7 minute read

How to Run Backtesting on Exness Terminal?

Backtesting is an essential part of developing and refining a trading strategy. It allows traders to test their strategies using historical data to evaluate how well they would have performed in real market conditions. Exness Terminal, available on MetaTrader 4 (MT4) and MetaTrader 5 (MT5), offers an excellent platform for running backtests. In this guide, we will explain how to run backtesting on Exness Terminal, the key factors you need to consider, and the best practices to ensure successful trading.

What is Backtesting?

Backtesting involves testing a trading strategy using historical data to see how it would have performed in the past. It helps traders to:

Evaluate whether a trading strategy is effective.

Understand the potential profits or losses resulting from the strategy.

Adjust the strategy to optimize performance before applying it to live trading.

Backtesting is a crucial step in a trading journey because it allows traders to make data-driven decisions and verifythe effectiveness of their trading style.

Why Backtesting is Important

Before you start trading with real money, backtesting helps you:

Evaluate performance: By testing your strategy on historical data, you can determine its effectiveness over different periods and under various market conditions.

Manage risk: Backtesting shows you the potential losses and drawdowns your strategy might experience, helping you to make necessary adjustments.

Refine strategy: Based on statistics from backtesting, you can tweak your trading strategy to improve its potential for future success.

Remember, backtesting does not guarantee future results. It’s simply a tool to help you make more informed decisions based on past data.

How to Run Backtesting on Exness Terminal: Step-by-Step

Step 1: Install Exness Trading Terminal (MT4 or MT5)

Before you begin, ensure that you have downloaded and installed Exness MetaTrader 4 (MT4) or MetaTrader 5 (MT5). Both versions of Exness Terminal support backtesting.

For Windows: Download the Exness MT4 or MT5 from the Exness website.

For mobile devices: Download Exness’s mobile trading app for MT4 or MT5 on Google Play or Apple Store.

Step 2: Set Up Your Trading Account

Once the terminal is installed, log in using your Exness account. You can either use a demo account or a live trading account for backtesting.

Demo account: Ideal for practicing strategies without the risk of losing real money.

Live trading account: Use this account to test strategies in real-time market conditions with actual funds.

Make sure to select the account type that best fits your trading strategy. For example, a raw spread account is suitable for experienced traders seeking low spreads.

Step 3: Choose the Trading Strategy to Test

Next, select the strategy you want to backtest. You can either:

Use your own strategy: Based on technical analysis, fundamental analysis, or price action.

Automated trading: If you’re using Expert Advisors (EAs), you can backtest the EA strategy on historical data.

Choose the strategy that aligns with your risk management and trading objectives. Make sure the strategy is suitable for the financial instruments you plan to trade, such as forex, cryptocurrencies, or stocks.

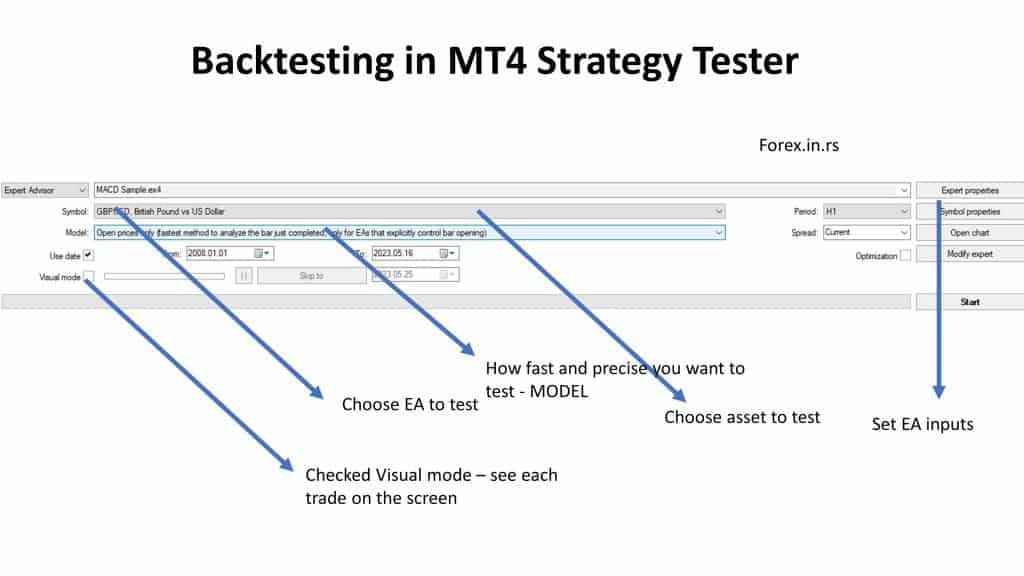

Step 4: Open the Strategy Tester

In MT4 or MT5, open the Strategy Tester by going to View > Strategy Tester.

For MT5: This tool is already built-in and allows you to test multiple strategies and complex instruments.

For MT4: The Strategy Tester is available for manual and automated trading strategies.

Once you have opened the Strategy Tester, configure the following settings:

Symbol: Choose the market or currency pair (e.g., EUR/USD) for your backtest.

Timeframe: Set the timeframe (M1, M5, H1, D1, etc.) for your test.

Period: Set the date range (e.g., one month, one year) for the historical data you want to backtest.

Start Trading: Open Exness Account or Visit Website

Step 5: Adjust the Parameters

Before running the backtest, you need to adjust the parameters. This includes:

Lot size: The volume of each trade. Select the lot size based on your account balance.

Stop loss and take profit: Set these risk management tools to ensure your backtest results align with your trading strategy.

Leverage: Adjust leverage according to your risk tolerance.

Make sure to enter realistic values that reflect your trading style and risk management approach.

Step 6: Run the Backtest

Once all parameters are set, click the Start button to begin the backtest. MT4 or MT5 will simulate trades based on the selected historical data. The backtest will show you the results in the Report and Graph tabs.

Report: Shows detailed information such as net profit, drawdown, and win rate.

Graph: Displays the equity curve, illustrating your account performance over time.

Step 7: Analyze the Results

After the backtest is completed, carefully analyze the results to determine the effectiveness of your trading strategy.

Profitability: Review the net profit and profit factor to understand the success of your strategy.

Drawdown: Examine the drawdown to assess the risk of losing money in volatile market conditions.

Win Rate: Check the number of winning trades versus losing trades.

Trade Execution: Look at the trade execution times and any slippage that may have occurred during the test.

Step 8: Make Adjustments

Based on your analysis, you may need to adjust your strategy. Common adjustments include:

Modifying entry points or exit points.

Changing your risk management settings (e.g., stop loss and take profit).

Trying different timeframes to see how the strategy performs in various market conditions.

Step 9: Verify the Results

It’s essential to verify that your backtest results are reliable. Run the backtest multiple times using different historical data periods. This will help you understand how the strategy performs in different market conditions and ensure its consistency.

Common Backtesting Errors to Avoid

While backtesting, there are several common errors traders should watch out for:

Overfitting: Optimizing a strategy too much to fit historical data, which can lead to poor future performance.

Ignoring Market Conditions: Backtest results may not reflect future market conditions, which can differ greatly from historical data.

Not Considering Slippage: Failing to account for slippage (when the trade is executed at a different price than expected) can skew results.

Start Trading: Open Exness Account or Visit Website

Best Practices for Backtesting

Use Realistic Assumptions: Always simulate real trading conditions by including slippage, spread, and execution delays.

Test Across Multiple Timeframes: A strategy that works on one timeframe may not work on another, so test across several timeframes.

Run Multiple Tests: Conduct multiple backtests over different periods to confirm the reliability of your strategy.

Conclusion

Backtesting on Exness Terminal is a powerful tool for refining your trading strategy. By following this step-by-step guide, you can test your strategies using historical data, manage your risk, and improve your chances of successful trading. Remember, while backtesting provides valuable insights, it’s important to adjust your strategy based on future market conditions and continue to monitor your performance in live trading environments.

FAQ

What is the minimum deposit required to start backtesting?

There is no minimum deposit required for backtesting on a demo account. However, if using a live account, your deposit depends on the account type (e.g., Standard Cent Account).

Can I backtest on Exness MetaTrader 5?

Yes, Exness MT5 allows you to backtest trading strategies using historical data, just like MT4.

Does backtesting guarantee future success?

No, backtesting does not guarantee future results. It’s simply a tool to help evaluate performance based on past data. Market conditions can change rapidly.

How do I know if my backtest results are reliable?

To verify your backtest results, run tests across different time periods and adjust your strategy as needed.

Can I backtest using custom indicators?

Yes, you can backtest custom indicators if you have them programmed into your MetaTrader platform.