10 minute read

Is forex trading legal in Germany? A Comprehensive Guide

from Exness

by Exness_Blog

Understanding Forex Trading

Definition and Basics of Forex Trading

Forex trading, or foreign exchange trading, is the act of buying and selling currencies on a global marketplace with the objective of making a profit from changes in currency values. Forex trading involves pairs of currencies like EUR/USD (Euro/US Dollar), where traders speculate on the future value of one currency relative to the other. This market operates 24 hours a day, five days a week, across major financial hubs like New York, London, and Tokyo, making it one of the largest and most liquid financial markets in the world, with a daily trading volume exceeding $6 trillion.

Top 4 Best Forex Brokers in Germany

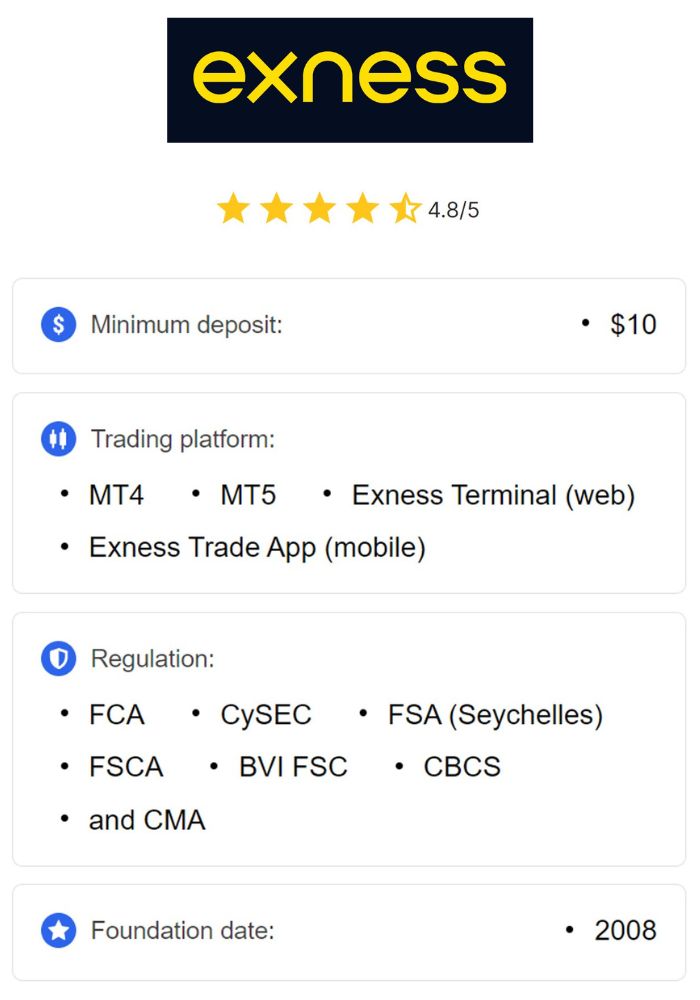

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

Global Forex Market Overview

The forex market is a decentralized network that allows participants, including banks, financial institutions, corporations, and retail investors, to exchange currencies. Unlike stock markets, forex trading does not occur on a centralized exchange but rather over-the-counter (OTC) through electronic networks. The high liquidity and accessibility of forex trading have made it popular among both institutional and individual investors. Traders can use various strategies, including day trading, swing trading, and scalping, to take advantage of currency fluctuations, which are influenced by global economic conditions, geopolitical events, and interest rate policies.

The Legal Framework for Forex Trading in Germany

Role of BaFin (Federal Financial Supervisory Authority)

In Germany, the primary regulatory body overseeing the financial markets, including forex trading, is the Federal Financial Supervisory Authority, known as BaFin (Bundesanstalt für Finanzdienstleistungsaufsicht). BaFin enforces financial regulations to protect traders and ensure market integrity. It oversees forex brokers operating in Germany, ensuring they meet licensing requirements, adhere to anti-money laundering (AML) and Know Your Customer (KYC) standards, and provide a transparent trading environment. BaFin's strict regulations aim to foster a secure market for retail and institutional forex traders, minimizing the risks associated with unregulated brokers.

Key Regulations Governing Forex Trading

Germany’s regulatory environment for forex trading aligns closely with European Union standards, including the Markets in Financial Instruments Directive (MiFID II), which sets uniform guidelines for financial services across the EU. Under MiFID II, forex brokers must provide transparent information about their services, including fees, spreads, and leverage limits. Leverage for retail forex trading in Germany is capped at 30:1 for major currency pairs and 20:1 for non-major pairs to protect traders from excessive risk. Additionally, brokers must implement negative balance protection, ensuring that traders cannot lose more than their initial investment, and must provide standardized risk disclosures.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Licensing Requirements for Forex Brokers in Germany

Types of Licenses Required

Forex brokers operating in Germany must be licensed by BaFin, which involves meeting stringent capital and compliance requirements. BaFin offers different licenses depending on the broker's activities, such as providing retail trading services, managing funds, or acting as an investment intermediary. To obtain a license, brokers must demonstrate financial stability, a robust organizational structure, and strict adherence to compliance standards. Only BaFin-licensed brokers are legally permitted to offer forex trading services to German residents, ensuring that traders are protected under German and EU financial regulations.

Application Process for Forex Brokers

The application process for a BaFin license is rigorous and involves multiple steps. Brokers must submit detailed documentation, including business plans, capital adequacy information, and organizational policies. BaFin evaluates these submissions to ensure the broker has sufficient capital reserves, sound risk management practices, and a reliable trading platform. The licensing process may take several months, and brokers are required to undergo regular audits to maintain their license. This thorough application process is designed to maintain high standards within the German forex market and ensure that brokers operate transparently and ethically.

Tax Implications of Forex Trading in Germany

Taxation on Forex Earnings

Forex trading profits in Germany are subject to taxation. Individual traders are required to report gains from forex trading as part of their capital income and pay a capital gains tax, known as Abgeltungsteuer. This tax rate is 25%, plus a solidarity surcharge of 5.5% and, in some cases, a church tax, depending on the trader’s residence. It’s important for traders to keep accurate records of all transactions, as they may be required to provide documentation of their trading activity to the tax authorities.

Reporting Requirements for Traders

German traders must report their forex trading earnings annually to the tax authorities. Maintaining detailed records of each trade, including profit and loss statements, is essential for accurate tax reporting. Many brokers operating in Germany provide clients with annual reports summarizing their trades, which can be used for tax purposes. Consulting a tax advisor with experience in financial markets is recommended to ensure compliance with Germany’s tax obligations and avoid penalties for misreporting or non-compliance.

Protection for Traders in Germany

Investor Compensation Schemes

Germany’s financial regulations include investor compensation schemes to protect retail traders. BaFin ensures that forex brokers operating in Germany participate in the Compensation Scheme of German Banks (Entschädigungseinrichtung deutscher Banken, EdB), which provides coverage for up to €100,000 per client in case of broker insolvency. This scheme offers an additional layer of security for traders, reassuring them that their funds are protected if their broker faces financial difficulties.

Regulatory Protections Against Fraud

BaFin enforces strict regulations to prevent fraudulent activities in the forex market, including requirements for transparency, disclosure, and fair treatment of clients. Brokers are required to segregate client funds from their operational funds, reducing the risk of misuse. BaFin also monitors brokers’ compliance with anti-money laundering (AML) policies, reducing the likelihood of fraud. Additionally, BaFin actively investigates and addresses consumer complaints, taking legal action against brokers that engage in unethical practices or violate German financial regulations.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Popular Forex Trading Platforms in Germany

Features to Look for in a Trading Platform

When choosing a trading platform in Germany, traders should look for features such as ease of use, advanced charting tools, real-time data, and secure fund management. Platforms should also provide access to a wide range of currency pairs, low latency for fast execution, and customizable trading options. Reliable customer support, a user-friendly interface, and comprehensive educational resources are essential features that can enhance a trader’s experience and effectiveness in the forex market.

Comparison of Top German Forex Brokers

Germany hosts several reputable forex brokers, many of which are BaFin-regulated, including well-known platforms like IG, CMC Markets, and DEGIRO. These brokers offer various trading platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), and proprietary platforms, allowing traders to choose the one that best suits their needs. Comparing brokers based on factors like fees, spreads, available currency pairs, and platform features can help traders select a reliable broker that aligns with their trading strategy and financial goals.

Risks Involved in Forex Trading

Market Volatility and Its Impact

Forex trading is highly volatile, and currency values can change rapidly due to economic data releases, geopolitical events, and monetary policy changes. German traders should be aware of these factors and understand how market volatility can impact their trading strategies. Developing a strong risk management plan, including setting stop-loss orders and avoiding excessive leverage, is essential for navigating the forex market's unpredictable nature.

Leverage Risks and Margin Requirements

While leverage allows traders to control larger positions with a smaller investment, it also amplifies potential losses. In Germany, leverage for retail traders is capped by BaFin at 30:1 for major pairs and 20:1 for minor pairs, aiming to protect traders from excessive risk. Margin requirements mean that traders must maintain a minimum account balance to keep positions open. Understanding these leverage limitations and margin requirements can help traders make informed decisions and avoid margin calls that could result in significant losses.

Educational Resources for Forex Traders

Online Courses and Webinars

A variety of online courses and webinars are available to help traders in Germany improve their forex trading knowledge. Many brokers and educational platforms offer resources on topics like technical and fundamental analysis, risk management, and trading psychology. Participating in online courses and webinars can provide valuable insights and strategies, allowing traders to refine their skills and stay updated on market trends.

Recommended Books and Literature

Books are an excellent resource for building a strong foundation in forex trading. Recommended titles include Currency Trading for Dummies by Kathleen Brooks, Forex Trading: The Basics Explained in Simple Terms by Jim Brown, and Trading for a Living by Dr. Alexander Elder. These books cover essential trading concepts, market analysis techniques, and practical advice for managing risk and improving trading performance.

Community and Networking Opportunities

Forex Trading Forums and Online Communities

Joining online communities and forex trading forums can provide German traders with opportunities to exchange ideas, discuss strategies, and learn from experienced traders. Popular forums like Forex Factory and BabyPips offer valuable information on trading strategies, market analysis, and broker reviews. Engaging with these communities can help traders gain new perspectives and enhance their understanding of the forex market.

Local Meetups and Workshops

Germany hosts a variety of local meetups and workshops for forex traders, providing networking and learning opportunities. These events allow traders to connect with like-minded individuals, gain insights from industry experts, and participate in interactive sessions on market analysis and trading strategies. Attending local events can be beneficial for both beginner and experienced traders looking to expand their knowledge and network within the trading community.

Ethical Considerations in Forex Trading

Transparency and Fair Practices

Ethical trading involves transparency, fair practices, and honesty in dealing with clients. BaFin enforces strict guidelines on transparency for forex brokers, requiring them to disclose all fees, commissions, and trading conditions to clients. Brokers are also required to act in the best interest of their clients, ensuring fair order execution and providing adequate risk disclosures. Ethical practices are crucial for maintaining trust and credibility in the forex market.

The Impact of High-Frequency Trading

High-frequency trading (HFT) involves executing a large number of orders within seconds to capitalize on small price movements. While HFT can increase liquidity, it may also lead to market manipulation and unfair trading advantages for certain firms. BaFin monitors HFT practices closely to ensure fair trading conditions, and some brokers in Germany place restrictions on HFT to maintain a level playing field for all traders. Ethical considerations in HFT focus on ensuring transparency and preventing market manipulation.

Future Trends in Forex Trading in Germany

Technological Advancements and Innovation

The future of forex trading in Germany is likely to be shaped by technological advancements, such as artificial intelligence (AI) and machine learning. These innovations can provide traders with more sophisticated tools for market analysis and trade execution, improving the accuracy of trading strategies. Blockchain technology and cryptocurrency trading are also likely to influence the forex market, offering new opportunities for diversification and secure transactions.

Changes in Regulation and Oversight

As the forex market evolves, regulatory bodies like BaFin are expected to adapt their policies to address emerging challenges and opportunities. Potential regulatory changes could involve further restrictions on leverage, enhanced transparency requirements, and stricter compliance standards for brokers. By staying proactive, BaFin aims to maintain a secure and transparent trading environment for German traders, fostering a stable financial market.

Conclusion

Forex trading is fully legal and regulated in Germany, with BaFin overseeing the industry to ensure compliance with strict European standards. The regulatory framework provides protections for both retail and institutional traders, fostering a safe and transparent trading environment. While forex trading carries inherent risks, including market volatility and leverage, Germany’s regulations mitigate these risks by enforcing leverage caps, transparency requirements, and investor protection schemes. German traders can take advantage of reliable brokers, advanced trading platforms, and numerous educational resources to develop their skills and succeed in the forex market. As technology continues to shape the industry, the future of forex trading in Germany promises to be dynamic and full of opportunities, supported by a robust regulatory foundation.

Read more: