14 minute read

How to Withdraw from Exness to Skrill

from Exness

by Exness_Blog

Introduction to Exness and Skrill

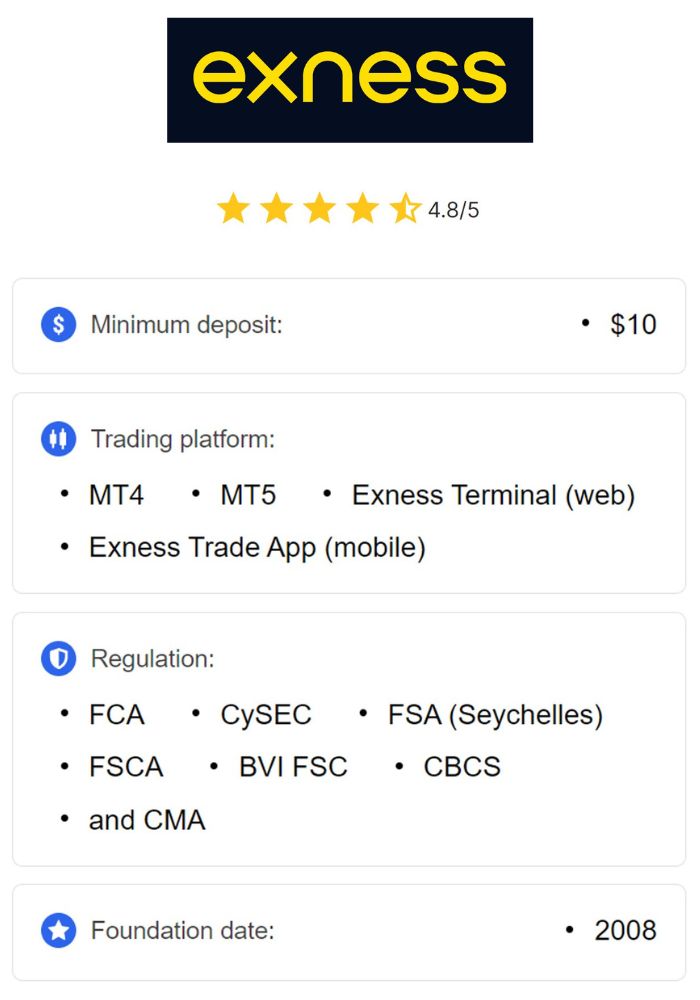

Overview of Exness Trading Platform

Exness is a leading broker that provides traders with access to various financial markets, including Forex, commodities, cryptocurrencies, and indices. Since its establishment in 2008, Exness has grown to serve millions of clients worldwide, offering advanced trading platforms like MetaTrader 4 and 5. Known for its transparency and commitment to client satisfaction, Exness provides flexible account types, high leverage, and competitive spreads that suit traders of all experience levels.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

A standout feature of Exness is its variety of deposit and withdrawal options, allowing clients to manage funds conveniently. Skrill is one such option, making withdrawals fast and straightforward for Exness users who prefer digital wallets. Skrill’s ease of use and quick processing times make it a favored choice for Exness traders looking for a secure withdrawal method.

Understanding Skrill as a Payment Processor

Skrill is a global payment processor known for its speed, security, and user-friendly interface. It allows users to send and receive funds electronically, making it ideal for international transactions. With its focus on low fees and high transaction speeds, Skrill has become a popular choice for online traders and businesses worldwide.

Skrill also prioritizes security, employing advanced encryption technologies to protect users’ financial information. For traders on Exness, Skrill provides a fast, reliable, and secure method to withdraw earnings, allowing them to access funds with minimal delays.

Importance of Withdrawal Methods

Why Choose Skrill for Withdrawals

Using Skrill as a withdrawal method offers several advantages, especially for traders who prioritize speed and convenience. Skrill is known for its fast transaction processing times, with most withdrawals completed within minutes. This feature is especially beneficial for traders who require quick access to their funds for reinvestment or personal expenses.

Another advantage of using Skrill is its international accessibility, supporting multiple currencies and allowing Exness users from various regions to withdraw funds seamlessly. Skrill’s compatibility with multiple currencies also reduces the need for currency conversion, minimizing potential fees and making it a cost-effective choice.

Benefits of Using Skrill with Exness

By choosing Skrill with Exness, traders can enjoy a smooth and efficient withdrawal process. Skrill's low fees make it an attractive option for traders looking to keep costs down. Additionally, Skrill offers user-friendly features such as transaction history tracking and instant notifications, allowing traders to monitor their withdrawals effectively.

Exness’s partnership with Skrill ensures that traders can use a trusted payment method with proven security measures, further enhancing the overall trading experience. Skrill’s compatibility with Exness adds an extra layer of convenience, allowing traders to manage their funds confidently.

Pre-requisites for Withdrawal

Account Verification Requirements

To withdraw funds from Exness to Skrill, you must complete the account verification process. Exness requires all users to verify their accounts to ensure compliance with regulatory standards and to protect against fraud. Verification involves providing proof of identity (such as a passport or national ID) and proof of residence (such as a utility bill or bank statement).

Completing the verification process unlocks the ability to withdraw funds and assures Exness that the account belongs to a legitimate user. This verification is essential for both security and compliance, so it’s recommended to complete it as soon as possible.

Linking Your Skrill Account to Exness

Before making your first withdrawal, you’ll need to link your Skrill account to your Exness account. To do this, simply navigate to the “Deposit” section on Exness, select Skrill as your payment method, and enter your Skrill account details. This linking process allows Exness to recognize Skrill as an authorized withdrawal method, streamlining future transactions.

Linking your Skrill account is straightforward and only needs to be done once. Ensuring your Skrill details are accurate prevents issues during the withdrawal process and makes future withdrawals faster.

Setting Up Your Skrill Account

Creating a Skrill Account

If you don’t already have a Skrill account, setting one up is easy:

Visit the Skrill Website: Go to Skrill’s official site and click on “Register.”

Enter Personal Details: Provide your name, email, and password.

Set Up Security Measures: Enable two-factor authentication (2FA) for added security.

Complete Registration: Submit the form, and you’ll receive a confirmation email to activate your account.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Once your account is created, you’re ready to link it with Exness for future transactions. Creating a Skrill account is free, and the setup process is quick.

Verifying Your Skrill Account

To fully activate your Skrill account, verification is required. Verification typically involves submitting proof of identity, such as an ID card or passport, and possibly proof of address. Completing this step allows you to increase transaction limits and ensures that your account remains secure.

Verification is essential for preventing delays in future transactions. By verifying your Skrill account, you can avoid limitations and manage withdrawals smoothly.

Steps to Withdraw Funds from Exness

Logging Into Your Exness Account

To begin the withdrawal process, start by logging into your Exness account. Use your registered email and password to access the main dashboard, where you can view your account balance, manage open trades, and access various account functions. If you have two-factor authentication (2FA) enabled, you may need to enter a code sent to your device for added security.

Once logged in, ensure you have sufficient funds in your Exness account to cover the amount you want to withdraw. Verifying your balance helps avoid issues later in the withdrawal process.

Navigating to the Withdrawal Section

From the Exness dashboard, go to the “Personal Area,” which is where you’ll find options for deposits, withdrawals, and account settings. In this section, click on “Withdraw,” which will display a list of all available withdrawal methods, including bank transfers, credit/debit cards, and e-wallet options like Skrill.

Navigating to the withdrawal section directly from the dashboard makes it easy to initiate and manage your transactions in a streamlined manner. This area is also where you can monitor the status of any pending withdrawals.

Selecting Skrill as Your Withdrawal Method

In the list of available withdrawal methods, select Skrill to proceed with your transaction. This choice will direct you to the Skrill withdrawal form, which includes fields for specifying the withdrawal amount and entering your Skrill account details. Make sure your Skrill account is already linked to your Exness account to ensure a seamless transaction.

Selecting Skrill as your withdrawal method allows you to benefit from Skrill’s fast processing times and lower fees, making it a popular choice among Exness users for quick fund access.

Entering Withdrawal Amount and Details

Next, enter the amount you wish to withdraw from your Exness account. Be mindful of Exness’s minimum and maximum withdrawal limits, which vary depending on the account type and withdrawal method. You’ll also need to provide your Skrill account email address to ensure the funds are transferred to the correct destination.

Double-check the entered amount and Skrill email details for accuracy. Ensuring the accuracy of this information minimizes the risk of delays or errors in the transfer process. Once everything is confirmed, proceed to the next step to initiate the transaction.

Confirming Your Withdrawal Request

Reviewing Withdrawal Information

Before finalizing the withdrawal, it’s essential to review all information carefully. Confirm the withdrawal amount, the Skrill account email, and any other relevant details to ensure accuracy. Reviewing this information helps avoid common errors, such as inputting the wrong amount or incorrect Skrill details, which can lead to processing delays.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Additionally, verify that the amount you’re withdrawing leaves a sufficient balance in your Exness account if needed for ongoing trades. Ensuring all details are correct before submission improves the efficiency of the withdrawal process and reduces the likelihood of complications.

Finalizing the Withdrawal Process

Once you have reviewed and confirmed all withdrawal details, click “Confirm” to complete the transaction. Exness will process your withdrawal request and provide you with a confirmation message once the transaction is submitted. You should also receive an email notification from Exness, and once the funds are successfully transferred, Skrill will send a confirmation to your registered email.

After finalizing, you can monitor the withdrawal status from the “Transaction History” section in your Exness Personal Area. Tracking the progress helps keep you informed and allows you to anticipate when the funds will be available in your Skrill account.

Common Issues During Withdrawal

Troubleshooting Withdrawal Errors

While withdrawing from Exness to Skrill is generally straightforward, some users may encounter issues that prevent successful transactions. Common errors include incorrect Skrill account details, unlinked accounts, or attempting to withdraw an amount below the minimum limit. To resolve these issues, double-check the Skrill email address you’ve entered, ensure your Exness and Skrill accounts are fully verified, and verify that the withdrawal amount meets Exness’s minimum requirement.

If you’re still experiencing issues, try refreshing the page or logging out and back into your Exness account. This simple step can often resolve minor technical glitches. Ensuring your internet connection is stable during the withdrawal process can also prevent disruptions that might interfere with your transaction.

Contacting Customer Support for Assistance

If troubleshooting doesn’t resolve the issue, Exness provides 24/7 customer support to help with withdrawal-related concerns. You can reach the support team via live chat, email, or phone, and they can provide personalized assistance based on your specific situation. When contacting customer support, have your account details, transaction history, and any relevant screenshots ready to help the support team resolve your issue quickly.

Exness’s customer support team is trained to handle common withdrawal problems, and they can guide you through additional steps if necessary, such as re-verifying information or checking for any pending system maintenance that might impact processing times.

Withdrawal Processing Times

Understanding Withdrawal Timeframes

Withdrawals from Exness to Skrill are generally processed instantly or within a few hours. However, in some cases, the transaction may take up to 24 hours to complete. This fast processing time is one of the primary reasons Skrill is a preferred option among traders who require quick access to their funds. Exness aims to ensure rapid processing for Skrill withdrawals, making it an efficient option for active traders.

If the transaction takes longer than 24 hours, this could indicate a need for further verification or possible maintenance within the Exness or Skrill systems. Checking with customer support can provide insights into any potential delays.

Factors Affecting Withdrawal Speed

Several factors can impact the speed of withdrawals, including account verification status, time of day, and the volume of transactions being processed by Exness. Fully verified accounts tend to experience faster processing times as they meet all security requirements. Additionally, withdrawals made during standard business hours are typically processed faster than those made outside business hours or on weekends.

High-volume trading periods, such as the beginning of the week or near market-close times, can also impact processing speeds. Planning withdrawals during low-traffic times may improve speed and reduce waiting periods.

Fees Associated with Withdrawals

Overview of Exness Withdrawal Fees

Exness generally offers Skrill withdrawals free of charge, making it a cost-effective option for traders. However, it’s advisable to check the latest fee schedule on Exness’s website, as fees may vary based on account type, transaction frequency, or current promotions. Using a withdrawal method without fees allows you to maximize your trading profits and ensures more efficient fund management.

For traders handling large or frequent withdrawals, opting for fee-free methods like Skrill is beneficial, as it reduces operational costs and allows for more flexible cash flow management.

Skrill Transaction Charges Explained

Although Exness may not charge fees for Skrill withdrawals, Skrill itself may apply small transaction fees, particularly for currency conversions or transfers to other bank accounts. Skrill’s conversion fees typically apply when withdrawing in a currency other than the one your Skrill account is set to. Reviewing Skrill’s fee structure can help you anticipate any additional costs and plan your transactions accordingly.

To minimize currency conversion fees, it’s recommended to set your Exness and Skrill accounts in the same currency if possible. This approach avoids additional charges and ensures you receive the maximum amount from each withdrawal.

Security Measures for Withdrawals

Ensuring Account Security

Exness prioritizes account security by implementing robust encryption technologies and strict verification protocols. For added security, enable two-factor authentication (2FA) on both your Exness and Skrill accounts. This extra layer of security requires a unique code generated on your mobile device, ensuring that only authorized users can access the accounts.

Regularly updating passwords, monitoring account activity, and using secure internet connections can also protect your Exness and Skrill accounts from unauthorized access. Maintaining high security standards allows you to manage withdrawals confidently, knowing your funds are protected.

Recognizing Phishing Attempts and Scams

Phishing scams and fake emails are common threats that can compromise your accounts. Be cautious about any emails or messages that claim to be from Exness or Skrill, especially if they request personal information, login credentials, or financial details. Only log in to Exness and Skrill through official websites, and avoid clicking on suspicious links in unsolicited emails or messages.

Recognizing and avoiding phishing attempts helps keep your accounts secure and protects you from potential fraud. Verifying official communication channels and practicing caution online can prevent unauthorized access to your funds.

Tips for Successful Withdrawals

Best Practices for Managing Withdrawals

To ensure a smooth withdrawal process, follow best practices like scheduling withdrawals during standard business hours, confirming all account details, and setting up a regular withdrawal schedule if you frequently withdraw funds. Keeping your Exness and Skrill accounts fully verified further speeds up processing and minimizes the risk of delays.

Using a consistent withdrawal schedule also helps you manage cash flow effectively, providing a steady availability of funds when needed. Staying organized and proactive about withdrawals ensures a reliable trading experience.

Keeping Track of Your Transactions

Maintaining a record of your transactions, including dates, amounts, and transaction IDs, allows you to monitor your trading activities and manage finances efficiently. Exness provides a transaction history in the Personal Area, where you can review details of all withdrawals, deposits, and transfers.

Keeping an organized record also helps in cases where you may need to report or follow up on a transaction with customer support. A well-maintained transaction history can streamline the resolution process and provide clear documentation of your financial activities.

Alternatives to Skrill for Withdrawals

Other Payment Methods Offered by Exness

In addition to Skrill, Exness supports various withdrawal options, such as bank transfers, credit/debit cards, and other e-wallets like Neteller. Each method comes with different processing times, fees, and requirements, allowing traders to choose the most suitable option based on their preferences and needs. Bank transfers, for instance, are ideal for larger amounts, while e-wallets offer faster access for smaller, frequent withdrawals.

Exploring other payment options helps traders adapt to different financial requirements and select the most effective method for their circumstances.

Pros and Cons of Different Withdrawal Options

Each withdrawal method on Exness has its own advantages and disadvantages. For instance, bank transfers offer high withdrawal limits but often come with longer processing times. E-wallets like Skrill and Neteller provide quick access to funds but may involve small fees for currency conversions. Credit and debit cards can be convenient for smaller withdrawals, but their processing times may vary based on the bank’s policies.

Understanding the pros and cons of each method allows traders to make informed decisions based on speed, convenience, and cost. Selecting the right option enhances the withdrawal experience and aligns with individual trading goals.

Conclusion

Withdrawing from Exness to Skrill is an efficient and secure process, offering traders fast access to their funds with minimal fees. By following the steps outlined above and ensuring that both Exness and Skrill accounts are fully verified, traders can enjoy a smooth, hassle-free withdrawal experience. Whether you’re a beginner or a seasoned trader, Skrill’s speed and reliability make it an ideal choice for managing trading profits on Exness. By maintaining best practices in account security, transaction tracking, and choosing the right withdrawal methods, you can enhance your financial management and focus on achieving success in the financial markets.

Read more: