15 minute read

Does Exness work in India? Regulated, Registered, Legal?

Does Exness work in India? This question resonates with many aspiring traders who seek reliable and effective platforms for online trading. Exness, a globally recognized online brokerage firm, offers an extensive range of financial instruments and services, making it an appealing option for traders around the world, including India.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Overview of Exness

Introduction to Exness

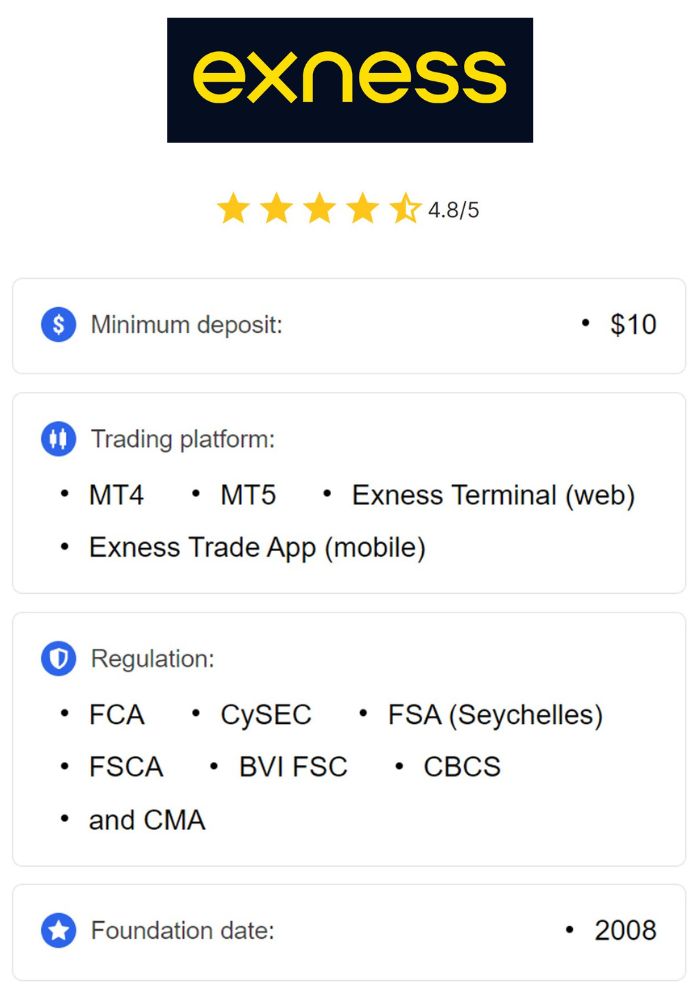

Founded in 2008, Exness has made significant strides in establishing itself as a leading online brokerage by offering a diverse array of trading solutions. The company prides itself on creating a user-friendly trading environment that caters to both novice and experienced traders alike. Its commitment to delivering competitive trading conditions and advanced technologies sets Exness apart from its competitors.

Exness operates within a multi-jurisdictional framework, allowing it to attract a wide client base across various regions. This operational strategy not only underpins its growth but also enhances its credibility as a trustworthy trading platform. As Indian traders increasingly explore opportunities in forex and other markets, they are drawn to Exness for its robust offerings and commitment to trader education.

Regulation and Licensing

One of the most critical aspects of any brokerage firm is its regulatory framework. Exness takes its regulatory obligations seriously, as seen through its licenses issued by several reputable international financial authorities. This includes:

CySEC (Cyprus Securities and Exchange Commission): Licensed under license number 178/12.

FCA (Financial Conduct Authority): Authorized and regulated by the FCA under the reference number 730729.

FSCA (Financial Sector Conduct Authority): Authorized and regulated by the FSCA under the reference number 49735.

Each of these licenses reinforces Exness’ dedication to maintaining a high standard of oversight and compliance. Such regulation ensures that traders’ funds are protected and that ethical practices govern trading operations. For Indian traders, these licenses are indicative of Exness' reliability and commitment to transparency in its dealings.

Exness Features and Offerings

Trading Platforms Available

Exness understands the diverse needs of traders, which is why it offers multiple trading platforms specifically designed to cater to different levels of expertise and trading preferences.

MetaTrader 4 (MT4) is perhaps the most widely recognized trading platform in the forex community. Its stable performance, versatile features, and user-friendly interface make it particularly appealing to beginners and seasoned traders alike. With MT4, users benefit from advanced charting tools, automated trading capabilities, and custom indicators, offering extensive opportunities for technical analysis.

MetaTrader 5 (MT5) is the successor to MT4 and comes packed with enhanced functionalities. It encompasses a wider array of technical indicators, sophisticated order management tools, and improved charting options. Traders seeking a more comprehensive approach to their trading strategies might find MT5 better suited to their needs.

Exness Terminal, a proprietary web-based trading platform, rounds out the available options. Offering a streamlined and intuitive experience, it allows users to trade directly from their browsers without the need for downloads or installations. This accessibility is particularly beneficial for traders who prioritize ease of use and quick navigation.

Account Types Offered

Exness provides a variety of account types tailored to accommodate varying levels of expertise and capital investment. Each account class comes with its own unique features and benefits.

The Standard Account remains a popular choice among beginner traders and active investors. It allows access to an impressive range of currency pairs and assets, complemented by competitive leverage and spreads.

For experienced traders who prioritize tighter spreads and can navigate commission-based pricing, the Raw Spread Account is ideal. This account type enables traders to operate under optimal market conditions with minimal slippage.

Lastly, the Cent Account is a good starting point for those new to trading or with limited capital. This account allows traders to engage in low-risk transactions using cent lots, providing an opportunity to practice and gain experience without exposing themselves to high stakes.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Range of Financial Instruments

The diversity of financial instruments offered by Exness is a key factor that attracts Indian traders looking to broaden their investment portfolios. Exness does not limit itself to just one market; instead, it opens doors to multiple asset classes.

In the Forex market, traders have access to a vast selection of currency pairs, enabling them to capitalize on fluctuations in exchange rates. Additionally, Exness offers trading in metals, such as gold and silver, providing valuable opportunities to leverage the commodities market's price movements.

Further diversifying the offerings, Exness includes energies, like oil and natural gas futures contracts, and indices, allowing traders to speculate on broader market trends via major stock indices. And for those intrigued by the digital frontier, trading in popular cryptocurrencies such as Bitcoin and Ethereum is also available, aligning with the growing trend of crypto investing.

Legal Considerations for Indian Traders

Regulatory Environment in India

The regulatory landscape for online trading in India is continuously evolving as technology and market dynamics change. The Securities and Exchange Board of India (SEBI) has established itself as the primary regulator overseeing securities markets. However, the regulatory framework specifically governing foreign exchange trading through international brokers like Exness remains relatively less defined.

While SEBI’s focus primarily lies on domestic trading activities, Indian traders often look toward international platforms for forex trading opportunities, raising questions about legality and compliance. As a result, it's essential for traders to remain informed about ongoing regulatory developments that could impact their trading experiences.

Compliance with International Regulations

Exness adheres to strict compliance standards set forth by various international regulators. While these regulations may not apply directly to Indian traders, they reflect Exness’ commitment to maintaining a transparent and secure trading environment. Such compliance assures traders that their chosen broker operates ethically and responsibly, significantly reducing the risks associated with trading fraud or mismanagement of funds.

By operating under rigorous regulatory frameworks, Exness demonstrates that it values the safety and well-being of its clients. For Indian traders, this can serve as a crucial reassurance when navigating the complexities of online trading.

Taxes on Trading Profits

Understanding the tax implications of trading profits is vital for Indian traders engaging with Exness. Revenue generated from forex trading is typically classified as either business income or capital gains, depending on the frequency of trades and the trader's intent.

Traders must be diligent in adhering to tax laws and regulations in India. They should accurately report their earnings to tax authorities and maintain proper records to ensure compliance. Consulting with a qualified tax advisor familiar with trading norms can help traders navigate the nuances of taxation and avoid potential legal issues down the line.

Opening an Exness Account from India

Eligibility Criteria

Opening an Exness account from India is accessible to a broad audience as long as certain eligibility criteria are met. Primarily, individuals must be at least 18 years old and possess a valid identification document and proof of address. Typically, Indian residents can easily register and start trading with Exness.

To further streamline the verification process, Exness accepts a variety of documents, including passports, national identity cards, and utility bills, ensuring that the onboarding process is efficient and user-friendly.

Step-by-Step Account Registration Process

Creating an Exness account is a straightforward and entirely online process. Here’s how aspiring traders can get started:

Visiting the Exness Website: Navigate to the official Exness website using a secure internet connection.

Clicking on the Open Account Button: Locate the account registration section and initiate the signup process.

Filling Out the Registration Form: Enter personal information, selecting your desired account type during this step.

Verifying Email Address: A confirmation email will be sent to the provided email address, which must be verified to activate the account.

Uploading Necessary Documents: Users will then be prompted to upload identity and address verification documents as outlined by Exness.

Completing the Account Setup: Review and agree to the terms and conditions to finalize the account setup.

This simple and user-friendly registration process is designed to facilitate easy access for traders looking to enter the world of online trading.

Verification Requirements

Identity and address verification represent critical steps within the account-opening journey. Exness follows stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols to safeguard the integrity of the platform and prevent fraudulent activities.

Typically, traders will be required to present:

Proof of Identity: Acceptable documents include a passport, driving license, or national identity card.

Proof of Address: Documentation like a recent utility bill or bank statement featuring the trader's name and address.

The verification process may take several business days to complete. Once approved, traders can access their accounts and begin trading, contributing to a secure trading environment.

Funding Your Exness Account

Deposit Methods Available in India

Exness recognizes that funding an account should be hassle-free, so it offers a rich variety of deposit methods to cater to Indian traders.

Bank wire transfers provide a traditional yet secure option, allowing direct deposits from bank accounts to Exness accounts.

For those seeking speed and convenience, credit and debit cards are widely accepted. Utilizing popular cards like Visa and Mastercard makes the deposit process both swift and straightforward.

E-wallets like Neteller and Skrill further enhance flexibility, allowing seamless transactions to and from trading accounts. Additionally, Exness may partner with local payment systems tailored to the Indian market, providing added options for convenient funding.

Withdrawal Options for Indian Traders

Exness ensures that the withdrawal process mirrors the ease of deposits, offering similar transaction methods for Indian traders.

Bank wire transfers are common for withdrawing funds back to bank accounts. If a trader initially funded their account using a credit or debit card, they can typically withdraw their funds back to the same card.

E-wallet withdrawals via Neteller and Skrill allow for quicker transfers to e-wallet accounts, providing additional flexibility. Depending on regional partnerships, local payment methods may also be available for withdrawals, accommodating the diverse needs of Indian traders.

Transaction Fees and Processing Times

Exness generally refrains from imposing fees on deposit and withdrawal transactions, although third-party payment providers may have their charges. Traders are encouraged to review the specific fees tied to their chosen methods to avoid surprises.

Processing times for transactions can vary depending on the method used. Bank wire transfers may take longer compared to e-wallet transactions, which typically process quickly. Understanding those timelines helps traders manage their funds effectively and plan their trading activities accordingly.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Trading Experience on Exness

User Interface and Ease of Use

A seamless trading experience is paramount for traders, and Exness delivers with its intuitive user interface. Both the MetaTrader platforms and Exness Terminal are designed to facilitate easy navigation, ensuring that traders can focus on executing their strategies rather than grappling with complex software.

Users appreciate the clarity of charts, customizable layouts, and straightforward access to essential trading tools. This level of usability empowers traders to analyze market conditions and execute trades efficiently, whether they are novices or experts.

Customer Support Services

Exness places significant importance on customer support, recognizing that prompt assistance is crucial for traders navigating challenges. The platform provides robust customer service, available through multiple channels, including live chat, email, and phone support.

Indian traders can expect timely responses from knowledgeable representatives who understand the intricacies of trading in the local context. This responsive support system builds trust and confidence, promoting a positive overall trading experience.

Educational Resources for Traders

Exness goes beyond simply providing a trading platform by equipping traders with educational resources to hone their skills. Through webinars, tutorials, and informative articles, traders gain insights into various trading strategies, market trends, and risk management techniques.

These learning materials empower traders to make informed decisions, enhancing their chances for success in the dynamic world of online trading. Exness prioritizes the development of its users, demonstrating a commitment to fostering a knowledgeable trading community.

Market Access for Indian Traders

Currency Pairs and Assets Available

When it comes to market access, Exness offers Indian traders the ability to delve into an extensive array of currency pairs and assets. The forex market is expansive, with numerous currency pairings available for trading, allowing traders to capitalize on fluctuating exchange rates.

Beyond forex, the inclusion of metals, energies, indices, and cryptocurrencies presents ample diversification opportunities. This richness in asset classes means that Indian traders can respond to changing market conditions and tailor their trading strategies to fit their individual objectives.

Leverage and Margin Trading Policies

Exness provides traders with the ability to utilize leverage, amplifying their trading capacity. This means traders can control larger positions than their initial capital would typically allow. While leverage can enhance profit potential, it is essential for traders to understand the risks involved, as higher leverage can also lead to increased losses.

Margin trading policies at Exness are designed to be transparent, with clear guidelines outlining margin requirements and the potential impact on leveraged positions. Educated decision-making regarding leverage is crucial for Indian traders aiming to optimize their trading outcomes.

Safety and Security Measures

Data Protection and Privacy Policies

In the digital age, safeguarding personal data is a top priority for online platforms. Exness employs stringent data protection measures to ensure that traders’ information remains secure. Robust encryption protocols and privacy policies guard against unauthorized access, reinforcing the trustworthiness of the platform.

By regularly updating and auditing their security measures, Exness demonstrates a proactive approach to data protection, reassuring Indian traders that their sensitive information is in safe hands.

Fund Safety and Segregation Policies

Another critical aspect of safety is the segregation of client funds. Exness adheres to industry best practices by keeping client funds in separate accounts from the company's operational funds. This segregation ensures that traders' capital remains protected even in the event of unforeseen circumstances.

Moreover, Exness participates in compensation schemes governed by regulatory bodies, providing an additional layer of security for client investments. Such measures align with the global standards for fund safety, positioning Exness as a responsible and reliable broker for Indian traders.

Comparative Analysis with Other Brokers

Exness vs. Domestic Brokers

When evaluating Exness alongside domestic brokers, several factors come into play. Many Indian brokers may offer localized services and support, catering specifically to the Indian market. However, Exness distinguishes itself through its extensive repertoire of financial instruments, flexible account types, and robust technological offerings.

While domestic brokers may boast familiarity with local regulations and a more localized approach, Exness’s international presence grants it access to better liquidity and more diverse trading opportunities. Traders must weigh these differences against their individual trading needs when considering which broker aligns best with their objectives.

Exness vs. Global Forex Brokers

Comparing Exness to global forex brokers highlights both strengths and areas of differentiation. Exness stands out due to its competitive trading conditions, extensive range of assets, and advanced trading platforms. These attributes resonate well with traders seeking a holistic trading experience.

However, some global brokers may offer additional services such as dedicated account managers or personalized trading advice, which could appeal to traders looking for more guidance. Ultimately, the choice between Exness and other global brokers will depend on the specific requirements and preferences of the individual trader.

Success Stories and Testimonials

Experiences of Indian Traders

Many Indian traders have shared success stories stemming from their experiences with Exness. Positive testimonials reflect satisfaction with the platform's features, ease of use, and supportive customer service.

Numerous traders emphasize how Exness has facilitated their entry into the forex market, allowing them to develop skills and achieve consistent results. These success stories underline the potential for profitability and growth, showcasing how Exness can empower traders looking to thrive in the competitive online trading landscape.

Case Studies of Successful Trading Strategies

Diving deeper into individual stories reveals how traders have implemented successful trading strategies while using Exness. Some traders highlight the importance of utilizing technical analysis tools available on the platform to identify potential trends and make informed trading decisions.

Others focus on the educational resources provided by Exness, noting how webinars and tutorials have helped them refine their approach and cultivate more disciplined trading habits. These case studies exemplify the impact of a supportive trading environment on individual trader success.

Challenges Faced by Indian Traders on Exness

Technical Issues and Downtime

Despite its reputation, some Indian traders have occasionally faced technical issues and downtime while using the Exness platform. While such occurrences are not uncommon in the fast-paced world of online trading, they can disrupt trading activities and lead to missed opportunities.

Exness continually strives to improve its infrastructure and minimize technical glitches, yet traders should stay vigilant and maintain alternative plans for executing their strategies when necessary.

Limitations on Certain Trading Activities

Like any brokerage, Exness imposes limitations on specific trading activities, which may pose challenges for Indian traders. For instance, there may be restrictions on specific trading instruments, or certain strategies may not be allowed within the platform's framework.

Being aware of these limitations is crucial for traders to adapt their strategies accordingly and remain compliant with the platform's policies. Engaging with customer support can provide clarity on any uncertainties surrounding permissible trading activities.

Conclusion

In summary, the question "Does Exness work in India?" is met with a resounding affirmative. Exness presents a comprehensive trading platform that effectively caters to the diverse needs of Indian traders. With its robust range of financial instruments, competitive trading conditions, and commitment to user education, Exness is well-positioned to facilitate traders’ journeys toward success.

Navigating the digital trading landscape may come with its set of challenges, but understanding the advantages of using Exness—as well as remaining cognizant of local regulations and potential obstacles—empowers Indian traders to make informed decisions. Whether you're a newcomer eager to learn or a seasoned trader seeking to expand your portfolio, Exness stands ready to support your trading aspirations.

Read more: