9 minute read

Where is Exness Based? A 2025 Overview

Exness is a global online forex and trading platform that has gained significant popularity among traders worldwide due to its reliable services and competitive offerings. Founded in 2008, Exness operates from its headquarters in Cyprus, a renowned hub for financial services and trading activities. With licenses from reputable regulatory bodies such as the UK’s Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC), Exness has built a reputation for transparency, security, and innovation in the forex industry. Over the years, Exness has expanded its presence internationally, providing access to forex, stocks, commodities, and cryptocurrency trading for both retail and institutional traders.

Exness: A Global Forex Broker

Exness is headquartered in the British Virgin Islands (BVI), which serves as its main base of operations. However, the company operates globally, offering its services to clients in numerous countries. Its global reach, combined with its commitment to transparency, makes Exness a trusted choice for retail traders and professional traders alike.

The Role of Exness in the Forex Industry

Exness has made significant strides in the forex trading sector, becoming one of the top forex brokers in the world. The company provides a wide range of trading instruments, including currency pairs, commodities, stocks, and cryptocurrencies. This flexibility has earned Exness a reputation as a multi-asset broker, catering to traders with different trading strategies and preferences.

Regulatory Oversight and Trust

Although Exness is based in the British Virgin Islands, the company is multi-regulated across various jurisdictions. This regulatory structure ensures that Exness operates within the boundaries of established financial laws and maintains a high level of financial security for its clients.

Exness is regulated by several major authorities, including:

Cyprus Securities and Exchange Commission (CySEC)

Financial Conduct Authority (FCA) in the UK

Securities and Exchange Commission (SEC) in various other countries

This wide-ranging regulatory oversight makes Exness a secure platform for clients who prioritize transparency and negative balance protection.

Why Does Regulation Matter for Exness Clients?

Regulation is critical for trading platforms because it ensures that brokers meet strict financial and operational standards. For Exness customers, this means a secure trading environment where their funds are protected, and trading is conducted in compliance with the law.

Exness provides negative balance protection, meaning traders cannot lose more than their initial investment, which adds an additional layer of safety.

Exness Services and Trading Environment

Exness offers a user-friendly trading platform, accessible via desktop or Exness trade mobile app. This trading platform provides all the essential tools necessary for making informed decisions in the financial markets, including market analysis tools, trading signals, and access to real-time market news.

Traders can take advantage of automated trading strategies or opt for manual trading using advanced technical analysis. Exness provides trading central webtv for traders looking to stay up to date with the latest developments and market conditions.

Exness Account Types and Minimum Deposit

Exness offers multiple account types, allowing traders to select the most suitable option based on their needs and trading skills. The most common accounts include:

Standard Accounts: Designed for beginner and intermediate traders, these accounts provide access to a variety of financial instruments with competitive spreads.

Professional Accounts: For experienced traders, these accounts offer tighter spreads and more flexibility in terms of leverage and trading strategies.

Standard Cent Accounts: These accounts are ideal for novice traders who want to start trading with smaller amounts, as they offer lower minimum deposit requirements.

Start Trading: Open Exness Account or Visit Website

The minimum deposit to start trading with Exness varies depending on the account type. For example, the Standard Cent Account has a minimum deposit requirement as low as $1, making it accessible for new traders who want to get started with limited capital.

Exness Trading Instruments

As a multi-asset broker, Exness offers a wide range of trading instruments that cater to both retail clients and professional traders. These include:

Currency Pairs: Exness provides access to over 100 currency pairs, including major, minor, and exotic currencies.

Commodities: Traders can also engage in the trading of popular commodities like gold, silver, and oil.

Cryptocurrencies: Exness offers cryptocurrency trading, allowing clients to trade popular cryptocurrencies such as Bitcoin, Ethereum, and Litecoin.

These instruments allow traders to diversify their trading portfolios and implement various trading strategies in volatile markets.

Exness Trading Costs and Competitive Spreads

One of the key advantages of trading with Exness is its competitive trading conditions. Exness offers tight spreads, which reduce the cost of trading, especially for high-frequency traders or those engaged in day trading.

Traders benefit from low trading costs, and there are no hidden fees. Exness is transparent about its deposit and withdrawal fees, and the company makes it easy for clients to manage their funds.

Exness also offers flexible leverage options, enabling traders to adjust their risk exposure and maximize their trading capital. The maximum leverage offered by Exness varies based on the account type, but it can be as high as 1:2000 for certain assets.

Exness Payment Methods and Withdrawal Fees

Exness supports a variety of payment methods for depositing and withdrawing funds. These include traditional bank transfers, credit and debit cards, and electronic payment providers like Skrill, Neteller, and WebMoney.

Deposits are typically processed quickly, and withdrawals can be completed within 24 hours, depending on the payment method. There are no withdrawal fees for most payment methods, though traders should check for any specific terms depending on their chosen method.

Exness Customer Support

Exness offers excellent customer support, available 24/7 to assist traders with any questions or issues they may encounter. Clients can contact Exness support through various channels, including:

Live Chat: Immediate assistance for urgent matters.

Email Support: For more detailed queries or issues.

Phone Support: A direct line for clients seeking personal assistance.

The Exness website provides comprehensive educational resources and an exness demo account for new traders to practice their skills before diving into live trading.

Start Trading: Open Exness Account or Visit Website

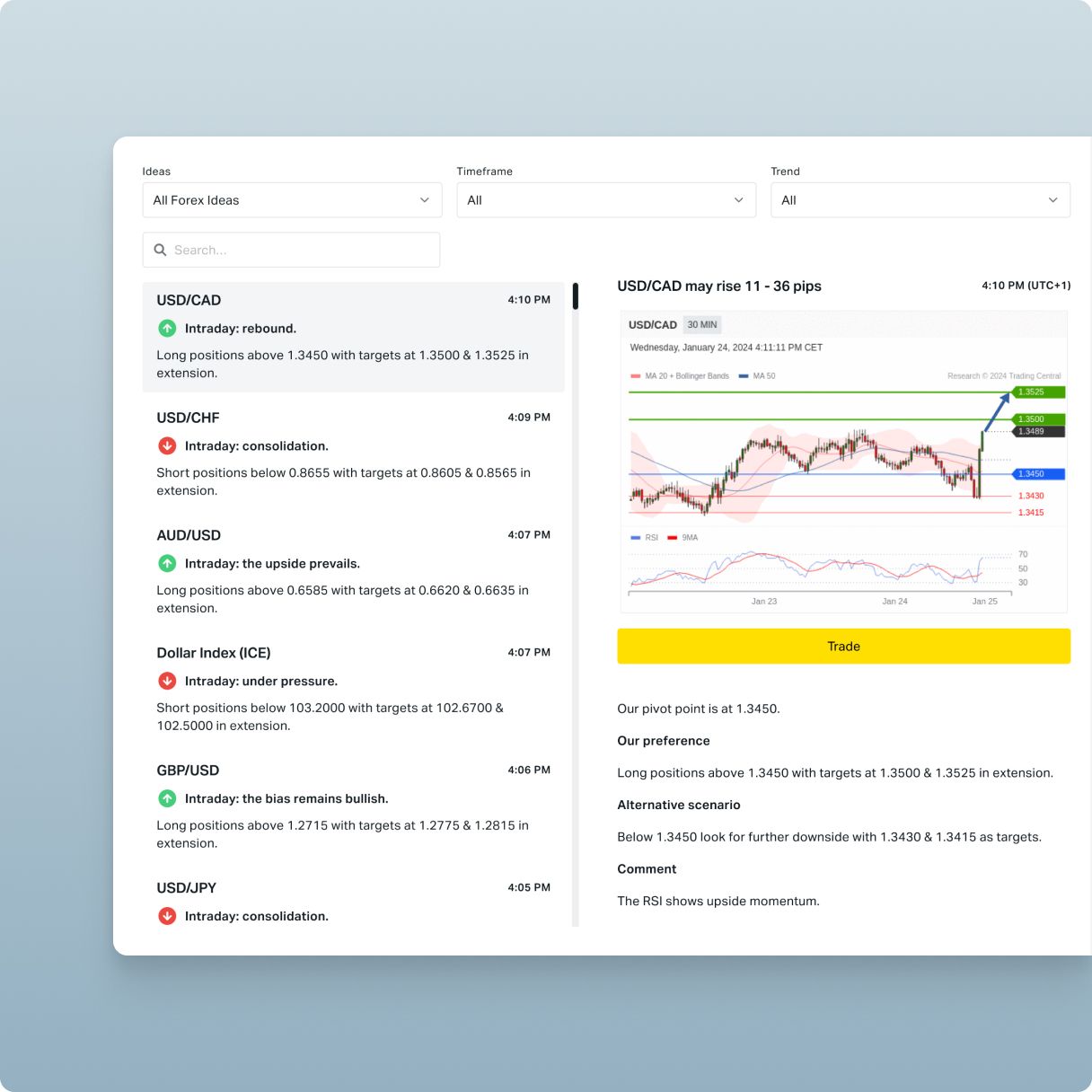

Exness Trading Central

Exness Trading Central provides experienced and novice traders with valuable market analysis, trading signals, and insights to improve their trading strategies. As part of Exness's commitment to offering a secure trading environment, this feature supports both retail clients and professional traders in navigating financial markets. With access to expert technical analysis, automated trading strategies, and real-time market news, Exness clients can enhance their trading experience. The Exness Trade mobile app and Exness terminal integrate seamlessly with Trading Central, offering users a comprehensive tool for managing trading activities, understanding market conditions, and making informed decisions without hidden fees or complicated account processes.

Exness for Experienced Traders

Exness, a multi-regulated forex broker based in the British Virgin Islands, offers an optimal trading environment for experienced traders. With a wide range of trading instruments, including currency pairs, commodities, and financial instruments, Exness provides competitive spreads and flexible trading conditions. Experienced traders can utilize advanced trading strategies, automated trading strategies, and access the Exness terminal or Exness Trade app for seamless execution. Exness offers multiple account types, including professional accounts and standard accounts, with a minimum deposit requirement suitable for various trading activities. The platform’s technical analysis tools, market analysis features, and trading signals from Trading Central support traders in navigating market volatility.

The Exness mobile app ensures that traders can manage their trading accounts on the go, offering secure trading environments with negative balance protection. With no hidden fees and a transparent account opening process, Exness stands as a trusted financial service provider, giving professional traders access to a range of educational resources, trading options, and the ability to deposit and withdraw funds easily. Whether using the Exness demo account for practice or trading with real funds, Exness clients benefit from a reliable, multi-asset broker that supports both retail and professional traders worldwide.

Exness Education and Training Resources

Exness is based in Cyprus and operates as a multi-regulated broker offering a wide range of trading instruments to both novice and experienced traders. The trading company provides access to forex trading, financial markets, and a variety of account types, such as standard accounts, professional accounts, and Exness demo accounts. Exness offers trading platforms like MetaTrader 4, MetaTrader 5, and the Exness Trade mobile app, allowing clients to engage in automated trading strategies, technical analysis, and market analysis.

The Exness trading environment is designed to ensure a secure trading environment, with features like negative balance protection, competitive spreads, and multiple payment methods for deposit and withdrawal. Exness clients can access educational resources such as Trading Central, trading signals, and the Trading Central WebTV to enhance their trading skills and navigate market volatility. Exness accepts retail clients and offers them a flexible trading experience with transparent trading costs, no hidden fees, and a minimum deposit requirement that suits both beginner traders and professional traders. The Exness account opening process is simple, and with a focus on customer support, Exness aims to provide traders worldwide with a reliable, secure, and profitable trading environment.

FAQ

Where is Exness based?

Exness is based in the British Virgin Islands, but it operates globally with multiple regulatory licenses across various jurisdictions.

Does Exness offer a demo account?

Yes, Exness offers a demo account for new traders to practice their trading activities without risking real money. This is an excellent way to build trading skills before live trading.

What are Exness' minimum deposit requirements?

The minimum deposit to open an account with Exness depends on the account type. For example, the Standard Cent Account requires a minimum deposit of just $1, while other accounts may require a higher deposit.

How do I deposit funds into my Exness account?

Exness supports a variety of payment methods, including credit/debit cards, bank transfers, and electronic wallets like Skrill and Neteller.

Is Exness regulated?

Yes, Exness is a multi-regulated broker, with licenses from several top-tier regulatory bodies, including CySEC and FCA.