially, but following a straightforward process can simplify the experience. By understanding each step involved, traders can efficiently establish their accounts and start trading.

Visiting the Exness Website

The first step in opening an Exness account is visiting the official Exness website. The website is user-friendly and offers easy navigation to the registration section. Before proceeding, potential traders should familiarize themselves with the available account types and choose one that suits their trading needs.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Once on the website, traders can find valuable resources, including tutorials and articles, that can assist them in understanding the trading process better. Engaging with these educational materials can enhance their knowledge base before diving into actual trading.

Filling Out the Registration Form

After selecting the desired account type, traders can proceed to fill out the online registration form. This form typically requires personal information such as name, email address, phone number, and country of residence. It’s crucial to provide accurate information, as any discrepancies may lead to delays in the verification process.

Additionally, traders may need to create a secure password for their account. Choosing a strong password that incorporates a mix of letters, numbers, and special characters is advisable to enhance security.

Email Verification Process

Following the completion of the registration form, traders will receive a confirmation email from Exness containing a verification link. Clicking this link initiates the email verification process, confirming that the provided email address is valid and accessible.

Successful email verification ensures that traders have full access to their accounts and can begin depositing funds and executing trades. If the email is not received promptly, traders should check their spam or junk folders or request a resend from the Exness support team.

Providing Required Documentation

Once the email verification is complete, traders must submit the necessary identification documents for account verification. This step is vital for compliance with regulatory standards and to secure the trading environment.

Traditionally, traders will need to upload a copy of their government-issued ID and proof of residency. After submitting the documents, the verification process usually takes a short time, depending on the volume of applications being processed. Promptly submitting clear and accurate documents can facilitate a smoother verification experience.

Choosing the Right Account Type

Selecting the right account type is critical in determining the trading experience and overall success. Traders should carefully consider their individual goals, risk appetite, and level of expertise when making this decision.

Factors to Consider

When choosing an account type, several factors come into play. First and foremost is the trading experience level; beginners may find standard accounts more approachable, while seasoned traders might prefer pro accounts for their advanced features.

Additionally, the trader's preferred trading style can dictate the choice of account. For instance, long-term investors may prioritize low spreads and commissions, while day traders might focus on rapid execution speeds and minimal slippage. Understanding these nuances can guide traders toward an account that aligns with their specific trading approach.

Comparing Features of Different Accounts

Traders should take the time to compare the features associated with each account type offered by Exness. Key considerations include spread sizes, commission structures, leverage options, and available trading instruments. Each account type offers unique benefits tailored to specific trading strategies.

By understanding the differences between account types, traders can make an informed decision that enhances their trading experience. Account comparisons allow prospective traders to weigh the advantages and disadvantages relative to their trading objectives.

Understanding Exness Trading Platforms

Navigating through the available trading platforms is essential for a successful trading experience. Exness supports a variety of platforms, each designed to cater to different trading preferences and skill levels.

MetaTrader 4 (MT4)

MetaTrader 4 is one of the most popular trading platforms globally, known for its advanced charting capabilities and automated trading features. The platform allows traders to implement various technical indicators, thereby enhancing their market analysis. Its user-friendly interface makes it accessible to beginners while still offering the sophistication needed for experienced traders.

MT4 supports algorithmic trading, enabling traders to automate their strategies through the use of Expert Advisors (EAs). This feature is particularly appealing to those looking to capitalize on market opportunities around the clock without constant monitoring.

MetaTrader 5 (MT5)

MetaTrader 5 is the successor to MT4 and offers additional features and improved functionality. While retaining the core attributes of its predecessor, MT5 introduces new order types and advanced analytical tools. The multi-asset capability allows traders to diversify across various asset classes while utilizing advanced charts and indicators.

Moreover, MT5 supports more timeframes and depth of market data compared to MT4, making it a preferred choice for traders who require detailed insights into market behavior. For those seeking a sophisticated trading tool, MT5 delivers an enhanced trading experience.

Web Trading Platform

Exness also offers a web-based trading platform that allows traders to access their accounts directly from a web browser without the need for software installation. This platform is ideal for individuals who prefer flexibility and convenience.

The web trading platform is equipped with essential trading tools and features, enabling users to monitor their accounts, execute trades, and analyze market trends seamlessly. This accessibility accommodates traders who are always on the go, ensuring they can stay engaged with the markets from anywhere.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Funding Your Exness Account

Understanding how to fund your Exness account is paramount for beginning the trading journey. Various payment methods are available, allowing traders to deposit and withdraw funds conveniently.

Accepted Payment Methods

Exness supports a wide array of payment methods tailored to cater to the preferences of Indian traders. Common options include bank transfers, e-wallets like Skrill and Neteller, and credit/debit cards. These diverse methods ensure that traders can choose the option that best aligns with their preferences for speed and convenience.

It's essential for traders to review the processing times and fees associated with each payment method, as this can vary significantly. Selecting a method that balances convenience with cost-effectiveness is crucial for optimizing the trading experience.

Currency Options for Deposits

When funding an Exness account, traders can operate in various currencies, including Indian Rupees (INR). The availability of INR as a currency option simplifies the deposit process for Indian traders, eliminating the need for currency conversion and minimizing additional fees.

Using the local currency streamlines the entire experience, making it easier for traders to manage their accounts without worrying about fluctuating exchange rates. This flexibility fosters a more user-friendly environment for local traders.

Minimum Deposit Requirements

Exness maintains a relatively low minimum deposit requirement, making it accessible to traders of all backgrounds. This aspect is especially appealing to those starting their trading journey, as it allows them to enter the market without significant financial commitment.

Traders should be aware that while a low minimum deposit is advantageous, it's also essential to consider their trading strategy and risk management approaches. Proper capitalization of trading accounts can aid in sustaining long-term trading endeavors.

Withdrawal Process from Exness Account

Withdrawing funds from an Exness account is a fundamental aspect of the trading experience. A seamless withdrawal process is vital for maintaining trust and satisfaction amongst traders.

Withdrawal Methods Available

Similar to funding options, Exness offers various withdrawal methods to suit the preferences of its clients. Traders can withdraw funds using the same methods they utilized for deposits, such as bank transfers, e-wallets, and credit/debit cards.

It’s essential for traders to choose a withdrawal method that aligns with their preferences regarding speed and convenience. Understanding the pros and cons of each method can help in selecting the most suitable option for withdrawing funds efficiently.

Timeframes for Withdrawals

Withdrawal timeframes can vary depending on the chosen method. E-wallets typically offer the fastest processing times, with withdrawals often completed within hours. Bank transfers, however, may take longer, sometimes up to several days.

Traders should be informed about the expected processing times for their preferred withdrawal method. Being aware of these timeframes allows traders to plan their finances and expectations accordingly.

Potential Fees on Withdrawals

While Exness aims to provide a cost-effective trading environment, it's essential for traders to remain aware of any potential fees associated with withdrawals. Depending on the chosen payment method, there may be transaction charges imposed by third-party providers.

Reviewing the fee structure associated with each withdrawal option can help traders make informed decisions, maximizing their net returns while minimizing costs.

Navigating Tax Obligations for Indian Traders

Trading in financial markets carries tax implications that traders must understand to remain compliant with local laws. In India, trading income is subject to taxation, and recognizing these obligations is vital.

Understanding Capital Gains Tax

In India, profits earned from trading are generally considered capital gains. These gains can be classified as either short-term or long-term, depending on the holding period of the traded assets. Short-term capital gains are typically taxed at a higher rate compared to long-term gains.

Traders must keep thorough records of their trades to accurately report their earnings and calculate capital gains tax owed. Understanding these tax obligations can help traders minimize their tax liabilities effectively while remaining compliant with regulations.

Reporting Income from Trading

Traders in India are required to report their trading income on their annual income tax returns. This reporting process involves disclosing any profits or losses incurred throughout the year. Timely filing of tax returns is essential to avoid penalties and ensure compliance with tax regulations.

Seeking professional advice from a tax consultant familiar with trading-related taxes can be beneficial, especially for active traders. Professional guidance can simplify the reporting process and help identify potential deductions and allowances.

Customer Support Services at Exness

Quality customer support is a hallmark of a reputable brokerage. At Exness, traders have access to various support channels, ensuring assistance is readily available when needed.

Channels for Customer Support

Exness offers multiple channels for customer support, including live chat, email, and phone support. Traders can choose the mode of communication that best suits their preferences and urgency.

Live chat support is particularly advantageous for immediate assistance, while email correspondence allows for more detailed inquiries. Having various channels available enhances the overall trading experience, ensuring traders feel supported throughout their journey.

Availability and Response Times

Customer support at Exness is available 24/7, allowing traders to seek assistance at any time, regardless of their location. This round-the-clock service is particularly beneficial for traders operating in different time zones or those engaging in overnight trading.

Response times are typically prompt, with live chat representatives often addressing queries instantly. Email responses may take slightly longer, but Exness strives to maintain efficient communication, helping traders resolve issues swiftly.

Safety and Security of Your Exness Account

Safety is paramount in online trading, and Exness places great emphasis on protecting client information and funds. Understanding the measures implemented by Exness can reassure traders about the security of their accounts.

Two-Factor Authentication

Exness employs two-factor authentication (2FA) as an added layer of security for its clients. This feature requires users to provide not only their password but also a one-time verification code sent to their registered mobile device. This dual-layer approach significantly reduces the risk of unauthorized access to accounts.

Enabling 2FA is highly recommended for all traders, as it enhances account protection and safeguards sensitive information against potential breaches.

Data Encryption Practices

Exness utilizes bank-level encryption to secure data transmitted between clients and its servers. This practice ensures that sensitive information, such as personal details and financial transactions, remains confidential and protected from potential cyber threats.

Understanding these encryption practices instills confidence in traders, knowing that their information is secure and that Exness takes data protection seriously.

Common Issues During Account Opening

Navigating the account opening process may present certain challenges for some traders. Familiarizing oneself with common issues and their solutions can ease the registration experience.

Troubleshooting Registration Problems

Encountering problems during the registration process is not uncommon. Common issues may include difficulties with filling out forms or technical glitches on the Exness website. Should any complications arise, traders are encouraged to reach out to customer support for immediate assistance.

Ensuring that all required fields are accurately filled out and that documents are in the correct format can prevent many registration issues. Patience during this phase is essential, as some problems may require time to resolve.

Resolving Document Verification Delays

Delays in document verification can occur due to high volumes of submissions or discrepancies in the provided identification. Traders experiencing extended verification times should check for any missing documents or errors.

Contacting Exness support can provide clarity on the status of document verification. Keeping communication lines open and responding to any requests for further information can expedite the resolution of verification delays.

Tips for Successful Trading with Exness

Success in trading goes beyond simply opening an account; it involves developing effective strategies and maintaining disciplined approaches to trading. Here are some tips to maximize the trading experience with Exness.

Developing a Trading Strategy

A well-defined trading strategy is the backbone of successful trading. Traders should assess their risk tolerance, market knowledge, and investment goals to create a personalized strategy that guides their trading decisions.

Whether employing technical analysis, fundamental analysis, or a combination of both, having a structured approach can lead to more consistent results. Regularly reviewing and adjusting the trading strategy based on performance can further enhance overall success.

Risk Management Techniques

Effective risk management is essential for protecting capital and achieving long-term trading success. Traders should establish clear risk-reward ratios for every trade and adhere to strict stop-loss levels. This practice can help mitigate losses and preserve capital during challenging market conditions.

Diversifying trading positions across various instruments can also reduce the impact of potential losses. By spreading risk, traders can safeguard their portfolios against the volatility of individual assets.

Community and Educational Resources

Engaging with the broader trading community and accessing educational resources can significantly enhance a trader's knowledge and skills. Exness provides a wealth of resources to support traders in their journeys.

Access to Trading Guides and Tutorials

Exness offers a comprehensive library of trading guides, tutorials, and webinars designed to educate traders on various aspects of trading. These resources cover topics ranging from basic trading concepts to advanced strategies, catering to traders of all experience levels.

By actively participating in these educational offerings, traders can broaden their understanding of financial markets and improve their trading proficiency. Continuous learning is essential in the ever-evolving landscape of online trading.

Engaging with Other Traders

Connecting with fellow traders can provide invaluable insights and foster a sense of community. Exness encourages traders to engage with each other through forums, social media platforms, and webinars.

Participating in discussions with like-minded individuals allows traders to share experiences, gain insights, and collaborate on strategies. Building a network of peers can enhance motivation and accountability, ultimately contributing to more successful trading endeavors.

Conclusion

Opening an Exness account in India presents a viable opportunity for traders seeking to engage in the financial markets. With a commitment to providing a secure trading environment, various account types, and robust customer support, Exness stands ready to empower traders at all skill levels. By understanding the intricacies of account opening, funding, and trading strategies, individuals can set themselves up for success on their trading journeys.

Read more: