11 minute read

Does Exness work in Ethiopia? Regulated, Registered, Legal?

from Exness

by Exness_Blog

Forex trading is growing in popularity in Ethiopia, and many traders are looking to platforms like Exness for their trading needs. However, before getting started, it’s essential to understand whether Exness is regulated, registered, and legal to use in Ethiopia. In this article, we’ll explore the key aspects of Exness’s operations in Ethiopia, including its regulatory status, compliance with local laws, and what you need to know before opening an account.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Exness

Overview of Exness as a Forex Broker

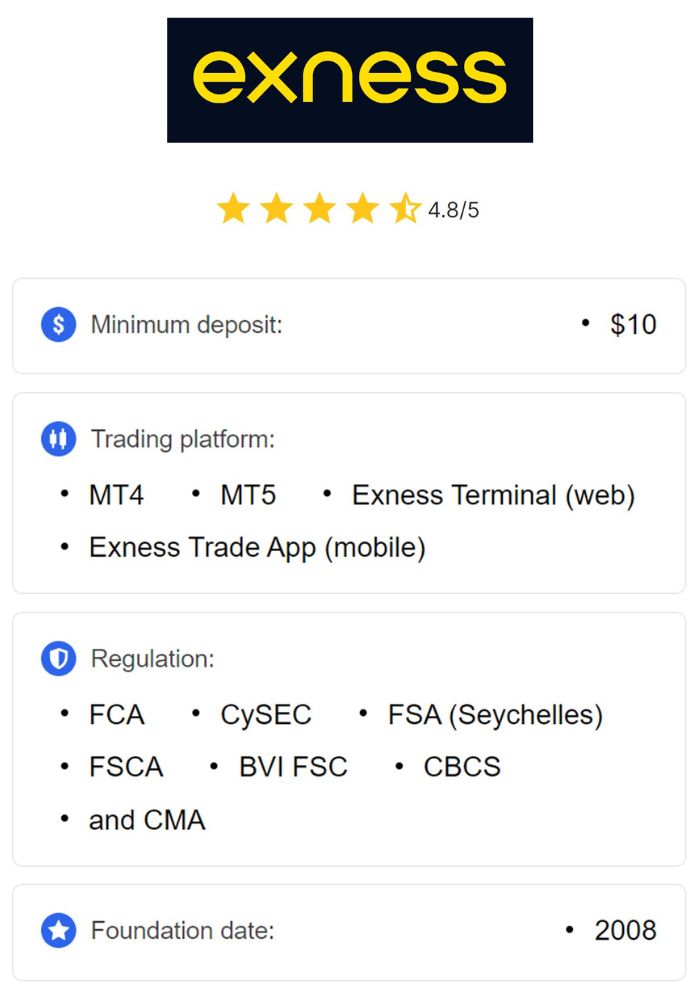

Exness is a globally recognized forex broker, established in 2008, that provides trading services for a wide range of financial instruments, including forex, commodities, indices, cryptocurrencies, and stocks. Known for its transparency, innovative technology, and excellent customer support, Exness has become a trusted platform for millions of traders worldwide.

The platform’s user-centric approach is evident in its flexible account options, competitive spreads, and advanced trading tools. With accessibility and convenience at the forefront, Exness caters to traders at all experience levels, making it a popular choice for beginners and seasoned professionals alike. For traders in Ethiopia, Exness offers an opportunity to engage with the global financial markets through a reliable and well-established broker.

Key Features and Services Offered by Exness

Exness offers a variety of standout features designed to enhance the trading experience. These include instant withdrawals, zero hidden fees, and tight spreads, which help minimize costs for traders. The platform supports trading on industry-standard tools like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), enabling users to access advanced charting tools, indicators, and automated trading capabilities.

Another significant advantage of Exness is its multilingual customer support, available 24/7 to assist traders from different regions, including Ethiopia. Additionally, Exness provides a comprehensive range of educational resources, such as webinars, video tutorials, and market analysis, empowering traders to make informed decisions. This combination of features and services positions Exness as a competitive choice for Ethiopian traders looking to venture into forex trading.

Regulatory Environment for Forex Trading in Ethiopia

Governing Authorities in Ethiopia

The financial sector in Ethiopia is regulated by the National Bank of Ethiopia (NBE), which oversees the country’s banking and financial services. While the NBE primarily focuses on domestic financial institutions, its regulations also impact forex trading activities within the country.

The NBE enforces strict capital controls, and access to foreign exchange is often limited. This creates a unique challenge for Ethiopian forex traders who wish to participate in the global markets. Despite these limitations, many traders turn to international brokers like Exness to access forex trading opportunities, provided they adhere to the local legal framework.

Regulations Impacting Forex Brokers

Forex trading in Ethiopia operates within a somewhat restrictive regulatory environment. While there are no explicit laws prohibiting individuals from trading forex online, the NBE has not established a clear regulatory framework for international brokers operating in the country. This means traders must exercise caution when selecting a broker, ensuring it adheres to international standards and offers a secure trading environment.

Exness, as a globally regulated broker, operates under stringent guidelines in various jurisdictions, ensuring compliance with international financial standards. Ethiopian traders using Exness should verify the platform’s licensing and terms of service to ensure their trading activities align with local regulations.

Exness Regulation and Licensing

Overview of Exness Regulation

Exness operates under the regulation of multiple reputable financial authorities, including the Financial Conduct Authority (FCA) in the United Kingdom, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Services Commission (FSC). These regulatory bodies ensure that Exness adheres to strict operational standards, including transparency, financial stability, and client fund protection.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

By maintaining compliance with these regulations, Exness demonstrates its commitment to providing a secure and trustworthy trading environment. The broker’s regulatory status is a significant factor that instills confidence among traders, including those in Ethiopia.

Jurisdictions Where Exness is Registered

Exness is registered in several key jurisdictions, enabling it to offer services globally while adhering to regional regulations. Its licenses include:

FCA (UK): A highly respected regulatory body known for enforcing stringent financial standards.

CySEC (Cyprus): Ensures compliance with European Union financial regulations.

FSC (Mauritius): Focuses on international financial services, offering flexibility for global operations.

These multiple licenses enable Exness to serve a diverse clientele while maintaining the highest standards of compliance and transparency. For Ethiopian traders, this global regulatory framework provides additional assurance of the platform’s credibility.

Is Exness Legal in Ethiopia?

Legal Framework for Online Trading in Ethiopia

The legal framework for online trading in Ethiopia is still in its nascent stages. The NBE primarily focuses on regulating domestic financial institutions and has not yet established comprehensive guidelines for online forex trading. As a result, Ethiopian traders often rely on international brokers like Exness, which are not directly regulated within Ethiopia but operate under globally recognized financial authorities.

While trading forex online is not explicitly illegal in Ethiopia, traders should ensure they comply with local tax and financial reporting obligations. Engaging with a reputable and regulated broker like Exness can help Ethiopian traders mitigate risks associated with unregulated platforms.

Implications of Using Offshore Brokers

Using offshore brokers such as Exness has its pros and cons for Ethiopian traders. On the positive side, Exness provides access to global markets, competitive trading conditions, and robust security measures. However, traders should be aware that relying on offshore brokers means they may not have direct recourse through Ethiopian authorities in case of disputes.

To mitigate these risks, Ethiopian traders should verify the broker’s regulatory credentials, review its terms of service, and practice due diligence before opening an account. Choosing a broker like Exness, which operates under multiple global licenses, can provide an added layer of security and assurance.

Opening an Account with Exness from Ethiopia

Required Documentation for Registration

Opening an account with Exness is a straightforward process that requires minimal documentation. Ethiopian traders typically need to provide:

Proof of Identity: A valid government-issued ID such as a passport or national ID card.

Proof of Address: A utility bill, bank statement, or other document that verifies the trader’s residential address.

These documents must be uploaded through Exness’s secure platform for verification. The process is quick and ensures compliance with international anti-money laundering (AML) regulations.

Account Types Available for Ethiopian Traders

Exness offers a variety of account types to cater to different trading needs. These include:

Standard Account: Ideal for beginners, offering low minimum deposits and straightforward features.

Pro Account: Designed for experienced traders, with tighter spreads and faster execution speeds.

Raw Spread Account: Offers the lowest spreads, suitable for scalpers and high-frequency traders.

Zero Spread Account: Features zero spreads on major pairs, providing cost-effective trading options.

Ethiopian traders can choose an account type that aligns with their trading style and financial goals. Exness also provides demo accounts, allowing users to practice trading strategies without risking real funds.

Payment Methods for Ethiopian Users

Deposit Options Supported by Exness

Exness provides multiple deposit options tailored to meet the needs of its global clientele, including Ethiopian traders. The platform supports a variety of payment methods, ensuring that users can fund their accounts conveniently and securely. Common deposit methods for Ethiopian users include:

Bank Transfers: Ethiopian traders can use local banks for direct deposits, ensuring smooth and secure transactions.

E-Wallets: Popular e-wallets such as Skrill and Neteller are supported, offering fast and low-cost deposit options.

Cryptocurrencies: Exness accepts deposits in major cryptocurrencies like Bitcoin, providing an alternative for traders who prefer decentralized payment systems.

Debit and Credit Cards: Traders can fund their accounts using Visa or Mastercard, a universally accessible method.

Exness ensures that deposits are processed instantly or within a few hours, enabling traders to start trading without unnecessary delays. Additionally, Exness does not charge deposit fees, making it a cost-effective choice for Ethiopian traders.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Withdrawal Procedures for Ethiopian Clients

Exness is well-known for its quick and hassle-free withdrawal processes. Ethiopian traders can withdraw funds using the same methods available for deposits, ensuring consistency and ease of use. The withdrawal steps include:

Logging into the trading account on the Exness platform.

Navigating to the withdrawal section and selecting the preferred payment method.

Entering the amount to withdraw and confirming the transaction.

Most withdrawals are processed instantly or within a few hours, depending on the method chosen. Exness’s commitment to fast withdrawals is a key advantage for Ethiopian traders who value liquidity and quick access to their funds. It’s worth noting that Exness does not charge withdrawal fees, though some payment providers may impose transaction costs.

Customer Support and Resources

Availability of Customer Service for Ethiopian Users

Exness provides robust customer support to ensure a seamless trading experience for its users, including Ethiopian traders. The support team is available 24/7 via live chat, email, and phone, offering quick resolutions to any queries or technical issues.

A standout feature is Exness’s multilingual support, which caters to a diverse client base. While Amharic support may not be explicitly available, traders can access assistance in widely spoken languages such as English. This ensures that Ethiopian users can communicate effectively with the support team and receive timely help.

Educational Resources Provided by Exness

Exness places a strong emphasis on trader education, offering a range of resources to help users enhance their trading skills. These include:

Webinars and Video Tutorials: Covering topics from beginner basics to advanced strategies.

Market Analysis: Daily insights and updates to keep traders informed about market trends.

Trading Tools: Access to economic calendars, calculators, and other utilities that aid in decision-making.

Demo Accounts: Allowing traders to practice and refine their strategies without financial risk.

These resources are invaluable for Ethiopian traders, especially those new to forex trading. By equipping users with the necessary knowledge, Exness empowers them to make informed decisions and improve their trading performance.

Risks Associated with Forex Trading in Ethiopia

Market Volatility and Its Impact

Forex trading is inherently risky due to market volatility. Prices can fluctuate rapidly, influenced by factors such as geopolitical events, economic data releases, and global market trends. For Ethiopian traders, this volatility presents both opportunities and challenges.

To mitigate risks, traders should adopt robust risk management strategies, such as setting stop-loss orders, diversifying their portfolios, and avoiding over-leveraging. Exness offers tools like risk calculators and educational content to help traders manage these uncertainties effectively.

Regulatory Risks for Ethiopian Traders

The lack of a clear regulatory framework for forex trading in Ethiopia poses additional risks. Traders must rely on offshore brokers like Exness, which may not be directly governed by Ethiopian financial authorities. This means that in case of disputes, local recourse options may be limited.

To address this, Ethiopian traders should prioritize brokers with strong global regulatory credentials, such as Exness. Conducting due diligence and staying informed about local financial laws can further reduce regulatory risks and ensure a safer trading experience.

User Experience and Reviews

Feedback from Ethiopian Traders on Exness

Ethiopian traders have generally expressed positive feedback about Exness, citing its user-friendly platform, competitive trading conditions, and reliable customer support. The availability of instant withdrawals and multiple payment options has been particularly appreciated, as it provides convenience and flexibility.

Some traders have highlighted challenges, such as navigating the advanced features of MetaTrader platforms or understanding complex trading strategies. However, these issues are often mitigated by Exness’s educational resources and responsive customer support. Overall, Exness has earned a favorable reputation among Ethiopian traders.

Comparative Analysis with Other Brokers

Compared to other international brokers operating in Ethiopia, Exness stands out for its transparency, low trading costs, and strong regulatory credentials. While some brokers may offer similar services, Exness’s instant withdrawals and multilingual support give it a competitive edge.

In terms of user experience, Exness’s intuitive platform and extensive educational materials make it an excellent choice for traders of all levels. For Ethiopian traders seeking a reliable and efficient broker, Exness often ranks as one of the top options in the market.

Conclusion

Exness provides a secure, accessible, and efficient platform for forex trading, making it a viable choice for Ethiopian traders. With its strong regulatory credentials, user-friendly features, and commitment to transparency, Exness addresses many of the challenges faced by traders in Ethiopia’s unique regulatory environment.

While risks such as market volatility and regulatory uncertainties exist, Exness’s robust security measures, educational resources, and responsive customer support help mitigate these concerns. By choosing a trusted broker like Exness, Ethiopian traders can confidently explore the opportunities of forex trading and access global financial markets.

Read more: