12 minute read

What is the pip value of XAUUSD?

from Exness

by Exness_Blog

Introduction to XAUUSD

Overview of Gold Trading

Gold trading is a significant segment of the financial markets, attracting investors and traders due to its historical value as a safe-haven asset. XAUUSD represents the trading pair where XAU denotes one troy ounce of gold, and USD is the United States dollar. The value of gold is influenced by various economic factors, including inflation, interest rates, and geopolitical events.

Top 4 Best XAUUSD Brokers

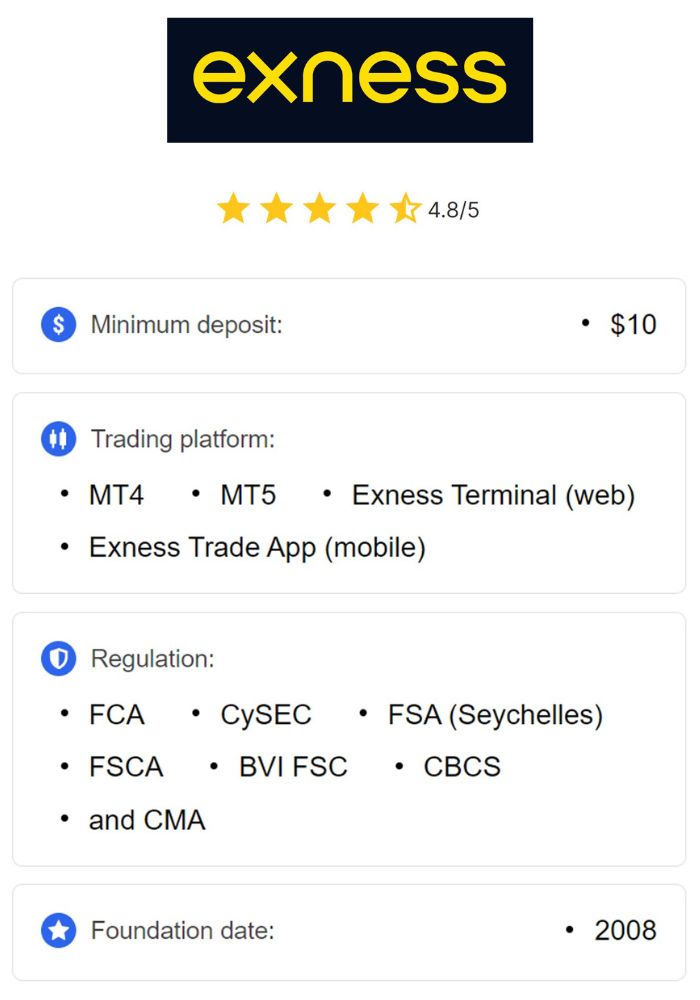

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

Gold has long been seen as a hedge against inflation and economic uncertainty, leading to its popularity among traders and investors. In the Forex market, gold is traded similarly to currencies, providing opportunities for profit through price fluctuations. Understanding the dynamics of gold trading is essential for anyone looking to engage in XAUUSD trading.

Importance of XAUUSD in Forex Market

XAUUSD plays a crucial role in the Forex market, serving as one of the most traded commodities globally. The price of gold is often viewed as an indicator of economic health, and fluctuations in the XAUUSD pair can significantly impact broader market trends.

Traders utilize XAUUSD to diversify their portfolios, hedge against currency risk, and speculate on gold price movements. Given its liquidity and volatility, XAUUSD offers opportunities for both short-term traders and long-term investors. Understanding the pip value of XAUUSD is essential for managing trades and calculating potential profits and losses.

What is a Pip?

Definition of a Pip

A pip, or "percentage in point," is the smallest price movement that a currency pair can make based on market convention. In Forex trading, a pip typically refers to a one-digit change in the fourth decimal place of a currency pair. For instance, if the EUR/USD moves from 1.1050 to 1.1051, that movement represents a change of one pip.

However, in the case of commodities like gold (XAUUSD), the definition of a pip is slightly different. Gold is quoted in dollars, and for XAUUSD, a pip represents a one-dollar change in the price of gold. Therefore, if XAUUSD moves from 1800.00 to 1801.00, it reflects a change of one pip.

Role of Pips in Trading

Pips are essential for measuring price movements in Forex trading, providing a standardized way to express changes in currency values. Understanding pip values helps traders calculate potential profits or losses on trades, set stop-loss orders, and implement effective risk management strategies.

For traders focusing on XAUUSD, knowing the pip value allows for better position sizing and trade management, leading to more informed decision-making in the market.

Understanding XAUUSD

Composition of XAUUSD

XAUUSD is a currency pair that represents the exchange rate between gold and the U.S. dollar. The price of XAUUSD indicates how much one troy ounce of gold is worth in U.S. dollars. The value of gold is influenced by various factors, including supply and demand dynamics, geopolitical tensions, currency fluctuations, and macroeconomic indicators.

The XAUUSD pair is affected by the overall health of the global economy, central bank policies, and changes in investor sentiment. For traders, understanding these dynamics is crucial for making informed decisions when trading XAUUSD.

Factors Influencing XAUUSD Price

Several factors can influence the price of XAUUSD, including:

Economic Indicators: Data such as GDP growth, employment rates, and inflation can affect gold prices. Weak economic data often leads to increased demand for gold as a safe haven.

Interest Rates: Changes in interest rates set by central banks impact the opportunity cost of holding gold. Lower interest rates tend to increase gold demand.

Geopolitical Events: Political instability, conflicts, and tensions can drive investors towards gold as a safe-haven asset.

U.S. Dollar Strength: Since XAUUSD is quoted in U.S. dollars, fluctuations in the dollar's value can affect gold prices inversely. A weaker dollar typically makes gold cheaper for holders of other currencies, increasing demand.

Traders should monitor these factors to anticipate potential price movements in XAUUSD.

Calculating Pip Value for XAUUSD

Formula for Pip Value Calculation

The pip value for XAUUSD can be calculated using a simple formula. Given that one pip for XAUUSD equals $1, the pip value can be expressed as follows:

Pip Value = (Pip Size / Exchange Rate) × Lot Size

For XAUUSD, since the pip size is $1, the formula simplifies to:

Pip Value = Lot Size (for standard lots, mini lots, or micro lots).

For instance, if you are trading one standard lot (100 ounces), the pip value would be $1 per pip. Therefore, for a movement of 10 pips, the total profit or loss would be $10.

Example Calculation of Pip Value

To illustrate the calculation of pip value for XAUUSD, consider the following scenario:

Lot Size: 1 standard lot (100 ounces)

Current Price of XAUUSD: $1800.00

Pip Movement: 10 pips

Using the pip value formula:

Pip Value = Lot Size = 1 standard lot = $1 per pip.

Total movement in value = 10 pips × $1 = $10.

Thus, for a movement of 10 pips in XAUUSD, a trader holding one standard lot would realize a profit or loss of $10.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Standard Lot Size and Its Impact on Pip Value

Definition of a Standard Lot

In Forex trading, a standard lot represents 100,000 units of the base currency. For XAUUSD, which is quoted in troy ounces of gold, a standard lot typically represents 100 ounces. This means that when trading XAUUSD, a standard lot allows traders to control 100 ounces of gold.

Understanding the concept of lot size is crucial for calculating pip value and managing trade positions effectively.

Relationship Between Lot Size and Pip Value

The relationship between lot size and pip value is straightforward. As the lot size increases, the pip value also increases. This means that trading larger lot sizes can lead to higher profits or losses per pip movement.

For example:

Standard Lot (100 ounces): $1 per pip

Mini Lot (10 ounces): $0.10 per pip

Micro Lot (1 ounce): $0.01 per pip

By selecting the appropriate lot size, traders can tailor their exposure to risk and control their pip values effectively.

Different Account Types and Their Influence on Pip Value

Standard Accounts

Standard accounts are commonly used by traders and typically allow for trading in standard lots. In this account type, the pip value is straightforward, with a standard lot representing a pip value of $1.

Standard accounts are suitable for traders looking for higher exposure and the ability to manage larger positions effectively. Understanding pip value in standard accounts is crucial for proper risk management and trade execution.

Mini and Micro Accounts

Mini and micro accounts offer traders the opportunity to trade smaller lot sizes, allowing for lower risk and more manageable exposure.

Mini Accounts: In mini accounts, traders can trade 10-ounce positions, with each pip valued at $0.10. This account type is ideal for beginners or those looking to test strategies with less capital at risk.

Micro Accounts: Micro accounts allow traders to trade 1-ounce positions, resulting in a pip value of $0.01. This account type is suitable for those just starting or who prefer to trade with minimal risk.

Understanding the differences in pip value across account types is essential for traders to choose the right option that aligns with their trading style and risk tolerance.

Currency Pair Specifications

Major vs. Minor Currency Pairs

In Forex trading, currency pairs are categorized into major, minor, and exotic pairs. Major pairs involve the most traded currencies globally, such as USD, EUR, and JPY. XAUUSD is considered a major pair due to the prominence of the U.S. dollar and gold as significant trading instruments.

Minor pairs involve currencies that are not as widely traded, while exotic pairs consist of a major currency paired with a currency from a developing economy. Understanding the classifications of currency pairs is important for evaluating trading opportunities and pip values.

How XAUUSD Fits into These Categories

XAUUSD fits into the category of major pairs due to the global significance of gold and the U.S. dollar in financial markets. Gold is widely recognized as a safe-haven asset and a hedge against inflation, making XAUUSD a crucial trading pair for many investors.

By understanding how XAUUSD fits into the broader market, traders can better anticipate price movements and leverage their knowledge of the dynamics that influence the gold market.

The Role of Leverage in Pip Value Calculation

Understanding Leverage

Leverage allows traders to control larger positions with a smaller amount of capital, effectively amplifying both potential profits and losses. For example, a leverage ratio of 1:100 means that a trader can control $100,000 in positions with only $1,000 in their trading account.

While leverage can enhance profits, it also increases the risk of significant losses, making it crucial for traders to use leverage responsibly. Understanding how leverage affects pip value is essential for effective risk management.

Effects of Leverage on Trading Outcomes

When trading XAUUSD with leverage, the pip value remains the same, but the overall potential profit or loss is magnified. For instance, if a trader uses a leverage of 1:100 and holds a standard lot position, a movement of 10 pips in XAUUSD could lead to substantial gains or losses.

It is essential for traders to consider the impact of leverage on their trading strategies and overall risk exposure. By using leverage judiciously, traders can maximize their trading potential while minimizing the risks associated with high leverage.

Volatility and Its Effect on Pip Value for XAUUSD

Definition of Volatility

Volatility refers to the degree of variation in trading prices over a specific period. In the context of XAUUSD, volatility can result from market factors such as economic data releases, geopolitical events, and changes in market sentiment.

High volatility can lead to significant price movements within short periods, impacting pip values and trading outcomes. Understanding volatility is essential for effective risk management and trading strategies.

Historical Volatility Trends of Gold

Historical trends indicate that gold prices can experience significant fluctuations due to various factors, including inflation rates, interest rate changes, and global economic stability. Traders should be aware of past volatility patterns to anticipate potential price movements in XAUUSD.

By analyzing historical volatility, traders can better understand market conditions and adjust their strategies accordingly to optimize their trading performance.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Risk Management and Pip Value

Importance of Knowing Pip Value

Understanding the pip value of XAUUSD is crucial for effective risk management in trading. Pip value directly influences how much a trader stands to gain or lose on a trade, allowing for informed decision-making regarding position sizing and stop-loss placements.

By accurately calculating pip values, traders can develop risk management strategies that align with their risk tolerance and trading goals. This knowledge helps mitigate potential losses and enhances overall trading performance.

Strategies for Managing Risk with XAUUSD

Several strategies can help traders manage risk when trading XAUUSD, including:

Setting Stop-Loss Orders: Using stop-loss orders helps limit potential losses by automatically closing positions at predetermined price levels.

Position Sizing: Calculating the appropriate position size based on pip value and account balance ensures that traders do not overexpose themselves to risk.

Diversification: Diversifying trading strategies across different instruments can reduce the impact of adverse price movements on overall trading performance.

By implementing effective risk management strategies, traders can navigate the volatility of XAUUSD while protecting their capital.

Common Mistakes When Trading XAUUSD

Misunderstanding Pip Value

One common mistake traders make is misunderstanding pip value, particularly in the context of XAUUSD. Confusion over how pip values work in relation to lot sizes and leverage can lead to poor trading decisions and increased risk.

To avoid this mistake, traders should take the time to learn and understand pip values and how they apply to their trading strategies. This knowledge is essential for successful trading.

Ignoring Market Conditions

Another mistake traders often make is ignoring market conditions when trading XAUUSD. Factors such as economic data releases, geopolitical events, and market sentiment can significantly impact gold prices.

Failing to consider these conditions can lead to unexpected losses. Traders should stay informed about relevant news and trends to make informed trading decisions.

Tools and Resources for Calculating Pip Value

Online Pip Calculators

Various online pip calculators can assist traders in quickly calculating the pip value for different currency pairs, including XAUUSD. These tools allow traders to input their lot size and the current price of gold to obtain accurate pip values instantly.

Using pip calculators can streamline the trading process, allowing traders to focus on developing strategies rather than manual calculations.

Software for Real-Time Analysis

Several trading software solutions provide real-time analysis and information about pip values and market trends. These tools can assist traders in making timely decisions based on up-to-date market data.

Investing in robust trading software can enhance a trader's overall performance by providing insights into potential trading opportunities and risks.

Conclusion

Understanding the pip value of XAUUSD is crucial for successful trading in the Forex market. By grasping key concepts such as pip definitions, lot sizes, and the factors influencing gold prices, traders can make informed decisions and develop effective trading strategies.

The significance of risk management, market analysis, and continuous learning cannot be overstated. By utilizing the right tools and resources, traders can navigate the complexities of XAUUSD trading effectively.

As the global financial landscape continues to evolve, staying informed about market trends and employing sound trading practices will be vital for achieving long-term success in trading XAUUSD. By honing their skills and understanding the dynamics of this popular trading pair, traders can position themselves for profitable opportunities in the Forex market.

Read more: