14 minute read

Does Exness work in Zimbabwe? Regulated, Registered, Legal?

from Exness

by Exness_Blog

Forex trading is growing in popularity in Zimbabwe, with traders seeking reliable platforms like Exness for competitive conditions and security. But is Exness legal and suitable for Zimbabwean traders? This article explores the regulatory environment in Zimbabwe, the legal status of Exness, and the benefits and challenges of using the platform in Zimbabwe. By the end, you'll have a clear understanding of whether Exness is a good choice for Zimbabwean forex traders.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Exness

Overview of Exness as a Forex Broker

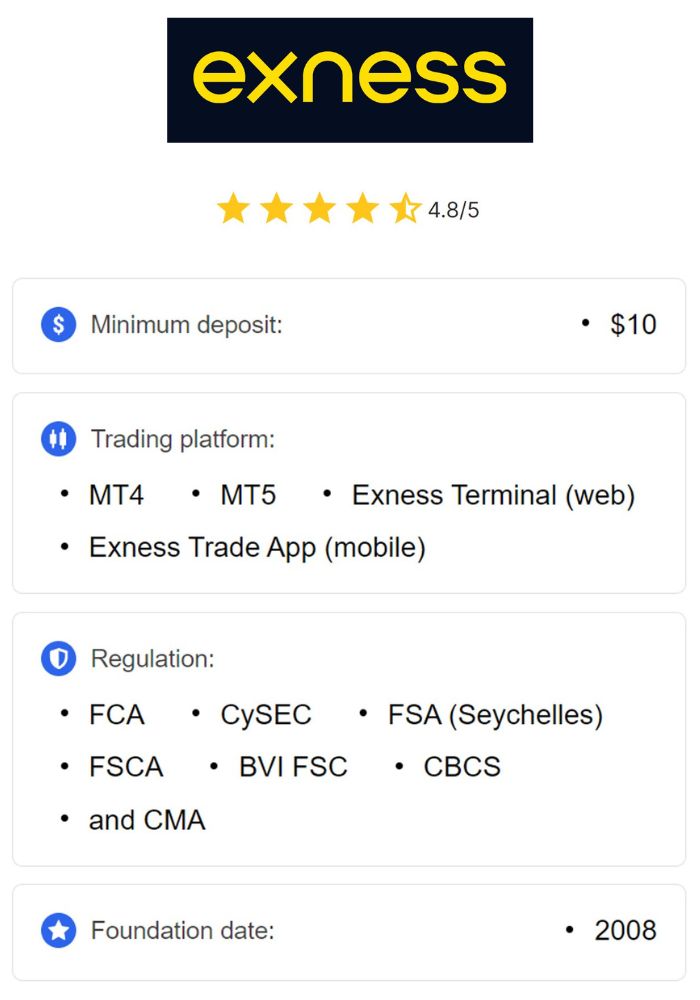

Exness is a well-established online forex and financial trading broker that has earned a reputation for offering competitive trading conditions, transparency, and a wide range of financial instruments. Founded in 2008, Exness has rapidly grown into one of the most recognized brokers in the global financial markets. The broker provides access to a variety of trading products, including forex, commodities, cryptocurrencies, and indices. What sets Exness apart is its commitment to offering low-cost trading opportunities, innovative platforms, and advanced tools to traders across the world.

For traders in Zimbabwe, Exness presents an attractive proposition with its advanced features, easy-to-use platform, and robust customer support. However, before jumping into trading, it is important to understand whether Exness operates legally in Zimbabwe and how the regulatory framework impacts its services in the country.

Key Features and Services Offered by Exness

Exness provides a wide range of trading features designed to cater to different trader profiles, from beginners to experienced professionals. Key features include:

Multiple Account Types: Exness offers various account types to accommodate traders with different needs, from beginner-friendly accounts to professional accounts with advanced features.

Low Spreads and High Leverage: The broker is known for its competitive spreads and high leverage options, giving traders greater flexibility and the ability to manage risk effectively.

Trading Platforms: Exness supports the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which provide traders with advanced charting tools, automated trading options, and a seamless trading experience.

Educational Resources: Exness offers an extensive library of educational materials, including webinars, articles, and tutorials, to help traders of all experience levels improve their skills.

These services make Exness an attractive option for traders in Zimbabwe who are looking for a reliable and user-friendly broker to access the global forex market.

Understanding the Legal Landscape in Zimbabwe

Financial Regulatory Framework in Zimbabwe

Zimbabwe’s financial sector is primarily regulated by the Reserve Bank of Zimbabwe (RBZ), which is responsible for overseeing monetary policy, banking, and financial services. However, when it comes to online forex trading, the regulatory framework is not as clear-cut as it is for traditional financial services. The RBZ has imposed strict regulations on the use of foreign currencies and has implemented measures to control inflation and stabilize the local currency, the Zimbabwean Dollar (ZWL).

Although forex trading itself is not illegal, it operates in a grey area in terms of formal regulations. This means that while Zimbabweans can trade forex online, the lack of specific regulations for online brokers makes it important for traders to select brokers that are globally regulated to ensure safety and compliance with international standards.

Role of the Reserve Bank of Zimbabwe

The Reserve Bank of Zimbabwe (RBZ) plays a significant role in shaping the country's financial environment. The RBZ is responsible for managing the country’s foreign exchange reserves, issuing currency, and regulating financial institutions. However, when it comes to the regulation of online forex brokers, the RBZ does not directly oversee the operations of offshore brokers like Exness.

The RBZ has warned against trading with unregulated forex brokers, as this could expose traders to higher risks. However, it has not banned trading with offshore brokers entirely, which leaves traders with the responsibility of ensuring that they work with well-regulated and reputable platforms like Exness. It is critical for Zimbabwean traders to be aware of local currency controls and ensure they are compliant with any financial reporting or taxation requirements imposed by the government.

Exness Regulation and Licensing

Global Regulatory Authorities Governing Exness

Exness is a globally recognized forex broker with licenses from some of the world’s leading financial regulators. These regulatory bodies include:

Financial Conduct Authority (FCA) - UK: One of the most stringent and well-respected regulatory authorities in the world, overseeing Exness’s operations in the UK.

Cyprus Securities and Exchange Commission (CySEC): This regulation allows Exness to offer services across the European Union, providing additional security for traders.

Financial Services Commission (FSC) - Mauritius: Exness operates under the oversight of Mauritius’s FSC, which allows the broker to provide services to international clients, including those in Africa.

The licenses from these regulatory bodies ensure that Exness complies with international standards of client protection, transparency, and operational integrity. This provides Zimbabwean traders with the assurance that Exness operates within a secure and regulated environment, even if it is not directly regulated by Zimbabwean authorities.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

The Importance of Regulation for Traders

Regulation is crucial in protecting traders' funds and ensuring a safe and fair trading environment. A regulated broker like Exness adheres to strict operational guidelines that guarantee transparency, security, and fair dealing. This is particularly important for Zimbabwean traders, as the country’s financial landscape presents certain risks, such as currency volatility and inflation. Choosing a well-regulated broker ensures that traders’ investments are protected and that they have access to legal recourse in case of disputes.

Is Exness Registered to Operate in Zimbabwe?

Current Status of Exness in Zimbabwe

Exness is not directly registered or licensed by the Reserve Bank of Zimbabwe, as Zimbabwe does not have a specific regulatory body for online forex brokers. However, the broker operates in Zimbabwe by offering its services through its global licenses, ensuring that it meets international standards of operation. As long as traders in Zimbabwe use the platform in compliance with local laws and regulations, there is no legal barrier to trading with Exness.

Zimbabwean traders can freely access the Exness platform, open accounts, and trade in various financial instruments. However, they must be aware of local financial regulations, such as foreign exchange controls and tax obligations, when using the platform.

How Registration Impacts Trading for Zimbabwean Clients

Exness's registration with global regulatory bodies means that it adheres to strict operational guidelines. While Exness is not specifically registered in Zimbabwe, the presence of these licenses ensures that the platform operates within the legal framework of other jurisdictions. Zimbabwean traders should take advantage of Exness's regulatory status to minimize risk and ensure compliance with international trading standards.

Legal Considerations for Zimbabwean Traders

Laws Affecting Online Trading in Zimbabwe

Zimbabwe’s legal framework for online trading is not fully developed. The Reserve Bank of Zimbabwe regulates the country's foreign exchange markets, but it does not have specific rules for online forex brokers. This leaves Zimbabwean traders in a gray area, where they must ensure compliance with general financial regulations, such as currency controls, tax obligations, and foreign exchange laws.

Traders are advised to stay informed about any changes in the local financial regulations and ensure that they follow proper reporting and tax procedures when engaging in online forex trading.

Implications of Trading Without Proper Registration

Trading with an unregulated broker can expose traders to various risks, including the loss of funds, poor customer service, and the lack of legal recourse in case of disputes. While Exness is globally regulated, Zimbabwean traders must still be cautious and ensure that they are fully aware of local financial regulations and tax obligations. Trading with a well-regulated broker like Exness helps mitigate these risks and offers greater security for traders’ investments.

Advantages of Using Exness in Zimbabwe

Competitive Trading Conditions

One of the primary advantages of using Exness in Zimbabwe is its competitive trading conditions. Exness is renowned for offering tight spreads and high leverage, both of which are highly beneficial for traders looking to maximize their potential profits. The broker provides multiple account types to suit the needs of both beginner and advanced traders. For example, the Standard accounts offer low spreads and flexible trading conditions, while the Pro accounts come with even tighter spreads and more advanced features for professional traders.

Exness also offers high leverage, which can be particularly advantageous for traders with limited capital. Leverage allows traders to control larger positions in the market with a relatively small initial investment, making it possible to amplify their profits. However, it is important to note that high leverage also comes with increased risk, so it is essential for traders to exercise caution and implement proper risk management strategies.

Another benefit of trading with Exness is its low minimum deposit requirement. This makes the platform accessible for new traders who may not have a large capital to invest initially. This ease of access lowers the barrier for entry, allowing more people in Zimbabwe to take part in the forex markets.

Access to Multiple Trading Platforms

Exness provides its clients with access to two of the most popular trading platforms in the world: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both of these platforms are known for their reliability, user-friendliness, and advanced charting and analysis tools, making them suitable for traders of all experience levels.

MetaTrader 4 is particularly popular with forex traders due to its extensive range of indicators, automated trading capabilities, and real-time data analysis features. Meanwhile, MetaTrader 5 builds on the MT4 platform with additional features, such as more timeframes, an economic calendar, and enhanced order management capabilities. These platforms are compatible with multiple devices, including desktop computers, mobile phones, and tablets, allowing Zimbabwean traders to manage their trades on the go.

Exness also offers its own proprietary trading platform, Exness Trader, which provides an intuitive interface and access to a wide range of assets. This platform is ideal for traders looking for a simpler, more streamlined trading experience.

Challenges Faced by Exness Users in Zimbabwe

Internet Connectivity Issues

While Exness provides a robust platform, Zimbabwean traders face challenges when it comes to internet connectivity. Zimbabwe, like many other countries, sometimes experiences slow or unreliable internet speeds, particularly in rural areas. This can create problems for traders who rely on a stable internet connection to monitor their trades in real-time.

Forex trading requires constant access to live market data, and any interruptions in internet service can result in missed opportunities or even financial losses. Traders in Zimbabwe need to ensure that they have access to a stable and fast internet connection when using Exness or any other online trading platform. Using a reliable internet service provider and having a backup internet option can help mitigate this issue.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Currency Exchange Challenges

Zimbabwe has faced significant challenges with its local currency, the Zimbabwean Dollar (ZWL), which has experienced high levels of inflation and volatility. This has made it difficult for traders to transact in local currency when trading on international forex platforms like Exness.

When trading with Exness, Zimbabwean traders need to convert their local currency into a foreign currency, such as USD or EUR, to deposit funds into their trading account. Currency conversion can be costly, as traders may have to pay additional fees and face unfavorable exchange rates. Furthermore, with the local currency's volatility, traders could face significant losses when converting funds to foreign currencies.

Exness offers several payment methods, including e-wallets, bank transfers, and cryptocurrencies, which can help Zimbabwean traders bypass some of these challenges. However, it is important for traders to keep in mind that these transactions may still incur additional costs, depending on the payment method chosen.

User Experience and Customer Support

Availability of Local Support Channels

Exness offers 24/7 customer support through multiple channels, including live chat, phone, and email. While Exness does not have a dedicated Zimbabwean support team, their customer service agents are multilingual and offer support in English, which is widely spoken in Zimbabwe. This makes it easier for Zimbabwean traders to access help when needed.

Additionally, Exness provides support in several languages, so traders can receive assistance in a language they are most comfortable with. The availability of round-the-clock support ensures that traders can resolve any issues or queries in a timely manner, minimizing disruptions to their trading activities.

For traders in Zimbabwe who may need assistance with their account, technical issues, or navigating the platform, Exness offers helpful resources such as a comprehensive FAQ section, video tutorials, and step-by-step guides to assist traders in resolving common issues without requiring direct support.

Reviews from Zimbabwean Exness Users

Feedback from Zimbabwean users of Exness has generally been positive. Many traders appreciate the platform’s user-friendly interface, low spreads, and range of educational resources. Exness’s ability to offer multiple payment methods, such as e-wallets and cryptocurrency payments, is also highlighted as a major advantage for Zimbabwean traders who may face challenges with currency exchange.

However, some traders have pointed out the challenges of dealing with currency fluctuations and internet connectivity issues, which can affect their trading experience. Despite these challenges, Exness remains a trusted and preferred choice for many Zimbabwean traders due to its competitive trading conditions and global reputation.

Payment Methods for Zimbabwean Traders

Accepted Deposit and Withdrawal Options

Exness provides several payment methods for Zimbabwean traders, which can be convenient for those looking to deposit or withdraw funds from their accounts. These payment methods include:

Bank Transfers: Traders can use bank transfers to fund their accounts or withdraw profits. However, this method may take longer to process compared to other methods, and fees may apply.

E-wallets: E-wallets such as Skrill, Neteller, and WebMoney are popular among Zimbabwean traders because they offer faster transaction times and lower fees compared to traditional bank transfers. These platforms also provide added security for online transactions.

Cryptocurrency: Exness supports cryptocurrency deposits and withdrawals, which can be a convenient option for Zimbabwean traders looking to bypass issues related to currency fluctuations. Cryptocurrencies like Bitcoin and Ethereum are often used for international transactions and may offer faster processing times.

These payment methods provide flexibility for Zimbabwean traders, allowing them to choose the option that best suits their needs.

Fees and Processing Times

Exness does not charge deposit or withdrawal fees, but traders should be aware that third-party payment processors, such as banks or e-wallets, may charge additional fees. The processing times for deposits are typically instant, especially when using e-wallets or cryptocurrencies. However, bank transfers may take a few business days to process.

Withdrawals are generally processed quickly, with e-wallet withdrawals often completed within 24 hours. Bank transfers may take longer, depending on the method used and the processing times of the respective bank. Zimbabwean traders should keep these processing times in mind when planning their trades or withdrawals.

Conclusion on Exness in Zimbabwe

Exness offers a competitive and reliable trading platform for Zimbabwean traders. While it is not directly regulated by the Reserve Bank of Zimbabwe, the broker operates under global regulatory frameworks, providing traders with a secure and transparent trading environment. The key benefits of using Exness in Zimbabwe include competitive spreads, high leverage, and access to popular trading platforms like MetaTrader 4 and MetaTrader 5.

However, Zimbabwean traders must be aware of the challenges that come with trading in a country with currency volatility and internet connectivity issues. Despite these challenges, Exness remains a strong option for Zimbabwean traders looking to participate in the global forex market. By choosing a well-regulated broker like Exness, traders can ensure that they are trading in a secure and compliant environment.

As with any form of trading, it is important for traders to practice caution, stay informed about local regulations, and implement risk management strategies to protect their investments. Overall, Exness provides a viable and effective platform for Zimbabwean traders to access the international forex markets.

Read more: