12 minute read

Is Exness SEBI registered? Review Broker

from Exness

by Exness_Blog

When it comes to choosing a forex broker, one question that often arises among traders is: Is Exness SEBI registered? Understanding the regulatory framework within which a broker operates is crucial for ensuring the safety of your investment and the legitimacy of trading practices. In this article, we will explore Exness in-depth, its regulatory status, and what it means for Indian traders who wish to engage with this broker.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Exness

Exness has carved out a prominent space in the global online trading arena since its inception. Known primarily as a Forex broker, it also facilitates Contracts for Difference (CFDs) trading. This platform has gained traction due to its user-friendly interface, competitive spreads, and rapid execution speeds. Traders can access an extensive array of instruments ranging from major and minor currency pairs to energies, indices, and precious metals. The focus on providing a transparent and reliable trading environment reflects Exness’s commitment to client satisfaction.

Overview of Exness as a Forex Broker

The landscape of Forex trading has evolved over the years, and Exness has played a pivotal role in this transformation. With a range of services designed for both novice and seasoned traders, Exness presents itself as a versatile broker.

Investors are not only attracted by the competitive pricing but also by the broker's reputation for transparency. Various educational resources and tools offered by Exness empower traders to make informed decisions, thus enhancing their overall trading experience.

What sets Exness apart from other brokers is its emphasis on customer service and support. Recognizing that the world of trading can be daunting, Exness provides clients with tools and resources that help demystify trading strategies. This focus on education promotes responsible trading practices, further solidifying Exness’s standing as a trusted broker in the Forex market.

History and Background of Exness

Founded in 2008, Exness began its journey as a small brokerage firm operating in the Russian Federation. A mere decade after its launch, it has positioned itself as a global player in the financial markets.

A significant factor contributing to Exness’s rapid ascent is its dedication to technological innovation. Continuous upgrades to its online platform have allowed it to stay ahead of the curve, effectively catering to the needs of modern traders.

Over the years, Exness has opened offices in various locations around the world, cementing its international presence. Its ability to adapt to changing market conditions and regulations has been instrumental in attracting millions of traders globally, thereby establishing a reputation grounded in reliability and innovation.

Understanding SEBI

In the context of trading in India, understanding the Securities and Exchange Board of India (SEBI) is essential. Established in 1988, SEBI serves as the primary regulatory authority overseeing the securities market in India.

As a trader, knowing about SEBI’s roles, functions, and the importance of its registration for brokers can significantly influence your decision-making process when selecting a trading platform.

What is SEBI?

The Securities and Exchange Board of India (SEBI) is tasked with safeguarding the interests of investors in the Indian securities market. Its establishment marked a significant stride toward fostering investor confidence and ensuring systematic growth in the financial sector.

SEBI operates under a comprehensive regulatory framework aimed at promoting fair trading practices and protecting investors from fraudulent activities. The organization is committed to creating a balanced and transparent investment environment, facilitating ease of access for both institutional and retail investors.

In recent years, SEBI has expanded its purview to include various segments of the financial market, such as stock exchanges, mutual funds, and derivatives, further emphasizing its importance as a regulatory body.

Role and Functions of SEBI

SEBI plays a multifaceted role in maintaining the integrity of the Indian financial market. Some of its key functions include:

Protecting Investors’ Interests: SEBI actively works to ensure that the interests of investors are prioritized throughout all transactions in the securities market. By enforcing strict regulations, it aims to prevent fraudulent practices and promote transparency.

Promoting Market Development: Beyond just regulation, SEBI endeavors to cultivate a thriving and efficient securities market. It focuses on nurturing an environment conducive to investments, which ultimately drives economic growth.

Regulation and Compliance: SEBI exerts control over various market participants, setting standards for intermediaries and ensuring compliance with established regulations. This oversight helps maintain the integrity of the market.

Intermediary Regulation: SEBI guarantees that all entities involved in the securities market adhere to stringent regulatory standards, preserving the market's integrity and stability.

Importance of SEBI Registration for Brokers

For any broker operating within India, obtaining SEBI registration is paramount. It serves as a mark of credibility and trustworthiness, assuring potential clients that the broker adheres to high standards of practice.

The registration process involves thorough scrutiny of the broker's operations, ensuring they meet specific criteria and comply with SEBI's regulatory framework. Such rigorous oversight fosters greater confidence among traders, providing them reassurance that their chosen broker operates within legal parameters.

Moreover, SEBI registration ensures that client funds are managed in accordance with strict guidelines, enhancing the safety and security of the trading environment.

The Regulatory Landscape in India

India's financial regulatory framework has undergone considerable evolution since its independence. The establishment of various regulatory bodies has been crucial in maintaining financial stability and promoting investor protection.

A well-defined regulatory landscape is vital not only for fostering growth but also for instilling confidence among traders and investors alike.

Financial Regulation in India

The financial environment in India is characterized by a robust regulatory framework aimed at safeguarding economic stability and protecting investors. Over the years, the country has developed a comprehensive set of regulations designed to bolster market efficiency and transparency.

Key aspects of this framework include stringent adherence to compliance measures, oversight mechanisms, and ethical standards across various segments of the financial sector.

The evolution of financial regulation in India has also been shaped by global trends, prompting authorities to adapt and enhance their regulatory approaches. By doing so, regulators aim to create a stable environment conducive to long-term economic growth.

Key Regulatory Bodies in the Indian Financial Market

In addition to SEBI, several other regulatory bodies play a key role in overseeing different segments of the Indian financial market.

The Reserve Bank of India (RBI) serves as the central bank, responsible for monetary policy formulation and regulation of the banking sector. The Insurance Regulatory and Development Authority of India (IRDAI) oversees the insurance industry, while the Pension Fund Regulatory and Development Authority of India (PFRDA) manages pension funds, ensuring stability and growth in these sectors.

These organizations work collaboratively to create a cohesive regulatory framework that fosters investor confidence, encourages economic growth, and maintains market integrity.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Impact of Regulations on Forex Trading

The impact of regulations on Forex trading in India has been significant and continues to evolve. Historically, the RBI maintained jurisdiction over foreign exchange markets, primarily governing cross-border transactions.

Recently, SEBI's involvement has expanded to encompass specific elements of Forex trading, particularly focusing on derivative instruments associated with the securities market. This shift highlights the increasing importance of regulatory oversight in managing the complexities of Forex trading.

As regulations develop, they strive to strike a balance between fostering market growth and protecting investors from risks, ensuring a safer trading environment.

Exness and Global Regulations

Exness operates within a complex web of global regulations, highlighting its commitment to providing a secure trading environment for its clientele.

Understanding how Exness navigates these regulatory landscapes will provide insights into its operational integrity and the protections it offers to traders.

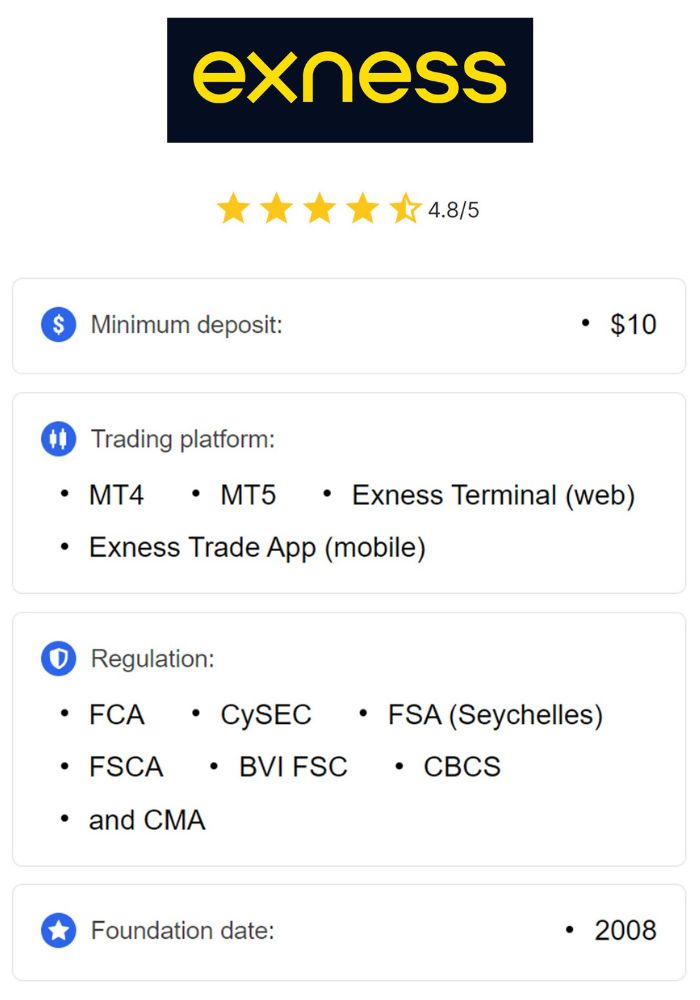

Overview of Exness' Regulatory Status Worldwide

Exness is regulated by multiple authoritative bodies across various jurisdictions, emphasizing its global commitment to compliance. Key regulators include:

CySEC (Cyprus Securities and Exchange Commission): Regulating Exness’s operations within the European Economic Area (EEA), CySEC ensures that the broker meets high standards of conduct, enhancing investor protection.

FSC (Financial Services Commission) of Mauritius: This license allows Exness to operate in compliance with Mauritian regulations, enabling them to serve clients effectively in that jurisdiction.

FCA (Financial Conduct Authority) of the United Kingdom: Holding an FCA registration number allows Exness to offer services to UK clients while adhering to strict regulatory requirements.

These licenses collectively illustrate Exness’s dedication to maintaining a compliant and secure trading environment, reassuring clients around the world.

Comparison with Other Regulatory Agencies

While Exness enjoys a robust regulatory framework through bodies like CySEC, FSC, and FCA, it lacks registration with SEBI in India. This distinction shines a light on differing regulatory approaches and expectations across countries.

Each regulatory agency has its unique mandate, standards, and compliance requirements. The absence of SEBI registration signifies that Exness is not bound by the same stringent regulations applicable to Indian brokers, potentially raising concerns among local traders.

Ultimately, the choice of a broker should consider the regulatory environment in which it operates, aligning with the trader's comfort level regarding risk and security.

The Importance of Regulated Brokers

Choosing a regulated broker is critical for traders seeking a safe and reliable trading environment. Regulation provides important layers of protection by ensuring that brokers adhere to ethical practices and comply with established standards.

Some benefits of engaging with regulated brokers include:

Financial Security: Regulated brokers must maintain client funds in segregated accounts, reducing the risk of losing funds due to insolvency or mismanagement.

Enhanced Transparency: Regulatory bodies impose standards for fair trading practices and transparency, ensuring that brokers disclose relevant information and behave ethically.

Dispute Resolution Mechanisms: If conflicts arise between clients and regulated brokers, traders have access to structured dispute resolution channels through regulatory bodies.

Investor Confidence: Operating under reputable regulatory frameworks fosters trust among traders, encouraging broader participation in the financial markets.

Is Exness SEBI Registered?

Now, let’s address the pressing question that many Indian traders have: Is Exness SEBI registered?

Current Regulatory Status of Exness in India

To clarify, Exness is not currently registered with SEBI in India. This lack of registration signifies that Exness has not received official authorization to operate as a forex broker or offer securities-related services within the Indian market regulated by SEBI.

The absence of SEBI registration raises questions about the regulatory protections available to Indian traders utilizing Exness's services. Without the rigorous oversight provided by SEBI, traders may be exposed to greater risks.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Reasons Behind Exness Not Being SEBI Registered

The reasons for Exness's lack of SEBI registration can be multifaceted:

Limited Scope of SEBI's Jurisdiction: SEBI's regulatory powers may not extend to all aspects of Forex trading, particularly involving transactions outside the Indian securities market.

Complexity of the Regulatory Process: Obtaining SEBI registration involves navigating a complex and lengthy procedure, requiring brokers to fulfill stringent compliance standards.

Business Decisions: Exness might have strategically chosen to concentrate on regulatory approvals and operations in other jurisdictions, where its business model aligns more closely with existing regulations.

Traders must consider these factors when evaluating the implications of using Exness as their broker.

Implications of Not Being SEBI Registered

Choosing to trade with a non-SEBI registered broker carries inherent risks for Indian investors. Understanding these potential pitfalls is essential for making informed trading decisions.

Risks Associated with Trading on Non-SEBI Registered Platforms

Trading with platforms that lack SEBI registration exposes investors to various risks, including:

Loss of Funds: Without the protective oversight offered by SEBI, clients face heightened risks of fund loss due to broker insolvency or fraudulent activity.

Lack of Redressal Mechanism: Disputes with non-SEBI registered brokers may lack adequate recourse, leaving traders without effective ways to seek resolution.

Non-compliance with Regulations: Brokers not registered with SEBI may not adhere to the investor protection standards outlined by the regulator, potentially compromising traders' rights.

Operational Risks: Non-SEBI registered brokers may not uphold the same standards of operational soundness and cybersecurity as regulated entities, exposing clients to additional operational risks.

What This Means for Indian Traders

For Indian traders considering Exness, the absence of SEBI registration implies increased risk levels. While Exness operates under licenses from other regulatory bodies, the lack of SEBI oversight indicates that there are no specific protections tailored for Indian traders.

Understanding these risks is crucial, as it empowers traders to make informed decisions when selecting a broker. Engaging with a non-SEBI registered platform could mean stepping into uncharted territory, where regulatory safeguards may be lacking.

Read more: What does raw spread mean in forex?

Alternatives for Indian Traders

For Indian traders looking for safer alternatives, several SEBI-registered brokers operate within the Indian market. These brokers offer the assurance of regulatory oversight and protection.

List of SEBI Registered Brokers in India

Some well-known SEBI-registered brokers include:

Zerodha

Upstox

Angel Broking

HDFC Securities

ICICI Direct

These brokers are subject to SEBI’s stringent regulatory measures, ensuring that they operate lawfully and uphold investor protection standards.

Benefits of Choosing a SEBI Registered Broker

Opting for a SEBI-registered broker brings several advantages:

Investor Protection: SEBI's regulatory framework guarantees that client funds are handled securely and transparently.

Compliance Assurance: SEBI-registered brokers are expected to comply with strict guidelines, providing traders with peace of mind.

Access to Dispute Resolution: Clients have access to a formal mechanism for resolving disputes, enhancing their rights as investors.

Market Integrity: Trading with SEBI-registered brokers upholds the integrity of the market, ensuring ethical trading practices.

Choosing a SEBI-registered broker helps mitigate risks and enhances the overall trading experience, particularly for Indian traders.

Conclusion

In conclusion, the question Is Exness SEBI registered? remains firmly answered with a no. While Exness operates under respected global regulatory agencies like CySEC, FSC, and FCA, the absence of SEBI registration poses challenges for Indian traders.

It is critical for traders to understand the implications of choosing a non-SEBI registered broker and the inherent risks involved. Exploring alternatives among SEBI-registered brokers can provide enhanced protection and peace of mind in the ever-evolving landscape of Forex trading.

As always, conducting thorough research and understanding the regulatory framework is essential for making informed trading decisions. By aligning their choices with credible and compliant brokers, traders can navigate the market more confidently and safely.