12 minute read

Best time to trade XAUUSD in India

from Exness

by Exness_Blog

Understanding XAUUSD Trading

What is XAUUSD?

XAUUSD represents the trading pair for gold (XAU) against the US dollar (USD) in the Forex market. This pairing indicates how many US dollars are needed to purchase one ounce of gold. Gold is a highly sought-after asset due to its intrinsic value, use as a hedge against inflation, and role as a safe haven during economic uncertainties. Traders and investors monitor XAUUSD closely, as its price can fluctuate significantly based on a variety of economic, geopolitical, and market factors.

Top 4 Best XAUUSD Brokers in India

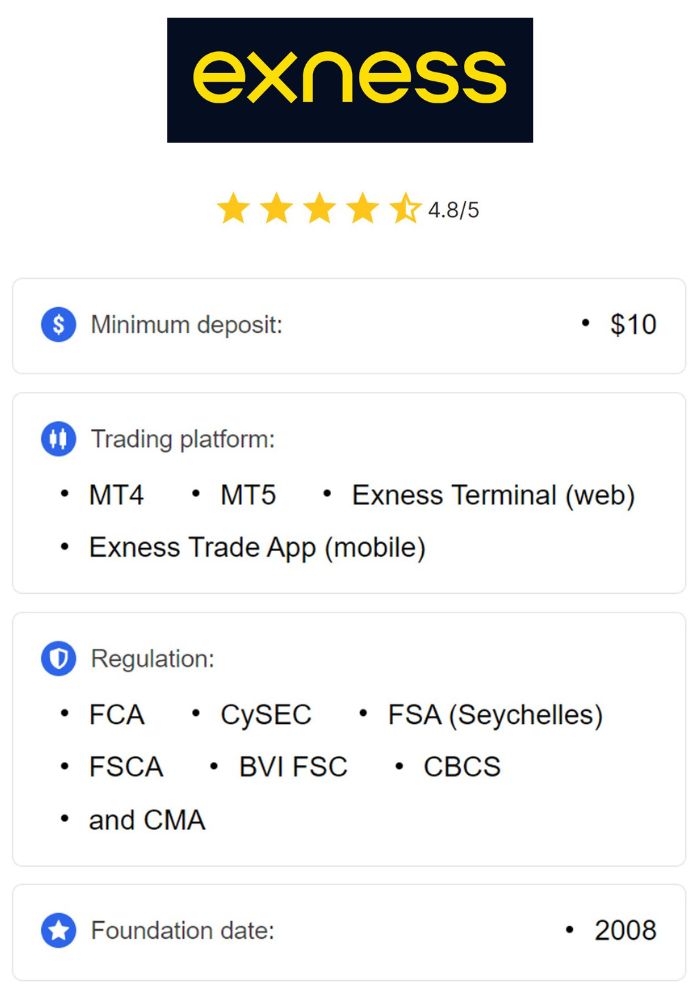

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

Trading XAUUSD allows participants to speculate on gold prices, taking advantage of both upward and downward price movements. Gold is unique compared to other commodities because it often serves as a financial instrument that reflects broader economic trends, making it essential for Forex traders to understand its behavior in the market.

Importance of XAUUSD in Forex Trading

Gold has long been considered a valuable asset and is often viewed as a barometer of economic health. Its significance in Forex trading lies in its ability to serve as a hedge against market volatility and inflation. When economic conditions deteriorate, investors flock to gold as a safe asset, which typically drives prices up.

Additionally, XAUUSD plays a crucial role in diversifying trading portfolios. For traders in India and around the world, gold trading provides an opportunity to capitalize on price movements caused by economic indicators, interest rates, and geopolitical tensions. Understanding when to trade XAUUSD effectively can lead to profitable trading opportunities.

Factors Influencing the Best Time to Trade XAUUSD

Market Hours and Liquidity

The Forex market operates 24 hours a day, five days a week, divided into major trading sessions: the Asian, European, and North American sessions. Each session has distinct characteristics, including varying levels of liquidity and volatility. The best time to trade XAUUSD often coincides with periods of higher liquidity, as this can lead to tighter spreads and more favorable trading conditions.

Liquidity is highest during the overlap of major trading sessions. For example, the overlap between the European and North American sessions typically sees increased trading volume, making it an optimal time for trading XAUUSD.

Economic Indicators and Reports

Economic indicators play a significant role in determining the price of gold. Key economic reports such as employment figures, inflation data, and GDP growth can influence market sentiment and lead to price fluctuations in XAUUSD. Traders should pay attention to the economic calendar and be prepared to adjust their trading strategies around the release of these reports.

For example, if inflation rates rise in the US, this can lead to increased demand for gold as a hedge against inflation, driving prices higher. Conversely, positive economic news may lead to a decline in gold prices as investors move to riskier assets.

Geopolitical Events Impacting Gold Prices

Geopolitical events, such as wars, trade disputes, and political instability, can significantly impact gold prices. During times of uncertainty, gold often experiences increased demand as a safe haven asset. Traders should stay informed about global events and how they may influence market sentiment regarding gold.

Understanding the interplay between geopolitical factors and gold prices can help traders anticipate market movements and identify the best times to trade XAUUSD.

Analyzing Global Market Hours

Major Forex Trading Sessions

The Forex market operates through three major trading sessions:

Asian Session: This session starts around 12 AM GMT and includes major financial centers like Tokyo and Sydney. Liquidity can be lower during this session, particularly for XAUUSD.

European Session: Opening at 7 AM GMT, this session sees significant trading activity, particularly in gold. Major financial centers such as London drive the market during this time.

North American Session: This session begins at 12 PM GMT and includes major markets like New York. The overlap with the European session from 12 PM to 4 PM GMT is particularly active, often resulting in increased volatility.

Understanding these trading sessions is crucial for identifying the optimal times to trade XAUUSD, as market dynamics vary throughout the day.

Overlapping Market Hours and Their Advantages

The overlap between the European and North American sessions is often considered the best time to trade XAUUSD. During this period, liquidity is at its highest, leading to tighter spreads and greater price movements.

Traders can take advantage of this overlap to execute trades more effectively, capitalizing on significant economic announcements and market sentiment changes. It’s essential for traders to recognize when these overlaps occur to optimize their trading strategies.

Best Times for Trading XAUUSD in Indian Time Zone

Major Market Openings Adjusted for IST

India operates in the Indian Standard Time (IST) zone, which is GMT+5:30. To identify the best times to trade XAUUSD, traders in India should convert the major market openings to IST:

Asian Session: 12 AM - 9 AM IST

European Session: 7 AM - 4 PM IST

North American Session: 12 PM - 9 PM IST

The most favorable trading conditions for XAUUSD typically occur during the overlap between the European and North American sessions, from 12 PM to 4 PM IST.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Ideal Trading Windows During the Week

While the market is open five days a week, certain days tend to be more favorable for trading XAUUSD due to market dynamics and economic events. Historically, the following windows are ideal:

Monday Morning (7 AM - 10 AM IST): The market is often more volatile as traders react to news and developments over the weekend.

Tuesday to Thursday (12 PM - 4 PM IST): These days generally see the highest trading volume and volatility during the overlap of the European and North American sessions.

Friday Afternoon (12 PM - 9 PM IST): The last trading day of the week can lead to increased volatility as traders position themselves ahead of the weekend.

Traders should consider these ideal trading windows when planning their XAUUSD trading strategies.

Strategies for Timing Trades

Day Trading Strategy Considerations

Day trading involves making short-term trades within a single day, aiming to profit from small price movements. When day trading XAUUSD, consider the following:

Time of Day: Focus on trading during peak liquidity times, particularly during the overlap of the European and North American sessions.

News Releases: Be aware of economic announcements that could lead to significant price movements. Position your trades accordingly.

Technical Analysis: Utilize technical indicators and chart patterns to identify entry and exit points for your trades.

Swing Trading and Long-Term Approaches

Swing trading involves holding positions for several days or weeks to capitalize on larger price movements. For swing traders focusing on XAUUSD, consider:

Market Trends: Identify the prevailing trend using moving averages and trend lines. Trade in the direction of the trend for higher probabilities.

Economic Fundamentals: Analyze economic data and news to forecast potential price movements over the coming days.

Patience: Unlike day trading, swing trading requires patience and discipline to wait for optimal entry points.

Choosing the appropriate strategy based on your trading style and risk tolerance is essential for success in trading XAUUSD.

Technical Analysis Tools for Timing

Identifying Key Support and Resistance Levels

Support and resistance levels are crucial in technical analysis for determining entry and exit points. Support levels indicate where a price might stop falling, while resistance levels signify where a price might stop rising.

Traders can use previous price data to identify these levels on the XAUUSD chart. By placing trades around these levels, traders can enhance their chances of success. For example, buying near support and selling near resistance can be a viable strategy.

Utilizing Moving Averages for Entry and Exit Points

Moving averages are widely used indicators that help traders smooth out price data and identify trends. Traders can use the following types of moving averages when trading XAUUSD:

Simple Moving Average (SMA): This indicator calculates the average price over a specified period, providing insights into the overall trend.

Exponential Moving Average (EMA): This indicator gives more weight to recent prices, making it more responsive to market changes.

Traders often use moving averages to determine entry and exit points. For example, when the price crosses above the moving average, it may signal a buying opportunity, while a cross below may indicate a selling opportunity.

Fundamental Analysis in XAUUSD Trading

Tracking Gold Supply and Demand Dynamics

Fundamental analysis involves examining the factors that influence the price of gold. Understanding supply and demand dynamics is critical for traders focusing on XAUUSD.

Factors to consider include:

Gold Production Rates: Changes in production levels from major gold-producing countries can affect supply.

Consumer Demand: Trends in jewelry consumption, industrial usage, and investment demand can influence gold prices.

By staying informed about these dynamics, traders can anticipate potential price movements and adjust their trading strategies accordingly.

Understanding Central Bank Policies Affecting Gold

Central banks play a significant role in the gold market, particularly in terms of monetary policy and gold reserves. Key aspects to monitor include:

Interest Rate Decisions: Changes in interest rates set by central banks can impact the opportunity cost of holding gold, thereby influencing demand.

Gold Reserves: Central banks' buying and selling of gold can significantly affect its market price.

Keeping track of central bank actions and policies can provide traders with valuable insights into potential price trends for XAUUSD.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Economic Calendar and Its Significance

Important Economic Releases to Monitor

The economic calendar is a vital tool for traders, providing information on upcoming economic events and reports that can impact the gold market. Key releases to watch include:

Inflation Data: Consumer Price Index (CPI) and Producer Price Index (PPI) reports provide insights into inflation trends.

Employment Figures: Non-farm payroll reports and unemployment rates can influence market sentiment regarding economic stability.

GDP Growth Rates: Changes in GDP can affect investor confidence and demand for gold.

By tracking these economic releases, traders can prepare for potential market volatility and adjust their strategies accordingly.

Integration of Economic Data into Trading Decisions

Integrating economic data into trading decisions is essential for successful trading. Traders should analyze how different economic indicators impact gold prices and adjust their trading strategies based on anticipated market reactions.

For instance, if inflation data shows a significant increase, traders might anticipate higher demand for gold and position themselves accordingly. Understanding the correlation between economic data and market behavior can enhance trading effectiveness.

Psychological Factors in Trading

Impact of Trader Sentiment on Price Movements

Trader sentiment can significantly influence price movements in the Forex market, including XAUUSD. Market psychology often drives traders to react to news and events, leading to collective buying or selling behaviors.

Understanding the sentiment of the market can provide insights into potential price movements. For example, if market sentiment is overwhelmingly bullish on gold, prices may continue to rise as more traders enter long positions.

Overcoming FOMO (Fear of Missing Out)

Fear of Missing Out (FOMO) is a common psychological barrier for traders. It often leads to impulsive trading decisions based on emotional reactions rather than sound analysis.

To overcome FOMO, traders should:

Stick to Your Trading Plan: Establishing a well-defined trading plan can help you stay disciplined and avoid impulsive decisions.

Set Realistic Goals: Focus on long-term goals rather than short-term gains, allowing you to navigate the markets without undue pressure.

Practice Mindfulness: Regularly take breaks to reflect on your trading decisions and avoid emotional reactions to market movements.

By addressing psychological factors, traders can improve their decision-making processes and enhance their trading performance.

Risk Management Techniques

Setting Stop-Loss and Take-Profit Levels

Risk management is crucial for success in trading, especially in volatile markets like gold. Setting stop-loss and take-profit levels helps traders manage their risk exposure and protect their capital.

Stop-Loss Orders: A stop-loss order automatically closes a trade at a predetermined price level, limiting potential losses.

Take-Profit Orders: A take-profit order ensures that a trade is closed when a specific profit target is reached, locking in gains.

Establishing these levels before entering a trade helps traders maintain discipline and reduce emotional decision-making.

Position Sizing Based on Volatility

Position sizing is another critical aspect of risk management. It involves determining the appropriate amount of capital to allocate to each trade based on volatility and risk tolerance.

By properly sizing positions, traders can manage their risk effectively and avoid overexposing their accounts to significant losses.

Key Takeaways for Traders

Recap of Best Practices for XAUUSD Trading

To summarize the best practices for trading XAUUSD in India:

Understand Market Hours: Identify the best times to trade based on market liquidity and overlapping sessions.

Utilize Fundamental and Technical Analysis: Analyze economic indicators and use technical tools to make informed trading decisions.

Implement Risk Management Strategies: Set stop-loss and take-profit levels and determine appropriate position sizes.

Stay Informed: Monitor economic news and developments that can impact gold prices.

Manage Psychological Factors: Recognize emotional triggers and develop discipline in trading.

Continuous Learning and Adaptation in Trading

The Forex market is dynamic and ever-changing, making continuous learning essential for traders. Stay updated with market trends, new trading strategies, and economic developments. Engage with educational resources, participate in forums, and seek mentorship from experienced traders to refine your skills.

Adapting to changes in the market environment will enhance your trading effectiveness and increase your chances of long-term success in trading XAUUSD.

Conclusion

Trading XAUUSD offers numerous opportunities for traders in India, but timing plays a crucial role in maximizing profitability. By understanding the market dynamics, including trading sessions, economic indicators, and psychological factors, traders can identify the best times to enter and exit positions.

With proper risk management, strategic planning, and continuous learning, you can navigate the complexities of the gold market and work towards achieving your financial goals. Stay informed, remain disciplined, and embrace the journey of trading XAUUSD effectively in the dynamic Forex market.

Read more:

Exness Review Uganda: Legit, Safe, Is a good broker?