16 minute read

Is forex banned in Nigeria? A Comprehensive Guide

from Exness

by Exness_Blog

Forex trading has gained significant attention globally, with many individuals exploring the potential of trading currencies online. As Nigeria continues to grow as an emerging market, one question that many aspiring traders often ask is: Is forex banned in Nigeria? The short answer is no, forex trading is not banned in Nigeria, but there are regulations in place to control and monitor its activities.

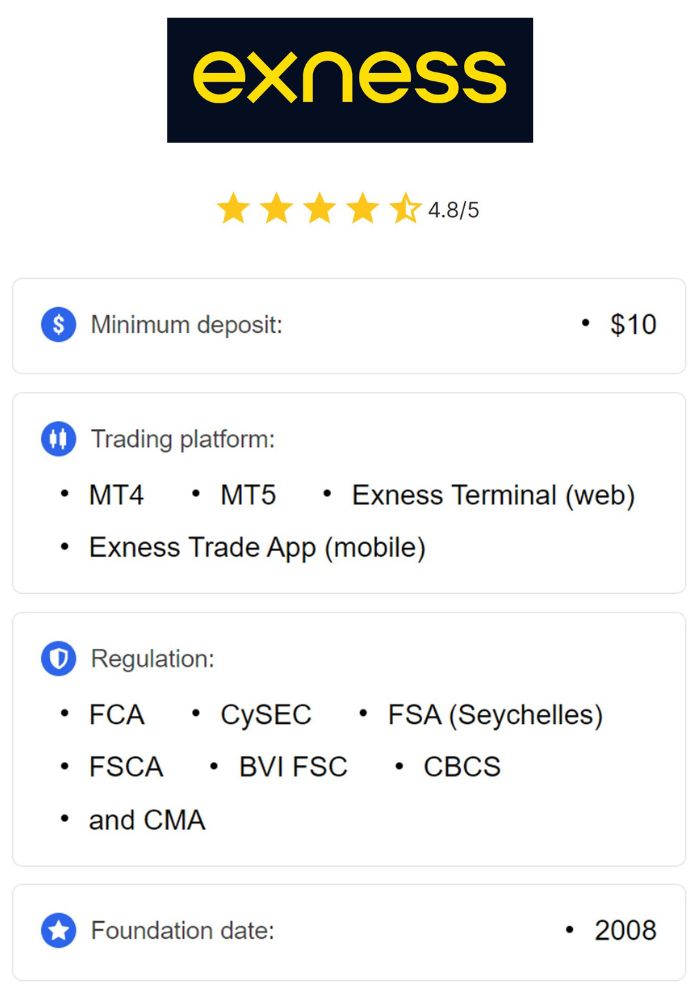

Top 4 Best Forex Brokers in Nigeria

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

In this article, we will delve into the complexities of forex trading in Nigeria, the regulatory environment, the myths surrounding forex trading, and the best practices for safe trading. We will also explore how forex trading works, the reasons behind restrictions or regulations, and the potential risks that Nigerian traders might face.

Understanding Forex Trading

Definition of Forex Trading

Forex, short for foreign exchange, is the global marketplace for buying and selling currencies. It involves the exchange of one currency for another, with the goal of profiting from changes in the currency value. Unlike stock trading, which involves buying shares of companies, forex trading is centered on the fluctuations in the value of national currencies.

For example, when trading the USD/EUR currency pair, traders aim to predict the movement of the U.S. Dollar (USD) against the Euro (EUR). A trader might buy the USD/EUR pair if they believe the U.S. dollar will strengthen against the euro. Forex trading is conducted 24 hours a day, five days a week, and is the largest and most liquid financial market in the world.

How Forex Trading Works

Forex trading operates through a decentralized market known as the Over-the-Counter (OTC) market, meaning there is no physical location for forex transactions to take place. Instead, traders interact through electronic platforms, such as MetaTrader 4 or MetaTrader 5, provided by forex brokers. These platforms allow traders to monitor price movements, place orders, and manage their accounts.

Traders can engage in a variety of strategies, including day trading, swing trading, and long-term investing, depending on their risk tolerance and market analysis. The basic mechanics of forex trading involve buying one currency while simultaneously selling another, and profits are made when there is a favorable movement in the exchange rate between the two currencies.

Importance of Forex Trading in the Global Economy

Forex trading is critical to the global economy for several reasons:

International Trade: Forex allows businesses to engage in international trade by providing a means to exchange currencies, facilitating global commerce.

Foreign Investment: It provides opportunities for investors to exchange their capital into foreign currencies, enabling investments in international markets.

Economic Stability: Forex markets help stabilize economies by adjusting exchange rates to reflect supply and demand, which can influence inflation, interest rates, and economic growth.

Forex trading, while being a highly liquid and accessible market, also poses risks due to the volatility of currency movements. This is why governments and regulatory bodies carefully monitor forex trading activities, especially in developing countries like Nigeria.

The Regulatory Environment for Forex in Nigeria

Overview of Financial Regulation in Nigeria

In Nigeria, the financial market is regulated by a number of bodies tasked with overseeing various financial activities, including forex trading. The Central Bank of Nigeria (CBN) is the primary regulatory authority for currency management in the country. The CBN has the responsibility to stabilize the Naira (NGN) and manage the country's foreign reserves.

Additionally, the Securities and Exchange Commission (SEC) is another key player in the financial markets in Nigeria, overseeing investment activities and ensuring that securities markets operate in an orderly manner. While the SEC doesn't directly regulate forex trading, it plays a role in regulating the broader financial ecosystem.

Key Regulatory Bodies Involved

Central Bank of Nigeria (CBN): As the main regulator for foreign exchange in Nigeria, the CBN governs the market's operations, sets policies, and ensures that the country's currency is managed appropriately. It also monitors foreign exchange flows into and out of Nigeria.

Securities and Exchange Commission (SEC): While the SEC primarily oversees securities markets, it also ensures that financial markets, including forex brokers offering other investment options, comply with regulations to prevent illegal activities and protect investors.

Nigerian Financial Intelligence Unit (NFIU): The NFIU helps combat financial crimes, including money laundering and terrorist financing, which can impact forex trading.

Policies Affecting Forex Trading

While forex trading is not banned in Nigeria, the government has imposed various policies to manage the flow of foreign exchange. The CBN regulates the official exchange rate, which can impact the way forex is traded. For instance, the CBN introduced restrictions on the use of certain platforms and the number of currencies accessible to traders to curb speculative trading and conserve foreign exchange reserves.

Historical Background of Forex Trading in Nigeria

Evolution of Forex Trading in Nigeria

Forex trading in Nigeria has evolved over the years, with the country seeing a rise in retail forex traders due to the growth of internet access and technological advancements. Initially, forex trading was largely controlled by commercial banks and financial institutions, with limited access for retail traders. However, the advent of online forex brokers and trading platforms in the 2000s democratized forex trading, enabling individual Nigerians to participate in the global forex market.

In the early days, forex trading in Nigeria was mostly done through the formal banking sector, with the government closely monitoring foreign exchange transactions. As the market expanded, brokers and online trading platforms began to offer retail forex services to Nigerians, creating an active online trading community.

Major Changes in Forex Legislation

There have been several regulatory changes over the years to streamline forex trading activities and improve market integrity in Nigeria. For instance, the CBN has frequently adjusted its forex policies to tackle issues like foreign currency shortages, speculative trading, and capital flight.

Notably, in 2015, the CBN implemented measures to limit access to foreign currency on the official market, which impacted the forex market by increasing demand in the parallel or black market. Over the years, this has led to debates on whether Nigeria needs more liberalized forex policies or stricter controls.

Impact of Economic Factors on Forex Trading

Nigeria's economic challenges, such as oil price fluctuations, inflation, and a reliance on imports, have had a profound impact on the forex market. The value of the Naira against major currencies like the US dollar has been volatile, leading to increased demand for forex trading as individuals and businesses try to protect their savings and investments from currency devaluation.

Current Status of Forex Trading in Nigeria

Legality of Forex Trading Activities

Forex trading in Nigeria is entirely legal. The Central Bank of Nigeria has not imposed a ban on forex trading, but it closely regulates the sector to ensure stability in the country’s financial system. Nigerian citizens are allowed to trade forex through licensed brokers, and many brokers worldwide accept Nigerian traders.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

However, the CBN has put in place policies to curb speculative trading and discourage excessive demand for foreign currency. These policies ensure that forex trading does not negatively affect the economy or lead to undue volatility in the Nigerian currency.

Availability of Forex Brokers in Nigeria

Many global forex brokers, including platforms like Exness, FXTM, and HotForex, provide services to Nigerian traders. These brokers are licensed in other jurisdictions, such as Cyprus, the UK, and Seychelles, and offer access to the Nigerian market. However, Nigerian traders are advised to ensure that they choose regulated brokers with a good reputation to avoid scams and fraudulent activities.

In addition to international brokers, there are also local forex brokers operating in Nigeria, offering services to traders who prefer to deal with locally-based companies. These brokers comply with Nigerian laws and regulations, and many offer additional services such as education and training for new traders.

Types of Forex Trading Allowed

The CBN allows forex trading, including speculative and hedging activities, as long as traders comply with the established regulations. While retail forex trading is common, the CBN has strict rules around the use of official forex markets, such as for the importation of goods and services. Traders are encouraged to trade on legitimate platforms and avoid engaging in illicit activities such as using the black market for forex transactions.

Reasons for Restrictions or Regulations

Economic Stability Considerations

One of the key reasons behind the regulations on forex trading in Nigeria is to safeguard the country's economic stability. The Nigerian economy, being largely dependent on oil exports, is highly susceptible to fluctuations in global oil prices. These fluctuations can impact the value of the Naira, Nigeria's currency, which is closely linked to the dollar and other major currencies.

The Central Bank of Nigeria (CBN) regulates forex trading to prevent excessive speculation and volatility that could harm the country's economic health. For instance, if the Nigerian Naira were to devalue too quickly due to uncontrolled forex trading activities, it would result in inflation and reduced purchasing power for Nigerians. By managing the forex market, the CBN aims to stabilize the economy, protect the Naira, and control inflation.

Additionally, the regulations prevent capital flight, where large sums of money could leave the country in search of better returns in foreign markets. This is especially important in an economy like Nigeria's, where managing foreign reserves is crucial to supporting the exchange rate and maintaining economic growth.

Prevention of Fraud and Scams

Another reason for the regulations surrounding forex trading in Nigeria is to protect traders from fraudulent activities. The forex market, while offering opportunities for profit, has been a target for scams and fraudsters, particularly in countries where there is little oversight. Unregulated brokers may lure traders with unrealistic promises of high returns and then disappear with clients' funds.

In Nigeria, there has been a rise in fraudulent forex schemes, often involving unregulated brokers or unauthorized platforms. By implementing regulations, the government aims to reduce these risks and ensure that forex traders are dealing with legitimate, transparent brokers. Regulatory bodies like the CBN and the Securities and Exchange Commission (SEC) help maintain market integrity, monitor brokers, and ensure they meet specific standards, thereby protecting consumers from financial fraud.

Need for Consumer Protection

Forex trading involves substantial risks, and without proper consumer protection, traders are vulnerable to losses. Regulations in Nigeria are designed to safeguard the interests of individual traders by enforcing rules on transparency, proper risk disclosures, and ensuring brokers provide fair trading conditions.

By regulating forex brokers and enforcing consumer protection laws, the Nigerian government aims to promote trust in the market and encourage responsible trading practices. Brokers are required to maintain segregated accounts for clients' funds, which means that clients' money is protected in case the broker faces financial difficulties. This helps protect traders from losing their funds in the event of a broker’s insolvency.

Furthermore, the government provides resources to help traders better understand the risks involved in forex trading. The presence of these regulatory frameworks also promotes a healthier trading environment where traders are more confident in participating.

Popular Myths About Forex Trading in Nigeria

Myth: Forex Trading is Completely Illegal

One of the most prevalent myths about forex trading in Nigeria is that it is completely illegal. This misconception may arise from the perception that the Nigerian government has strict control over foreign exchange and currency markets. While it is true that the Central Bank of Nigeria (CBN) implements policies to control forex transactions, forex trading itself is not prohibited.

As long as traders engage with licensed and regulated brokers, forex trading remains legal. The CBN’s regulatory framework is designed to prevent illegal activities such as speculation or the use of the parallel market (black market) for forex exchange. Traders can access the official market through regulated brokers, and as long as they follow the prescribed guidelines, they can engage in forex trading without violating any laws.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Myth: Only Wealthy Individuals Can Trade Forex

Another common myth is that forex trading is reserved for the wealthy. Many Nigerians believe that they need large sums of money to start trading, which deters them from entering the market. In reality, forex trading can be accessible to individuals with small initial investments. Most online brokers allow traders to open accounts with as little as $10 to $50, making it possible for even small investors to participate in the forex market.

Additionally, the rise of online trading platforms and mobile trading apps has made it easier for individuals of varying financial backgrounds to access the forex market. With the right knowledge and strategy, forex trading can be profitable for traders of all financial backgrounds, not just the wealthy.

Myth: Forex Trading Guarantees High Returns

A common myth that attracts people to forex trading is the belief that it guarantees high returns. While it is true that the forex market offers opportunities for profit, it is also highly volatile, and there is no certainty of gains. Many traders, especially beginners, enter the market with the expectation of quick, significant profits but may face losses if they are not well-prepared or lack a sound trading strategy.

Forex trading requires careful analysis, patience, and a solid understanding of market dynamics. Traders must be aware of the risks involved and use proper risk management techniques, such as setting stop-loss orders and diversifying their trades. The notion that forex trading guarantees high returns can lead to unrealistic expectations and poor decision-making.

Risks Associated with Forex Trading in Nigeria

Financial Risks for Individual Traders

Forex trading, like any other form of investment, carries significant financial risks. The forex market is highly volatile, meaning that currency values can fluctuate rapidly, sometimes within seconds. While this volatility presents opportunities for profit, it also exposes traders to the risk of substantial losses.

For individual traders, managing risk is crucial. Without proper risk management strategies, such as setting stop-loss limits or limiting exposure to highly volatile currency pairs, traders can quickly lose their capital. In addition, traders must be cautious of leverage, which can magnify both gains and losses. Overleveraging can lead to a situation where a trader loses more money than they initially invested, leading to significant financial distress.

Potential Legal Consequences

Although forex trading itself is legal in Nigeria, engaging in illegal activities related to forex can have serious legal consequences. These activities include trading through unregulated or unauthorized brokers, using the parallel market (black market) for forex transactions, or engaging in money laundering through forex dealings. The Central Bank of Nigeria (CBN) has strict policies regarding the use of the official forex market, and violations can result in penalties, fines, or other legal actions.

Traders should ensure they are working with licensed and regulated brokers who comply with Nigerian regulations. The use of unlicensed platforms can expose traders to fraud, and trading on the black market is illegal and can attract severe penalties. By adhering to the rules and engaging only with legitimate brokers, traders can avoid the risk of legal issues.

Challenges Posed by Unregulated Brokers

One of the biggest challenges in the Nigerian forex market is the presence of unregulated brokers. These brokers often operate in the gray market, offering enticing promotions and low spreads to attract traders. However, many of these brokers lack transparency, and some even operate as scams, taking advantage of inexperienced traders.

Trading with unregulated brokers is risky, as they may engage in practices that harm traders, such as withholding profits, mismanaging funds, or manipulating prices. The Nigerian government, through agencies like the CBN, works to ensure that brokers comply with local regulations to protect traders from these risks. It is essential for Nigerian traders to conduct due diligence and choose brokers that are properly licensed and regulated by reputable authorities.

Best Practices for Engaging in Forex Trading

Choosing a Regulated Broker

One of the most important steps in forex trading is choosing a regulated broker. A regulated broker provides a safe and secure trading environment, ensuring that your funds are protected and that the broker operates under the supervision of a recognized financial authority. Regulated brokers must adhere to strict rules and transparency standards, which helps prevent fraud and ensures fair trading conditions.

Traders should always verify the regulatory status of a broker before opening an account. This can be done by checking the broker’s licenses with local and international financial regulators, such as the Central Bank of Nigeria, the UK’s Financial Conduct Authority (FCA), or the Cyprus Securities and Exchange Commission (CySEC).

Developing a Trading Strategy

To be successful in forex trading, it is important to develop a well-thought-out trading strategy. This strategy should be based on a combination of technical analysis, fundamental analysis, and market research. Traders should carefully analyze price movements, study economic indicators, and stay updated on global events that could impact currency markets.

A good trading strategy should also include clear risk management practices, such as setting stop-loss orders to limit potential losses and determining position sizes that align with your risk tolerance. Trading without a plan or strategy can lead to poor decision-making and substantial losses.

Staying Informed on Market Trends

Forex markets are highly dynamic, and staying informed about current market trends is crucial for making informed trading decisions. Traders should follow news, economic reports, and market analyses to understand how global events impact currency values. The ability to react quickly to market changes can make a significant difference in a trader's success.

Many forex brokers offer educational resources, such as webinars, analysis reports, and trading signals, which can help traders stay updated and improve their skills.

Future of Forex Trading in Nigeria

Predictions for Regulatory Changes

As Nigeria continues to develop its financial markets, it is likely that we will see further regulatory changes in the forex industry. The Central Bank of Nigeria may continue to implement policies to protect the Naira, stabilize the economy, and prevent speculative trading. Traders should remain adaptable to changes in regulations and ensure compliance with any new rules or guidelines introduced by the government.

Emerging Trends in Global Forex Markets

The global forex market is constantly evolving, with technological advancements and changes in trading platforms offering new opportunities for traders. With increasing access to mobile trading apps and the development of blockchain technologies, the forex industry is likely to see further growth in Nigeria.

Opportunities for Nigerian Traders

Despite the challenges, the forex market offers significant opportunities for Nigerian traders. With the right education, tools, and risk management strategies, individuals can profit from forex trading. As Nigeria’s economy stabilizes and regulatory frameworks continue to evolve, the forex market will likely become more accessible to a wider range of traders, fostering greater opportunities for growth.

Conclusion

In conclusion, forex trading is not banned in Nigeria, and it remains a legal and accessible investment avenue. While there are regulations in place to ensure market stability and consumer protection, these regulations are designed to prevent illegal activities, such as speculative trading and the use of unregulated brokers. By choosing a licensed broker, developing a sound trading strategy, and staying informed about market trends, Nigerian traders can engage in forex trading safely and profitably.

Read more: