14 minute read

Is Exness Trust broker in India? Review Broker

from Exness

by Exness_Blog

Introduction to Exness

Overview of Exness as a Brokerage Firm

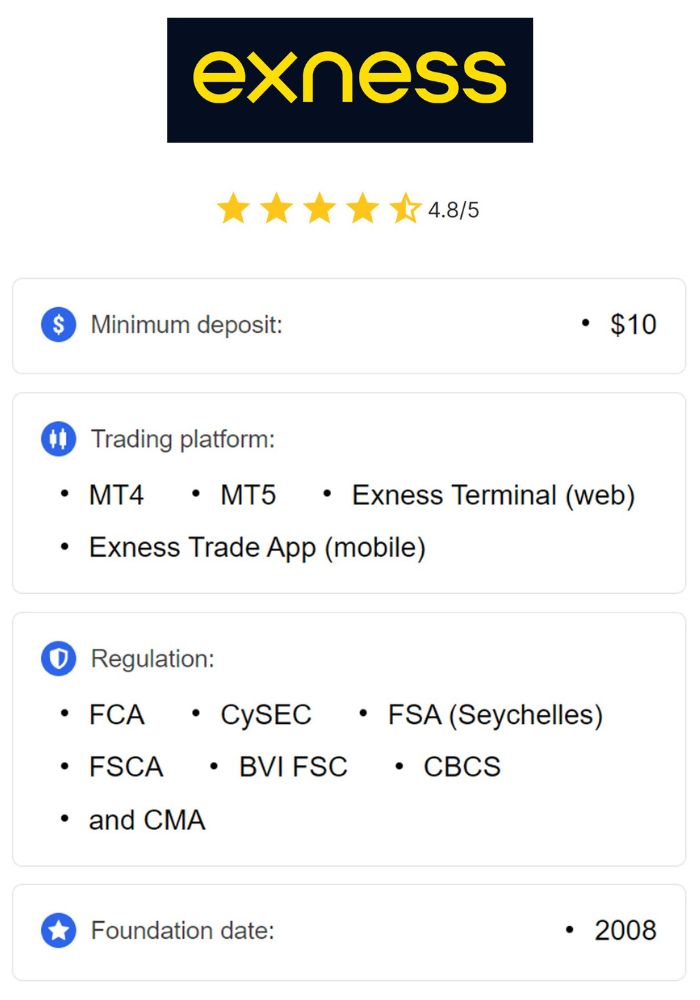

Exness is a globally recognized forex and CFD brokerage known for its transparency, advanced trading technology, and commitment to customer service. Established in 2008, Exness provides access to a wide range of financial instruments, including forex, commodities, cryptocurrencies, indices, and stocks. With a reputation for low fees, tight spreads, and efficient customer support, Exness has become a popular choice for traders in India and worldwide. The brokerage supports trading on two of the industry’s most popular platforms—MetaTrader 4 (MT4) and MetaTrader 5 (MT5)—offering advanced charting tools, technical indicators, and automated trading features.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Exness is structured to accommodate all levels of traders, from beginners to professionals, with flexible account types and various tools designed to meet the diverse needs of its client base.

History and Establishment of Exness

Founded in Cyprus in 2008, Exness quickly expanded its operations and established itself in multiple countries, earning a reputation as a trusted broker. Exness has grown consistently, gaining a foothold in regions including Europe, Asia, and Africa. Its growth can be attributed to its focus on transparency, high regulatory standards, and its dedication to providing traders with competitive trading conditions. Today, Exness serves millions of clients and is regulated by several international authorities, positioning itself as a reliable choice for traders looking for global market access.

Regulatory Framework for Brokers in India

Importance of Regulation in Forex Trading

Regulation is a fundamental component of trust in the forex market. A regulated broker is required to follow specific guidelines to ensure fair trading, transparency, and the protection of client funds. In India, the forex market is regulated by several authorities to ensure that investors are safeguarded from fraud and malpractice. For Indian traders, choosing a regulated broker offers peace of mind and confidence that their broker operates ethically and in compliance with international standards.

Regulatory oversight also enforces important protections, such as client fund segregation, regular audits, and dispute resolution mechanisms. As a result, traders can operate with an additional layer of security, knowing that their broker is accountable to financial authorities.

Key Regulatory Bodies in India

In India, forex trading is regulated by entities like the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). While SEBI does not directly regulate foreign brokers, it oversees local brokerage operations to ensure compliance with Indian laws, particularly in relation to currency trading. RBI regulates the legality of forex trading and enforces restrictions, allowing forex trading only in pairs that involve the Indian Rupee (INR).

As Exness is an international broker, it does not fall under SEBI’s regulation directly but operates legally in India under global regulatory licenses. Indian traders should be aware of these regulations and choose brokers that comply with reputable international authorities to ensure a secure trading environment.

Exness Regulation Status

Licensing and Registration of Exness

Exness is licensed and registered under several prominent global regulatory bodies, ensuring a secure trading environment. These licenses include:

Financial Conduct Authority (FCA) in the UK: The FCA is known for its strict requirements, including segregating client funds and conducting regular audits.

Cyprus Securities and Exchange Commission (CySEC): As an EU-based regulator, CySEC enforces high standards for transparency, client fund protection, and operational security.

Financial Sector Conduct Authority (FSCA) in South Africa: The FSCA provides oversight, particularly in emerging markets, ensuring that brokers adhere to ethical trading practices.

These licenses underscore Exness’s commitment to maintaining regulatory compliance and offering a transparent, reliable trading experience for its clients worldwide, including those in India.

Global Regulation of Exness

Exness’s regulatory framework is built on adherence to high standards of compliance enforced by international bodies. Each regulatory body has specific requirements, such as client fund segregation, transparency in fees, and adherence to anti-money laundering (AML) protocols. Exness’s global regulation ensures that Indian traders can enjoy a safe trading experience backed by international standards, even though it is not directly regulated by Indian authorities.

Trustworthiness of Exness in India

Customer Reviews and Feedback

Customer feedback is a valuable indicator of a broker’s trustworthiness. Exness has received positive reviews from Indian traders who appreciate its user-friendly platforms, competitive spreads, and responsive customer support. Many traders highlight Exness’s low-cost structure, fast execution times, and transparent pricing as key reasons for choosing the broker. The availability of educational resources and demo accounts has also contributed to its popularity among new traders in India.

Negative feedback is minimal, though some traders express a preference for brokers that are regulated locally by SEBI. Overall, Exness’s reputation among Indian traders is strong, with most clients expressing satisfaction with the trading conditions and security measures provided.

Analysis of Exness’s Reputation in the Market

Exness has established a solid reputation in the global forex market, known for its regulatory compliance, low fees, and advanced trading tools. Compared to other brokers, Exness is highly regarded for its transparency and reliability, making it a preferred choice for Indian traders seeking a trusted platform for forex trading. Exness’s reputation is further strengthened by its strict adherence to international regulatory standards and its focus on client protection, setting it apart as a reputable and reliable broker in the industry.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Trading Conditions Offered by Exness

Types of Accounts Available

Exness offers several account types designed to cater to traders of all experience levels:

Standard Account: Ideal for beginners, this account type offers competitive spreads, no commission, and access to most of Exness’s trading features.

Raw Spread Account: This account offers low spreads starting from 0.0 pips, with a small commission on each trade, suitable for traders who prefer tight spreads.

Zero Account: The Zero Account provides spreads starting from 0.0 pips on key currency pairs with a transparent commission structure.

Pro Account: Designed for experienced traders, the Pro Account offers fast execution, low spreads, and flexible leverage options.

These account types allow Indian traders to choose the one that best suits their trading goals and experience level, providing flexibility and transparency in trading costs.

Spreads, Leverage, and Commissions

Exness is known for its competitive spreads, which start as low as 0.0 pips on certain accounts. The broker also provides flexible leverage options, allowing traders to adjust their risk exposure according to their strategy. Leverage can amplify both profits and losses, so Exness’s flexible approach enables traders to choose levels that align with their risk tolerance.

Additionally, Exness maintains a transparent commission structure, especially on accounts like the Raw Spread and Zero accounts, where small commissions apply. This transparent pricing helps traders make informed decisions and manage costs effectively.

Safety of Funds with Exness

Segregation of Client Funds

Exness follows strict protocols for client fund security, including segregating client funds from the company’s operational funds. This segregation ensures that client assets are protected in case of unforeseen financial difficulties faced by the broker. The funds are held in reputable banks, providing an added layer of security and instilling confidence among traders.

Insurance and Investor Protection Policies

While Exness is not directly regulated by SEBI, its adherence to international regulatory standards includes investor protection policies enforced by FCA and CySEC. In some regions, Exness is part of compensation schemes that protect client funds up to a certain limit, ensuring that traders have recourse in case of broker insolvency. These policies underscore Exness’s commitment to client protection and add to its trustworthiness in the Indian market.

Payment Methods Supported by Exness

Deposit and Withdrawal Options

Exness provides Indian traders with a variety of deposit and withdrawal methods, including:

Bank Transfers: Local and international bank transfer options are available for funding accounts in PKR or other currencies.

Credit/Debit Cards: Visa and Mastercard deposits are typically instant, allowing for quick account funding.

E-wallets: Popular e-wallets like Skrill and Neteller are available, offering fast transactions for both deposits and withdrawals.

Cryptocurrency: Exness supports cryptocurrency deposits, offering an additional payment option for those comfortable with digital assets.

These flexible payment methods make it convenient for Indian traders to manage their funds on Exness, while ensuring quick processing times.

Transaction Fees and Processing Times

Exness is known for its minimal transaction fees, with many deposit and withdrawal methods offered at no extra charge. Processing times are generally quick, with instant processing available for most methods. However, Indian traders should review any potential fees associated with currency conversion or bank transfers to ensure transparency in costs.

Customer Support Services

Availability of Customer Support

Exness prides itself on providing round-the-clock customer support, which is especially valuable for traders in India who may need assistance at any time. With support available 24/7, Exness ensures that clients can reach out whenever they encounter issues, whether it’s related to account setup, deposits, withdrawals, or trading platforms. This accessibility demonstrates Exness’s commitment to client satisfaction, allowing traders to address their concerns promptly without disrupting their trading activities.

The Exness support team can be reached through various channels, including live chat, email, and phone. The live chat feature, in particular, is popular among traders for its convenience and speed, allowing immediate assistance with trading inquiries or technical issues.

Languages Offered for Support

To cater to its diverse clientele, Exness provides multilingual support, including support in English and Hindi, which is beneficial for traders in India who prefer assistance in their native language. This linguistic accessibility makes it easier for Indian clients to communicate their needs, ensuring that language barriers do not prevent them from accessing support. Exness’s ability to cater to different languages is a key factor in establishing trust with Indian traders, as it shows dedication to meeting the needs of clients from various backgrounds.

Having support in multiple languages enhances the user experience and contributes to Exness’s reputation as a globally accessible broker. By providing language options, Exness helps traders feel more comfortable and understood, fostering a positive relationship between the broker and its clients.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Trading Platforms Provided by Exness

Overview of Trading Platforms

Exness offers access to two of the most popular and powerful trading platforms in the forex industry: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are well-regarded for their comprehensive charting tools, advanced technical analysis capabilities, and compatibility with automated trading systems. The availability of these platforms allows Exness to cater to a wide range of traders, from beginners to professionals, who rely on these industry-standard tools for their trading activities.

Both MT4 and MT5 are available in desktop, web, and mobile versions, providing flexibility and convenience for traders. The web and mobile versions ensure that traders can monitor their accounts and execute trades from anywhere, making it easy to stay connected to the markets on the go.

Features and Tools Available

MT4 and MT5 offer various features and tools that enhance the trading experience:

Technical Indicators and Charting Tools: Both platforms come with a suite of built-in technical indicators, trend lines, and charting tools to help traders analyze market conditions and identify trading opportunities.

Automated Trading: Exness supports automated trading on both MT4 and MT5 through the use of Expert Advisors (EAs), allowing traders to execute strategies without manual intervention.

Timeframes and Order Types: MT4 and MT5 provide multiple timeframes and order types, offering flexibility in analyzing data and executing trades based on diverse strategies.

Market Depth: MT5 includes an additional feature known as Market Depth, which provides insights into market liquidity and order flow, making it ideal for professional traders who require more granular market data.

These tools and features empower traders with everything they need for technical and fundamental analysis, risk management, and strategic execution, making Exness a versatile choice for Indian traders seeking a powerful trading environment.

Educational Resources and Tools

Training Programs for Traders

Exness is committed to educating its clients, offering a range of training programs to help traders build their skills and knowledge of the forex market. Exness provides educational resources such as video tutorials, webinars, and comprehensive guides on trading basics, technical analysis, and risk management. These resources are particularly valuable for beginner traders in India, as they offer a structured approach to learning about forex trading and building the necessary skills to trade effectively.

Live webinars hosted by experienced analysts allow traders to learn in real-time, ask questions, and gain insights into market trends. Exness’s educational offerings help create a supportive environment, allowing traders to continue their development and improve their trading strategies.

Market Analysis and Research Tools

In addition to training resources, Exness provides market analysis and research tools to keep traders informed about market trends and economic events. These tools include daily market news, economic calendars, and expert insights that help traders make informed decisions. The economic calendar, for example, allows traders to track important events like interest rate announcements and employment reports, which can significantly impact currency prices.

Exness’s research tools are designed to empower traders with up-to-date information and expert analysis, helping them stay informed and make better trading decisions. Access to reliable analysis tools is a crucial aspect of successful trading, and Exness ensures that its clients have the resources they need to navigate the forex market with confidence.

Comparing Exness with Other Brokers in India

Differences Between Exness and Local Brokers

While Exness is an international broker regulated by prominent authorities like FCA, CySEC, and FSCA, many Indian traders may consider local brokers who operate under SEBI’s regulations. Local brokers can offer INR-based currency pairs, which is a requirement for SEBI-regulated brokers. Exness, however, does not offer INR pairs, as it primarily serves traders interested in accessing international forex markets with global currencies and financial instruments.

Another key difference is that Exness provides access to a broader range of trading platforms and account types, appealing to traders who want flexibility in trading options and leverage. While SEBI-regulated brokers focus on INR-based pairs, Exness’s international regulatory framework enables Indian traders to explore a wider array of forex pairs, commodities, and cryptocurrencies.

Competitive Advantages of Exness

Exness has several competitive advantages that make it a preferred choice for Indian traders. Some of the main benefits include:

Low Spreads and Flexible Leverage: Exness is known for its tight spreads and flexible leverage options, allowing traders to maximize profitability while managing risk.

Advanced Trading Platforms: Exness offers both MT4 and MT5, with access to automated trading, advanced charting, and a wide range of indicators.

Global Regulation: Although Exness is not regulated by SEBI, it complies with international regulatory standards, providing security and transparency for Indian traders.

24/7 Customer Support: Exness offers around-the-clock customer support, allowing Indian traders to access assistance whenever needed.

These advantages make Exness an attractive option for traders in India who are looking for a reliable, internationally regulated broker with a diverse range of features.

Common Concerns About Exness

Addressing Misconceptions about Exness

Like any popular broker, Exness may be subject to misconceptions and myths. One common misconception is that Exness’s lack of SEBI regulation makes it unsafe for Indian traders. However, Exness’s regulatory compliance with the FCA, CySEC, and FSCA provides a strong level of security for Indian traders, ensuring that their funds are protected and that they have access to fair trading practices.

Another misconception is that Exness may have high fees. In reality, Exness is known for its competitive fee structure, with low spreads and minimal transaction costs, making it affordable for both new and experienced traders.

Evaluating Risks Associated with Trading on Exness

As with any trading platform, there are risks associated with trading on Exness, primarily due to the volatile nature of the forex market. While Exness itself is a secure and trustworthy broker, traders must be aware of the risks of leverage and market volatility. Using high leverage without proper risk management can lead to substantial losses, which is why it is essential for traders to implement stop-loss orders and other risk management tools.

Exness provides the necessary tools and support to help traders manage these risks, but it is ultimately up to each trader to make informed decisions and practice responsible trading.

Conclusion

In conclusion, Exness is a trustworthy and reputable broker for traders in India, offering a secure and regulated environment backed by respected international regulatory bodies like FCA, CySEC, and FSCA. While Exness is not SEBI-regulated, it provides Indian traders with access to global financial markets, competitive spreads, low fees, and advanced trading tools, making it a viable option for those looking to trade forex, commodities, and cryptocurrencies.

The broker’s commitment to customer support, educational resources, and innovative platforms further strengthens its appeal in the Indian market. By choosing Exness, Indian traders gain access to a globally recognized brokerage that prioritizes transparency, client security, and a positive trading experience.

For Indian traders seeking to explore international markets responsibly, Exness presents a compelling choice, combining regulatory compliance, reliable customer support, and a wide range of trading options to ensure a seamless and trusted trading experience.

Read more: 10 legal forex trading apps in India