13 minute read

Exness minimum deposit in Nigeria

from Exness

by Exness_Blog

Understanding Exness as a Trading Platform

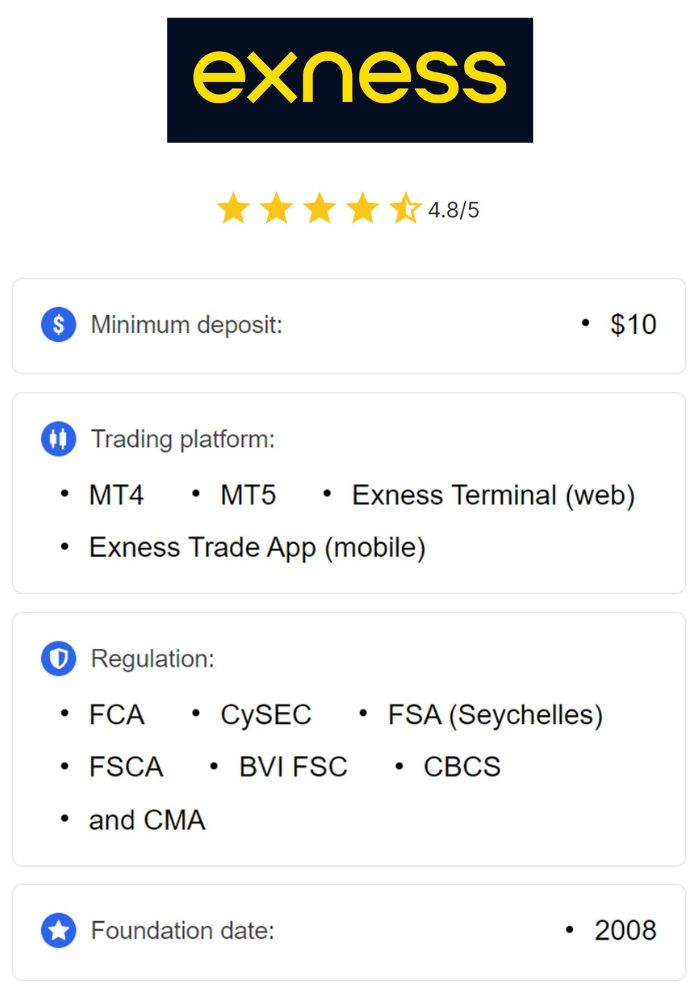

Overview of Exness

Exness is a globally recognized forex and CFD trading platform that has built a strong reputation for offering competitive trading conditions and advanced technology. Founded in 2008, Exness provides a range of trading instruments, including forex, commodities, indices, and cryptocurrencies. The platform offers multiple account types suited to both beginner and advanced traders, each with unique features and benefits. With a user-friendly interface and support for popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), Exness caters to diverse trading preferences.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Exness is particularly popular among Nigerian traders due to its flexibility, low fees, and the availability of high leverage, allowing traders to maximize their potential returns. Moreover, Exness’s transparent pricing and commitment to providing educational resources make it an accessible option for newcomers to forex trading.

Regulatory Compliance and Security Measures

Exness operates under strict regulatory compliance, holding licenses from reputable financial authorities such as the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). These licenses ensure that Exness adheres to stringent standards for transparency, fund safety, and ethical business practices. For Nigerian traders, Exness’s regulatory oversight provides assurance that their funds are secure and that the broker operates with accountability.

Additionally, Exness utilizes advanced security measures, including encrypted transactions and segregated accounts, to protect client funds. These security protocols are essential for maintaining a trustworthy trading environment, particularly for beginners who prioritize platform reliability.

Importance of Minimum Deposit in Online Trading

Defining Minimum Deposit

The minimum deposit is the lowest amount a trader must deposit to open a live trading account. This amount varies depending on the broker and account type. A low minimum deposit is advantageous for beginner traders as it allows them to start trading with a smaller investment, reducing the financial risk involved. Exness is known for its flexible minimum deposit policies, making it accessible to a wide range of traders.

Impact on New Traders

For new traders, the minimum deposit requirement plays a crucial role in their decision-making process. A low minimum deposit allows beginners to experiment with live trading without risking large sums. This smaller initial investment reduces financial pressure, enabling traders to gain experience and build confidence. In contrast, higher deposit requirements may deter new traders from entering the market, as they require more upfront capital.

Exness’s low minimum deposit makes it an appealing choice for Nigerian traders who are just starting their trading journey. By offering an affordable entry point, Exness empowers beginners to learn and practice trading with minimal financial exposure.

Exness Minimum Deposit Requirements

General Minimum Deposit for Various Account Types

Exness offers several account types, each with unique features and minimum deposit requirements:

Standard Account: Designed for beginners, the Standard account has a low minimum deposit requirement, which can start as low as $1, depending on the region and payment method. This account type provides access to essential trading tools and supports both MT4 and MT5 platforms.

Pro Account: For experienced traders, the Pro account offers tighter spreads and more advanced trading features. The minimum deposit for this account type is generally higher than the Standard account, catering to traders looking for a more robust trading environment.

Raw Spread and Zero Accounts: These accounts are ideal for high-frequency traders and scalpers, offering spreads starting from 0.0 pips. The minimum deposit for these accounts is typically higher, allowing traders access to institutional-grade pricing.

Regional Variations in Deposit Requirements

While Exness maintains flexible minimum deposit requirements, the exact amount can vary by region and payment method. For Nigerian traders, the minimum deposit for a Standard account is generally around $1, depending on the chosen payment method. However, the minimum deposit may be higher for specific accounts or due to regional variations in banking practices.

Nigerian traders are encouraged to check the specific minimum deposit requirement for their account type and payment option to avoid unexpected fees or restrictions.

Payment Methods Available for Deposits in Nigeria

Bank Transfers

Bank transfers are a popular deposit method for Nigerian traders on Exness, providing a secure and direct way to fund accounts in local currency (Naira). Although bank transfers may take longer to process than other payment methods, they are convenient for traders who prefer traditional banking. Exness supports various local banks, making this method accessible and reliable.

E-wallets and Online Payment Systems

E-wallets, including Skrill, Neteller, and Perfect Money, are available for Nigerian traders who prefer faster transactions. These digital wallets allow for almost instant deposits, making them ideal for traders who want to start trading quickly. E-wallets often have lower fees and faster processing times compared to bank transfers, making them a favored option among Exness users.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Cryptocurrency Options

Exness also supports cryptocurrency deposits, which is an attractive option for traders who hold digital assets. Cryptocurrency deposits are typically processed quickly, though they may involve additional fees depending on blockchain network congestion. For traders comfortable with digital currencies, this method provides an efficient alternative for funding their accounts.

How to Make a Deposit with Exness

Step-by-Step Guide to Deposit Funds

Log in to Your Exness Account: Access your account on the Exness app or website.

Navigate to the Deposit Section: Click on ‘Deposit’ to view the available payment methods.

Select Your Payment Method: Choose the option that suits you best, such as bank transfer, e-wallet, or cryptocurrency.

Enter Deposit Amount: Specify the amount you wish to deposit, ensuring it meets the minimum requirement.

Confirm Payment: Follow the prompts to complete the transaction. Funds will typically be available within a few minutes to several business days, depending on the method chosen.

Common Issues and Troubleshooting Tips

Occasionally, traders may encounter issues during the deposit process, such as transaction delays or payment errors. Common troubleshooting tips include:

Double-checking Payment Details: Ensure that your payment details are correct to avoid delays.

Contacting Customer Support: If a deposit doesn’t appear in your account, reaching out to Exness support can help resolve the issue.

Reviewing Bank and Payment Provider Policies: Some banks may have restrictions on international transactions, so reviewing these policies beforehand can help prevent unexpected delays.

Benefits of the Low Minimum Deposit

Accessibility for Beginners

Exness’s low minimum deposit requirement makes it a highly accessible option for beginner traders in Nigeria. With an initial deposit as low as $1 (depending on the account type and payment method), new traders can enter the forex market without a large financial commitment. This accessibility allows beginners to experience live market conditions, test trading strategies, and gain practical knowledge without the stress of risking a substantial amount of money.

The low entry point also enables beginners to learn the basics of forex trading in a real environment. Many people are hesitant to invest a large sum right away, especially if they are new to trading, so the minimal deposit requirement on Exness is attractive for those who want to start small, gradually build confidence, and only increase their investment once they are comfortable with the platform and trading strategies.

Risk Management for New Traders

A low minimum deposit can also support better risk management for beginners, allowing them to engage in live trading with limited financial risk. With a smaller deposit, new traders can practice using stop-loss orders, leverage, and other risk management tools to protect their funds. This practice helps them build essential risk management skills, which are critical for long-term success in forex trading.

Starting with a low deposit helps beginners focus on improving their trading skills rather than worrying about potential losses from a larger investment. It reduces the financial impact of early mistakes, giving them room to learn and develop a disciplined approach to trading. As traders become more experienced and confident, they can increase their deposits and expand their trading activities.

Potential Drawbacks of a Low Minimum Deposit

Limited Features for Lower Deposit Accounts

While a low minimum deposit is beneficial for beginners, it may come with certain limitations on the Exness platform. Lower deposit accounts, such as the Standard account, might have higher spreads or lack some of the advanced features available on accounts that require a larger deposit, like the Pro or Raw Spread accounts. These higher-level accounts typically offer tighter spreads and lower trading costs, which can be advantageous for more experienced traders.

For beginners who start with a low deposit, these limitations are usually not a major concern, as they are primarily focused on learning the basics of trading. However, as traders gain experience, they may find that upgrading to an account with a higher minimum deposit offers additional benefits, such as better trading conditions and access to more advanced tools.

Psychological Factors in Trading

Starting with a low deposit can sometimes lead to a relaxed attitude toward risk, as beginners may feel they have less at stake. This mindset can encourage risky behaviors, such as overleveraging or overtrading, because the financial impact of losses may seem minimal. However, developing poor trading habits early on can have long-term consequences, as it undermines the discipline required for successful trading.

To avoid these psychological pitfalls, it’s essential for traders to treat even a small account seriously. Setting clear goals, following a trading plan, and sticking to risk management principles are critical habits to establish early in a trader’s journey, regardless of the account size.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Comparing Exness Minimum Deposit with Competitors

Overview of Other Trading Platforms in Nigeria

Several forex brokers operate in Nigeria, each offering different minimum deposit requirements, trading conditions, and platform features. Popular brokers like FXTM, OctaFX, and HotForex also cater to Nigerian traders, often with low minimum deposit options to attract beginners. However, these brokers vary in their fee structures, leverage options, and range of available trading tools, which can influence a trader’s choice.

For instance, while FXTM also offers a low minimum deposit, it may have different spreads or account options compared to Exness. Similarly, OctaFX provides competitive trading conditions but may not offer the same level of customer support or flexibility in payment methods. Comparing Exness’s minimum deposit with these competitors helps traders determine where they can get the most value based on their specific needs and trading preferences.

Advantages of Choosing Exness

Exness stands out among competitors for its combination of low minimum deposit requirements, transparent fee structure, and reliable customer support. The platform’s flexibility, allowing traders to start with as little as $1, makes it an appealing choice for those new to forex trading. Additionally, Exness provides a wide variety of payment methods, including local bank transfers, e-wallets, and cryptocurrencies, making it convenient for Nigerian traders to deposit and withdraw funds.

Another advantage of Exness is its regulatory compliance and strong security measures, which add to the broker’s credibility and trustworthiness. By choosing Exness, Nigerian traders benefit from a broker that is not only accessible but also reliable and secure, with features designed to support traders at all experience levels.

Customer Support and Assistance for Depositing

Contacting Exness Support

Exness offers 24/7 customer support to assist traders with any questions or issues related to deposits. Traders in Nigeria can contact Exness’s support team through various channels, including live chat, email, and phone. Live chat is especially useful for immediate assistance, providing traders with real-time help to resolve any deposit-related inquiries. Exness’s support team is known for its responsiveness, ensuring that traders receive prompt and effective assistance.

If traders experience any difficulties, such as delayed deposits or payment verification issues, contacting Exness’s support team can help resolve the situation quickly. The availability of dedicated support makes the deposit process smoother and provides reassurance for new traders who may be unfamiliar with online trading.

Resources and FAQs for Deposit Queries

Exness’s website includes a detailed FAQ section that addresses common questions related to deposits, payment methods, and processing times. These resources offer valuable insights for new users, helping them understand the deposit process and find answers to frequently asked questions without needing to contact support. The FAQ section also includes troubleshooting tips for common issues, such as payment processing delays or verification requirements.

Using these resources can save time for traders by providing quick answers to basic questions and guiding them through the deposit process. For beginners, the FAQ section serves as a helpful resource, allowing them to familiarize themselves with Exness’s deposit policies and make informed decisions.

Best Practices for Managing Your Deposit

Setting a Trading Budget

Managing funds effectively is essential for success in forex trading. One of the best practices for beginners is to set a trading budget based on their financial goals, risk tolerance, and experience level. Establishing a budget ensures that traders only invest money they can afford to lose and helps prevent impulsive or emotional trading decisions.

For Nigerian traders using Exness’s low minimum deposit, it’s important to treat the initial deposit as a part of a larger trading budget. Traders should avoid depositing more than they are comfortable risking and regularly review their budget to stay on track. This disciplined approach helps build a foundation for responsible trading and reduces the risk of financial loss.

Monitoring Account Performance

Monitoring account performance is crucial for evaluating the effectiveness of trading strategies and making necessary adjustments. By regularly reviewing trade history, profit and loss, and account balance, traders can assess their progress and identify areas for improvement. Exness provides various tools and reports to help traders track their performance, which can be especially valuable for beginners learning to analyze their trades.

Keeping a trading journal, noting each trade’s details and results, can also enhance performance tracking. By analyzing past trades and identifying patterns, traders can improve their strategies and make more informed decisions in the future. Monitoring performance is a key habit for growth, helping traders develop consistency and discipline in their trading.

Conclusion

Exness’s low minimum deposit requirement makes it an appealing choice for beginner traders in Nigeria who want to start trading forex with minimal financial risk. The flexibility of starting with a small deposit allows beginners to gain practical experience, develop trading skills, and understand market dynamics without a significant initial investment. Exness’s accessibility, combined with its range of payment methods, regulatory compliance, and customer support, provides a reliable foundation for new traders.

While there are potential drawbacks to starting with a low deposit, such as limited features and psychological challenges, the benefits of learning and practicing with a small investment outweigh these concerns for most beginners. Exness’s support for low deposits, coupled with its educational resources and tools, empowers Nigerian traders to enter the forex market confidently and responsibly.

As traders become more experienced, they may consider increasing their deposits to access advanced account features and enhance their trading potential. Overall, Exness provides an ideal platform for Nigerian traders who are new to forex, offering them a secure, accessible, and supportive environment to begin their trading journey.

Read more:

Is forex trading safe in India?