11 minute read

Is Exness Legal in Rwanda? Review Broker

from Exness

by Exness_Blog

Understanding Exness as a Broker

Overview of Exness

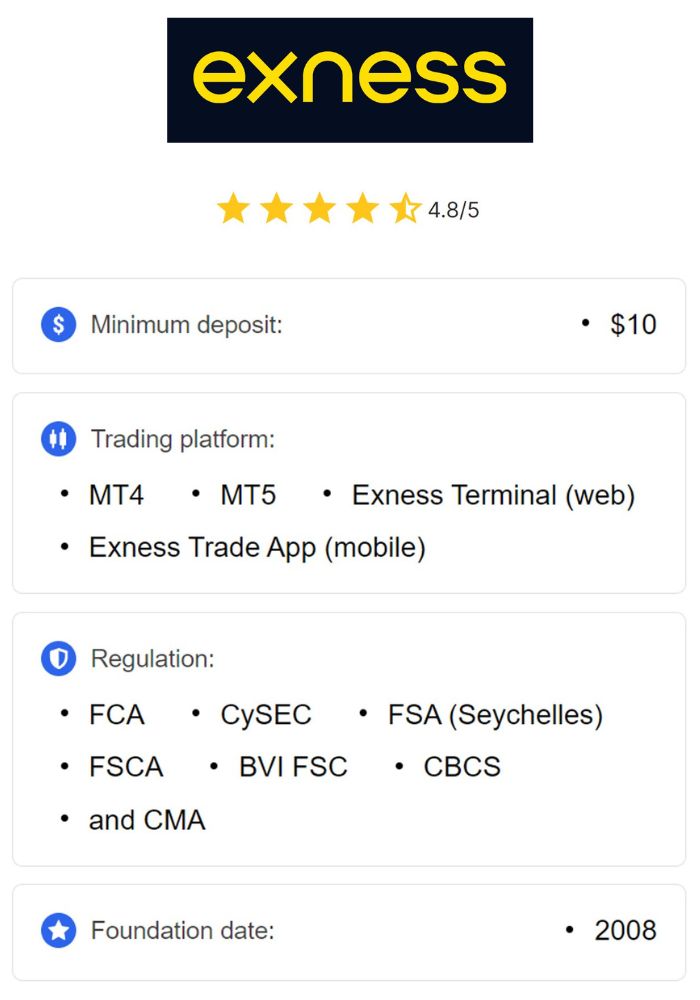

Exness is a leading online brokerage platform known for offering a wide range of financial products to traders globally. Founded in 2008, Exness has grown into one of the most trusted brokers in the online trading industry, providing traders access to forex, commodities, cryptocurrencies, indices, and more. With its user-friendly platform, competitive spreads, and a reputation for transparency and security, Exness attracts a broad client base, including both retail traders and institutional investors.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Exness operates in a variety of regions and is regulated by multiple financial authorities around the world, ensuring that it complies with the highest industry standards. Its platform is compatible with both beginner and advanced traders, offering a variety of trading tools, educational resources, and customer support to ensure a seamless trading experience.

Types of Trading Accounts Offered

Exness offers several types of accounts to cater to traders of all experience levels and trading preferences. The key account types provided by Exness include:

Standard Accounts: These are designed for beginners and casual traders. Standard accounts allow access to basic trading features with low minimum deposit requirements and relatively simple account management.

Professional Accounts: These accounts are suited for experienced traders who require more advanced tools and options, including higher leverage and access to tight spreads. Professional accounts typically require a higher minimum deposit and offer more complex trading features.

ECN Accounts: ECN (Electronic Communication Network) accounts are for traders who seek high liquidity, lower spreads, and fast execution speeds. These accounts are best suited for institutional traders or those looking to execute larger trades.

Cent Accounts: These accounts allow traders to open positions with smaller amounts, as they operate in cents rather than full units of currency. This is ideal for those who want to practice trading with smaller amounts of capital or for beginners who want to test strategies in real market conditions.

Each account type offers different features, with varying levels of risk, leverage, and access to advanced trading tools. Traders can select the account type that best suits their individual needs, trading goals, and risk tolerance.

The Regulatory Landscape in Rwanda

Financial Market Regulation in Rwanda

Rwanda's financial market is regulated by several key bodies that ensure financial activities, including forex trading, are conducted in a fair and secure manner. The Rwanda Capital Market Authority (CMA) plays a significant role in regulating and supervising financial markets, including stock and bond trading. While Rwanda's capital markets are still developing, the government has focused on building a robust legal framework to attract foreign investments, improve financial services, and ensure financial stability.

The Central Bank of Rwanda (National Bank of Rwanda - NBR) is the primary regulatory authority overseeing monetary policies and banking operations, including the control of exchange rates and foreign currency activities. The NBR does not specifically regulate forex brokers directly, but it plays a key role in ensuring the stability of Rwanda’s financial system, which indirectly affects forex trading activities in the country.

Rwanda’s financial sector has been undergoing modernization in recent years, with efforts to integrate more advanced financial products and services, which include an increasing number of international online brokers catering to Rwandan traders.

Role of the National Bank of Rwanda

The National Bank of Rwanda (NBR) is responsible for formulating and implementing monetary policies in the country. The NBR manages currency stability, interest rates, and inflation, which indirectly impacts the forex market. While NBR’s focus is primarily on maintaining the stability of the Rwandan franc (RWF), its policies also influence the broader economy, including the accessibility of foreign exchange for Rwandan traders.

The NBR works closely with the Rwanda Capital Market Authority (CMA) to promote the development of financial markets in Rwanda. However, the regulation of retail forex trading, which is often done through international brokers such as Exness, is not as clearly defined in Rwanda's regulatory landscape. As such, many traders in Rwanda use brokers that are regulated by international authorities, which provides a level of protection and legitimacy for traders.

Licensing and Compliance for Brokers

Importance of Broker Licenses

Broker licenses are a crucial aspect of ensuring that a financial institution operates legally and transparently. In the forex industry, a broker’s license indicates that it adheres to regulatory standards and practices, such as protecting client funds, ensuring fair trading conditions, and maintaining transparency in its operations. Brokers that hold licenses from reputable financial authorities are seen as more trustworthy and secure, as they are required to follow strict compliance measures that safeguard investors’ interests.

When trading with brokers that are not properly licensed or regulated, traders may be exposed to greater risks, including fraud and market manipulation. Therefore, choosing a broker with legitimate and trusted licenses is vital to ensuring the safety of funds and a reliable trading environment.

How Exness Complies with International Regulations

Exness is licensed and regulated by several reputable financial authorities across different regions, including the Cyprus Securities and Exchange Commission (CySEC), the UK’s Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), and the Seychelles Financial Services Authority (FSA). These licenses require Exness to adhere to strict regulations regarding client fund protection, market transparency, and reporting standards.

In Rwanda, while Exness is not directly regulated by the country’s authorities, it complies with international regulations and maintains a high standard of financial conduct, ensuring that Rwandan traders can trade with confidence. Exness's licenses from these respected authorities provide Rwandan traders with the assurance that their trading activities are being conducted within a safe, transparent, and regulated environment.

Exness' Legal Standing in Rwanda

Current Status of Exness in Rwanda

As of now, Exness operates legally in Rwanda, providing its services to local traders. Although it is not regulated by Rwandan authorities, Exness is fully compliant with international regulations, making it a legitimate option for traders in the country. Exness offers a wide range of financial instruments, competitive trading conditions, and advanced platforms, all of which make it an appealing choice for traders in Rwanda looking to access global financial markets.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Rwandan traders can legally open accounts with Exness, provided they comply with the country’s financial guidelines, such as adhering to tax obligations on forex profits and ensuring that their trading activities remain within the bounds of the law.

Comparison with Other Forex Brokers Operating in Rwanda

Compared to other forex brokers operating in Rwanda, Exness stands out due to its reputation for transparency, solid regulatory compliance, and the variety of trading services it offers. Many international brokers, including Exness, operate in Rwanda without direct local regulation. However, the broker’s compliance with global financial regulations, including those of CySEC, FCA, and ASIC, places it in a strong position relative to others that may not hold such licenses.

Other brokers in Rwanda may not be as well-regulated or may offer fewer tools, features, or financial products, which makes Exness an attractive alternative for Rwandan traders seeking reliable and professional trading services.

User Experience and Accessibility

Account Registration Process

Registering an account with Exness is a simple and straightforward process. Rwandan traders can easily sign up by visiting the Exness website and providing their personal details, including name, email, and phone number. After completing the registration form, traders must verify their identity by submitting documents such as a government-issued ID, proof of address, and sometimes a source of income. This verification process ensures that Exness complies with anti-money laundering (AML) and know-your-customer (KYC) regulations.

Once the account is verified, traders can fund their accounts using a variety of payment methods, including bank transfers, credit/debit cards, and e-wallets. The user-friendly account setup and verification process make Exness accessible to traders in Rwanda who are looking to begin trading with a reputable and secure broker.

Availability of Support Services

Exness offers robust customer support services for traders in Rwanda. The support team is available 24/5 via various communication channels, including live chat, email, and phone. This ensures that traders can get assistance at any time with issues related to account management, technical problems, or general trading inquiries.

Exness also offers multilingual support, including English and French, which makes it easier for Rwandan traders to interact with the support team in their preferred language. This level of support ensures that traders in Rwanda have a smooth experience while using the Exness platform.

Risks of Trading with Exness in Rwanda

Potential Risks Involved

While Exness offers a secure and regulated environment, forex trading, in general, carries inherent risks due to market volatility and the potential for significant financial loss. This is especially true for high-leverage trading, which amplifies both profits and losses. Rwandan traders should be aware of the risks involved in trading on margin and use proper risk management techniques, such as stop-loss orders, to minimize exposure.

Additionally, global market fluctuations, economic instability, or geopolitical events can have a major impact on forex prices. These factors can lead to unexpected market changes, which might affect traders' positions.

Security Measures Taken by Exness

To mitigate the risks associated with online trading, Exness employs advanced security protocols to protect traders' funds and personal data. The broker uses SSL encryption technology to ensure that all data transmitted between traders and the platform is secure. Furthermore, Exness segregates client funds from its own operational funds, ensuring that traders' capital is always kept safe and accessible.

Additionally, Exness is fully compliant with global data protection regulations, ensuring that traders' personal information is safeguarded against fraud and misuse.

Benefits of Using Exness

Competitive Trading Conditions

Exness offers some of the most competitive trading conditions in the industry. Traders can access tight spreads, low commissions, and flexible leverage options, making it a cost-effective choice for both new and experienced traders. The broker also provides access to advanced trading platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are known for their speed, reliability, and comprehensive charting tools.

These competitive conditions are a significant advantage for Rwandan traders who are looking to maximize their profits while minimizing trading costs.

Variety of Trading Instruments

Exness offers a broad range of trading instruments, including more than 100 currency pairs, commodities, indices, cryptocurrencies, and stocks. This diversity allows Rwandan traders to diversify their portfolios and take advantage of different market opportunities. Whether they prefer trading forex, commodities, or cryptocurrencies, Exness provides a wide range of options for traders to explore.

The availability of various financial instruments also allows traders to implement diverse trading strategies, whether they are looking for short-term gains or long-term investments.

Reviews from Rwandan Traders

General Sentiment Towards Exness

Rwandan traders generally have a positive sentiment towards Exness. The broker is well-regarded for its transparency, competitive pricing, and reliable customer support. Many traders appreciate the ease of use of Exness’s trading platforms, as well as the availability of educational resources that help beginners understand the basics of trading.

Common Feedback and Complaints

While feedback from Rwandan traders is mostly positive, some traders have raised concerns about the risks of trading with high leverage, particularly in volatile market conditions. Additionally, a few traders have mentioned issues with the verification process, which can take some time to complete. However, these issues are not unique to Exness and are common among most regulated brokers.

Alternatives to Exness in Rwanda

Other Popular Forex Brokers

While Exness is one of the most popular brokers in Rwanda, other well-known international brokers, such as ForexTime (FXTM), IC Markets, and XM, also operate in the country. These brokers offer similar services, including access to global financial markets, competitive spreads, and advanced trading platforms.

Comparative Analysis of Alternatives

When comparing Exness to other forex brokers in Rwanda, Exness stands out for its strong regulatory compliance, variety of account types, and competitive conditions. However, brokers like IC Markets and ForexTime also provide excellent trading opportunities, with varying account features and regional support services. Rwandan traders should consider factors such as spreads, available instruments, and platform usability when choosing a broker.

Conclusion

In conclusion, Exness operates legally in Rwanda and offers a secure and regulated trading environment for local traders. Although it is not regulated by Rwandan authorities, Exness complies with international regulations, ensuring a trustworthy and transparent trading experience.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

With its competitive trading conditions, wide range of instruments, and reliable customer support, Exness is an excellent choice for Rwandan traders seeking to access the global forex markets. As with all trading activities, it is essential for traders to be aware of the risks involved and to trade responsibly.

Read more: