13 minute read

Is Exness Legal in Philippines? Review Broker

from Exness

by Exness_Blog

Introduction to Exness

Overview of Exness as a Forex Broker

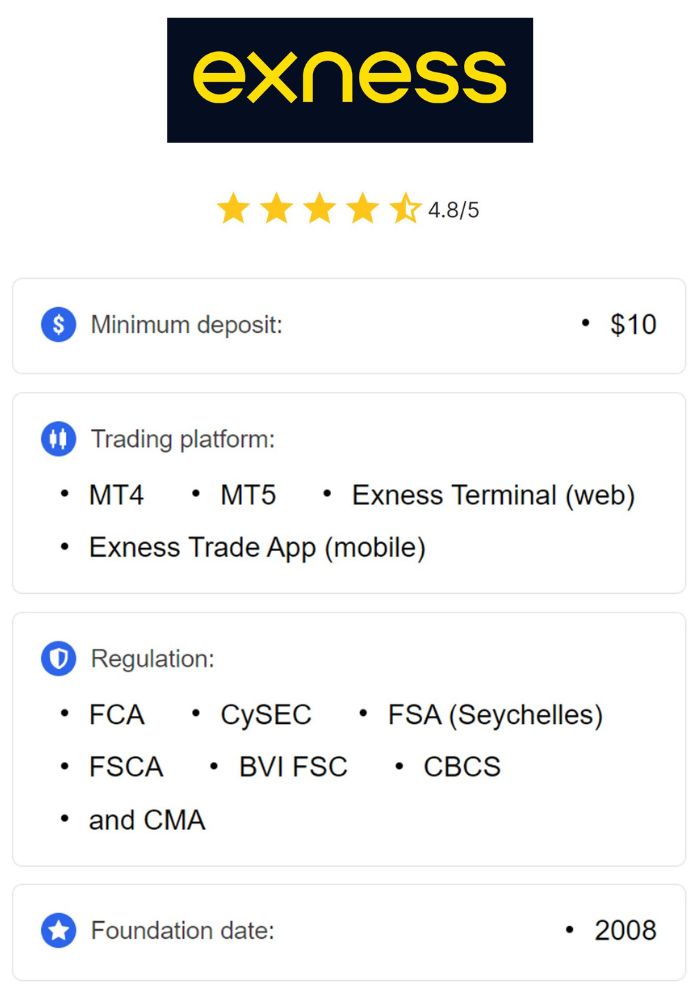

Exness is a globally recognized online forex broker that provides a platform for individuals and institutions to trade in the foreign exchange markets. Established in 2008, Exness has become one of the most popular choices for traders due to its user-friendly features and comprehensive trading options. It offers a wide range of financial instruments, including forex, commodities, indices, cryptocurrencies, and more. As of today, Exness is present in over 130 countries, with a strong presence in emerging markets like the Philippines.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Exness stands out for its commitment to transparency, reliability, and offering traders a comprehensive range of tools and services. With a focus on both individual traders and institutional clients, Exness provides an excellent balance of competitive pricing, advanced tools, and customer service.

Exness Trading Features

Exness offers several key features that cater to both novice and experienced traders. These features include:

MetaTrader Platforms: Exness provides access to both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are two of the most widely used and trusted trading platforms in the forex industry. These platforms are known for their stability, advanced charting tools, and automated trading features.

Low Spreads and High Leverage: Exness offers competitive spreads, which help traders reduce trading costs. The platform also offers leverage, allowing traders to control larger positions with a smaller initial investment. This leverage is adjustable depending on the trader's needs and risk appetite.

Variety of Account Types: Exness offers a range of account types tailored to different trading styles and experience levels. These include Standard, Pro, and Zero accounts, each with its own features and minimum deposit requirements.

Security and Transparency: Exness is fully regulated and provides traders with the peace of mind that their funds are protected. The platform operates in compliance with international standards and regulations, ensuring transparency and fair trading practices.

Regulatory Framework for Forex Trading in the Philippines

Overview of Financial Regulations in the Philippines

The Philippines has a well-established financial regulatory framework designed to protect investors and ensure the integrity of financial markets. Forex trading, as a form of financial activity, falls under this regulatory landscape.

In the Philippines, the primary regulatory bodies responsible for overseeing financial markets, including forex trading, are the Securities and Exchange Commission (SEC) and the Bangko Sentral ng Pilipinas (BSP). While the SEC primarily handles the regulation of securities and investments, the BSP manages the regulation of foreign exchange activities and banking transactions.

Role of the Securities and Exchange Commission (SEC)

The SEC plays a pivotal role in regulating the securities and investment industry in the Philippines. While its primary focus is on securities, mutual funds, and investments, the SEC also enforces laws that govern forex brokers and trading activities in the country.

To ensure compliance, the SEC has stringent requirements for financial firms offering investment services, including forex brokers. Any broker wishing to operate in the Philippines must adhere to local regulations, such as registering with the SEC, ensuring transparency, and complying with anti-money laundering laws. This protects Filipino traders from fraudulent activities and ensures the safety and security of investments.

Importance of Regulation in Forex Trading

The importance of regulation in forex trading cannot be overstated. Regulations help protect traders by ensuring that forex brokers operate in a fair and transparent manner. In the Philippines, regulatory bodies such as the SEC and BSP ensure that forex brokers comply with industry standards, maintain adequate financial reserves, and follow ethical business practices.

For traders in the Philippines, dealing with a regulated broker like Exness helps ensure that their trading activities are protected and that they are not exposed to unnecessary risks. It also offers a level of confidence, knowing that the broker is required to meet the strict standards set by regulatory authorities.

Exness' Regulatory Status

Licenses held by Exness

Exness holds licenses from a number of prestigious international regulatory bodies, ensuring that it complies with industry standards and best practices. These licenses include:

Financial Conduct Authority (FCA): Exness is regulated by the UK’s FCA, one of the world’s most respected financial regulators. The FCA ensures that Exness complies with strict rules regarding client fund protection, transparency, and fair trading practices.

Cyprus Securities and Exchange Commission (CySEC): Exness is also licensed by CySEC, the regulatory authority for financial markets in Cyprus. This license allows Exness to operate across the European Union, offering a high standard of regulatory compliance.

International Financial Services Commission (IFSC): Exness is regulated by the IFSC, which provides oversight to brokers operating in Belize. The IFSC ensures that Exness meets international standards for transparency and client protection.

These licenses ensure that Exness adheres to a strict regulatory framework, providing a safe and secure trading environment for its clients. The fact that Exness is licensed by such respected bodies means it operates within the legal boundaries of several jurisdictions, including the Philippines.

Compliance with International Standards

Exness is committed to complying with international regulations, ensuring that it operates in a fair and transparent manner. By adhering to the rules set by regulatory authorities like the FCA, CySEC, and IFSC, Exness demonstrates its dedication to providing traders with a trustworthy and secure trading platform.

Furthermore, Exness employs robust internal controls and risk management systems to protect traders from potential risks and ensure that its operations remain transparent. The company also undergoes regular audits to ensure compliance with financial standards and regulations, which adds an additional layer of security for Filipino traders.

Legality of Exness in the Philippines

Analysis of Local Laws Regarding Forex Brokers

Forex trading in the Philippines is not outright banned, but it is heavily regulated to ensure that brokers operate transparently and fairly. While there are no specific laws that prohibit Filipino traders from using international brokers like Exness, local regulations do require brokers to be licensed by the SEC or BSP to operate within the country.

Exness, while it is regulated in other jurisdictions, does not hold a specific license from the SEC or BSP. However, it operates under international regulations and adheres to high standards of transparency and client protection. Filipino traders can still legally use Exness as a broker, provided they are aware of the regulations and the potential risks involved.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

How Exness Operates within Legal Boundaries

Exness complies with the regulatory requirements of the countries in which it operates, even though it does not hold a direct license from the SEC or BSP. Filipino traders are free to use the platform as long as they follow local laws regarding forex trading.

To ensure compliance, Filipino traders are encouraged to verify their accounts and conduct thorough research before engaging in forex trading activities. Exness also offers clear terms of service and risk warnings, ensuring that traders are fully informed before entering any trades.

Benefits of Trading with Exness

Competitive Spreads and Leverage Options

Exness offers highly competitive spreads, which help minimize the trading costs for Filipino traders. Lower spreads allow traders to keep more of their profits, making Exness a cost-effective choice for forex trading. In addition to low spreads, Exness offers flexible leverage options, enabling traders to adjust their risk levels according to their trading style.

The ability to use leverage allows traders to control larger positions with smaller investments. However, it’s important for traders to be cautious, as high leverage can also amplify risks, especially during periods of market volatility. Exness provides risk management tools to help mitigate these risks.

User-Friendly Trading Platform

Exness provides two of the most popular trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are widely recognized for their user-friendly interfaces, advanced charting capabilities, and automated trading functions. Filipino traders can access a range of tools and resources to enhance their trading experience, whether they are trading on desktop or mobile devices.

Both MT4 and MT5 are known for their stability, reliability, and ease of use. Exness also offers mobile applications for both platforms, ensuring that traders can stay connected to the markets and manage their trades on the go.

Customer Support Services

Exness provides 24/7 customer support via multiple channels, including live chat, email, and phone. Filipino traders can easily reach out to Exness' support team for assistance with any trading-related issues. The customer support team is highly responsive and well-trained, ensuring that all queries are handled promptly and efficiently.

Exness also provides educational resources to help traders improve their trading skills and make informed decisions. These resources include webinars, tutorials, and detailed articles on various trading strategies.

Risks Associated with Trading on Unregulated Platforms

Potential for Fraud and Mismanagement

Trading on unregulated platforms can expose traders to the risk of fraud and mismanagement. While Exness is regulated in several jurisdictions, Filipino traders should always ensure that the broker they choose adheres to international standards and operates transparently.

Using a regulated platform like Exness significantly reduces the risk of fraudulent activity, as regulatory bodies enforce strict standards for financial operations and client protection.

Lack of Consumer Protection Mechanisms

Unregulated brokers often lack consumer protection mechanisms, which means that traders have limited recourse if something goes wrong. Regulated brokers like Exness are required to implement measures such as segregating client funds and providing dispute resolution services, offering Filipino traders peace of mind.

Experiences of Filipino Traders with Exness

Testimonials from Local Users

Filipino traders who have used Exness generally report positive experiences. Many praise the broker for its easy-to-use platform, fast execution speeds, and comprehensive educational resources. Exness provides detailed guides, webinars, and tutorials, which help both beginners and experienced traders understand market trends and enhance their skills. Filipino traders often comment on how user-friendly the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms are, which offer a wide range of technical indicators, real-time data, and automated trading tools.

Moreover, Exness has a reputation for quick and reliable customer support, which is available 24/7. Filipino users appreciate that Exness provides multiple contact channels, including live chat, email, and telephone, to resolve any issues promptly. Traders have highlighted the ease of communication with support teams and their willingness to go the extra mile to help resolve any concerns.

Common Challenges Faced by Filipino Traders

Despite the overall positive feedback, there are a few challenges faced by Filipino traders when using Exness. One common issue involves deposit and withdrawal methods. While Exness supports a wide variety of payment options, some traders experience difficulties when transferring funds through local Filipino payment channels. Although Exness offers international banking methods like bank transfers, credit cards, and e-wallets, processing times and fees for some Filipino payment methods can be longer compared to global options.

Another challenge noted by Filipino traders is the complexity of navigating advanced trading tools, especially for beginners. While Exness provides ample educational resources, some novice traders can initially struggle to understand the full range of features offered by the trading platform. However, with time and practice, most users find the learning curve manageable and beneficial for their trading experience.

Comparison with Other Forex Brokers in the Philippines

Exness vs. Local Brokers

Exness stands out when compared to many local forex brokers in the Philippines, primarily because of its international licenses, robust regulatory compliance, and wide selection of trading tools. Local brokers in the Philippines may not offer the same level of international oversight or global exposure as Exness, which operates under the regulation of respected authorities like the FCA (Financial Conduct Authority) and CySEC (Cyprus Securities and Exchange Commission).

In terms of trading conditions, Exness typically offers more competitive spreads and better leverage options than local brokers. Local brokers may have limited leverage due to regulatory restrictions in the Philippines, which is something Exness offers more flexibility on. Additionally, Exness provides access to both MetaTrader 4 and MetaTrader 5 platforms, which are more advanced and widely used than some of the local platforms provided by Filipino brokers.

However, local brokers may have an advantage when it comes to familiarity with Filipino users and the local financial ecosystem. They are more accustomed to the specific challenges and preferences of Filipino traders, including supporting payment methods that are more commonly used in the country.

Exness vs. International Competitors

When comparing Exness to other international forex brokers, it holds up well in terms of regulation, trading conditions, and platform features. Brokers such as XM, FXTM, and IC Markets also have a strong international presence and offer competitive spreads, leverage, and advanced platforms. However, Exness distinguishes itself with its excellent customer service, ease of withdrawal, and commitment to transparency.

Exness also often stands out in terms of the variety of payment options it supports for Filipino traders, especially when compared to some of its international competitors that might not have as many localized payment methods. Furthermore, Exness' clear and easy-to-understand terms of service make it a preferred choice for traders who want a reliable and well-regulated broker.

Recommendations for Filipino Traders Considering Exness

Steps to Ensure Safe Trading Practices

For Filipino traders considering using Exness, it’s important to take steps to ensure a safe and secure trading experience. First, traders should verify their identity and make sure they complete all the necessary KYC (Know Your Customer) procedures before starting to trade. This ensures that their accounts are fully verified and they comply with any local regulatory requirements. Traders should also familiarize themselves with the risks involved in trading, particularly when using leverage, and ensure they are aware of how to manage their risk effectively.

Moreover, it's advised for Filipino traders to start with a demo account. Exness offers a free demo account that allows traders to practice trading strategies without any financial risk. This is a great way for beginners to familiarize themselves with the platform and the various features offered by Exness.

Importance of Education and Research

Before committing to real trading, Filipino traders should take full advantage of the educational resources Exness offers. There are various guides, webinars, and tutorials available that cater to traders of all experience levels. Education is key to successful trading, and Exness provides the tools to help traders build their knowledge and improve their strategies.

Additionally, Filipino traders should also keep up with market news and updates. Forex markets are constantly changing, and staying informed can help traders make better decisions and anticipate market movements. Exness provides a range of analytical tools that can be helpful in this regard, including economic calendars and real-time price feeds.

Conclusion

In conclusion, Exness is a legal and viable forex broker for traders in the Philippines. While it does not hold a license from the Philippine Securities and Exchange Commission (SEC) or Bangko Sentral ng Pilipinas (BSP), Exness operates under international regulations from respected authorities like the FCA and CySEC, ensuring that it provides a safe, transparent, and reliable platform for Filipino traders.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

The broker offers competitive trading conditions, such as low spreads, flexible leverage, and advanced trading platforms like MetaTrader 4 and MetaTrader 5. Additionally, Exness provides excellent customer support and educational resources, making it an attractive choice for both new and experienced traders in the Philippines.

However, Filipino traders should ensure they are aware of the potential risks involved in forex trading, especially when using high leverage. It's also important to conduct thorough research, use safe trading practices, and ensure that all necessary verification processes are followed.

Overall, Exness offers a high standard of service and operates within legal boundaries to provide Filipino traders with a reliable platform to engage in forex trading. As with any financial decision, due diligence is key, but Exness stands as a legal, safe, and reputable choice for forex traders in the Philippines.

Read more: