15 minute read

Is Exness trading legal in India?

from Exness

by Exness_Blog

Understanding Exness as a Trading Platform

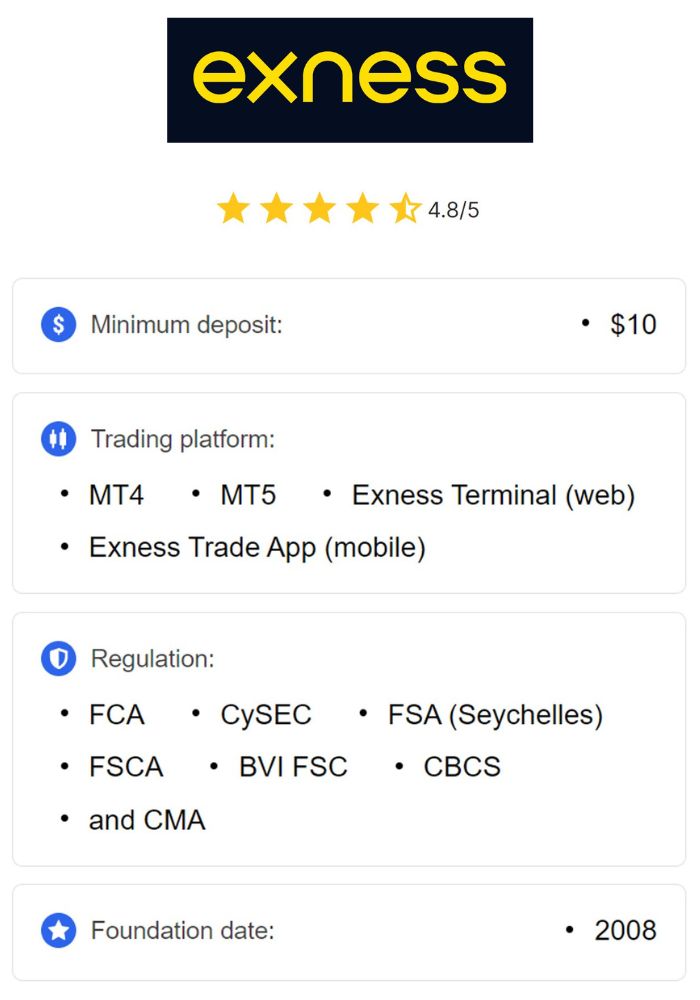

Overview of Exness

Exness is a globally recognized forex and CFD trading platform established in 2008. With operations in multiple countries, Exness offers traders access to various financial markets, including forex, commodities, cryptocurrencies, and stocks. Known for its user-friendly interface, competitive spreads, and high execution speed, Exness appeals to both beginner and experienced traders. The platform also provides a wide range of account types and leverages options, allowing traders to select plans that suit their trading needs and goals.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Exness operates on popular trading platforms such as MetaTrader 4 and MetaTrader 5, which offer advanced trading features, technical analysis tools, and flexible trading options. These tools empower users to customize their trading strategies and make informed decisions. The company is also committed to transparency, offering real-time data on trading volumes and trade execution speeds, which enhances its reputation as a reliable broker.

Types of Financial Instruments Offered

Exness provides a diverse array of financial instruments, including major, minor, and exotic forex pairs, commodities like gold and oil, stock indices, cryptocurrencies, and individual stocks. This variety enables traders to diversify their portfolios, manage risk more effectively, and explore opportunities in different markets based on their expertise and risk tolerance. The platform’s extensive offerings also allow traders to switch between instruments depending on market conditions.

This diversity in trading instruments is a key advantage for traders in India who are interested in expanding their investment options beyond traditional markets. By trading on Exness, Indian investors can explore international markets and gain exposure to assets that might not be available through local brokers.

Key Features and Benefits of Using Exness

Exness is known for its unique features, including competitive spreads, fast withdrawals, multiple account types, and 24/7 customer support. The platform offers high leverage options, which can magnify potential returns, though it also increases risk. Additionally, Exness ensures a secure trading environment by implementing stringent security measures and compliance with regulatory standards.

Other benefits include an easy-to-navigate mobile app, multi-language support, and a demo account for beginners. The demo account is especially valuable as it allows new traders to practice strategies without risking real money. Exness also provides resources such as webinars, tutorials, and market analysis, which enhance traders' knowledge and confidence in executing trades.

Regulatory Framework for Online Trading in India

The Role of SEBI in Regulating Financial Markets

In India, the Securities and Exchange Board of India (SEBI) plays a central role in regulating financial markets. SEBI's primary aim is to protect investors' interests, ensure transparency, and promote fairness in the market. SEBI sets strict rules for brokers and financial institutions, covering aspects such as registration, fund management, reporting standards, and operational transparency.

SEBI regulates online trading platforms that offer Indian Rupee (INR)-based trading pairs, while platforms that allow foreign currency trading, such as forex platforms offering USD pairs, are usually outside SEBI’s jurisdiction unless they establish operations within India. Traders need to understand SEBI’s guidelines and regulations to engage in legally compliant trading activities in India.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Laws Governing Forex Trading

Forex trading laws in India primarily fall under the Foreign Exchange Management Act (FEMA) and SEBI regulations. According to FEMA, residents in India are permitted to trade only in currency pairs that include the Indian Rupee, such as USD/INR, EUR/INR, GBP/INR, and JPY/INR. Trading in non-INR pairs on international platforms, including brokers like Exness, may raise legal concerns due to the lack of explicit regulatory oversight.

While SEBI regulates INR-based forex trading within India, individuals trading non-INR pairs on foreign platforms often face unclear legal standing. Traders need to carefully consider these regulations and assess the risks associated with trading non-INR currency pairs on international platforms.

Importance of Compliance with Indian Regulations

Compliance with local regulations is essential for protecting traders’ rights and ensuring secure trading. Brokers regulated by SEBI or other recognized authorities are subject to audits, capital adequacy requirements, and operational guidelines designed to prevent fraud and protect investor funds. Trading on a regulated platform offers assurance that the broker follows ethical practices, reduces potential risks, and offers legal recourse if any issues arise.

Exness, being an international broker, is regulated in several jurisdictions but is not directly regulated by SEBI. This lack of local regulation could potentially pose risks for Indian traders, particularly in case of disputes. Indian traders interested in forex trading should be aware of the regulations, the risks involved, and any potential legal implications.

Status of Exness in the Indian Market

Exness' Regulatory Standing Globally

Exness holds licenses and regulatory approvals from multiple reputable authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Seychelles Financial Services Authority (FSA). These regulatory bodies ensure that Exness adheres to strict operational, financial, and ethical standards, thereby providing a level of assurance for international clients.

However, Exness does not have regulatory approval from SEBI, which means it does not have a local presence or license to operate directly in the Indian forex market. This global regulatory standing provides some protection for Indian traders, but it does not replace the protections provided by a SEBI license, which covers INR-based forex trading.

Relationship with Indian Traders

Exness is accessible to Indian traders who wish to participate in forex trading and explore international financial markets. Exness offers its platform to Indian residents, allowing them to open accounts, deposit funds, and trade various financial instruments. The platform has grown in popularity among Indian traders due to its user-friendly interface, variety of trading options, and access to global markets.

While Exness serves Indian traders, it is essential for users to understand that Exness operates as an international broker and does not fall under SEBI regulation. This status means that Indian users need to be cautious, particularly when trading in non-INR pairs, as this could have potential legal implications.

Availability of Exness Services in India

Exness provides Indian users with access to a wide range of services, including forex trading, commodities, cryptocurrencies, and indices. However, users need to remember that Exness’s offerings are subject to international regulatory standards and not Indian regulations. The platform’s features, including leverage options, various account types, and instant withdrawals, make it appealing to Indian traders, but caution should be exercised due to the regulatory gap.

Factors Affecting the Legality of Exness Trading in India

Definition of Legal Trading Practices

Legal forex trading in India is defined by FEMA, which only permits trading in INR-based pairs through regulated platforms. Trading non-INR pairs through international brokers like Exness may be legally ambiguous for Indian residents. While Indian authorities generally do not penalize individual traders, it is technically outside SEBI’s regulatory scope and could lead to issues if disputes arise.

Many Indian traders engage in forex trading on platforms like Exness under the assumption that international brokers offer a safe space for trading non-INR pairs. However, since these trades fall outside SEBI’s purview, traders should conduct thorough research to understand potential risks.

Comparison with Other Forex Brokers

Many international brokers offer services in India, including platforms like XM, FXTM, and OctaFX. Unlike brokers regulated in India, most international brokers are regulated by authorities like CySEC or FCA. While these brokers comply with international regulations, they are not subject to Indian regulatory standards. Traders should compare Exness’s offerings, regulatory status, and reputation with other brokers before making a decision.

Comparing Exness with other brokers reveals that while Exness provides a robust trading platform and competitive spreads, its lack of SEBI regulation is a common limitation shared by many international brokers. Indian traders should weigh the benefits of features such as low spreads and high leverage against the lack of local regulatory protection.

Implications of Trading with Unregulated Platforms

Trading on platforms not regulated by SEBI can expose Indian traders to potential risks, such as disputes over funds or lack of legal recourse in case of issues. While Exness operates under multiple international regulatory bodies, these protections may not fully apply to Indian traders. It’s essential for traders to be aware of these implications and take necessary precautions, such as selecting regulated brokers if they want comprehensive local protection.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Risks Associated with Trading on Exness in India

Understanding Leverage and Margin Trading Risks

Exness offers high leverage options, allowing traders to maximize their potential gains, but also increasing the potential risks. Leveraged trading can lead to substantial losses, particularly for inexperienced traders who are unfamiliar with the risks involved. It’s essential to fully understand how leverage and margin requirements work before trading, as improper use of leverage can quickly result in losses exceeding the initial investment.

Potential for Fraud and Scams

Since Exness is not regulated by SEBI, Indian traders may be more vulnerable to fraud or scams if trading goes awry. Although Exness is regulated internationally, traders do not have the same protection as they would with SEBI-regulated brokers. Fraud risk is generally lower with reputable brokers like Exness, but traders must remain vigilant, especially with third-party payment methods or unofficial support channels.

The Volatility of Forex Markets

Forex trading inherently involves high volatility, which can lead to significant fluctuations in market prices. This volatility, combined with leverage, can result in rapid changes in account balances, which might be challenging for inexperienced traders to manage. Exness provides tools and resources to help traders manage these risks, but understanding market volatility is crucial for anyone looking to trade on the platform.

How to Trade Legally on Exness in India

Steps to Sign Up and Verify Account

To begin trading on Exness from India, the first step is to create an account on the Exness platform. The sign-up process is straightforward and requires you to provide basic personal information, such as your name, email, and phone number. After submitting your details, you’ll receive a verification email to confirm your account. Verifying your account is crucial, as it ensures that Exness complies with international KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations.

After creating an account, the next step is identity verification, which is required to start trading and access all features. Exness typically requests proof of identity (such as a passport or government-issued ID) and proof of address (such as a utility bill or bank statement). This verification not only strengthens the security of your account but also aligns with regulatory standards, which can provide added peace of mind to Indian traders who might be concerned about using an international platform.

Acceptable Payment Methods for Indian Traders

Indian traders can fund their Exness accounts using a variety of deposit methods. Exness supports local payment solutions that are convenient for Indian users, including UPI (Unified Payments Interface), bank transfers, and e-wallets like Skrill and Neteller. These payment options are accessible, making it easy for Indian traders to deposit funds without having to navigate complex international banking requirements.

In addition to bank transfers and e-wallets, Exness also accepts credit and debit card payments, offering flexibility in funding your account. However, it's crucial to check the transaction fees associated with each payment method, as some methods may incur additional charges. It’s also advisable to stick to verified payment options provided directly by Exness, as using unapproved third-party channels can increase the risk of fraud or transaction issues.

Understanding Tax Implications of Trading Profits

Profits earned from forex trading on platforms like Exness are considered taxable income in India. According to Indian tax regulations, income from forex trading falls under the category of “speculative income” if held for a short period. Indian traders are required to report these earnings on their tax returns, and taxes are levied based on the individual's income tax bracket. It’s essential to consult with a tax professional who can guide you on accurately reporting your trading profits.

In addition to income tax, Indian traders should also be aware of other potential fees, such as Goods and Services Tax (GST) on certain types of financial transactions. While Exness does not handle tax reporting for its users, it provides transaction history records that traders can download and use for tax filing purposes. Proper documentation of all trades and profits will help ensure compliance with Indian tax laws and avoid any penalties.

Alternatives to Exness for Indian Traders

List of Regulated Forex Brokers in India

Indian traders who prefer to trade with regulated brokers have several options that operate under the supervision of SEBI. Some of the well-known SEBI-regulated brokers include Zerodha, Angel Broking, and ICICI Direct. These platforms offer forex trading with INR currency pairs, making them fully compliant with Indian laws. By choosing a SEBI-regulated broker, traders gain the benefit of legal recourse within India, as well as additional protection measures mandated by Indian regulators.

Unlike international brokers, SEBI-regulated platforms are required to adhere to strict guidelines on fund management, reporting practices, and investor protection. While these brokers may offer fewer currency pairs compared to Exness, they provide a safer trading environment for those who want to avoid potential legal ambiguity associated with trading on international platforms.

Advantages of Choosing a Regulated Broker

One of the main advantages of choosing a SEBI-regulated broker is the legal protection it provides. SEBI-regulated brokers are subject to oversight, meaning that traders have recourse in the event of fraud, disputes, or broker insolvency. Additionally, trading with a regulated broker means that you are in compliance with Indian financial laws, reducing the risk of legal complications that can arise from using international platforms for non-INR currency pairs.

Regulated brokers in India also offer the advantage of INR-based forex pairs, allowing traders to legally participate in forex trading without concerns over FEMA compliance. Furthermore, SEBI-regulated brokers generally offer educational resources and risk management tools designed to promote safe trading practices, which can be particularly helpful for new traders.

Comparison of Features and Fees

When comparing Exness with SEBI-regulated brokers, there are notable differences in features, fees, and accessibility. Exness often provides more competitive spreads, higher leverage options, and a broader range of financial instruments, including non-INR forex pairs, commodities, and cryptocurrencies. However, the lack of SEBI regulation means that Exness operates in a regulatory grey area in India, and users may not receive the same level of legal protection.

SEBI-regulated brokers may have higher transaction fees or fewer available trading instruments, but they offer the advantage of legal clarity and support within India. Indian traders must weigh these factors carefully, considering both the benefits of Exness’s offerings and the security and compliance advantages provided by SEBI-regulated brokers.

Frequently Asked Questions

Common Concerns About Trading Legally

One common question among Indian traders is whether it’s legal to trade on platforms like Exness that aren’t regulated by SEBI. While many Indian traders use international brokers, it’s important to understand that trading non-INR currency pairs on foreign platforms may be considered outside the bounds of SEBI regulation. While penalties are rare, traders should weigh the risks and consider legal alternatives if they want complete peace of mind.

Another frequent concern is the risk of funds being frozen or lost in case of disputes with international brokers. Choosing reputable brokers like Exness, which adhere to multiple international regulations, mitigates this risk. Nonetheless, Indian traders are advised to perform due diligence on any platform they plan to use and understand the legal landscape before committing funds.

Clarifying Myths About Forex Trading in India

A common misconception about forex trading in India is that it’s entirely illegal. In reality, forex trading is permitted when it involves INR-based pairs on SEBI-regulated platforms. Many traders mistakenly believe that they can freely trade any currency pair through international brokers, but such activities may fall into a legal grey area if the trades involve non-INR pairs.

Another myth is that profits from forex trading are not taxable. In fact, any income earned from forex trading is subject to Indian income tax laws, regardless of whether the trades occur on local or international platforms. Traders should ensure they are correctly reporting any profits to avoid penalties.

Resources for Further Information

For Indian traders seeking more information on forex trading regulations, SEBI’s official website is a valuable resource, offering guidelines and updates on compliant trading practices. Additionally, FEMA guidelines available on the Reserve Bank of India’s website provide insights into the legal aspects of forex trading involving the INR. For traders using international brokers, consulting a financial advisor or tax professional can also provide clarity on legal and tax-related questions.

Conclusion

Exness is a reputable international trading platform that offers a variety of financial instruments and advanced trading tools. However, the legality of trading on Exness for Indian residents is nuanced due to the restrictions imposed by Indian regulations on non-INR forex pairs. Exness is not regulated by SEBI, which may present certain legal risks for Indian traders, especially those trading currency pairs that do not involve INR.

While many Indian traders successfully use Exness for accessing global markets, it’s essential to remain informed about the potential regulatory implications and consider alternatives if compliance with Indian regulations is a priority. For those who choose to use Exness, careful management of trading practices, adherence to tax regulations, and a comprehensive understanding of SEBI and FEMA guidelines will contribute to a safer trading experience.

Read more: