11 minute read

Is forex trading profitable in Uganda? A Comprehensive Guide

Introduction to Forex Trading

Definition of Forex Trading

Forex trading, or foreign exchange trading, involves the buying and selling of currencies on a global scale. This market operates as a decentralized network where traders can engage in the exchange of currency pairs, with the primary aim of profiting from fluctuations in exchange rates. The forex market is the largest and most liquid financial market in the world, with a daily trading volume exceeding $6 trillion. Traders can participate in this market 24 hours a day, five days a week, making it accessible to individuals and institutions worldwide.

Top 4 Best Forex Brokers in Uganda

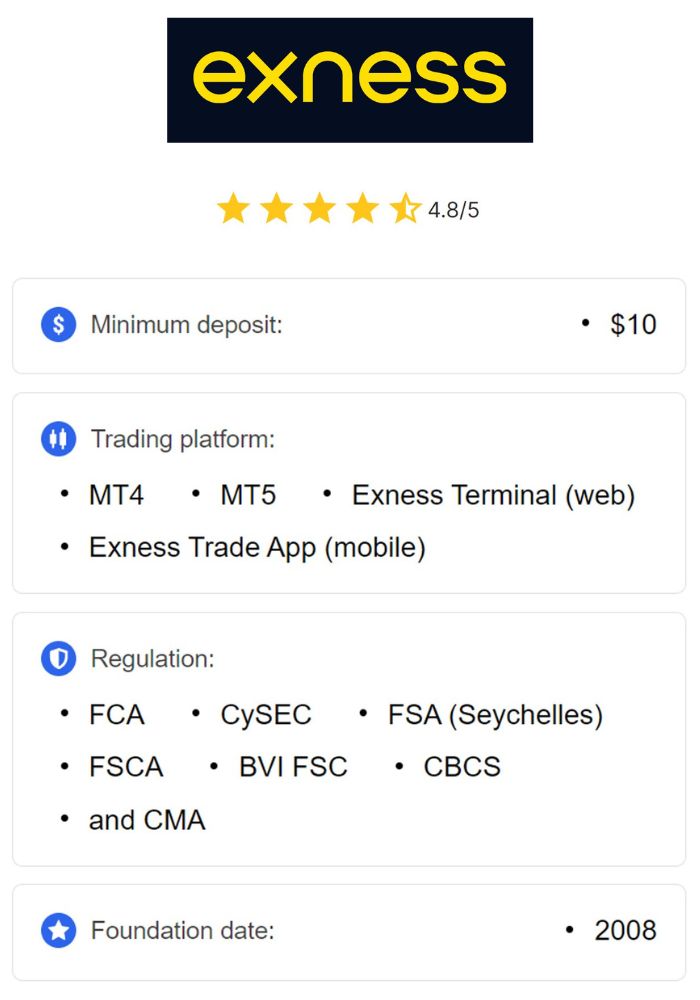

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

The Mechanics of Currency Exchange

The mechanics of currency exchange are foundational to forex trading. When traders engage in forex transactions, they do so by purchasing one currency while simultaneously selling another. Currencies are traded in pairs, such as EUR/USD or USD/UGX, where the first currency is the base currency and the second is the quote currency. The exchange rate reflects how much of the quote currency is needed to purchase one unit of the base currency. Traders analyze market conditions, economic indicators, and geopolitical factors to make informed decisions about when to enter or exit trades.

Global Market Overview

The global forex market encompasses a wide range of participants, including banks, financial institutions, corporations, and individual traders. The market operates in three primary sessions: the Asian, European, and North American sessions. This structure allows for continuous trading and provides ample opportunities for participants to engage in currency exchange. Major currency pairs, such as the Euro (EUR), US Dollar (USD), British Pound (GBP), and Japanese Yen (JPY), dominate the market due to their high liquidity and trading volumes. Understanding the global landscape of forex trading is essential for traders in Uganda looking to capitalize on international market trends.

The Current State of Forex Trading in Uganda

Popularity and Growth Trends

In recent years, forex trading has gained significant popularity in Uganda, with an increasing number of individuals exploring it as a viable investment option. The country's growing interest in forex trading can be attributed to several factors, including the need for additional income sources and the accessibility of online trading platforms. As more Ugandans become aware of the potential profits that can be made through forex trading, the market has experienced notable growth. This trend is further supported by the rise of educational resources and community support that empower traders to enhance their skills.

Regulatory Environment in Uganda

The regulatory environment surrounding forex trading in Uganda is overseen by the Capital Markets Authority (CMA), which aims to promote investor protection and maintain the integrity of the financial markets. The CMA has established guidelines for forex brokers operating in Uganda, ensuring they adhere to best practices and regulatory standards. While the regulation of forex trading is still evolving, it is essential for traders to select licensed brokers to mitigate risks associated with unregulated entities. Understanding the regulatory framework helps traders navigate the market safely and confidently.

Key Players in the Ugandan Forex Market

Several key players operate in the Ugandan forex market, contributing to its growth and development. These include local and international forex brokers, banks, and financial institutions that provide trading services and liquidity to traders. Some notable brokers in Uganda offer a range of trading platforms and resources tailored to meet the needs of local traders. Additionally, the emergence of fintech companies has facilitated easier access to forex trading, enabling more Ugandans to participate in the market.

Factors Influencing Profitability in Forex Trading

Economic Indicators and Their Impact

Economic indicators play a crucial role in determining currency values and influencing trading decisions. Key indicators such as Gross Domestic Product (GDP), inflation rates, and employment statistics provide insights into a country's economic health. For instance, strong GDP growth may lead to currency appreciation, while high inflation can weaken a currency's value. Traders in Uganda must stay informed about local and international economic developments to make informed trading decisions. Analyzing economic data and understanding its implications can significantly impact a trader's profitability in the forex market.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Political Stability and Currency Fluctuations

Political stability is another critical factor influencing currency fluctuations in Uganda. Political events, such as elections, policy changes, and social unrest, can create uncertainty in the market, leading to volatility in currency values. A stable political environment often fosters investor confidence, while instability can result in capital flight and depreciation of the local currency. Traders must keep abreast of political developments and assess their potential impact on the forex market to manage risks effectively and identify profitable trading opportunities.

Technological Advancements and Access to Trading Platforms

Technological advancements have revolutionized forex trading, providing traders in Uganda with access to sophisticated trading platforms and tools. Online trading platforms enable traders to execute orders in real-time, access market analysis, and utilize advanced charting features. The availability of mobile trading applications allows traders to manage their positions on the go, increasing flexibility and accessibility. Staying updated with the latest technological trends is essential for Ugandan traders seeking to enhance their trading experience and profitability.

Risks Associated with Forex Trading

Volatility of Currency Markets

The forex market is characterized by its inherent volatility, which can present both opportunities and risks for traders. Currency prices can fluctuate rapidly due to various factors, including economic news, geopolitical events, and market sentiment. While volatility can lead to significant profit potential, it also increases the risk of losses if traders are not adequately prepared. Understanding market dynamics and employing effective trading strategies can help traders navigate volatility and protect their capital.

Leverage and Margin Trading Risks

Leverage is a common feature in forex trading that allows traders to control larger positions with a smaller amount of capital. While leverage can amplify profits, it also increases the risk of substantial losses. Traders must be cautious when using leverage, as it can lead to margin calls if account equity falls below a certain threshold. Proper risk management techniques, such as setting stop-loss orders and maintaining appropriate position sizes, are essential for mitigating the risks associated with margin trading.

Psychological Factors in Trading Decisions

Psychological factors significantly influence trading decisions and can impact profitability. Emotions such as fear and greed can lead to impulsive decision-making, resulting in unnecessary losses. Traders must cultivate emotional discipline and develop a robust trading plan to guide their decisions. Implementing strategies to manage emotions, such as maintaining a trading journal and adhering to a predetermined set of rules, can help traders maintain focus and improve their overall trading performance.

Strategies for Successful Forex Trading

Fundamental Analysis Techniques

Fundamental analysis involves evaluating economic indicators, financial news, and geopolitical events to forecast currency movements. Traders in Uganda should familiarize themselves with key economic reports, such as inflation data, interest rate announcements, and employment figures. By analyzing these factors, traders can gain insights into market trends and make informed decisions about their trades. Incorporating fundamental analysis into trading strategies can enhance the likelihood of identifying profitable opportunities in the forex market.

Technical Analysis Tools

Technical analysis is another critical component of successful forex trading. This approach involves studying price charts, patterns, and technical indicators to predict future price movements. Traders can use tools such as moving averages, Relative Strength Index (RSI), and Fibonacci retracements to identify trends and potential entry and exit points. By mastering technical analysis, traders can make data-driven decisions and enhance their ability to navigate the complexities of the forex market.

Risk Management Strategies

Effective risk management strategies are essential for long-term success in forex trading. Traders should establish risk tolerance levels and adhere to strict guidelines when entering and exiting trades. Key risk management techniques include setting stop-loss orders to limit potential losses, diversifying trading positions to spread risk, and using proper position sizing based on account equity. By prioritizing risk management, traders can protect their capital and increase their chances of profitability in the competitive forex market.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Educational Resources for Aspiring Forex Traders

Online Courses and Webinars

Aspiring forex traders in Uganda can benefit from a wide range of online courses and webinars that provide valuable education on trading strategies, market analysis, and risk management. Many brokers and educational platforms offer free or affordable resources to help traders enhance their skills and knowledge. Participating in these programs can equip traders with the tools they need to navigate the forex market effectively and increase their chances of success.

Books and Publications on Forex Trading

Books and literature focused on forex trading offer in-depth insights into various trading strategies, market dynamics, and successful trading practices. Many renowned authors and traders have published works that provide valuable lessons and techniques for both novice and experienced traders. Reading widely on forex trading can help traders develop a comprehensive understanding of the market and refine their trading approaches.

Mentorship and Community Support

Engaging with mentorship programs and community support networks can significantly benefit aspiring forex traders. Learning from experienced traders and participating in discussion groups fosters a collaborative learning environment. Many successful traders are willing to share their experiences and insights, providing valuable guidance to those starting their trading journeys. Building a network of supportive peers can enhance traders’ knowledge, confidence, and overall performance in the forex market.

Success Stories: Local and International Traders

Case Studies of Profitable Traders in Uganda

Numerous Ugandan traders have achieved notable success in the forex market, showcasing the potential for profitability with the right approach. One case study involves a trader who initially struggled but committed to continuous learning and disciplined trading. By focusing on technical analysis and risk management, this trader was able to grow their account significantly, ultimately transitioning to full-time trading. Their story highlights the importance of perseverance and the value of education in achieving success in forex trading.

Lessons Learned from Failed Trading Attempts

While success stories are inspiring, there are also valuable lessons to be learned from failed trading attempts. Many traders encounter challenges due to a lack of preparation, inadequate risk management, or emotional decision-making. Analyzing these failures can provide insights into common pitfalls and help aspiring traders avoid similar mistakes. By understanding what went wrong in previous trading experiences, traders can develop more effective strategies and improve their overall performance.

Expert Opinions on Trading Success

Expert opinions and insights from successful traders and industry professionals can provide valuable guidance for aspiring forex traders in Uganda. Many experts emphasize the importance of education, discipline, and continuous improvement in achieving trading success. By learning from the experiences of seasoned traders, aspiring traders can gain a deeper understanding of the market and develop strategies that align with their goals.

The Role of Brokers in Forex Trading

Choosing the Right Broker in Uganda

Selecting the right forex broker is a crucial step for traders in Uganda. Factors to consider include regulatory compliance, trading conditions, available trading platforms, and customer support. It is essential to choose a broker that is licensed by the relevant authorities to ensure a safe trading environment. Additionally, traders should evaluate the broker's fees, spreads, and available trading instruments to find one that aligns with their trading strategy.

Understanding Broker Fees and Commissions

Understanding the fees and commissions associated with forex trading is vital for assessing the profitability of trades. Brokers may charge spreads, commissions, and overnight financing fees (swap rates) for their services. Traders should carefully review the fee structures of potential brokers to ensure they understand the costs involved. Choosing a broker with competitive pricing can help traders minimize their trading costs and improve their overall profitability.

The Importance of Customer Support

Reliable customer support is an essential aspect of choosing a forex broker. Traders may encounter technical issues, need assistance with account management, or have questions about trading conditions. A broker that provides responsive and knowledgeable customer support can significantly enhance the trading experience. Traders should assess the available support channels, such as live chat, email, and phone support, when selecting a broker.

Conclusion

In conclusion, forex trading presents both opportunities and challenges for traders in Uganda. While the potential for profitability exists, it requires a thorough understanding of market dynamics, effective risk management strategies, and a commitment to continuous education. By navigating the regulatory landscape, choosing reputable brokers, and developing essential trading skills, Ugandan traders can position themselves for success in this dynamic market. As the forex landscape continues to evolve, those who adapt and stay informed will likely thrive in the ever-changing world of forex trading in Uganda.

Read more:

What is the pip value of XAUUSD?