6 minute read

Beginner’s Guide to Using the Exness Trading App

The Exness trading app is a powerful tool designed for both beginner traders and experienced investors looking to participate in forex trading. This beginner's guide will help you understand how to navigate the app, manage your risk, and implement trading strategies to achieve profits in the forex market. Whether you are interested in day trading, social trading, or forex trading, Exness offers a range of account types that suit different trading styles. By using a demo account to practice, you can learn how to assess economic indicators, apply stop loss orders, and leverage the market without risking your capital. As a regulated broker under Cyprus Securities, Exness ensures that your investments are protected while offering access to the stock market, currencies, and other assets. With features like leverage, exchange commissions, and advanced market data, Exness supports traders in managing potential losses and navigating the high volatility of the financial markets.

What Is the Exness Trading App?

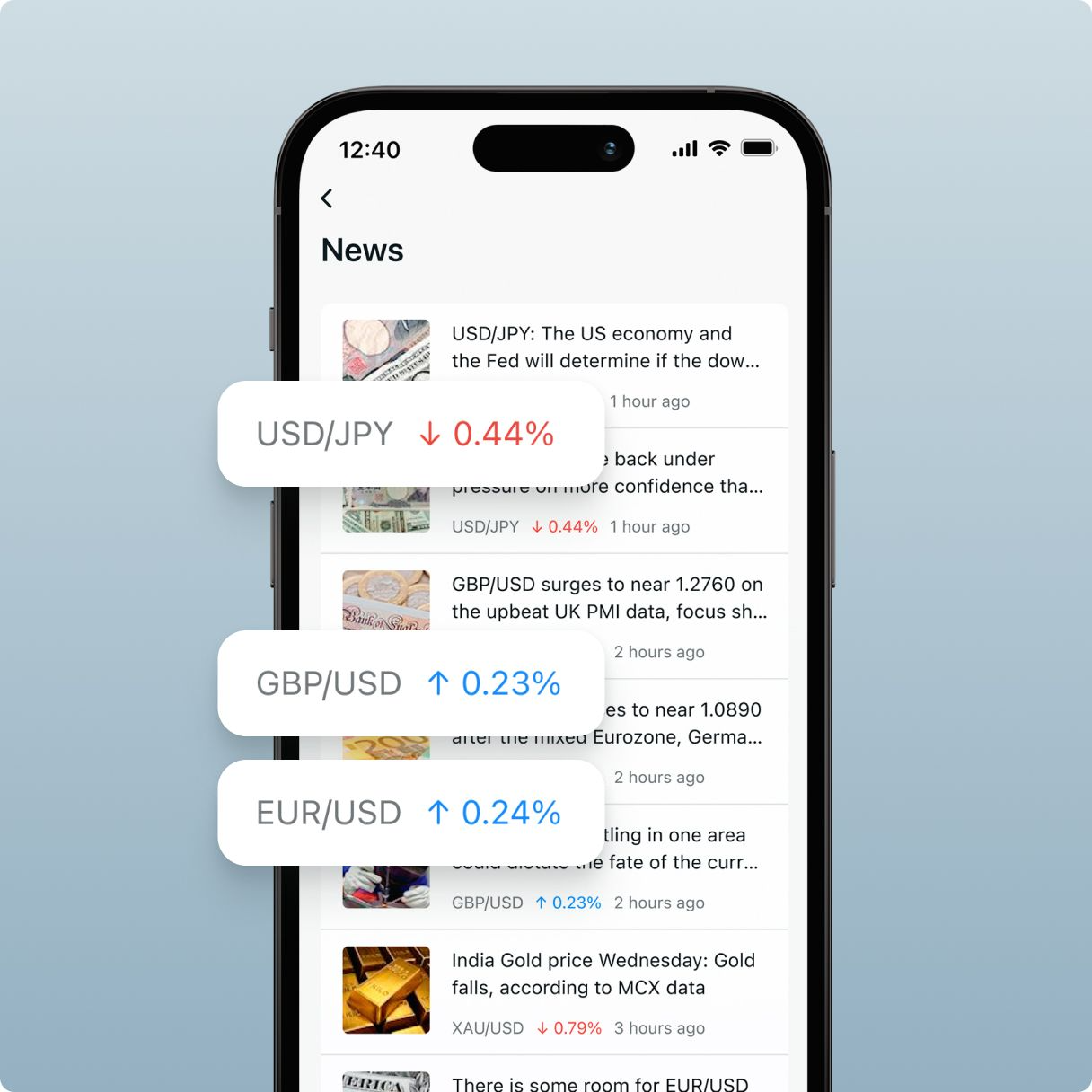

The Exness trading app is a mobile version of the Exness platform, designed to give traders access to the forex market, stocks, and other financial assets anytime, anywhere. Whether you're an experienced trader or a new trader, the app provides access to real-time market data, economic indicators, and powerful trading tools. It allows users to place orders, track positions, and manage their account type all from their mobile device.

Setting Up Your Exness Account

Before you can start trading, you need to open an Exness account. Here’s a simple process to get started:

Download the Exness Trading App. Go to the Exness website or your device’s app store to download the app. It is available for both Android and iOS devices.

Sign Up for an Exness Account. Create an account by entering your personal information, including your name, email, and phone number. You will also need to upload verification documents to comply with Cyprus Securities regulations.

Select an Account Type. Exness offers various account types such as Standard, Raw Spread, or Cent accounts. Choose the one that suits your trading style and budget.

Make Your First Deposit. Exness has low minimum deposit requirements to start trading. You can deposit funds using a variety of payment methods, including bank transfers, credit cards, and e-wallets.

Start Trading. Once your account is funded, you can start trading by selecting the currency pairs or other assets you wish to trade.

Start Trading: Open Exness Account or Visit Website

Understanding the Exness Trading App Interface

The Exness trading app provides a user-friendly interface, making it easy for beginners to get started. Here’s a breakdown of key features:

Dashboard: Displays your account balance, open trades, and profits or losses.

Trading Tools: Includes charting tools, economic indicators, and the option to place stop loss and take profit orders to manage risk.

Market Watch: Allows you to monitor the live prices of currencies, stocks, and other assets.

Order Placement: Place buy or sell orders, specify the price level, and set the leverage for your trade.

Understanding these features will help you get comfortable with the app and make informed decisions as you start trading.

Trading Strategies for Beginners

When you’re just starting with the Exness trading app, it’s essential to have a strategy in place. Here are some beginner tips:

Start with a Demo Account. Use the demo account to practice forex trading and familiarize yourself with the Exness platform without risking real money. This is an essential step for new traders.

Use Risk Management Tools. Set stop loss and take profit levels to manage risk effectively. These tools can help you limit your potential losses and secure your profits automatically.

Leverage Cautiously. While leverage can amplify your profits, it can also increase your risk. Use leverage cautiously, especially as a beginner. It’s recommended to start with lower leverage to avoid high volatility.

Follow Economic Indicators. Keep an eye on economic indicators like interest rates, inflation, and unemployment data. These market data points can give you insights into forex market trends and help you make informed trading decisions.

Develop Your Trading Style. Day trading, swing trading, or position trading—choose a style that suits your risk tolerance and time commitment. As you gain more experience, you’ll find which approach works best for you.

Managing Risk with Exness Trading App

Risk management is an essential part of successful trading. The Exness trading app provides several features that help manage your capital and reduce potential losses:

Stop Loss: A tool that automatically closes your position when the price moves against you by a specified amount, limiting your losses.

Take Profit: Automatically closes your position once the price hits a level where you’ve made a profit.

Leverage: While leverage can boost your profits, it also increases your exposure to risky trades. It’s important to adjust your leverage to match your trading style and experience level.

By using these tools, you can help minimize the inherent risks of forex trading and protect your funds while aiming for consistent profits.

Exness Social Trading: A Beginner-Friendly Feature

For new traders looking for additional support, Exness social trading is a great way to copy the strategies of successful traders. This feature allows you to select a strategy provider and automatically replicate their trades in your own account. By following seasoned traders, you can gain exposure to the forex market and learn trading strategies without having to make all the decisions yourself.

Understanding Trading Costs and Fees

It’s important to be aware of the fees and trading costs associated with your Exness account. Different account types have varying spreads and commission fees. For example:

Standard Accounts: Typically offer fixed spreads and no commissions, making them great for beginner traders.

Raw Spread Accounts: Offer lower spreads but charge a small commission per trade, making them suitable for skilled traders focused on tight spreads and high-frequency trading.

Make sure you understand the minimum deposit requirements and the spread associated with your account type to ensure you’re trading within your budget and risk tolerance.

Frequently Asked Questions (FAQ)

What is the Exness trading app?

The Exness trading app allows traders to access forex markets, manage their Exness account, and trade a variety of financial assets from their mobile devices.

How do I start trading on Exness?

After downloading the Exness app, create an Exness account, choose an account type, make a deposit, and start trading forex or other financial assets.

Can I practice trading with Exness?

Yes, Exness offers a demo account where you can practice trading with virtual funds and familiarize yourself with the platform before investing real money.

What is the minimum deposit for Exness accounts?

The minimum deposit varies depending on the account type you choose. Some accounts, like Cent accounts, have a very low minimum deposit requirement.

How do I manage risk with the Exness app?

Use risk management tools such as stop loss, take profit, and leverage settings to control your potential losses and protect your investments.