15 minute read

How does Exness make money?

from Exness

by Exness_Blog

Introduction to Exness

Overview of Exness as a Brokerage Firm

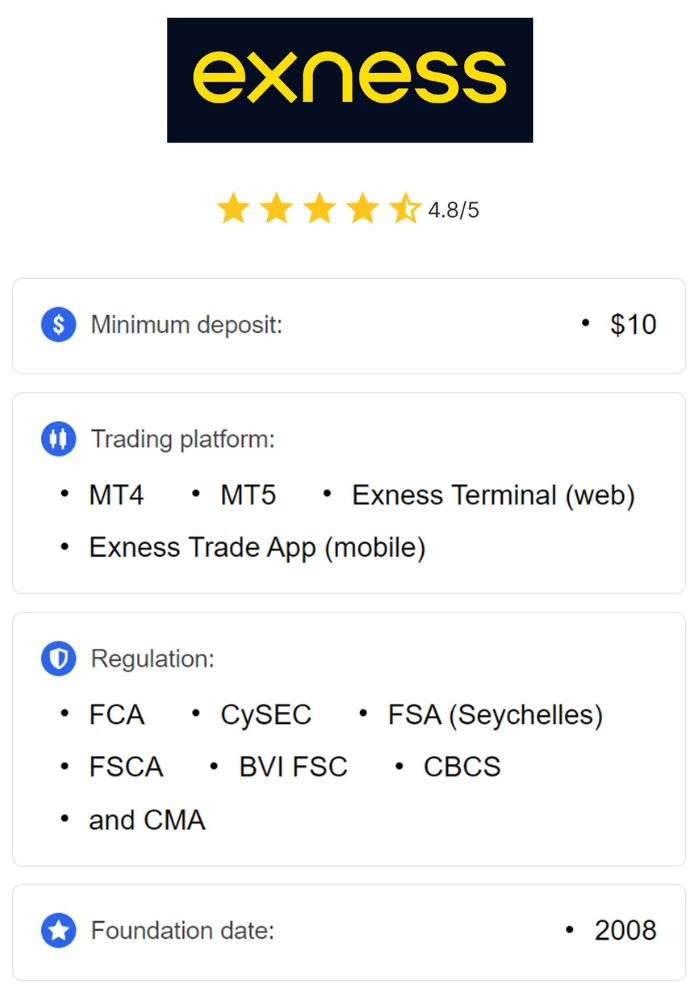

Exness is a globally recognized online brokerage firm that offers a wide range of trading services across various financial markets, including forex, commodities, indices, and cryptocurrencies. Founded in 2008, Exness has built a strong reputation for providing competitive trading conditions, including low spreads, high leverage options, and user-friendly platforms like MetaTrader 4 and MetaTrader 5. Catering to both retail and professional traders, Exness has seen substantial growth in trading volume, making it one of the leading brokers in the industry.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

The brokerage’s success can be attributed to its client-centric approach and commitment to transparency. Exness operates under multiple regulatory frameworks across different regions, including licenses from top-tier authorities like the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). These regulatory endorsements ensure that Exness adheres to strict standards, providing a safe and reliable trading environment for clients globally.

The Role of Online Trading in Modern Finance

Online trading has revolutionized the financial landscape, making it accessible for individual investors and institutions alike. Through platforms like Exness, traders can now access global markets in real time, executing trades from anywhere with an internet connection. The democratization of trading has empowered millions of individuals to invest and speculate on financial instruments, contributing to a surge in trading volumes and liquidity.

As online trading continues to grow, brokers like Exness play a crucial role in facilitating seamless access to financial markets. They provide essential tools, educational resources, and risk management options to help traders make informed decisions. This increased accessibility has driven competition among brokers, compelling firms like Exness to innovate continuously and offer value-added services to attract and retain clients.

Business Model of Exness

Understanding the Market Maker Model

In the brokerage industry, a common revenue model is the market maker approach, where brokers act as counterparties to their clients’ trades. In this model, Exness may choose to execute trades internally rather than routing them directly to the open market. By acting as a market maker, Exness can manage trades within its system, allowing it to control spreads and manage order execution efficiently. Market makers earn revenue primarily from the spread, which is the difference between the bid and ask price.

The market maker model can be advantageous in terms of providing liquidity and fast execution speeds. However, Exness has adopted measures to ensure fair trading practices, so clients receive competitive pricing without any conflict of interest. By offering low spreads and stable trading conditions, Exness has gained trust from traders who value reliability and transparency.

Introducing the ECN Model

Exness also offers an ECN (Electronic Communication Network) model, which provides traders with direct access to liquidity providers in the market. Under the ECN model, Exness acts as an intermediary, matching trades between buyers and sellers without taking a position in the trade itself. This model is popular among professional traders who prioritize transparency and access to real market prices.

The ECN model allows Exness to earn through commissions on each trade rather than relying on spreads alone. This model benefits traders who prefer tighter spreads and are willing to pay a small commission for improved pricing. By offering both market maker and ECN models, Exness provides clients with flexibility in choosing the trading conditions that best suit their strategies and trading styles.

Revenue Streams for Exness

Spreads and Commissions

One of the primary ways Exness generates revenue is through spreads—the difference between the bid and ask prices of a trading instrument. For market maker accounts, Exness earns directly from these spreads, with narrower spreads offered to attract active traders. The platform also charges a small commission on ECN accounts, where clients enjoy ultra-tight spreads and access to the interbank market.

By maintaining competitive spreads across different account types, Exness can cater to a broad client base, including scalpers, day traders, and long-term investors. The combination of spread-based and commission-based revenue helps Exness diversify its income sources while providing flexible pricing options for its clients.

Overnight Financing Fees (Swap Rates)

In addition to spreads and commissions, Exness generates revenue through overnight financing fees, commonly known as swap rates. When traders hold leveraged positions overnight, they incur a swap fee, which compensates for the interest difference between the two currencies in a forex pair or the cost of holding a leveraged position in other asset classes.

These fees are either credited or debited from a trader’s account, depending on the position and the prevailing interest rates. Swap rates are an essential component of Exness’s revenue model, as they apply to long-term trades that remain open beyond standard trading hours. Swap-free accounts are also available for traders who wish to avoid overnight fees, such as Islamic account holders.

Client Fund Management

Segregation of Client Funds

Exness maintains a clear separation between client funds and the company's operational funds by using segregated accounts. This means that the money clients deposit for trading is held in separate accounts and is not used to fund Exness’s operational activities. This practice, mandated by regulatory authorities, ensures that client funds are safeguarded, even in the event of financial difficulties within the company.

Segregation of funds is a cornerstone of Exness’s commitment to client protection and financial integrity. By holding client funds in top-tier banks and ensuring they are separate from the broker's assets, Exness builds trust with its clients, which in turn contributes to its strong client retention rate and long-term success.

Interest Income from Client Deposits

While Exness does not use client funds for trading, it may earn interest on client deposits held in segregated bank accounts. The interest earned from these accounts can provide Exness with an additional revenue stream, albeit a relatively minor one compared to its primary sources of income. This interest income can help offset operational expenses, contributing to the firm’s financial stability.

However, it is worth noting that Exness’s primary focus remains on providing top-quality trading services rather than relying heavily on interest income. The brokerage prioritizes transparency and adheres to regulatory standards that govern the handling of client funds, ensuring that clients’ interests are always placed first.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Trading Volume and its Impact

How Trading Volume Affects Revenue

High trading volumes contribute significantly to Exness’s revenue, as they increase the number of transactions and, consequently, the income from spreads and commissions. With a large and active client base, Exness benefits from consistent trading activity, especially during times of market volatility when trading volumes tend to spike. Increased trading volume translates to higher revenue, allowing Exness to maintain competitive spreads and invest in technology and customer service.

For Exness, fostering an environment that encourages active trading helps in boosting trading volumes. Offering educational resources, competitive pricing, and flexible leverage options are some of the ways Exness promotes trading activity, thereby generating a steady stream of revenue.

The Importance of Liquidity Providers

Liquidity providers play a crucial role in ensuring smooth trade execution, particularly for brokers like Exness that offer tight spreads and rapid execution. By partnering with top-tier liquidity providers, Exness can manage high trading volumes efficiently while minimizing slippage and maintaining low spreads. Reliable liquidity partners ensure that Exness has access to the best available prices, which enhances the trading experience for clients and increases the broker's competitiveness.

In the ECN model, liquidity providers facilitate direct access to market prices, ensuring transparency and accuracy in pricing. This relationship with liquidity providers is fundamental to Exness’s operational success, as it allows the broker to offer optimal trading conditions to clients while maintaining a stable revenue stream.

Leverage and Margin Trading

Understanding Leverage in Forex Trading

Leverage is a powerful tool in forex trading that allows traders to control larger positions with a smaller amount of capital. By using leverage, Exness clients can amplify their trading power and potentially increase returns on their investments. For example, with a leverage of 1:100, a trader can control a position worth $10,000 with just $100 in their account. Exness offers a range of leverage options, allowing traders to choose the level that aligns with their risk tolerance and trading strategy.

However, while leverage can boost profits, it also increases the potential for significant losses. Traders using high leverage should be mindful of the associated risks and understand how to manage their exposure effectively. Exness provides educational resources to help traders understand leverage, and it encourages responsible use of this tool, especially for beginners who may not fully grasp its implications.

Impact of Margin Calls on Company Revenue

Margin trading also introduces the concept of margin calls, which occur when an account’s equity falls below the required margin level due to market movements. In such cases, Exness may close positions to protect traders from falling into negative balances, but the company may still earn revenue from these activities, as margin trading increases overall trading volume.

By maintaining competitive leverage options and clearly defined margin requirements, Exness can attract a broader range of traders, from those seeking high-leverage opportunities to those prioritizing risk management. The revenue generated through leverage and margin trading not only contributes to the company's profits but also reinforces its position as a broker that offers flexible, client-oriented trading options.

Affiliate Programs and Partnerships

Overview of Affiliate Marketing Strategies

Exness has a comprehensive affiliate marketing program that allows individuals and organizations to earn commissions by referring new clients to the platform. Through the affiliate program, Exness incentivizes partners to bring in more traders, providing them with a percentage of the revenue generated by their referrals. This program benefits both the affiliates, who earn commissions, and Exness, which gains increased exposure and a steady stream of new clients.

The affiliate program is particularly popular due to its transparency and competitive commission structure. Affiliates receive tools to track their performance and optimize their campaigns, ensuring they can maximize their earnings while promoting Exness as a reliable trading platform. Affiliates are a vital part of Exness's marketing strategy, helping to expand its client base and grow its revenue stream.

Collaborations with Other Financial Institutions

In addition to its affiliate program, Exness collaborates with various financial institutions and fintech companies to broaden its service offerings and market reach. By partnering with reputable financial organizations, Exness can enhance its credibility, especially in markets where financial security and reputation are crucial for attracting new clients.

These partnerships allow Exness to leverage the strengths of other organizations, whether in terms of technology, payment processing, or market analysis. Collaborations with financial institutions help Exness strengthen its position in the global trading market, enabling the company to offer additional value to its clients while increasing its competitive advantage.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Technology and Infrastructure Costs

Investment in Trading Platforms

Exness’s revenue is significantly affected by its investment in advanced technology and trading platforms. To offer seamless trading experiences, Exness invests in popular platforms like MetaTrader 4 and MetaTrader 5, as well as its proprietary solutions. These platforms require substantial investment in terms of licensing, development, and continuous upgrades to meet evolving market demands and ensure robust performance.

High-quality technology infrastructure not only enhances user experience but also supports Exness's capacity to handle high trading volumes, which directly contributes to its revenue. The reliability and functionality of these platforms play a key role in attracting and retaining traders, as clients value brokers that offer dependable tools for executing trades efficiently.

Maintenance of High-Quality Services

Maintaining high-quality services also incurs ongoing operational costs, including server maintenance, cybersecurity measures, and system upgrades. Exness has to ensure that its platform is secure, fast, and able to support thousands of simultaneous transactions without delay. Regular maintenance and the adoption of cutting-edge technology are crucial to preserving Exness’s reputation as a reliable broker.

The costs associated with maintaining high standards in technology and infrastructure are ultimately balanced by the revenue generated from a satisfied and loyal client base. Traders who have confidence in a platform’s stability and security are more likely to engage in higher trading volumes, resulting in increased revenue for Exness.

Regulatory Compliance and Its Financial Implications

Costs Incurred for Licensing and Regulation

Operating in multiple jurisdictions, Exness is subject to various regulatory standards, each with specific licensing fees and compliance requirements. These fees are a necessary part of doing business in the financial industry and contribute to Exness's credibility as a regulated broker. Obtaining licenses from reputable regulatory bodies, such as the Financial Conduct Authority (FCA) and CySEC, requires substantial financial commitment and adherence to strict regulatory guidelines.

These regulatory costs include audits, reporting obligations, and implementation of client protection measures. Although compliance can be expensive, it provides clients with confidence in the broker’s integrity and commitment to transparency, which can enhance Exness’s long-term profitability by attracting more clients.

Impact of Regulations on Profitability

While regulations protect clients, they can also impact Exness’s profitability. For instance, restrictions on leverage ratios in some jurisdictions may reduce trading volumes, limiting potential revenue. Additionally, regulatory bodies often impose rules on how client funds are handled and mandate specific risk disclosures, which can limit some of Exness’s operational flexibility.

Despite these constraints, Exness views regulatory compliance as an investment in its reputation and client trust. By adhering to these standards, Exness ensures a stable and transparent environment for traders, which is essential for maintaining long-term profitability and a loyal client base.

Customer Support and its Cost-Benefit Analysis

Role of Customer Service in Retaining Clients

Customer support plays a crucial role in the success of Exness, as it directly impacts client satisfaction and retention. Effective customer service can address traders' concerns, resolve technical issues, and provide assistance in real-time, which is invaluable in the fast-paced trading environment. By investing in a dedicated support team, Exness aims to build trust with its clients, leading to increased trading activity and loyalty.

Moreover, Exness offers multilingual support to cater to its global client base, ensuring that traders from various regions receive assistance in their preferred language. The positive client experience generated through responsive customer service can lead to higher client retention rates, which is essential for sustained revenue generation.

Impact of Quality Support on Company Image

High-quality customer support not only improves client satisfaction but also bolsters Exness’s brand reputation. Positive client reviews and testimonials about customer service can attract new traders, while negative experiences can damage the company's image. Exness understands that proactive and efficient customer support is a competitive advantage in the crowded brokerage industry.

Exness’s commitment to providing robust support services, including live chat, email, and phone support, contributes to its image as a reliable and client-focused broker. This focus on customer support helps Exness maintain a positive reputation, attract new clients, and retain existing ones, all of which directly contribute to the company’s revenue.

Market Trends Affecting Exness’s Revenue

Economic Factors Influencing Trading Volumes

Economic conditions have a profound impact on trading volumes, which in turn affect Exness’s revenue. During periods of economic instability or major financial events, market volatility often increases, leading to higher trading activity. For Exness, this can result in a surge in trading volumes, as more traders seek to capitalize on price movements. Conversely, stable economic periods may see reduced trading activity and consequently lower revenue.

Exness monitors global economic trends and market conditions to anticipate changes in trading behavior and adapt its strategies accordingly. By offering timely market analysis and insights, Exness can encourage traders to stay active in various economic climates, ensuring a more consistent revenue flow.

The Rise of Retail Trading and Its Implications

The growth of retail trading has opened new revenue opportunities for brokers like Exness. With increasing interest in online trading, more individuals are participating in the forex market, driving trading volumes higher. Exness capitalizes on this trend by providing accessible account options, educational resources, and low-barrier entry points for new traders.

As retail trading continues to expand, Exness’s client base grows, increasing the broker’s revenue potential. The firm’s efforts to cater to both beginner and professional traders through a diverse range of products and services have positioned it favorably in the evolving trading landscape.

Future Outlook for Exness

Opportunities for Expansion

Looking ahead, Exness is well-positioned to expand into new markets and introduce innovative trading solutions. The firm has already established a solid presence in key regions, and further expansion into emerging markets could provide additional revenue streams. Technological advancements, such as AI-driven trading tools and blockchain-based transactions, present exciting opportunities for Exness to offer cutting-edge solutions to its clients.

Exness’s focus on client satisfaction, regulatory compliance, and technological innovation will likely contribute to its continued success in the competitive forex industry. By identifying and capitalizing on emerging trends, Exness aims to sustain its growth and enhance its market share globally.

Potential Challenges Ahead

While the future appears promising, Exness may face challenges, particularly from regulatory changes and economic uncertainty. Increasing regulatory scrutiny in some regions could limit leverage offerings and impose additional compliance costs. Moreover, market volatility and economic downturns could affect trading volumes, impacting revenue.

To mitigate these risks, Exness will need to adapt its business model, ensure operational resilience, and invest in areas that enhance client experience. By staying ahead of industry trends and focusing on client trust, Exness can continue to navigate potential challenges while maintaining a profitable and sustainable business.

Conclusion

Exness has built a profitable business model that leverages various revenue streams, including spreads, commissions, and affiliate partnerships, to sustain its growth. Through a client-focused approach, robust regulatory compliance, and strategic investments in technology and support, Exness has positioned itself as a trusted and reliable broker. As the company navigates future challenges and opportunities, its commitment to transparency and innovation will remain key drivers of its success in the dynamic online trading landscape.

Read more: